Here's How You Can Check Whether You Have Any Forgotten Money Being Kept By The Govt

RM8.75 billion worth of unclaimed money is currently being held by the government. Everyone is encouraged to check whether they have any unclaimed money on eGUMIS.

Did you ever lose money from your childhood savings account after it was left untouched for many years?

Don't you worry, because the money did not disappear into thin air.

In fact, all unclaimed money — or Wang Tak Dituntut (WTD) — is being safely kept by the government under the Accountant General's Department of Malaysia (AGD).

The source of unclaimed money does not just come from dormant bank accounts, it can also come from your employers, insurance, stock market, and more.

AGD separates possible sources of unclaimed money into three categories:

1. Monies that are legally payable to the owner but have remained unpaid for a period of not less than one year.

- Salaries, wages, bonuses, commissions, and other payments due to employees

- Dividend

- Profits declared for distributions

- Insurance claims which have been approved for payment

- Bank draft, cashier's order, and other documents of similar nature which validity period have lapsed

- Fixed deposits (without automatic renewal instructions) which have matured

- Tender deposits for which the intended purpose has been fulfilled

- Sundry creditors or sundry debtors with credit balance

2. Monies standing to the credit of an account that has not been operated in whatever manner by the owner for a period of not less than seven years.

- Savings account

- Current account

- Fixed deposit (with automatic renewal instructions)

3. Monies to the credit of a trade account that has remained dormant for a period of not less than two years.

- Trade creditors account

- Trade debtors account with credit balance

To check whether you have any unclaimed money, all you need is an identification card (IC) number and a computer with an Internet connection

You can even check whether there is any unclaimed money on your family members' behalf as long as you have their IC numbers.

You can retrieve the money on their behalf as well as long as you can provide the supporting documents.

It is recommended that you do this for your late or elderly family members as they are more likely to have forgotten money held by the government.

According to The Malaysian Reserve, as of December 2020, AGD had RM8.75 billion worth of unclaimed money waiting for citizens to retrieve them.

Up until December 2019, the department managed to return RM2.13 billion back to their rightful owners.

It is learnt that having a large amount of money sitting idly under AGD's management actually works against the economy as the money can be better used to spur economic activities.

In November last year, experts even urged the government to start using unclaimed money amidst the COVID-19 pandemic, reported The Star.

Additionally, not retrieving the money is disadvantageous for the rightful owners as the money held by AGD will not be given any interest. Meaning, the RM5,000 you lost 30 years ago will still be RM5,000 despite the inflation.

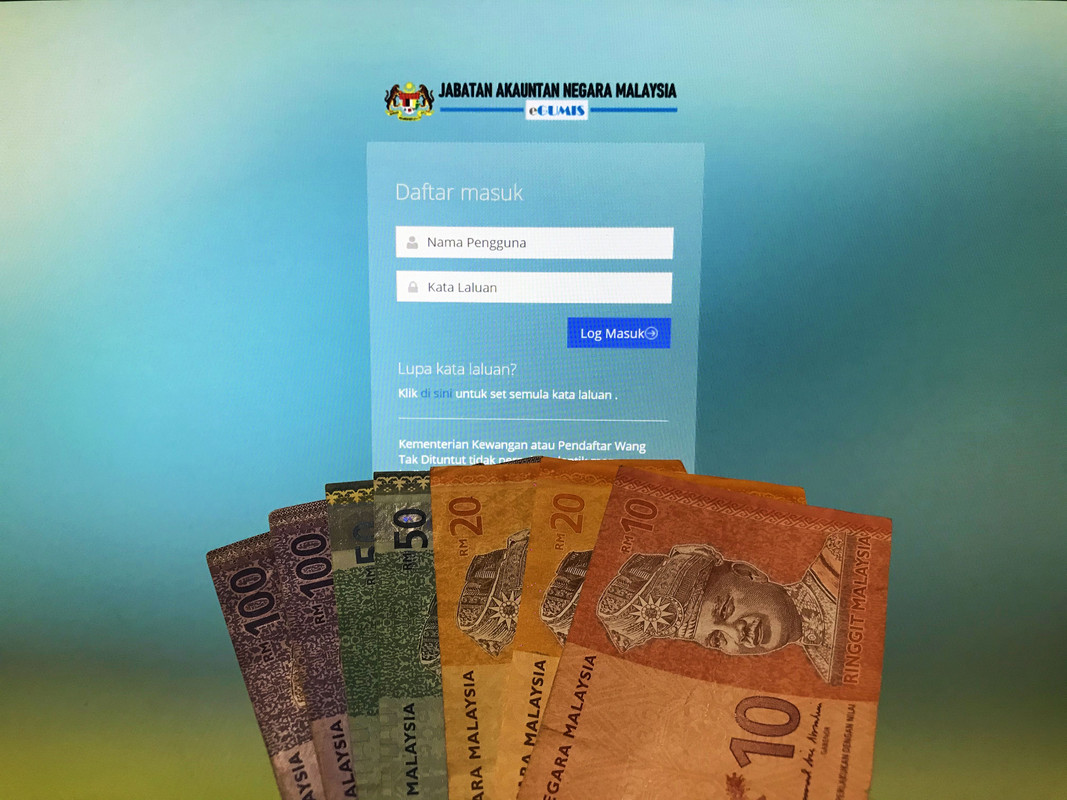

To combat the problem, AGD launched an online portal called eGUMIS (Electronic Government Unclaimed Moneys Information System) where the public can check the status of their unclaimed money.

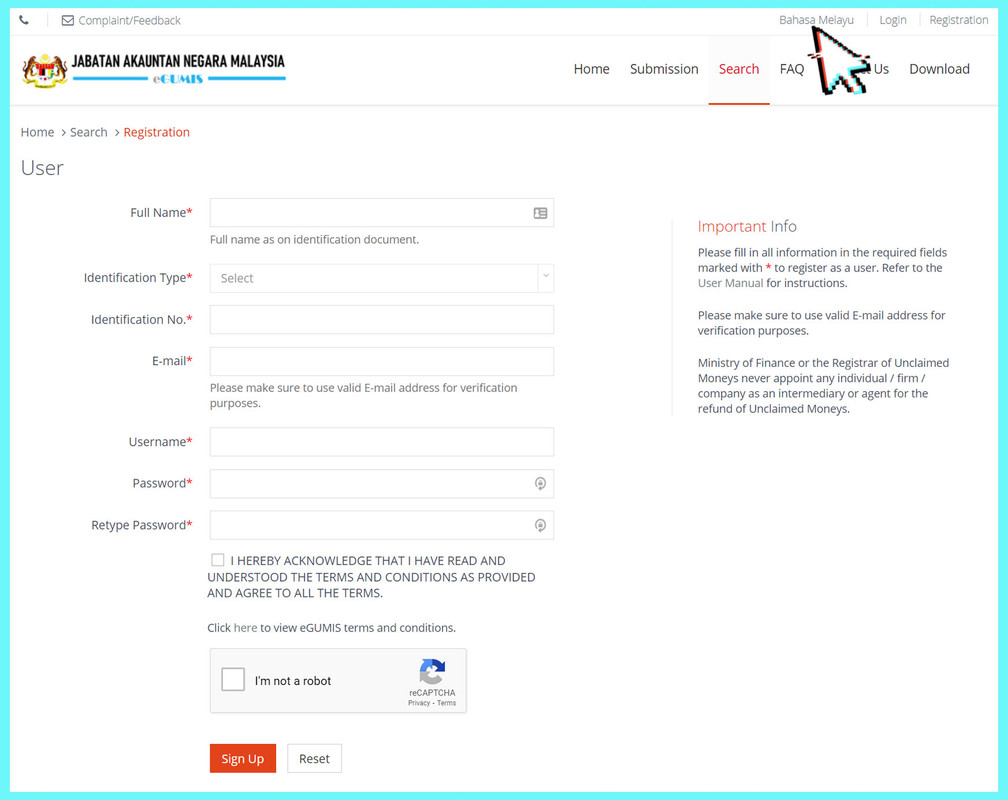

1. Visit eGUMIS and create an account

Click here to visit the eGUMIS home page.

You can change the language of the webpage to English by clicking 'Bahasa Melayu'.

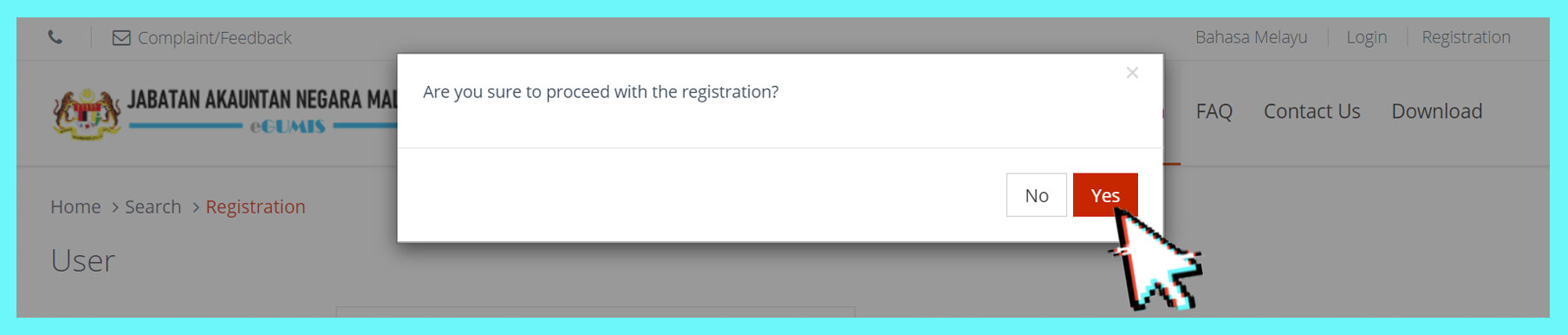

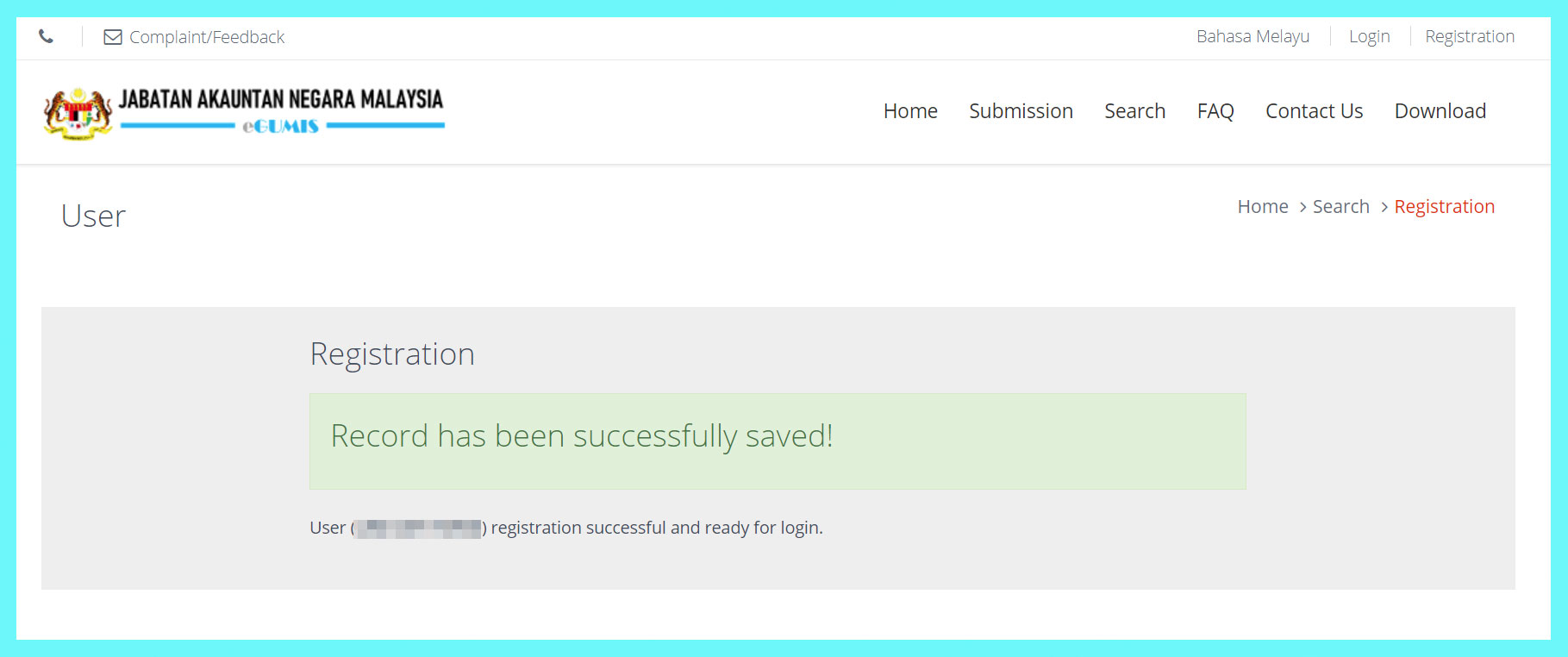

2. Confirm your eGUMIS account creation

When you are done filling up the details, click 'Yes' on a pop-up menu.

You will then be notified that your account has been successfully created.

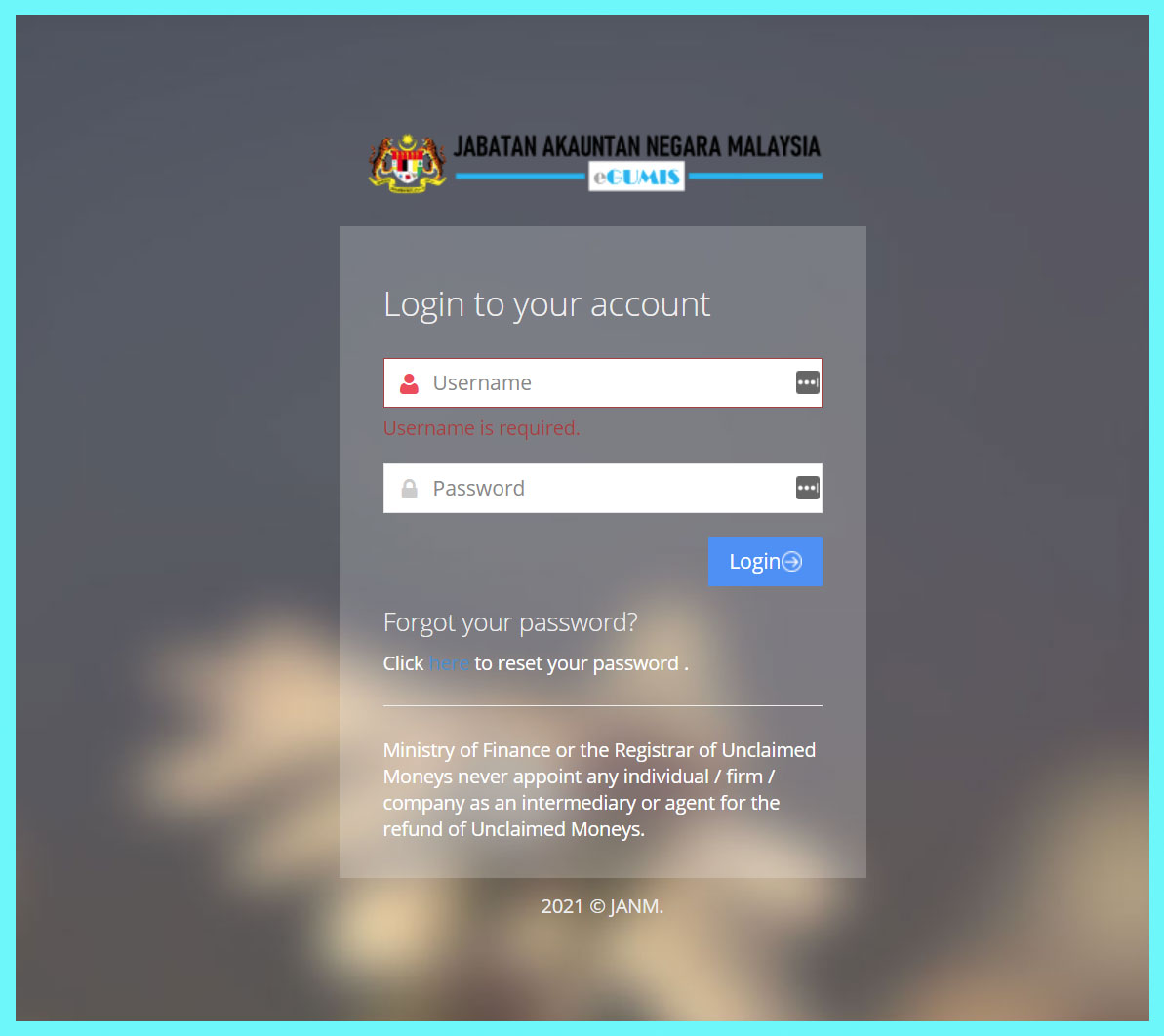

3. Login into your eGUMIS account

The 'Login' button can be found on the top right corner of the eGUMIS home page.

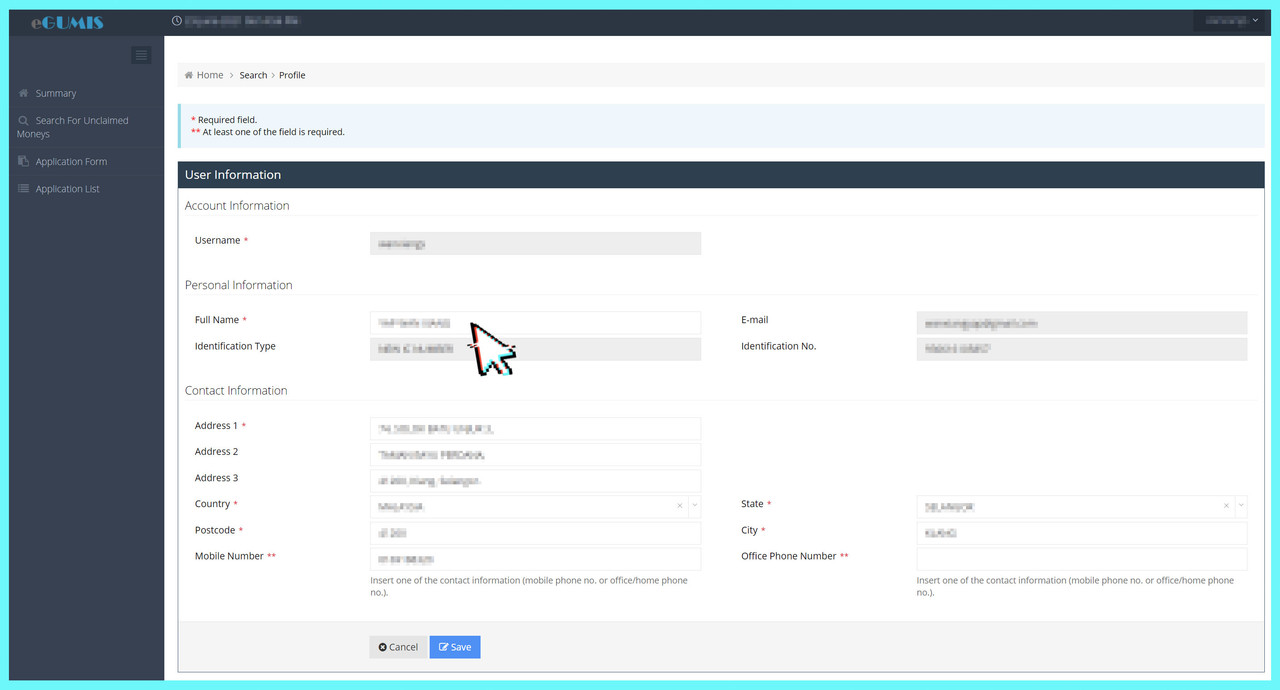

4. Fill up more details

Once you have logged in, you will be prompted to fill up more details.

Fill them up and click 'Save'.

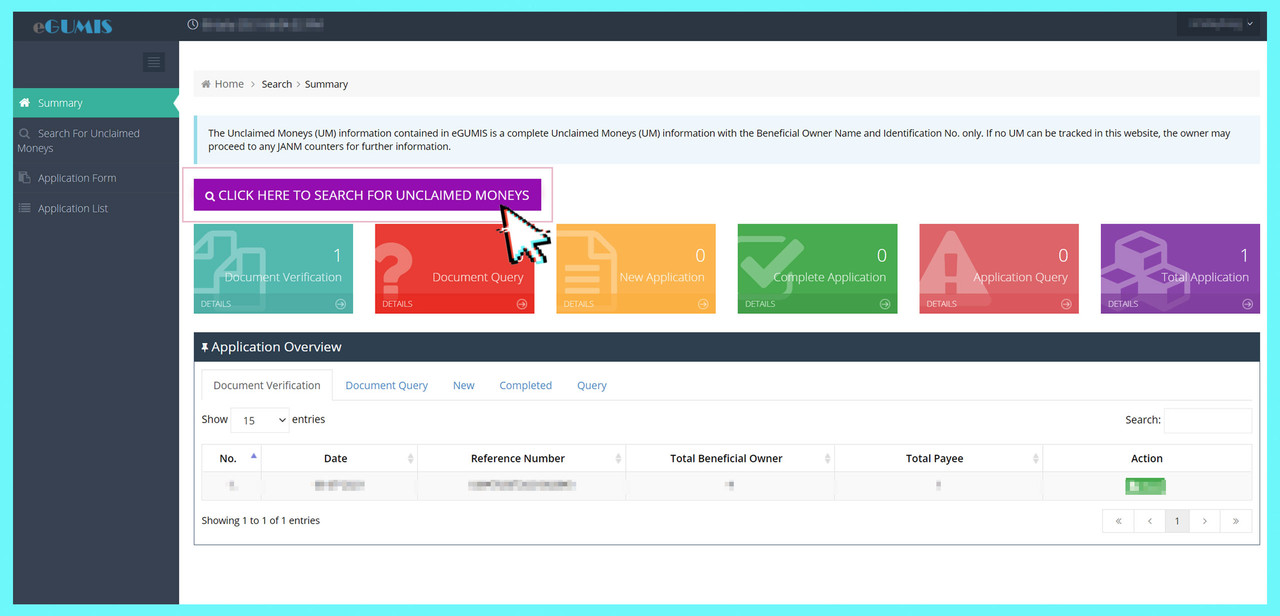

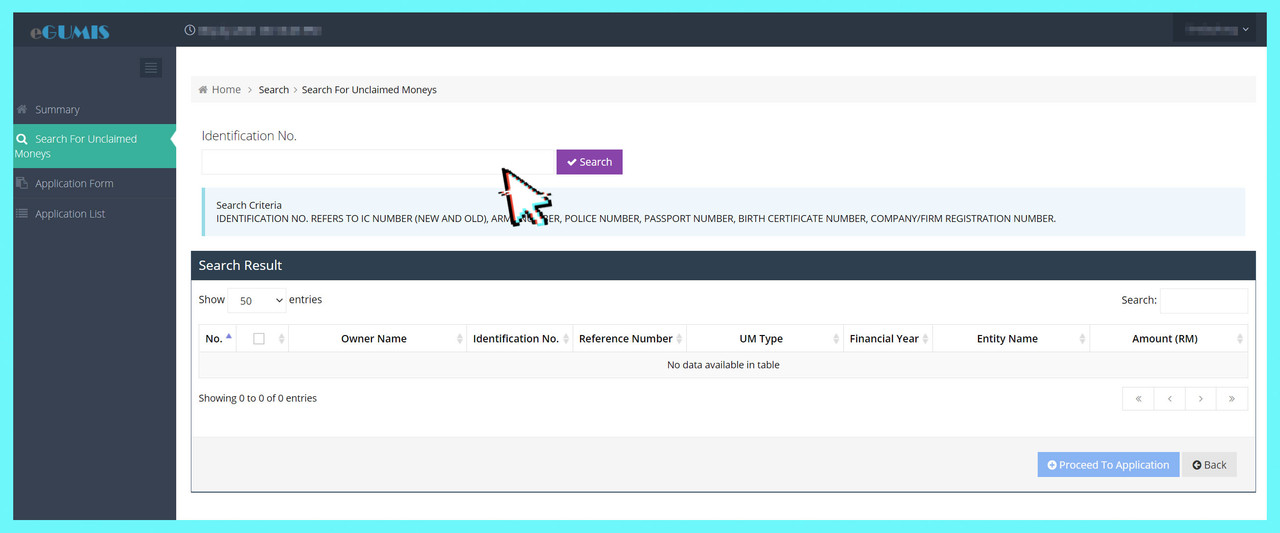

5. Start checking for unclaimed money by using IC numbers

Click 'Click here to search for unclaimed moneys'.

Then, you will be brought to a page with a box to enter an IC number.

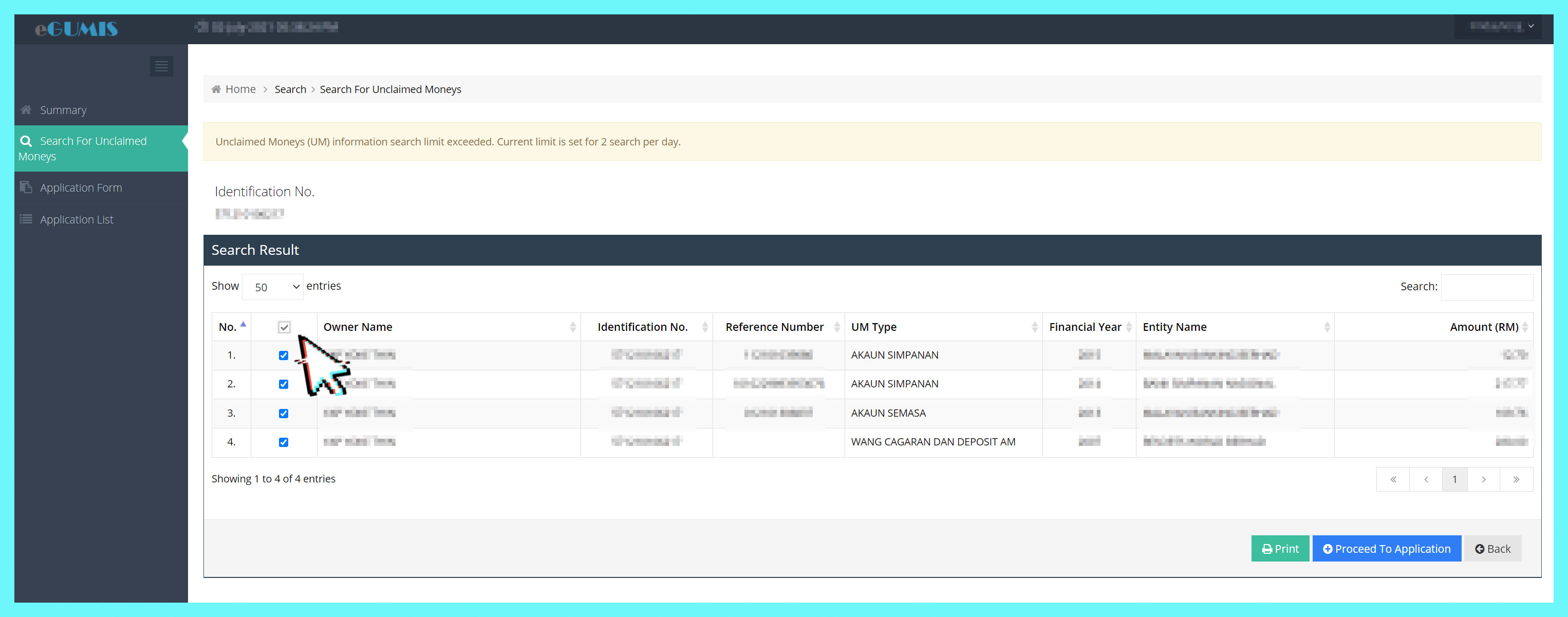

Note that each eGUMIS account can only check unclaimed money from two IC numbers in a day.

And the website will log you out once you are inactive. Thus, it is recommended that you complete the entire process in one sitting because you cannot try more than two times with each eGUMIS account.

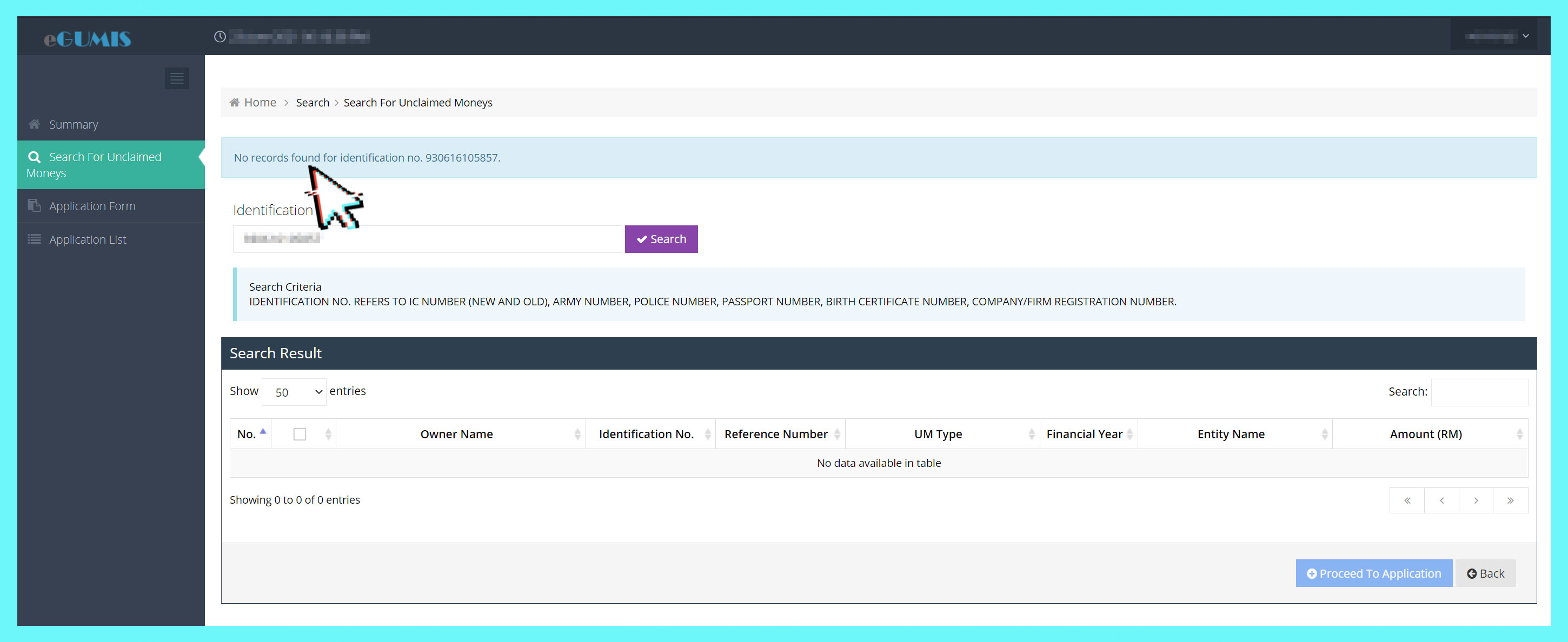

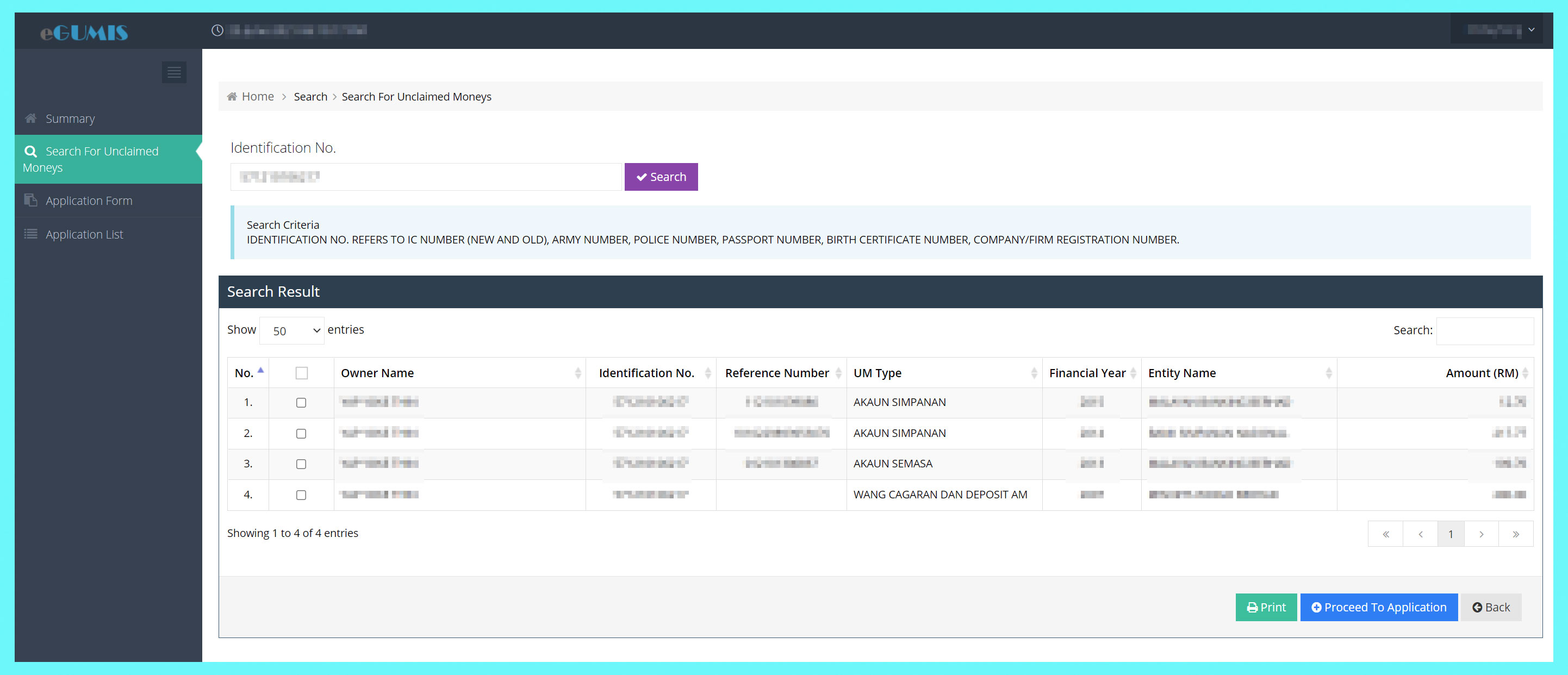

6. Once you have entered an IC number, you will receive two kinds of results

If the person does not have any unclaimed money, you will be prompted with a message that reads 'No records found for the identification no. [...]'.

However, if the person has unclaimed money, you will be able to see the details of the money, such as the source of the money, the year that the money was debited, the entity that debited the money, and the amount of the money.

In the example shown below, three sources of the unclaimed money come from dormant bank accounts. The IC number inserted belongs to a late family member of this SAYS writer.

7. Select all the entries to retrieve the unclaimed money

You can select the entry you want by ticking the boxes in the second column or you can select all of them in one go by ticking the first box in the column.

Once you are done, click 'Proceed To Application'.

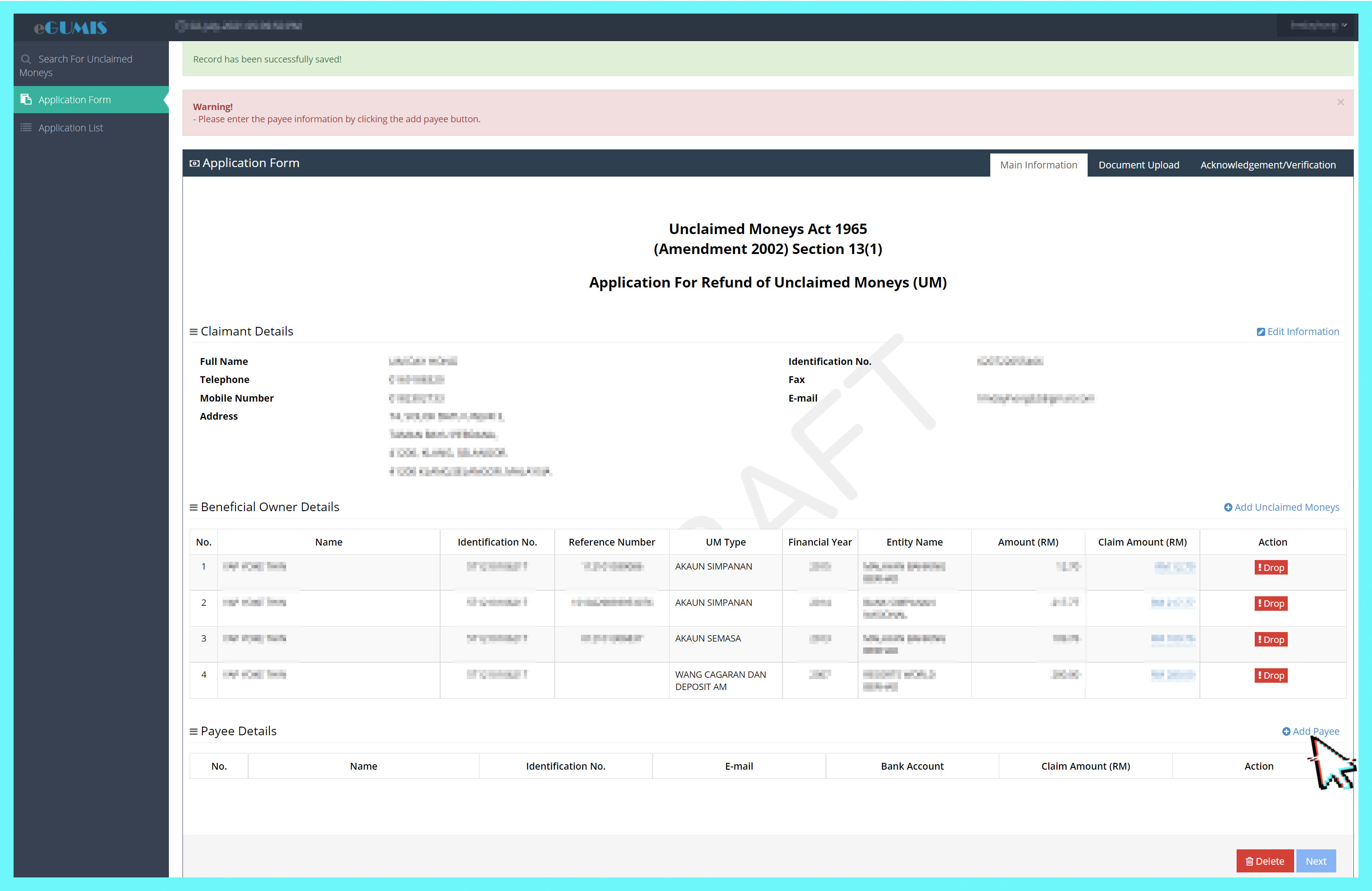

9. Fill in the details and bank account number that you want to receive the unclaimed money

Note that if you are the claimant of the unclaimed money, you can tick the box found above. It will automatically fill the first section of the form for you.

After you insert the bank name, you will be told to enter the bank account number that you wish to receive the unclaimed money.

It is best that you use a bank account with a readily available bank account statement because you will need to submit it as a supporting document later.

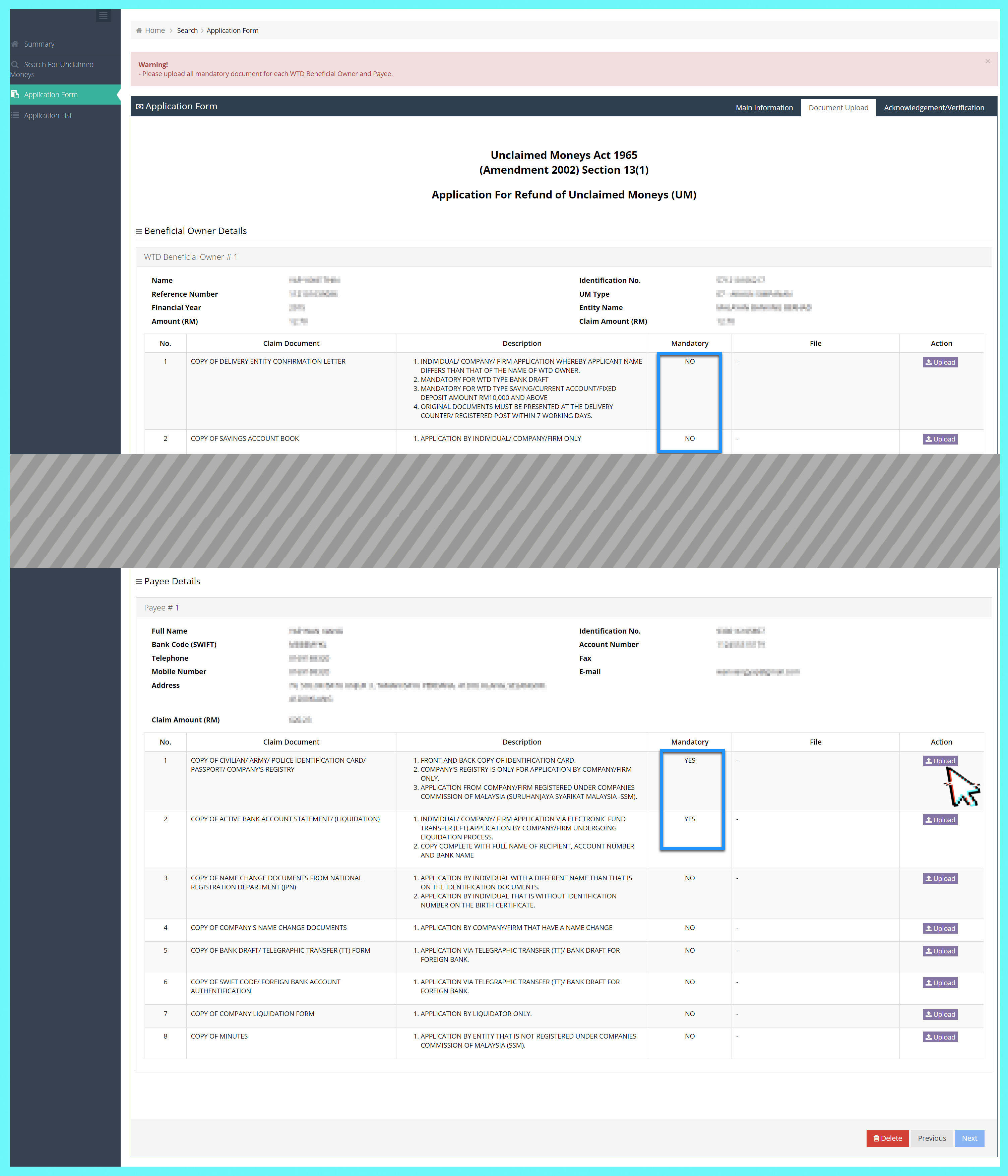

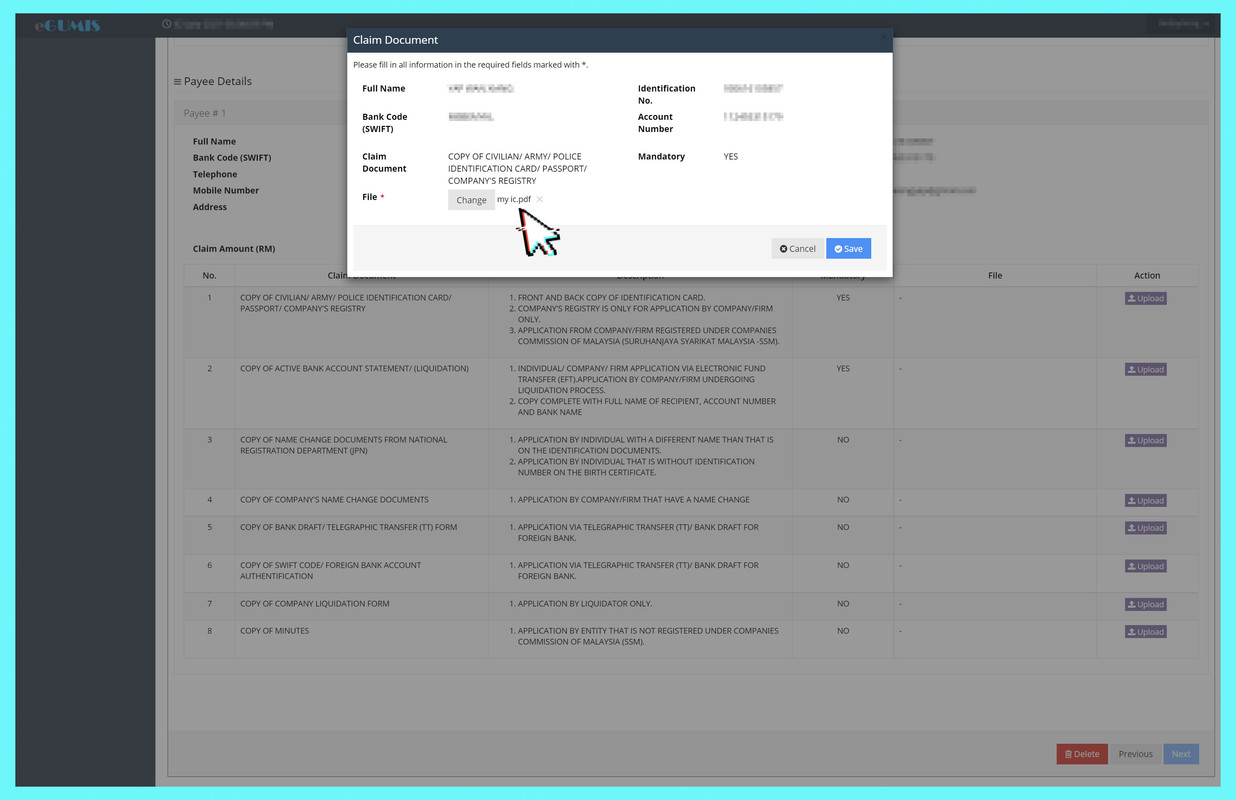

10. Upload the supporting documents

Scroll through the page and look at the 'Mandatory' column. If it is stated 'Yes', you need to upload the required supporting documents.

To submit the supporting documents, click 'Upload' and select the file on your computer.

Click 'Save' when you are done and repeat the process for all the mandatory rows.

For this SAYS writer's case, all I needed to upload was a copy of my IC (front and back) and the bank account statement of the bank account number I entered earlier.

When you are done, scroll to the bottom of the page and click 'Next'.

Click 'Yes' when a confirmation prompt pops up.

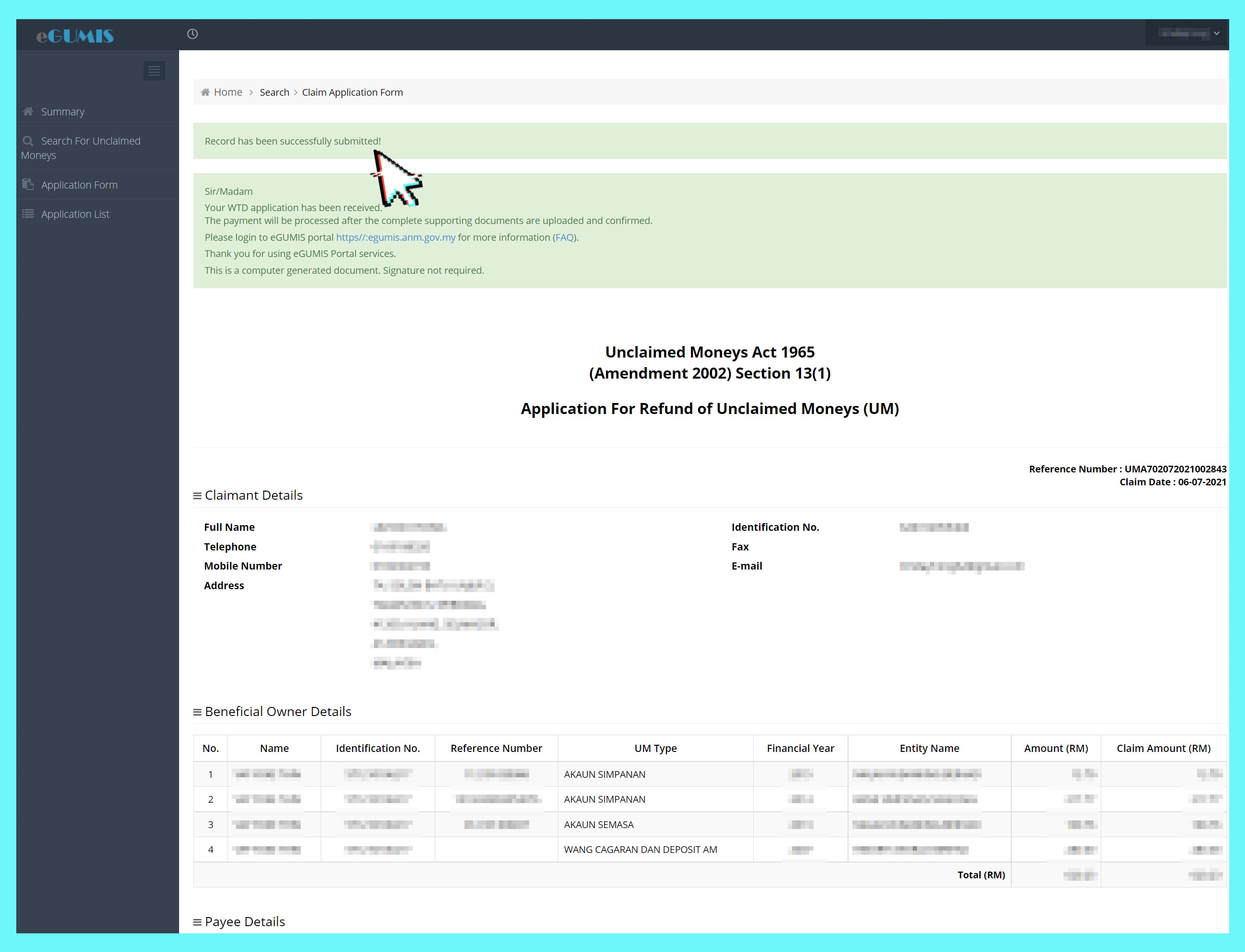

11. Voila! You are done. Now save a copy of your application.

After you have submitted all the required documents, you will be brought to a page with a message that reads 'Record has been successfully submitted!'.

Scroll to the bottom and click 'Print' to save a copy of your application. Click the 'Save' icon to download the PDF copy.

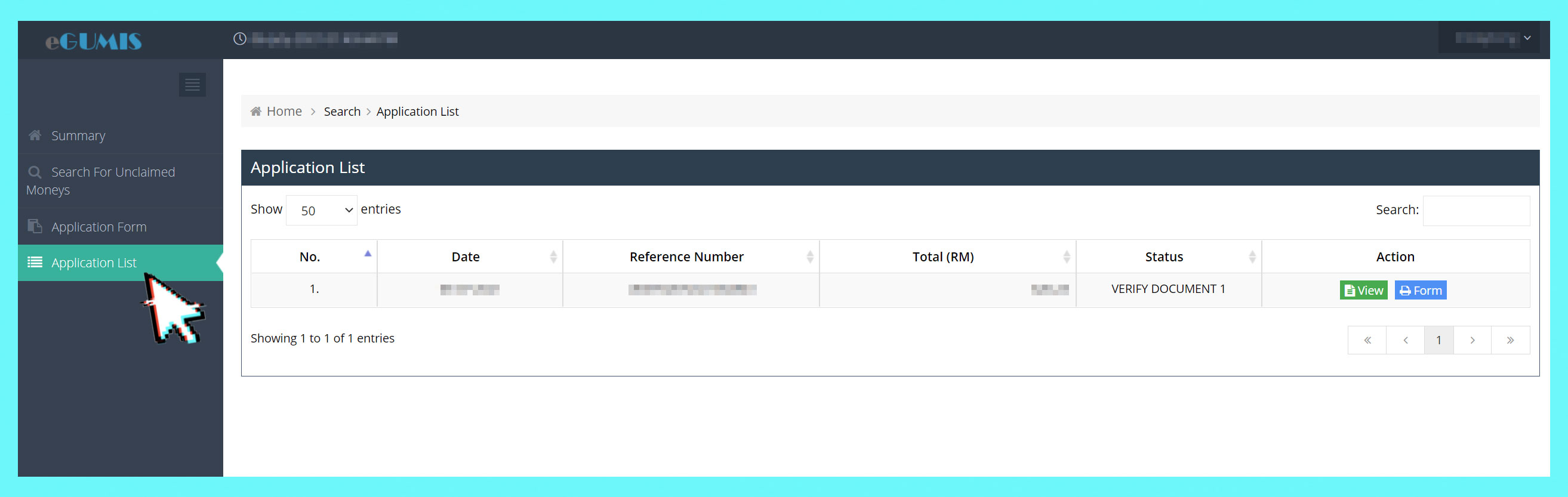

12. You can check the status of your application at 'Application List'

You will receive the unclaimed money within a few months. According to eGUMIS' frequently asked questions (FAQ) page, there are two stages of verification for the application.

When your supporting documents have been verified, you will receive a message that reads 'The process of validating the documents supporting for your WTD application was successful'.

You will also receive 'Your WTD application is being processed' and 'The payment will be credited to your account within 30 working days from the date of this notification' depending on the stage of your application.

Do note that an inactive eGUMIS account of more than six months will be automatically deactivated. Therefore, it is advised that you check your application status after your submission before your account lapses.

To know more about eGUMIS and its services, visit its FAQ page here.

Click here to start retrieving your forgotten money.