"How Do I Start Investing?" — These Everyday Malaysians Share Their Experiences

Don't worry, you can always start somewhere!

Thinking of investing, but not really sure where to start?

Investing in stocks can seem intimidating at first, but the good news is that you don't need to know everything about the stock market to start — everyone can start somewhere.

And beyond just profits, the journey to investing offers invaluable lessons on managing risks, analysing companies, and making informed decisions.

We spoke to everyday Malaysians on how they kickstarted their investing journey, and here are their stories:

1. "When I first started out, I set aside less than RM1,000 and bought local stocks"

"Of course, you need to do your due diligence by understanding how healthy and profitable the company is, how its competitors are performing, what are the disruptions taking place in the company's industry, etc.

"I made some gains when the pandemic hit as some of my holdings grew. I also saw one related to travel tank too. Overall, the experience was a valuable one.

"For anyone starting out, RM1,000 is a safe amount to start with because even if you make losses, it won't be so devastating.

"Before trading stocks, another advice is to ensure you have between six to 12 months worth of emergency savings set up. This is because you need some form of defence in the event any crisis arises."

- Sukhbir, 38 years old

2. "My advice is to start as early as possible. Start with RM500 or RM1,000 and quickly become familiar with the market and the trading platform you are using."

"Once you know how things work, start consuming financial news and books that teach you basic investing knowledge. Podcasts and YouTube videos by financial experts have been my number one source of information.

"But head knowledge is not enough. The best way to learn is to actually trade, so I suggest getting familiar with your chosen trading platform and start making your first trades as soon as you can. This will allow you to work faster, learn helpful tricks, and recognise the pitfalls of trading. Practice makes perfect, after all!

"Also, never invest based on other people's recommendations; always do your own research before investing.

"Today, I own stocks from 11 companies/ETFs and also have investments in cryptocurrencies. Investing is a journey, and I continue to learn every day."

- Wan Xiang, 31 years old

3. "After multiple years of investing, my biggest advice for beginners is this: invest in yourself first"

"My first few years of investing in the stock market, I was constantly chasing trends and analysing charts, but I didn't truly understand how the market worked.

"Although I managed to make some gains, I wasn't fully confident in my decisions. I also ended up made a lot of mistakes due to my FOMO. Looking back, I wish I had spent more time learning about the fundamentals of investing and getting familiar with trading platforms before diving in.

"Patience is key when it comes to investing — rushing in without proper knowledge can lead to unnecessary mistakes."

- Bernice, 29 years old

4. "I wasn't really sure where to start, so I only invested in companies I recognised and heard good things about"

"For me, my first stock was Maybank because it was a company I was familiar with and trusted.

"For beginners, I think it’s a good idea to invest in companies you know and use in your daily life. It makes the experience feel more tangible, like you’re investing in something real rather than just numbers and charts on an app.

"When I started, I also remember the older generation advising to focus on blue-chip stocks—companies with a track record of consistent performance. Instead of overthinking where to invest, starting with something proven and reliable is a safer bet for beginners."

- Chan, 31 years old

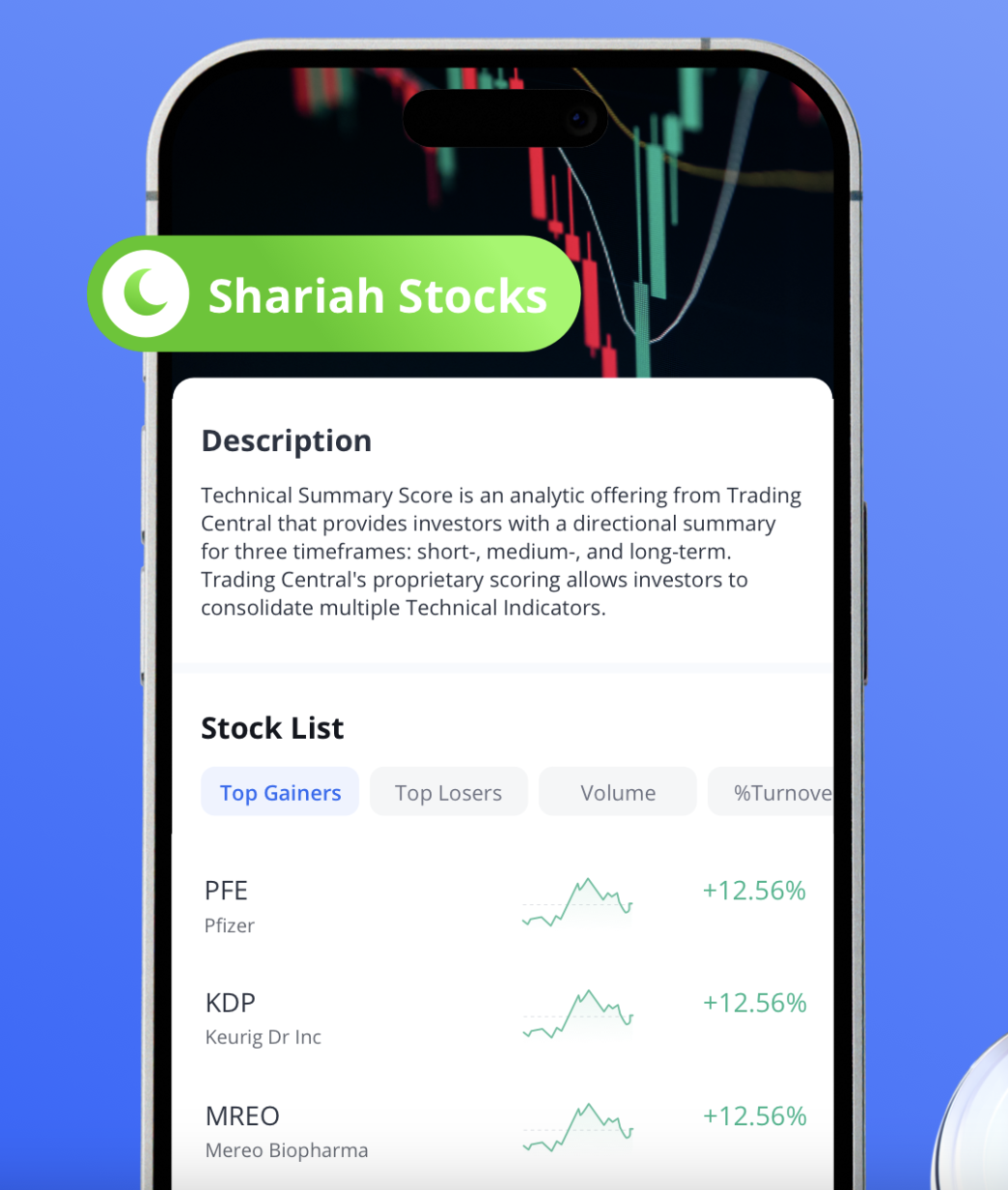

5. "Early on, I consulted with my colleagues to learn about how to trade Shariah-compliant stocks"

"In line with my beliefs, I focus exclusively on Shariah-compliant investments that come from trusted halal resources, so finding the right brokerage platforms was crucial for me.

"My colleagues, who had experience in this area, were an invaluable resource. They taught me the ins and outs of trading Shariah-compliant stocks and highlighted key factors to watch for. While online resources are helpful, having someone to guide you step by step makes the learning process much smoother and more manageable."

- Arif, 34 years oldFor those looking to start their investing journey, Webull Malaysia makes it accessible and easy even if you've never done it before

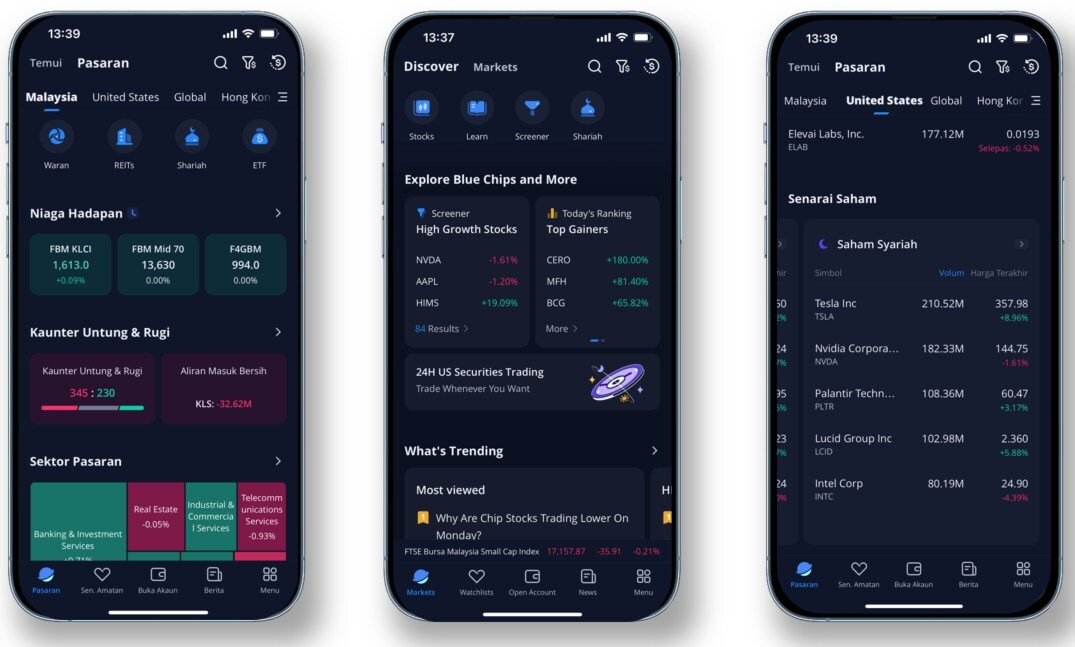

For starters, you can rest assured that you'll be enjoying competitive rates — Webull Malaysia offers one of the lowest rates at just 0.025% for US stocks.

And whether you're eyeing Malaysian stocks on Bursa Malaysia or exploring US markets, Webull Malaysia offers zero commission fees for the first 90 days. It's the ideal platform for beginners looking to grow their portfolio without high costs holding them back.

On the Webull Malaysia platform, you'll also get to enjoy trading in your native language, be it English or Bahasa Melayu. The app also allows you to filter the kinds of stocks you want to see, making it easier for those who want to trade Shariah-compliant stocks.

All in all, Webull Malaysia is catered to not only seasoned investors, but also everyday Malaysians looking to get into investing without much prior experience.

For a limited time, investors on Webull Malaysia will get to enjoy exclusive benefits

If you maintain the deposit for 60 days and complete at least one 'Buy' trade before 28 February, you'll receive rewards valued at RM400, comprising free US stocks and Trading Vouchers. You can choose fractional shares worth RM300 from well-known Shariah-compliant companies such as NVIDIA (NVDA), Apple (AAPL), Lululemon (LULU), and Google (GOOGL).