[VIDEO] Don't Have A Fixed Income? This SJKP Scheme Can Help You Get Housing Financing

Those eligible can get home loans of up to RM400,000 from participating banks.

Typically, in order to buy a house, you would first need to secure a home loan

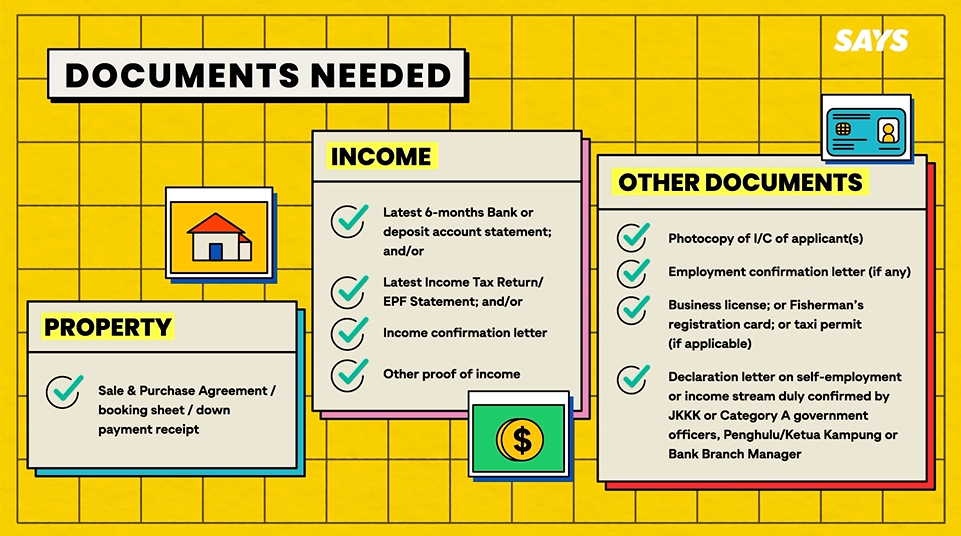

This usually requires you to have documents such as three months of payslips, showing a steady income stream, so that banks can see that you are able to pay back the loan.

However, for those without a fixed income, such as gig workers, taxi or e-hailing drivers, farmers, independent business owners, or freelancers, this process can be incredibly difficult due to insufficient financial proof.

For those who fall under those categories, this year could be your year to finally buy your first house!

Under Budget 2022, the government has allocated an additional RM2 billion for the 2022 Housing Credit Guarantee Scheme to help more Malaysians buy their first home. The scheme is under Syarikat Jaminan Kredit Perumahan Berhad (SJKP), which is wholly owned by the Ministry of Finance.

It forgoes the traditional way of financing your house as there are many other ways to show proof of income. Those eligible can get home loans of up to RM400,000 from participating banks.

Watch the video below for a detailed breakdown on the scheme:

To apply, gather all required documents and apply directly to any of the participating banks

Participating banks include Agro Bank, Bank Islam, Bank Rakyat, BSN, RHB, and Bank Muamalat.

When applying at your selected bank, let the bank officer know that you are applying for a home loan under the SJKP scheme. The bank will then evaluate and review your credit application before submitting it to SJKP.

If your application is approved by SJKP, the bank will extend an offer letter and financing to you.

Now, let's go through what the scheme offers you in detail

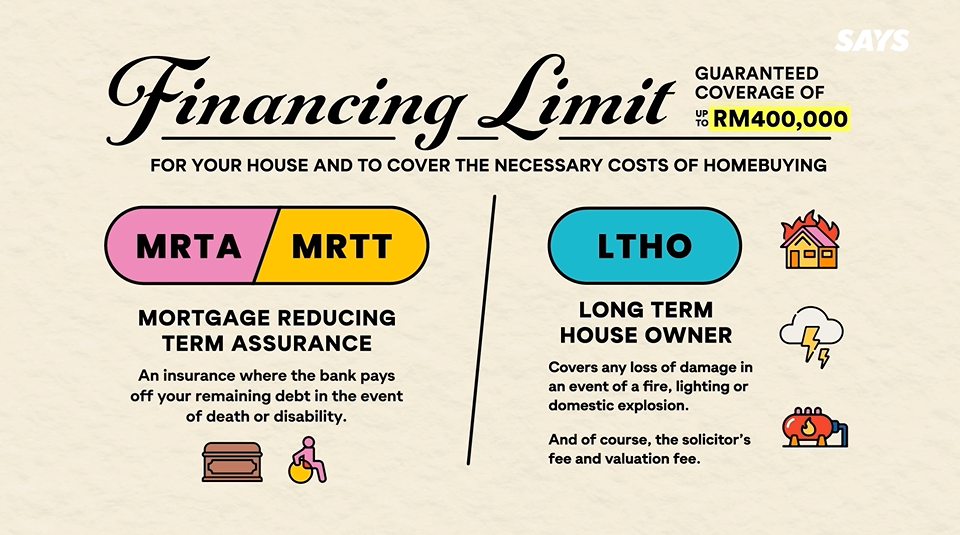

You are offered a financing limit with a guaranteed coverage of up to RM400,000 for your house and other necessary costs of homebuying.

This includes the following:

- Mortgage Reducing Term Assurance (MRTA) or Mortgage Reducing Term Takaful (MRTT), which is an insurance where the bank pays off your remaining debt in the event of death or disability

- Long Term House Owner (LTHO), which covers any loss of damage in the event of a fire, lightning, or domestic explosion

- Solicitor's fee and valuation fee

As for loan repayment, you will have up to 35 years, or the tenure of the loan (depending on the applicant's age), whichever is earlier

To extend the repayment period, the scheme also allows for two-generation financing and joint applicants, including pairs such as husband-wife, brother-sister, and parent-child.

The interest rate will be determined by the bank.

Wondering if you're eligible for this scheme? Here's the list of criteria you must meet:

2. Looking to buy and live in your first new residential house, existing house (sub-sale), or auctioned house which are under the low, medium, or affordable category

3. The total repayment of all loans does not exceed 65% of your gross monthly income

4. Have a good credit score

5. No other adverse credit records within the last 24 months