Is It Bad To Spend Disposable Income Instead Of Getting Takaful? Here's What M'sians Say

If you're feeling torn, you're not alone!

When it comes to takaful, we all know it's important as a form of financial protection

Despite that, not every Malaysian has the coverage, with cost being a major factor. For most of us, getting a takaful plan would eat into our disposable income, leaving us with less to spend on lifestyle wants or unexpected expenses. As a result, we often find ourselves torn between investing in takaful protection or having extra cash in hand to spend every month.

For instance, you may be thinking to yourself, "I'm itching to get that new iPhone on monthly instalments, but I know that getting takaful is important too". And the thing is, more often than not, you may have just enough for one or the other.

Which is more important — lifestyle or protection?

But wait, let's see what some other Malaysians have to say about this.

According to 27-year-old Hanif, he only realised the importance of takaful protection two years into his career.

While disposable income is super important for my daily needs and my hobbies, takaful provides a safety net that ensures I won't be financially broke by unexpected events,"he said.

Erin, a 36-year-old single mother, said that takaful is not just about protecting herself, but also securing her son's future.

"Every ringgit counts, and sometimes it's hard to justify spending on something that doesn't offer immediate benefits. However, after a health scare last year, I realised the value of takaful. While it does reduce my disposable income, I consider it a necessary sacrifice for long-term security," she shared.

For some Malaysians though, having disposable income is a non-negotiable.

"I'm not entirely sure how takaful works, but I feel that having disposable income is really important. It gives me a clear idea of how much money I have left for saving and spending each month. For now, my priority is having that extra money for both security and enjoying my youth life," said 25-year-old Amanda.

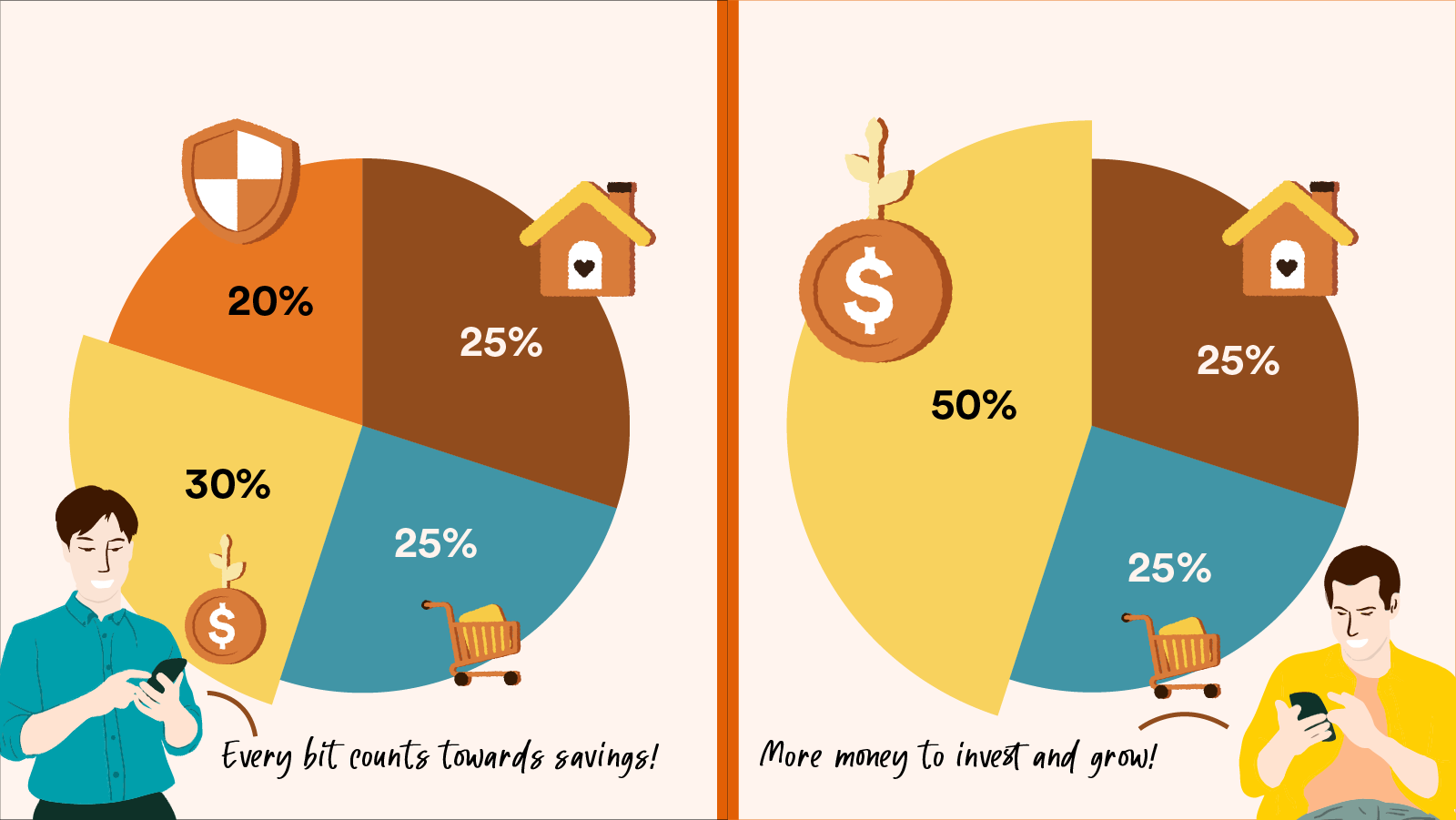

Here's the thing — the reality is that disposable income and takaful protection are both equally important!

Thanks to FWD i-Lindung, individuals can now strike a balance between financial security and disposable income. This innovative solution allows certificate owners to utilise their EPF (Employees Provident Fund) account balance to pay for coverage, ensuring that they have the necessary coverage without digging into their monthly disposable income.

Not sure how it works? Take a look at the benefits of paying for takaful using your EPF account balance:

Scenario 1:

Paying for takaful yourself: You'll have to dip into your monthly expenses

Paying for takaful with EPF: You won't need to even open your wallet! :D

Scenario 2:

Paying for takaful yourself: You'll have less disposable income to spend

Paying for takaful with EPF: You have extra disposable income to spend

Scenario 3:

Paying for takaful yourself: You're on a tight budget as it is after paying for necessities and takaful coverage, so not much more to save and invest.

Paying for takaful with EPF: Your contribution is paid for with your EPF account balance, so you have extra disposable income to save and invest <3

Scenario 4:

Paying for takaful yourself: In an emergency, you may not have cash in hand.

Paying for takaful with EPF: In an emergency, you have enough to tanggung.

Scenario 5:

Paying for takaful yourself: You get protected!

Paying for takaful with EPF: You get protected!

All in all, choosing FWD EPF i-Lindung gives you the best of both worlds

It eases your financial burden by allowing you to utilise your EPF funds to alleviate the strain of takaful contributions. This ensures that you have the necessary coverage when it's needed most, without compromising your monthly budget.

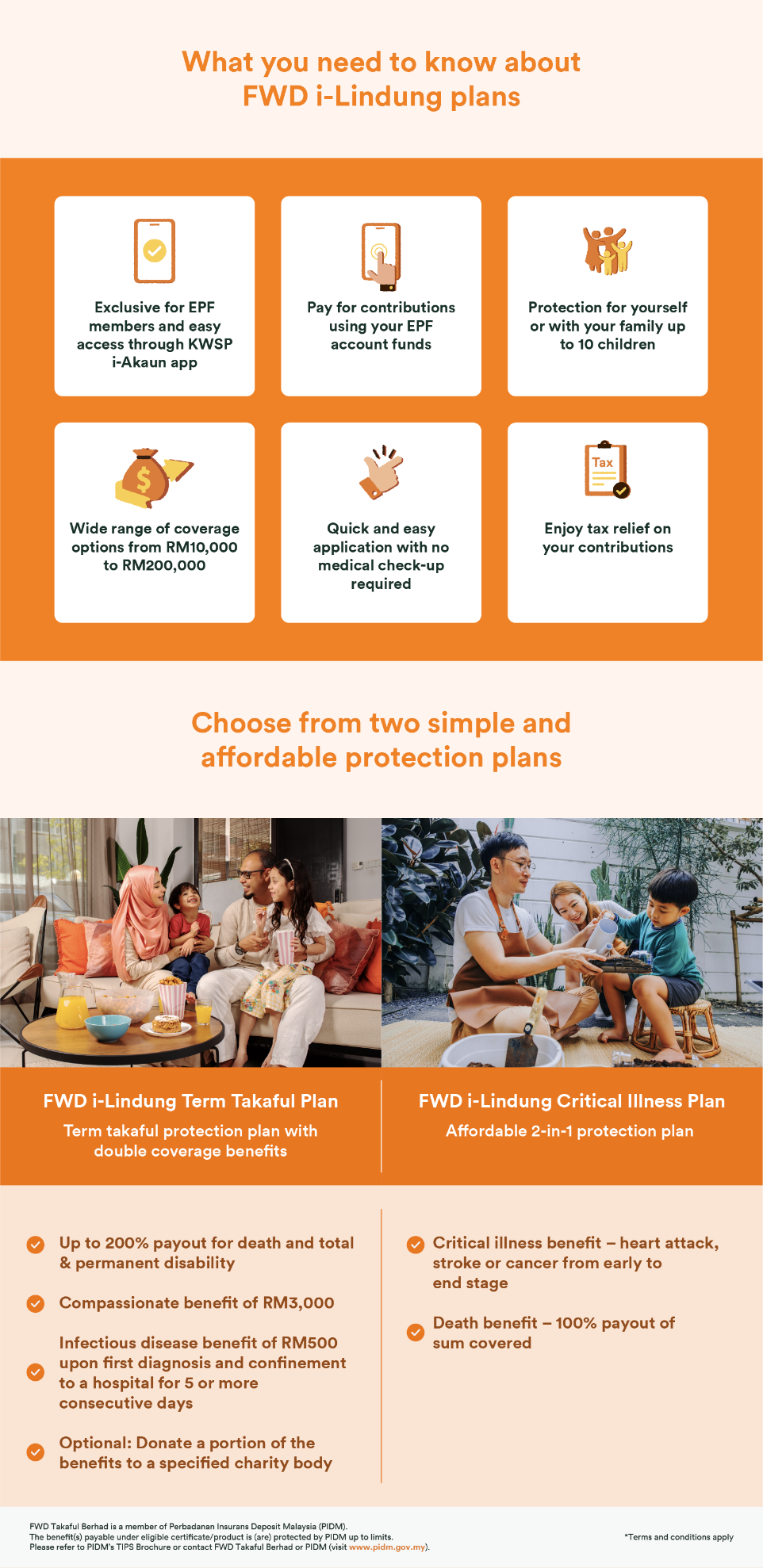

There are two plans to choose from:

- FWD i-Lindung Term Takaful Plan offers up to 200% payout for death and total & permanent disability as well as coverage for infectious diseases. The plan also offers a compassionate benefit of RM3,000 and an option to donate part of your sum covered to a charity body.

- FWD i-Lindung Critical Illness Plan is a comprehensive 2-in-1 plan that provides coverage for the top 3 critical illnesses in Malaysia – cancer, heart attack, and stroke, as well as death coverage.

With both plans, you have the option to cover just yourself, or your whole family up to 10 children. With a self-service application available online via the KWSP i-Akaun app, it is convenient and stress-free to apply for the FWD i-Lindung plans - no medical checkup is required.

Find out how you can use your EPF funds to protect yourself and your loved ones with FWD i-Lindung on this website.