Here's The Ultimate Step-By-Step Guide To Filing Your Income Tax For The First Time

The last day to file your income tax via e-Filing is 15 May 2023.

The income tax season is here and your days are numbered before the deadline to file your tax closes in on 30 April 2023

This guide is catered to young adult Malaysians or any first-time taxpayers who are salaried employees not under Monthly Tax Deductions (MTD/PCB).

Although the official deadline falls on the end of April, for those who file under e-Be — which stands for 'individual without business source of income' — and are filing online, the deadline is extended to 15 May 2023.

Before we start, here are a few things you will need:

- EA form(s) from the compan(ies) you worked for last year,

- A relatively updated computer device, in terms of both the operating system and browser, and

- If you are a first-time taxpayer, you will need a PIN for e-Filing which can be obtained online or at any Inland Revenue Board (LHDN) branches.

With that said, some of you might not be able to complete the task in one sitting if you do not currently have an e-Filing account (MyTax) or do not have the EA form from the previous company you worked at last year.

Every employer is legally bound to provide you an EA form even if you have already left the company the following year. If they fail to produce an EA form for you, they are chargeable under Section 83(1A) of the Income Tax Act 1967.

Therefore, you are advised to contact your former employer as soon as possible.

If you think you could skip filing your income tax, the consequences are severe

According to Section 112(1) of the Income Tax Act 1967, an individual can be imprisoned up to six months or fined up to RM2,000 whenever he or she fails to furnish an income tax return form.

If you submit late within the first 60 days, you will need to pay 10% more than the tax payable as a fine. If it continues, you will be fined another 5%.

You are liable to file your income tax if you make more than RM34,000 annually, after the Employees Provident Fund (EPF) deduction.

While there is no specific requirement to file for those who do not make more than RM34,000, it is still best practice to do so.

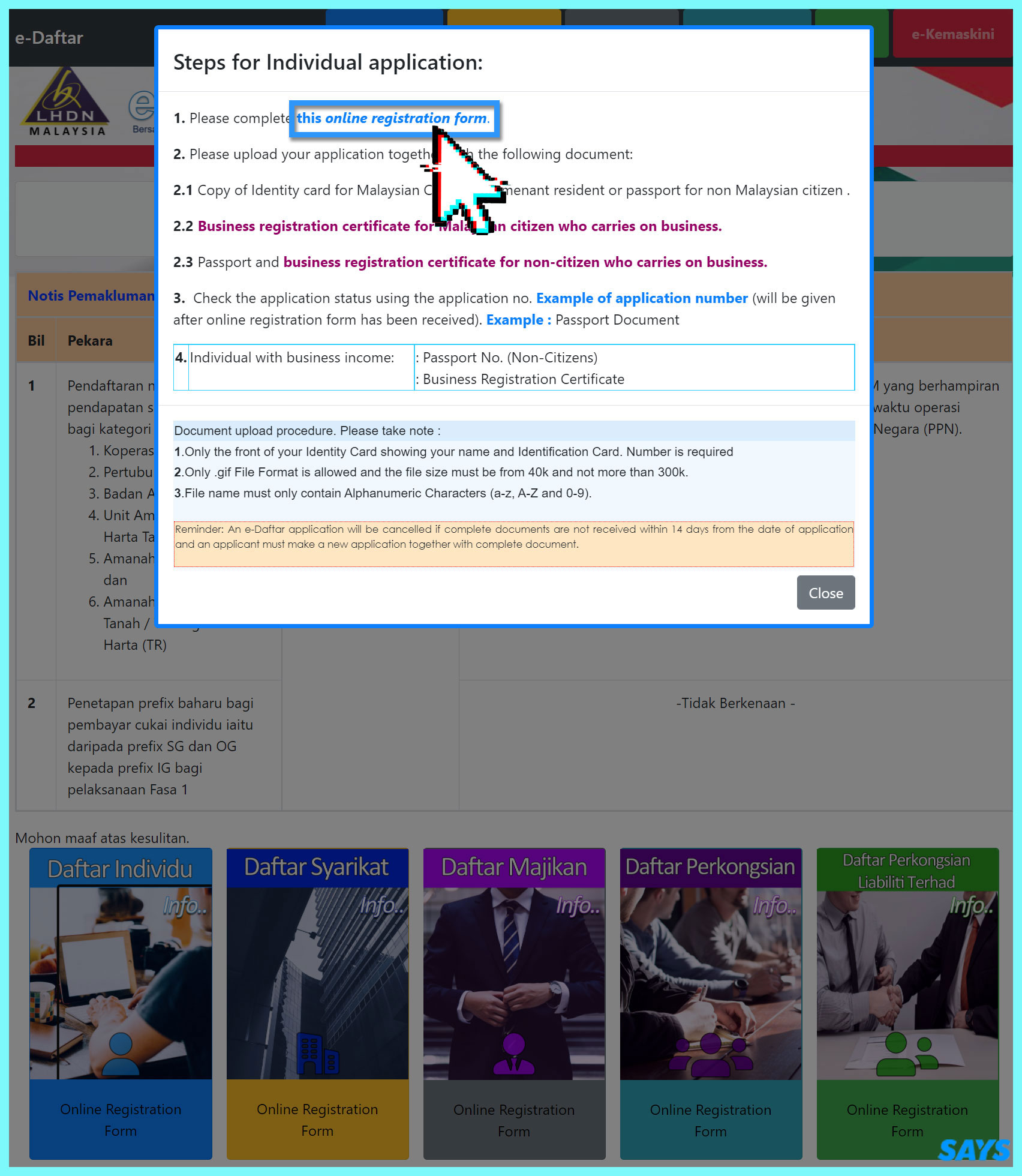

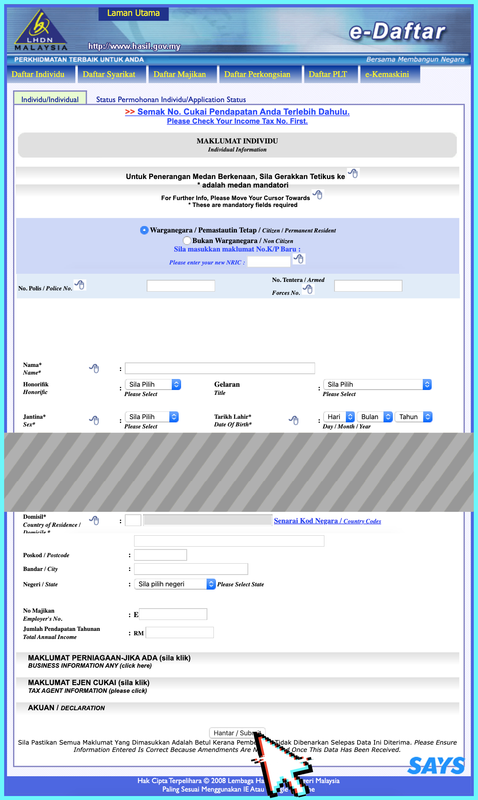

2. Fill up all the details

Ignore the 'Business Information Any' and 'Tax Agent Information' sections if they are not relevant to you.

Once you are done, click 'Submit'.

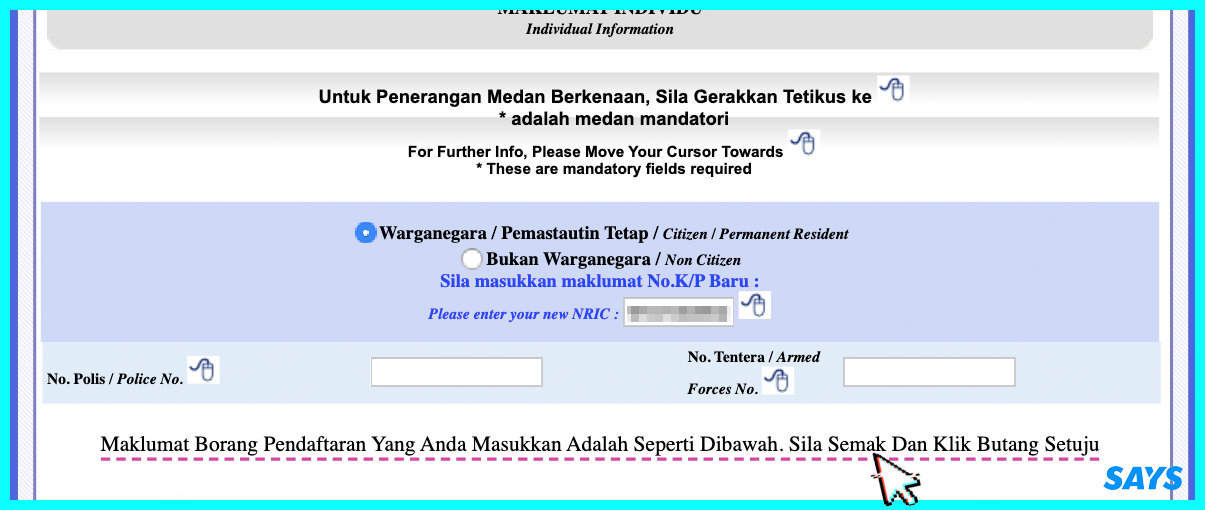

3. Confirm your details again

Once you have double-checked your details, click 'Accept'.

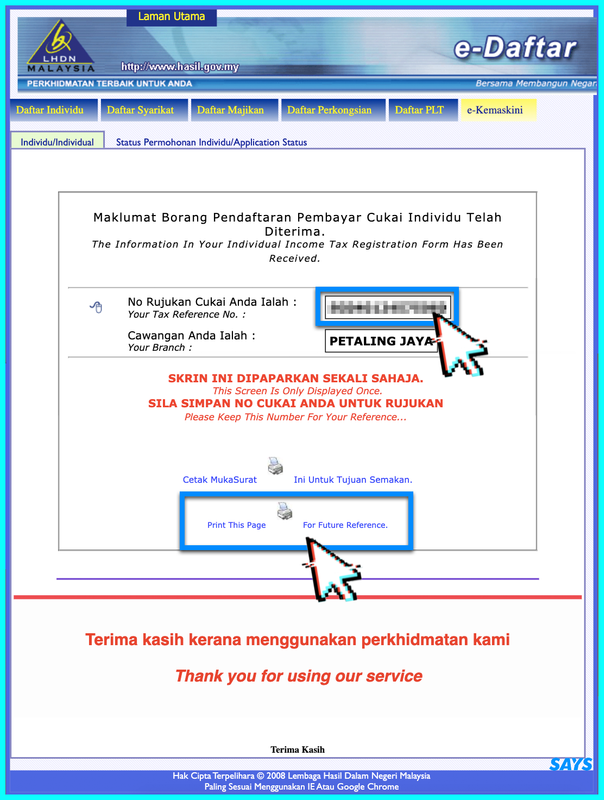

4. Save your Tax Reference number

Record down your tax reference number. You can save the page as a PDF by clicking 'Print This Page For Future Reference'.

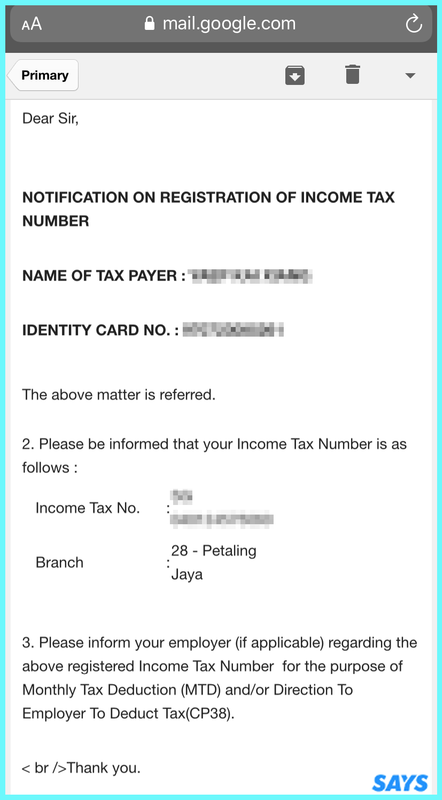

5. Wait about two to three days for LHDN to process your application

You will receive an email that looks like this.

After this step. You have two choices.

Either head to a LHDN branch to obtain a PIN required to open an ezHasil account or you can obtain a PIN online, which will take you a few days to receive it.

[Option 1]

6.1. Head to the nearest LHDN branch to obtain your PIN

Once your account application has been approved, you will need to visit a LHDN branch.

This is the only step that requires you to step outside. You can find the locations of all the LHDN branches here.

When you are there, tell the receptionist that you are requesting for the ezHasil's first-time PIN and you will be directed to the relevant counter — probably without the need of taking a queue number.

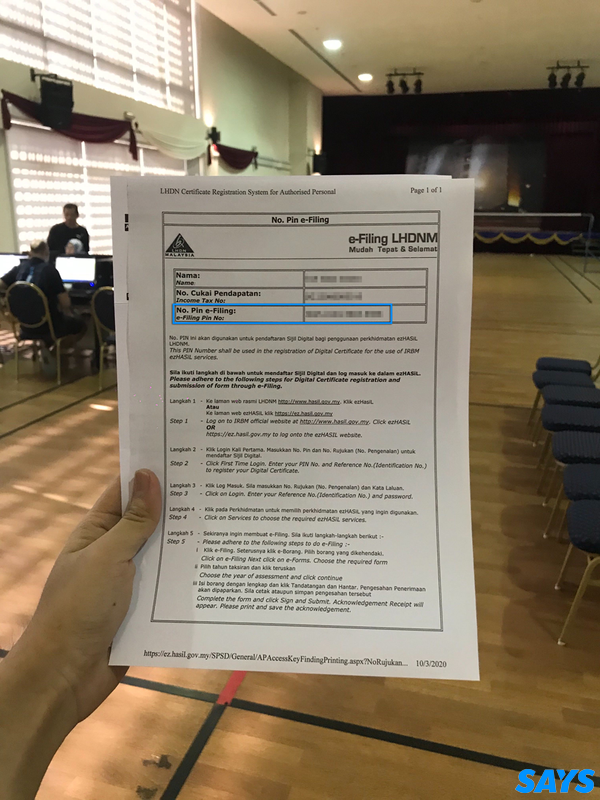

You will then be handed a paper with your income tax number and e-Filing PIN number. This is how the paper would look like:

Since you are at the LHDN branch, chances are there will be computers and personnel ready to help you to file your income tax.

If you wish to get more hands-on guidance, just bring all of your required documents to the LHDN branch and the personnel there will be more than happy to assist you in filing your income tax until the final step.

Here is a picture of the tax filing station at the LHDN branch in PJ Trade Centre, Petaling Jaya:

[Option 2]

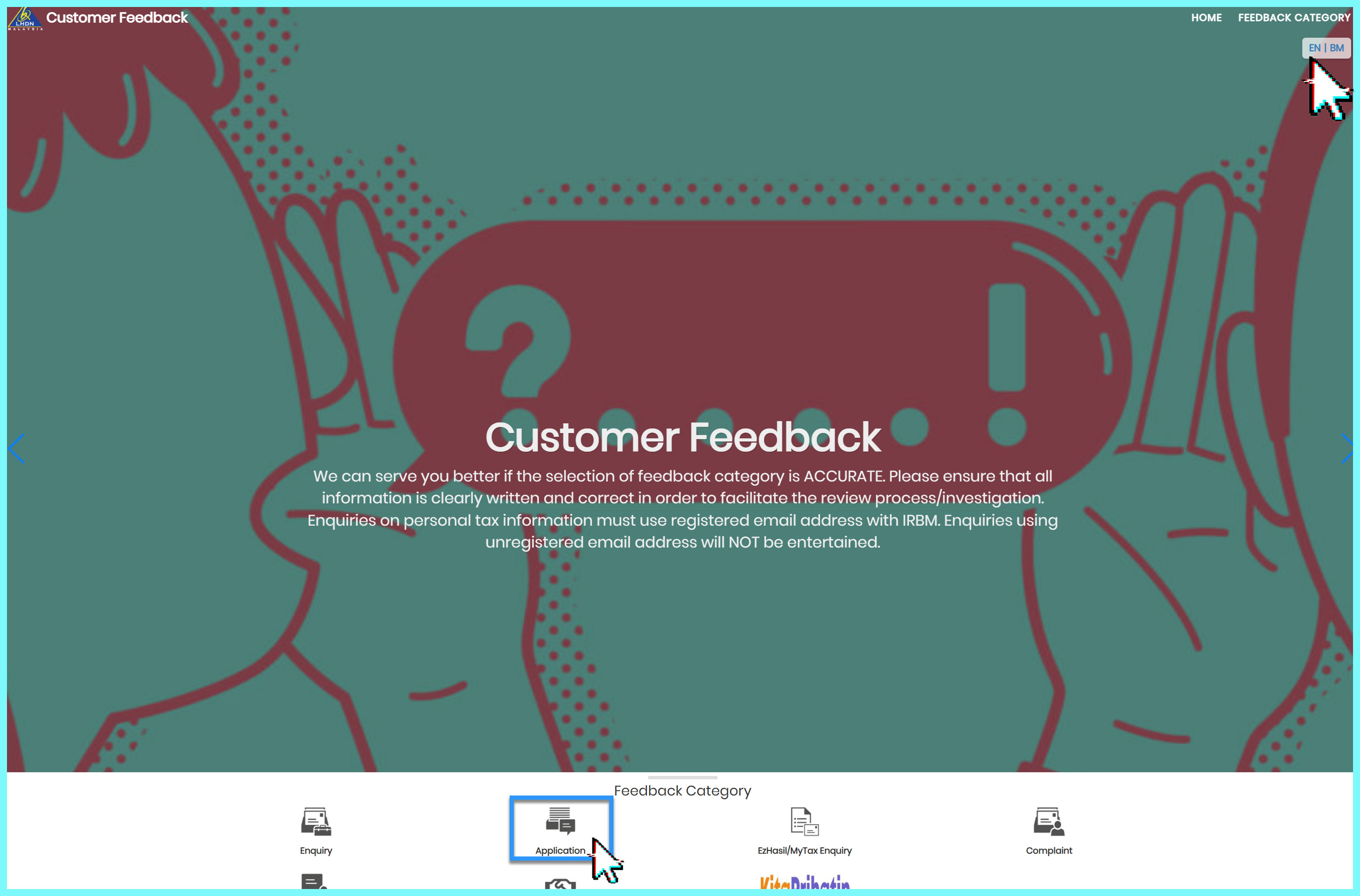

6.2. Visit LHDN's Customer Feedback website to request a PIN

To do that, click here to visit LHDN's Customer Feedback website. Again, you can always toggle the language of the page by clicking "EN | BM".

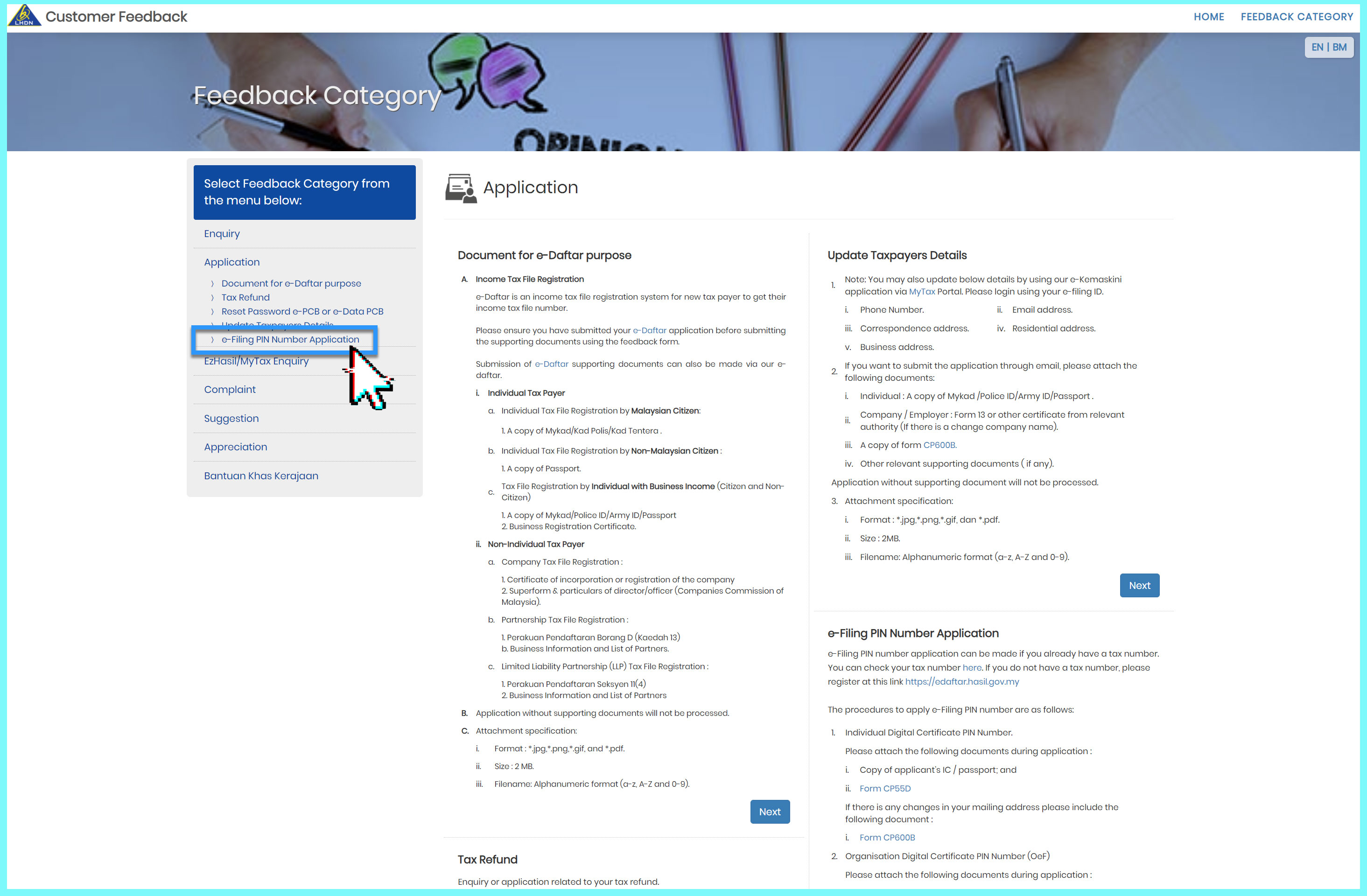

While you are here, click "Application" which can be found below. On the Feedback Category page, click 'e-Filing PIN Number Application' which can be found on the left.

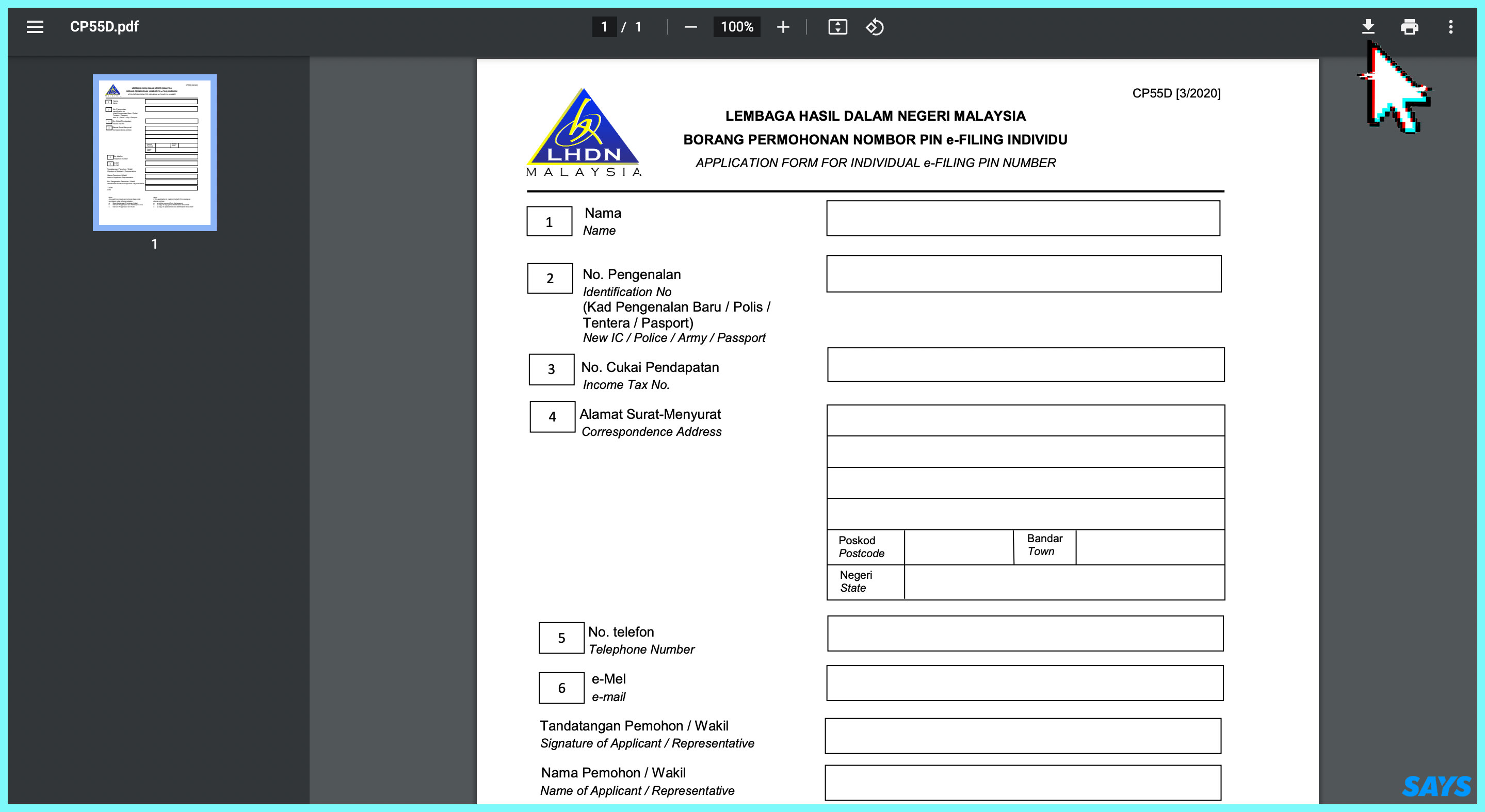

Read through the information on the page. But essentially, in this step, you will need to prepare a digital copy of your MyKad (front and back) and fill up 'Form CP55D'.

Click 'Form CP55D' to download the form and fill it up in a PDF reader. If you do not have one, you may consider filling it up on your phone or downloading one of these programmes on your computer to fill it up.

You will need to sign in one of the columns in the form too. So, it is easier to do it on mobile.

Once you have filled it up and have a file of your MyKad front-and-back photos ready, go back to the 'e-Filing PIN Number Application' page and click 'Next'.

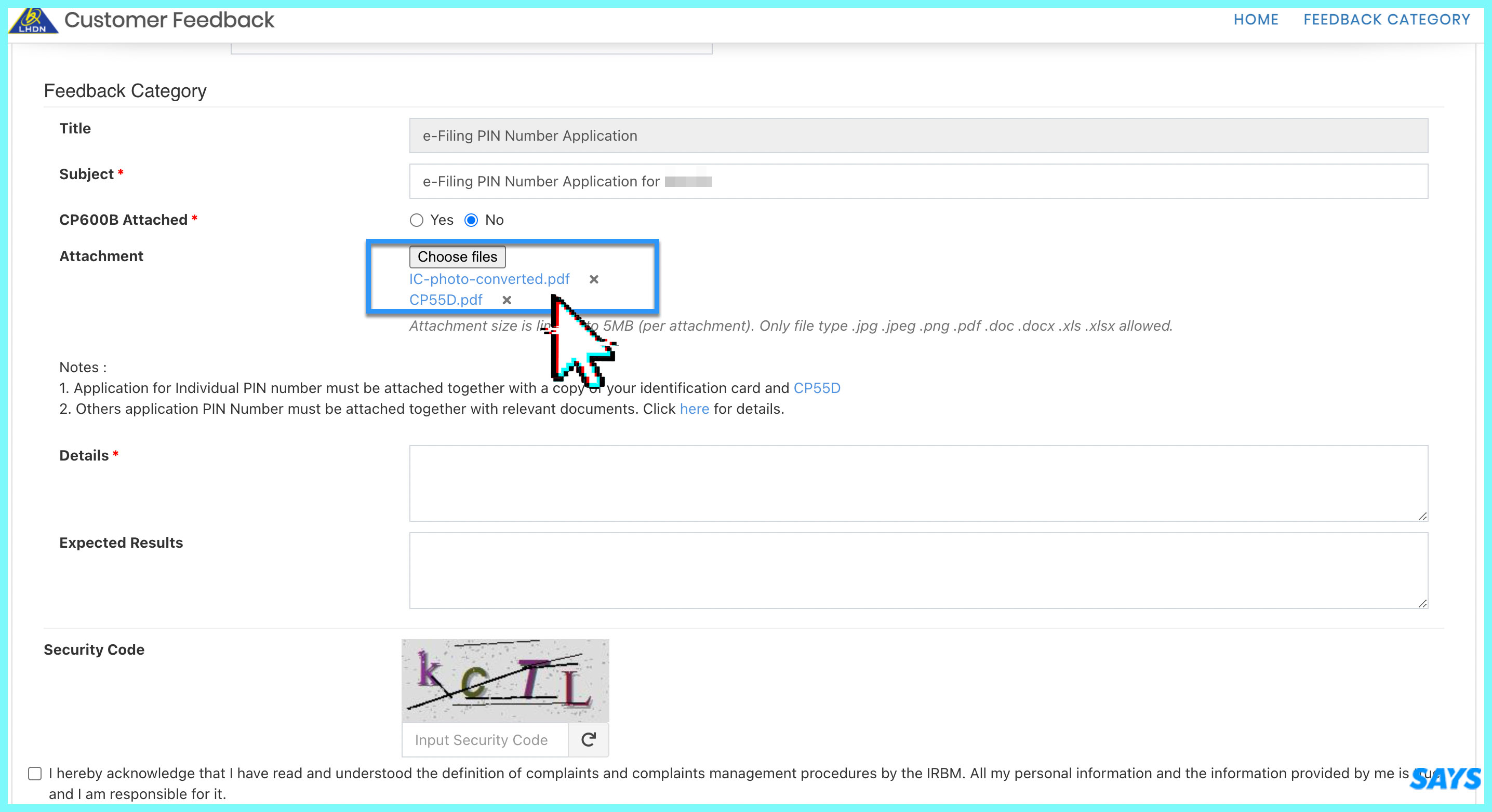

Here, you have another form to fill out. In the column 'CP600B Attached', select 'No'. Under the 'Attachment' section, you need to upload the Form CP55D you just filled up and your MyKad photos. You can upload two separate files here.

In the 'Details' column, write 'Borang CP55D dan IC'. The 'Subject' can be 'Permohonan Nombor PIN e-Filing untuk [your name]'.

Then, click 'Submit'. Once you are done, you will receive your Submission No. After this step, wait for seven days to receive your PIN in your email.

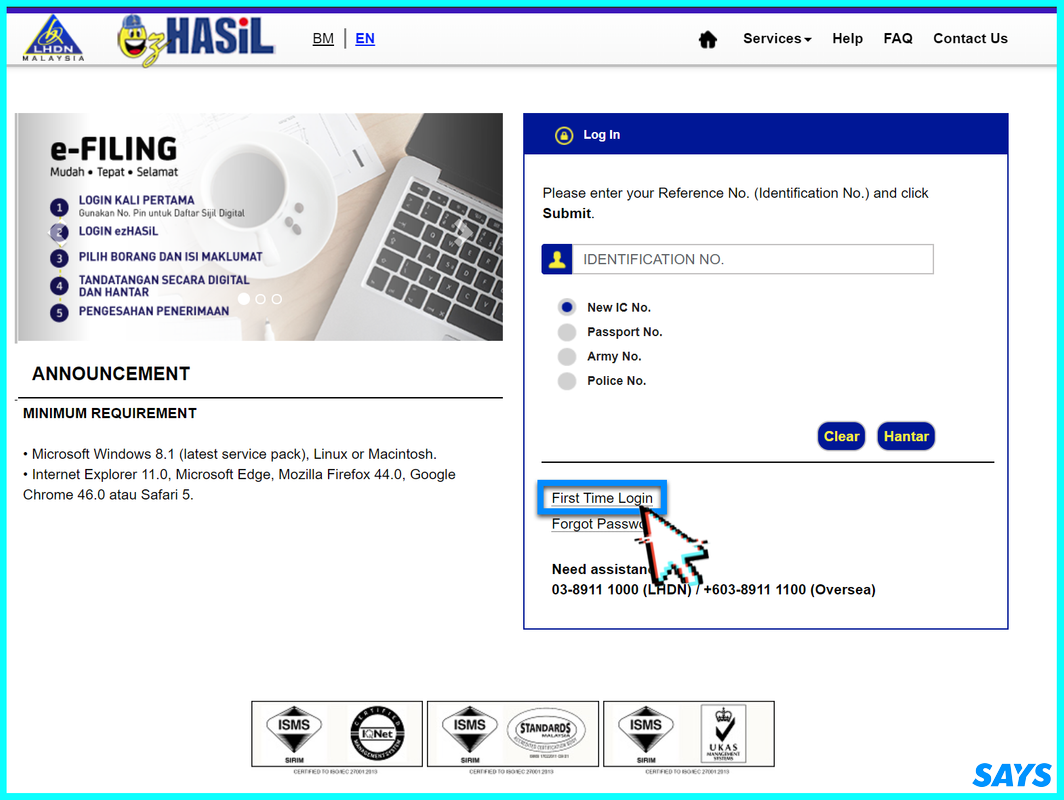

Now that you have registered and obtained the PIN, it is time to login into your ezHasil account and start filing your income tax:

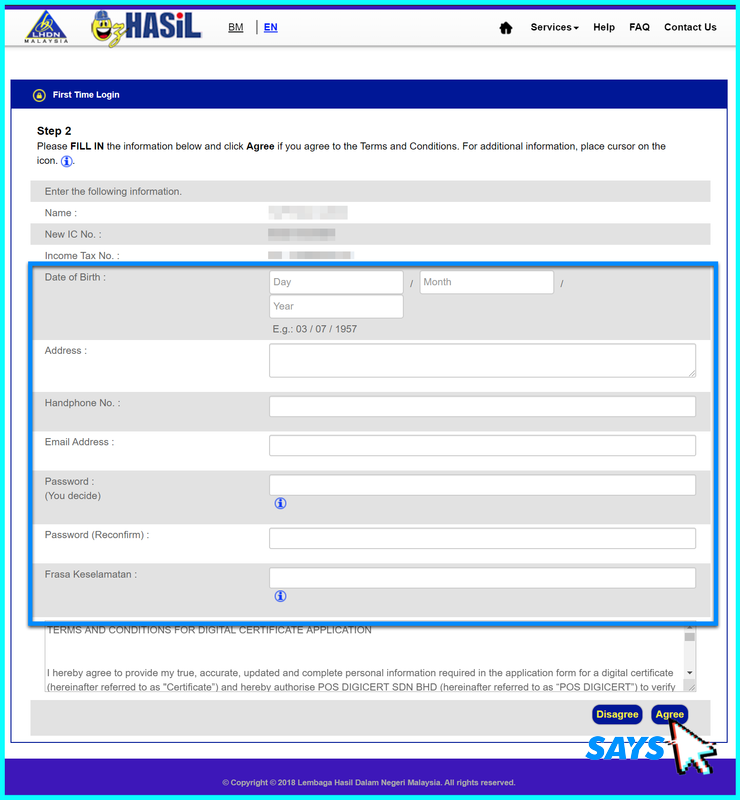

8. Fill up the details for your ezHasil account

You can hover over the blue 'i' icon to find out the criteria required for the column.

Once you have filled up the form and read through the terms and conditions, click 'Agree'.

Confirm the information you have keyed in on the next page. When you are done, click 'Submit' again.

You will then receive a message that says, "Your Digital Certificate has been successfully registered. Please click here to log in."

Click it to login into your ezHasil account.

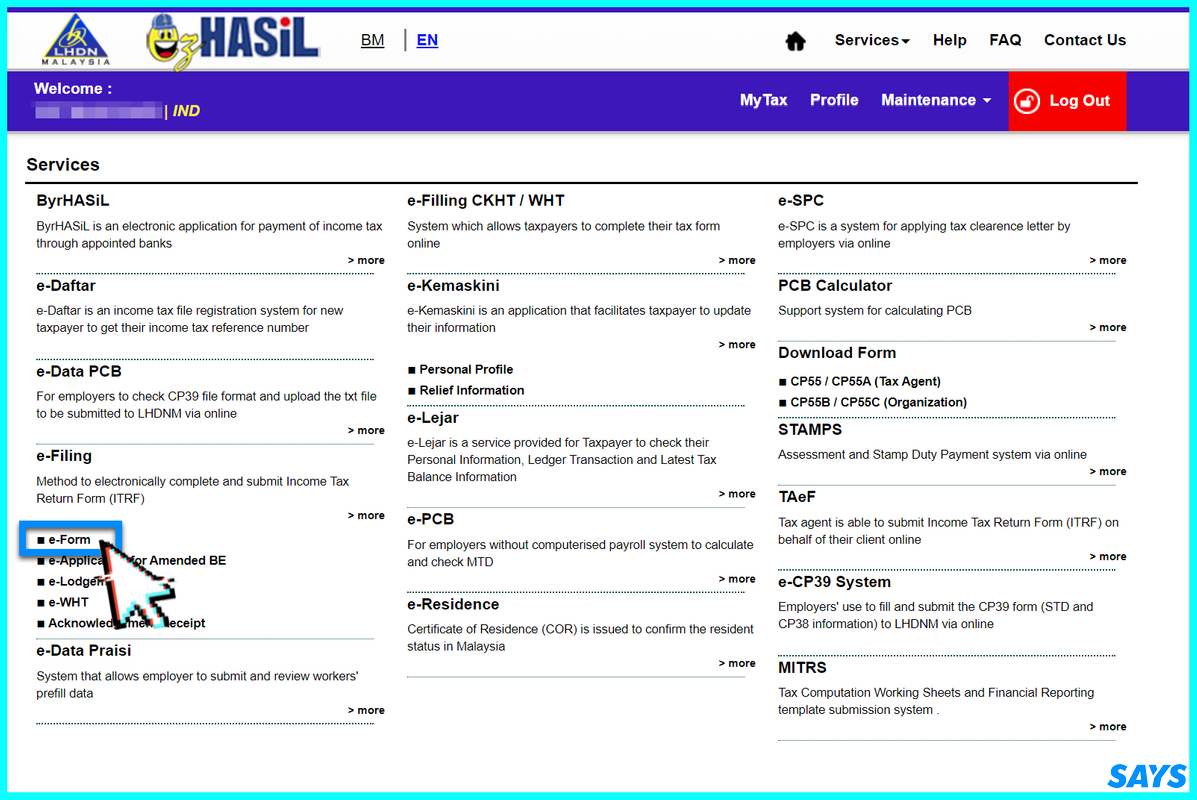

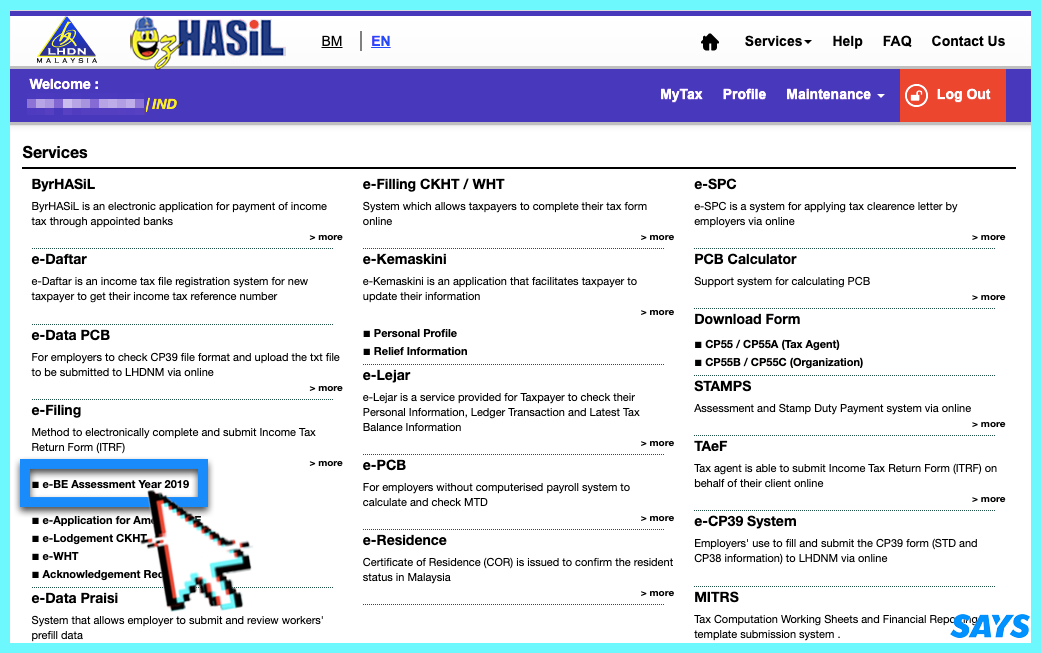

9. Once you have logged into your ezHasil account, select e-Form under the e-Filing section

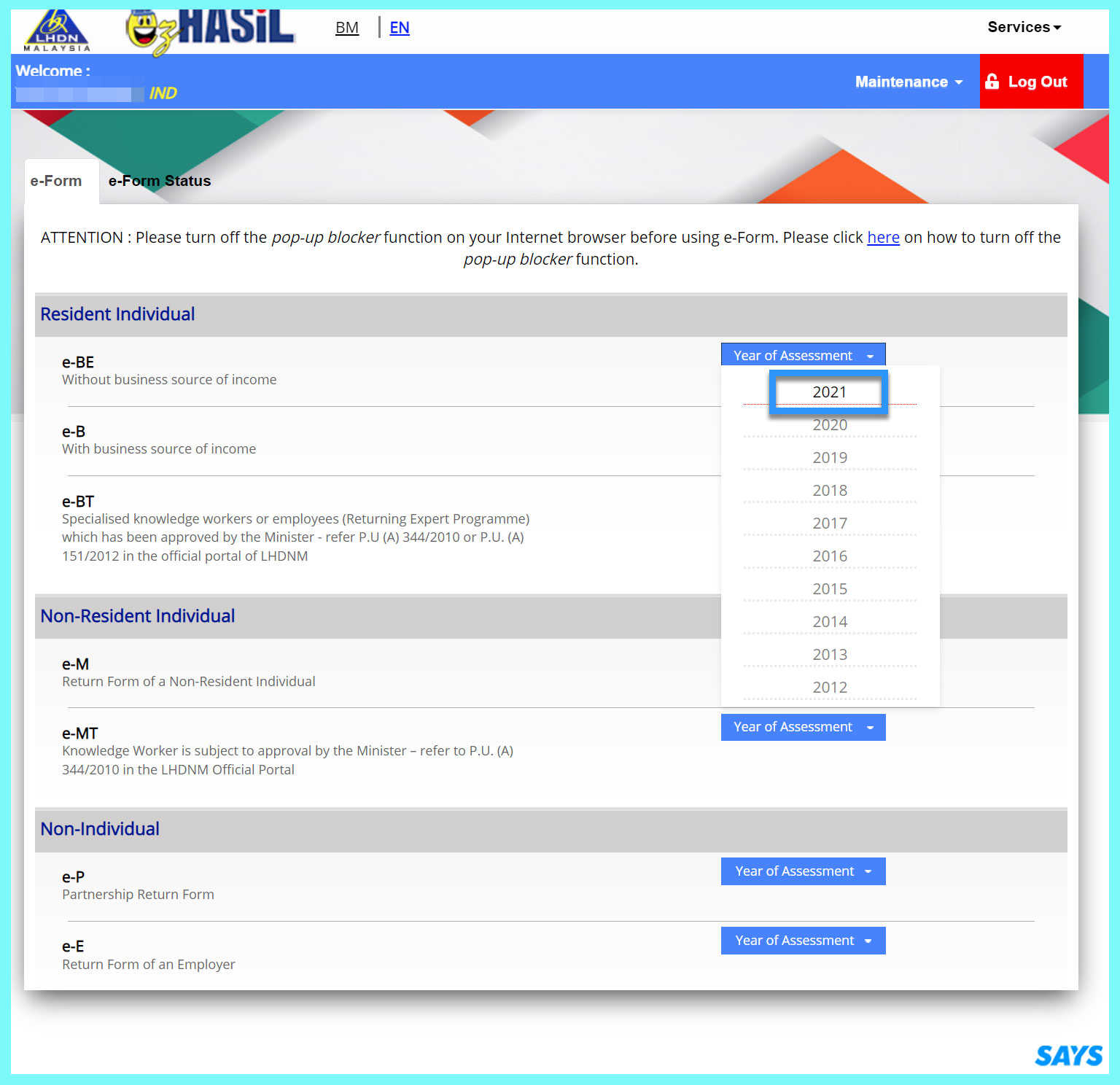

10. Go to e-BE and select last year under the 'Year of Assessment'

As mentioned earlier, this guide is for Malaysian salaried employees. Thus, we are selecting e-BE in this step, which stands for 'individual without business source of income'.

If you are not a Malaysian salaried employee (for example, you have a side business or work freelance), select the option that you seem fit.

From this point onwards, you are advised to allow the pop-up feature on all LHDN webpages.

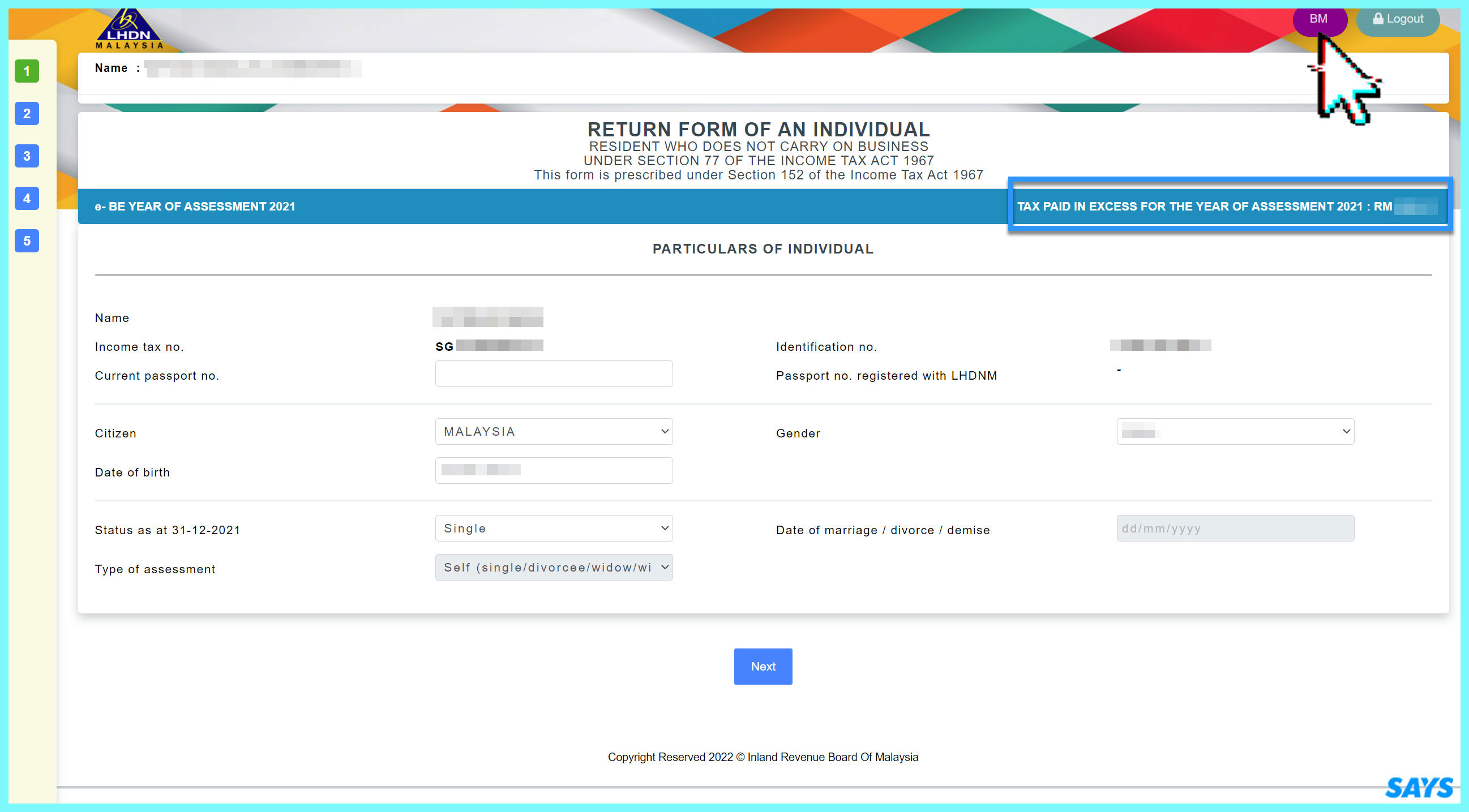

11. Fill up your particulars in the first section of the e-BE form

There are four different sections for you to fill up in this e-BE form. Remember, you can always toggle the language of the page by clicking 'Bahasa Melayu' or 'English' found on the top right corner.

If you have trouble understanding what some columns are requesting, you can click 'BE explanatory notes' found at the bottom left of the screen. They will provide all the information you need to know.

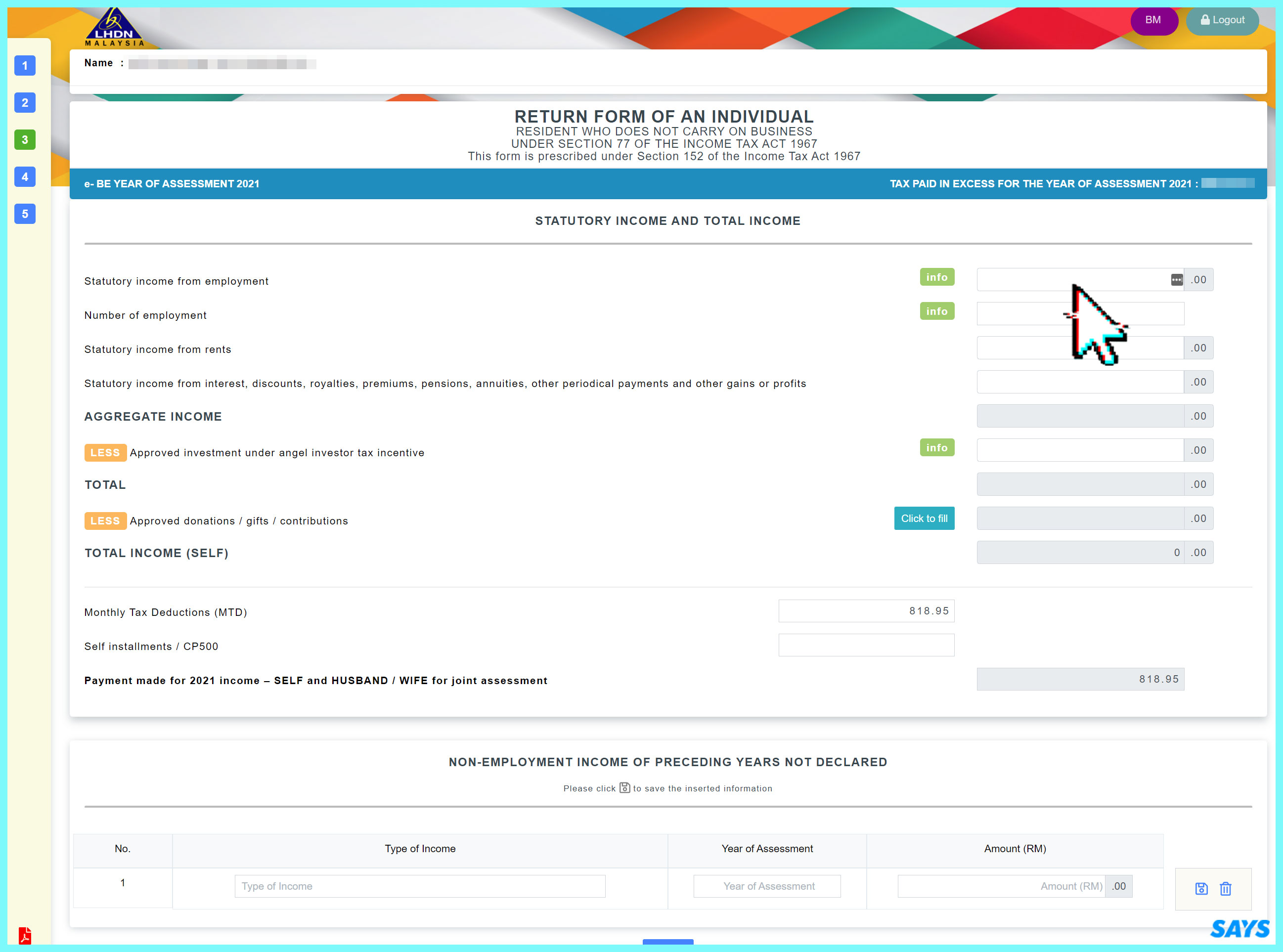

Before we proceed, on the top right above the form, you will see the amount of "Tax Paid In Excess For The Year Of Assessment [last year]". Your mission here is to take back as much money as you have paid in advance in the tax relief section (fourth section).

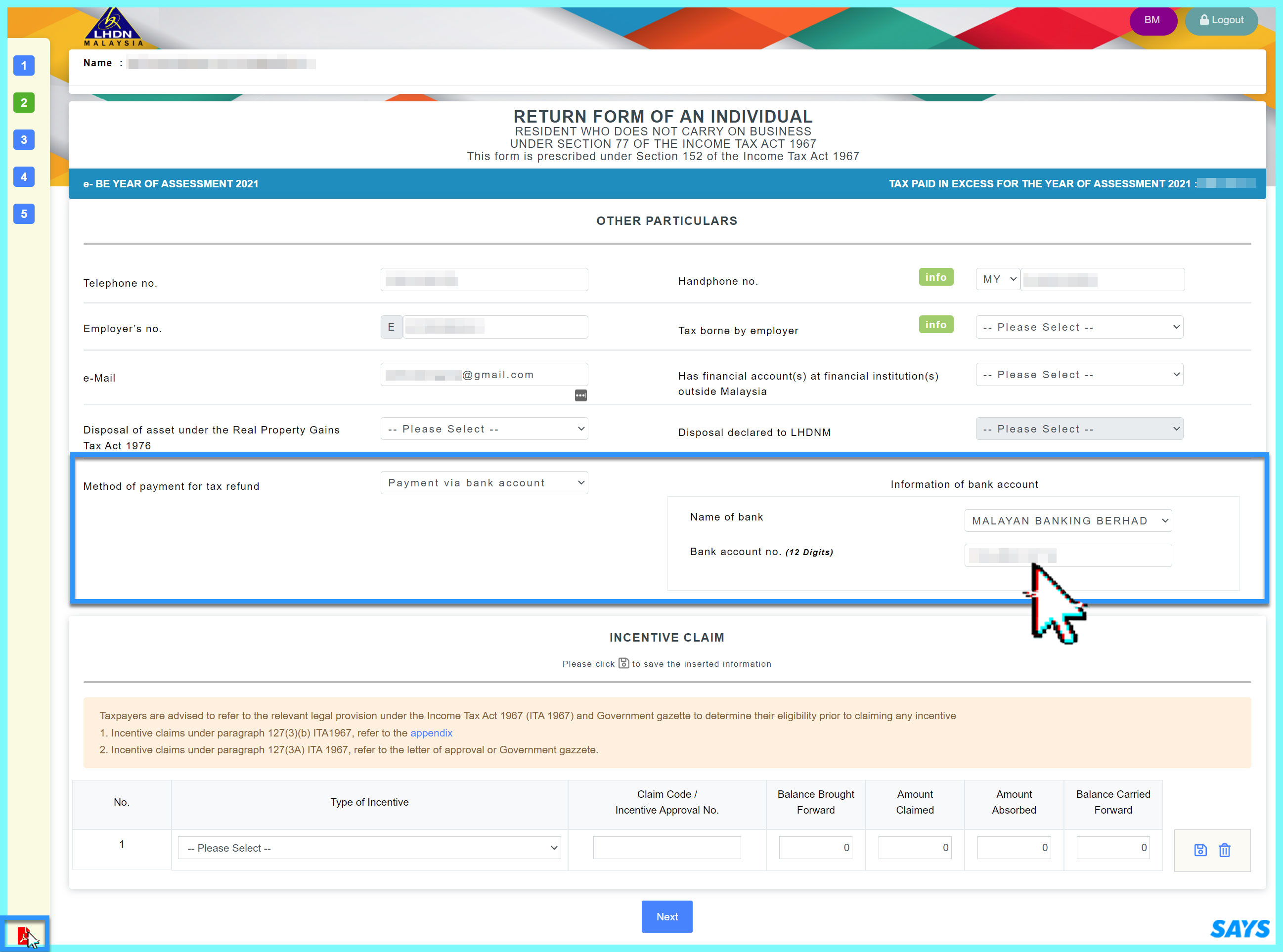

Before that, in the second section, you will be asked to fill up the name of your bank and the account number. The purpose of this is for LHDN to reimburse you any tax refunds after your submission.

Once you are done filling up your particulars, expand the next section by clicking 'Next' or '3' on the left menu.

Also note that if you stay idle on this page, you will be logged out automatically. However, all of your input will be saved. You can always access where you left off by clicking 'e-BE Assessment Year (last year)' on your ezHasil home page.

12. Declare your income

Refer to your previous year's EA form(s) and fill in your statutory income. However, you do not have to file the total amount stated in the EA form(s).

For example, if you received perquisites and benefits-in-kind during your employment, the money you get is exempted from income tax.

Perquisite / benefits-in-kind income includes:

- Parking allowances

- Medical allowances

- Petrol allowances (exempted up to RM6,000)

- Childcare allowances (exempted up to RM2,400)

- Monetary reward for past achievements, service excellence, or long service (exempted up to RM2,000)

All you have to do is take your annual income after EPF deduction and minus off whatever perquisite / benefits-in-kind income you received last year.

This step is important because it will reduce your taxable income. It is likely that you might drop from an upper income tax bracket, and in return, pay lesser tax to LHDN.

Here is how it works:

For example, your annual income after EPF deduction is RM40,000. You received RM1,000 for parking allowances, RM300 for medical allowances, RM1,200 for petrol allowances, and RM2,000 for your excellence reward. In the end, you only have to declare RM35,000.To understand the full list of income that is exempted from income tax, visit here.

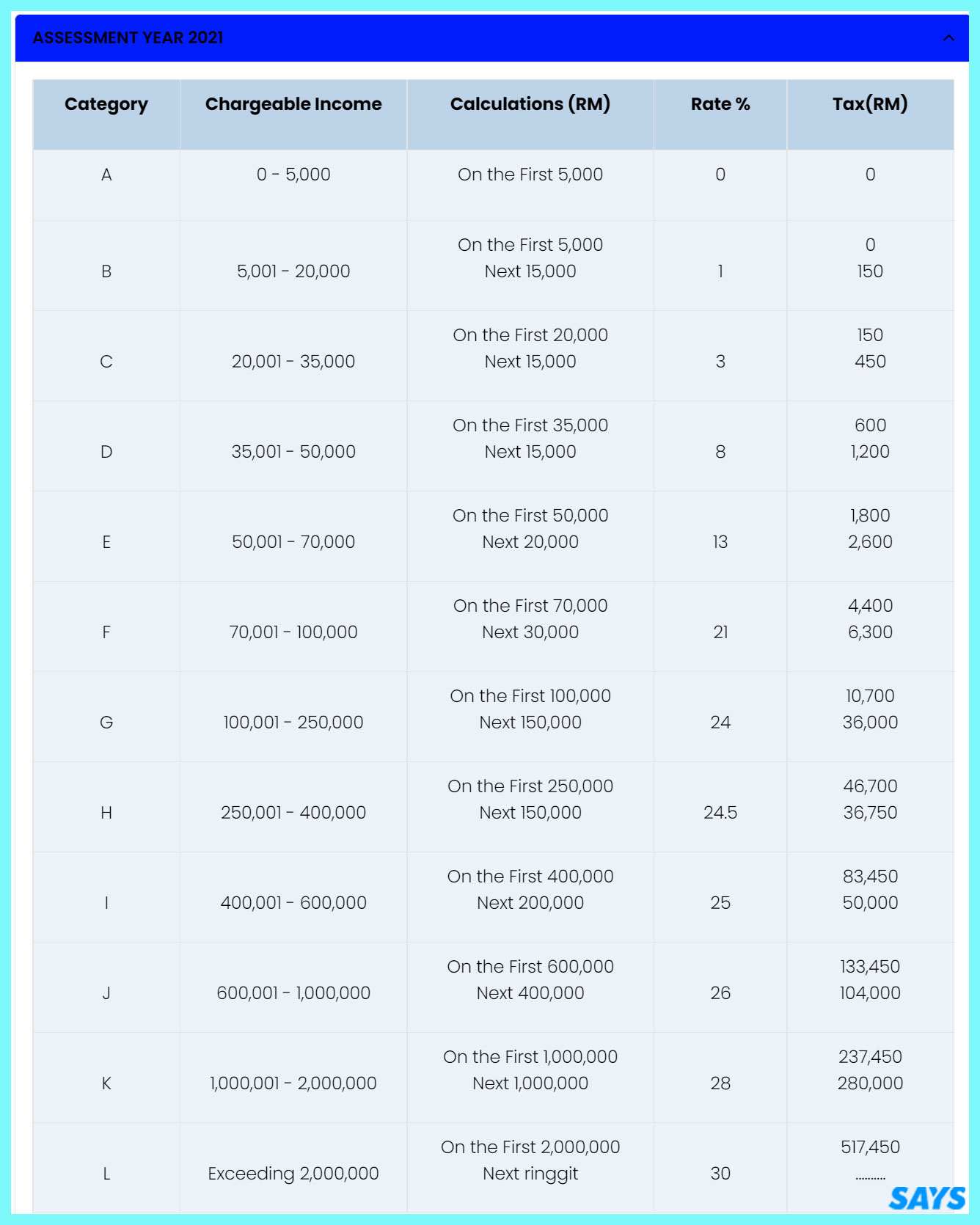

After taking out the tax exempted items, you only have to pay RM600 in tax:

- RM150: 1% tax in the second bracket

- RM450: 3% tax in the third bracket

You have saved RM400 in payable tax because the RM4,500 exempted income would not be declared and it would not be charged under the 8% tax bracket.

Meanwhile, below is the table of the income tax bracket found on the LHDN website:

13. Claim your tax relief

While there are many options for you to claim for tax reliefs, this guide will just highlight four of the popular 'individual tax relief types' since many first-time taxpayers are paying under the lower tax brackets.

If you have kept the receipts of computer, smartphone, and book purchases, they all fall under the 'lifestyle' tax relief.

The purchases of sports equipment, gym membership fees, and Internet subscription bills fall under the same relief too. You can claim up to RM2,500 in this category.

Additionally, if you have life and education & medical insurance, you can claim the premiums as well in two different categories. There is a RM3,000 cap in both categories.

If neither of the mentioned categories adds up to your payable tax, take a look at your EA form and key in the amount you paid for SOCSO. You can claim up to RM250 in this category.

In the year of the pandemic, you can also claim expenses on COVID-19 test kits.

For the full tax relief list, you can visit the LHDN website here.

So quickly dig through your emails and find all the electronic invoices. All these bills you have been paying for are finally useful.

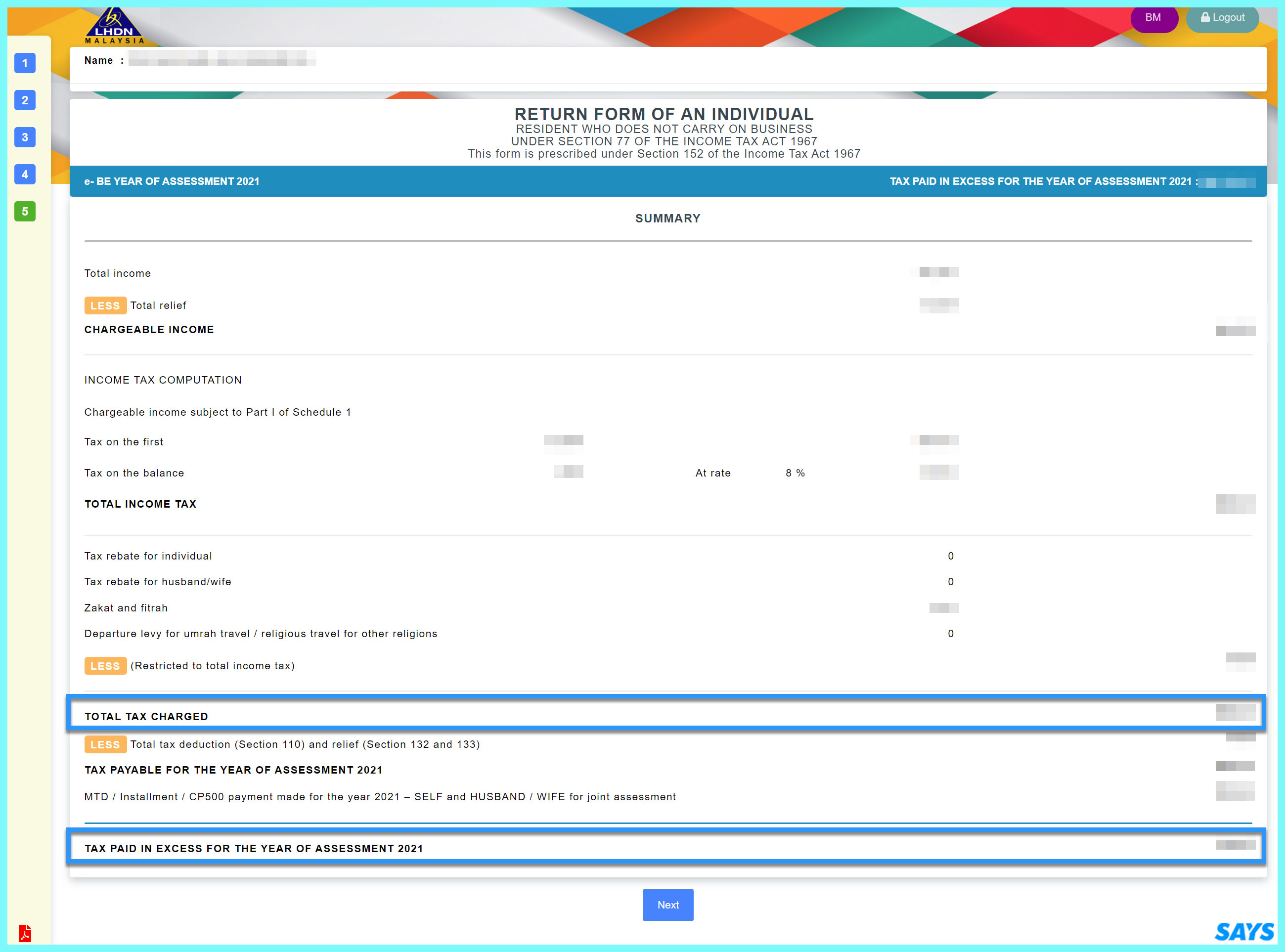

14. Check the total tax payable or tax return

The first blue box in the screenshot shows the amount of tax charged, while the second blue box shows if any tax return if you are under monthly tax deductions (MTD/PCB).

Once you are done, click 'Continue'.

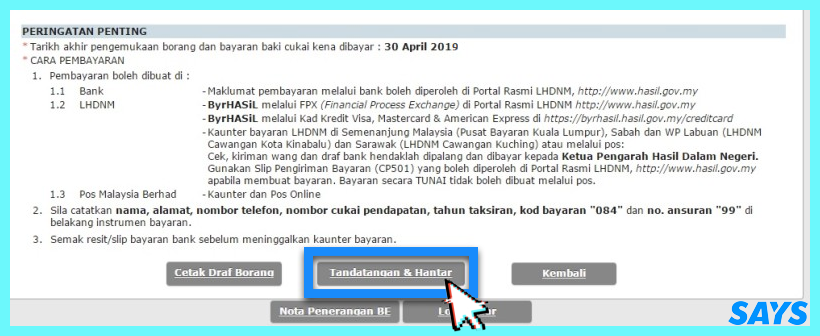

The final step is to declare that all the information provided is true. Then, click 'Tandatangan & Hantar' to electronically sign the form and submit your e-BE form to LHDN.

Voilà, you are done!