No Cash To Invest? You Can Use Your EPF Savings To Build Your Future Wealth

You even get to enjoy 0% sales charge when investing with Principal Asset Management Berhad!

People always say you should save and invest when you're young, so you can enjoy more wealth later...

But let's be honest, cost of living is high, and it's continuing to increase.

After paying rent, bills, loans, groceries, and all your other necessities, most of us don't even have anything left to save... let alone invest!

The great news is that it's super simple to invest with Principal Asset Management Berhad (Principal) using your existing EPF savings

Formerly known as CIMB-Principal Asset Management Berhad, Principal has been helping Malaysians grow their wealth since 1994.

And yes, you can actually use your EXISTING EPF SAVINGS* to grow your wealth! It's pretty cool tbh.

*You can use up to 30% of the amount in excess of Basic Savings from EPF Account 1 savings to invest through i-Invest.

But why should you invest in Principal... using your EPF funds?

2. It diversifies your portfolio and minimises your risk of loss.

3. You can invest in less than 5 minutes using EPF's i-Invest platform.

4. Principal currently offers a 0% sales charge for unit trusts purchased on the i-Invest platform.

What is a unit trust?

A unit trust basically pools money from investors into a single fund. This pool of money is managed by a fund manager, like Principal, who will help you invest your money in a variety of investments. Ultimately, you're letting the pros decide the best way to grow your money, so you don't have to!

Easy peasy lemon squeezy :)

1. You get to enjoy 0% sales charge when purchasing on EPF i-Invest*

*For a limited time only.

2. Principal has award winning funds that focus on equities in mega countries like the US and Japan

It sounds complicated but basically this means that Principal is a trusted fund manager all over the world. Here's a quick look at the available funds:

- Principal Islamic Asset Management Sdn. Bhd. | 5-year annualised return: 7.91%

- CIMB-Principal Asian Equity Fund | 5-year annualised return: 9.26%

- CIMB-Principal Asia Pacific Dynamic Income Fund (Class MYR) | 5-year annualised return: 10.91%

- CIMB-Principal Global Titans Fund (Class MYR) | 5-year annualised return: 12.08%

- CIMB-Principal Greater China Equity Fund | 5-year annualised return: 14.30%

3. With Shariah compliance funds available, there are options for every Malaysian

Principal is a credible choice with an established track record of managing Islamic portfolios. It offers pure management of Islamic assets with all processes in accordance with Islamic principles.

A recommended fund is Principal Islamic Asia Pacific Dynamic Equity Fund.

While there are a few ways to invest in unit trusts, an easy way is to use your EPF savings. Here's a step-by-step guide:

STEP 1:

If you don't have an EPF i-Akaun yet, head over to your nearest EPF branch or kiosk to get your activation code and register online. Remember to bring your IC along!

STEP 2:

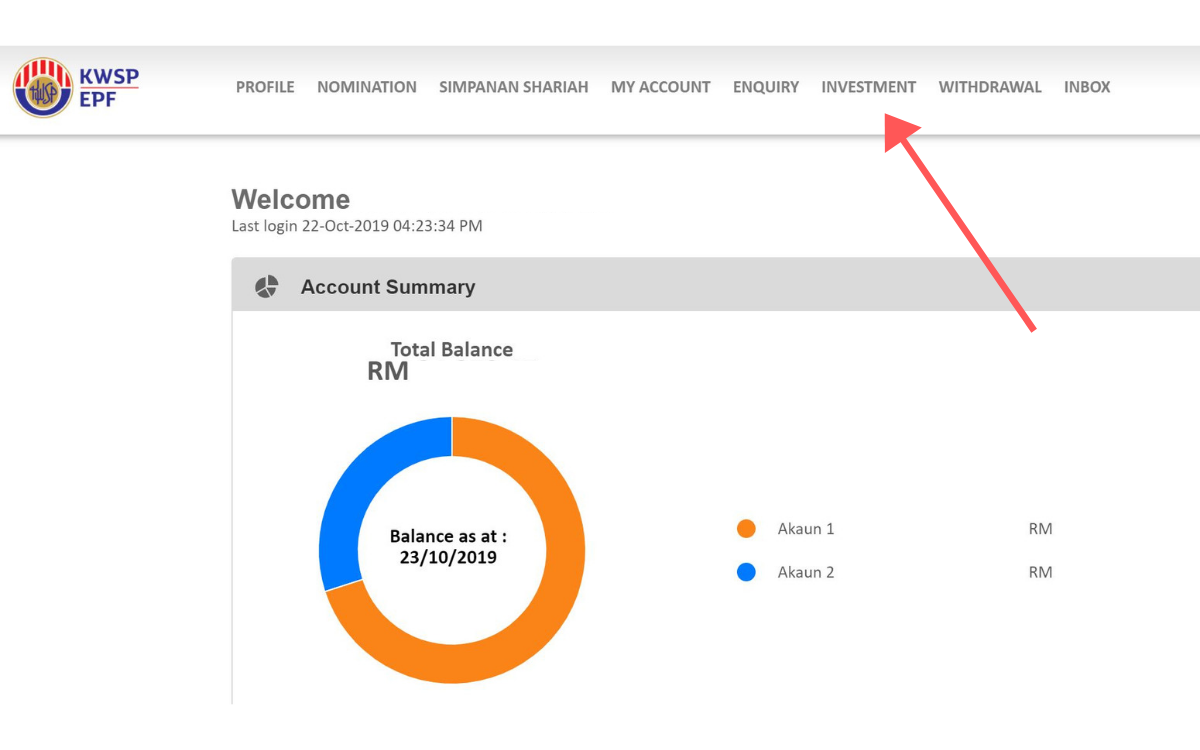

Login to your EPF account on their website, and select "Investment" on the top menu bar.

STEP 3:

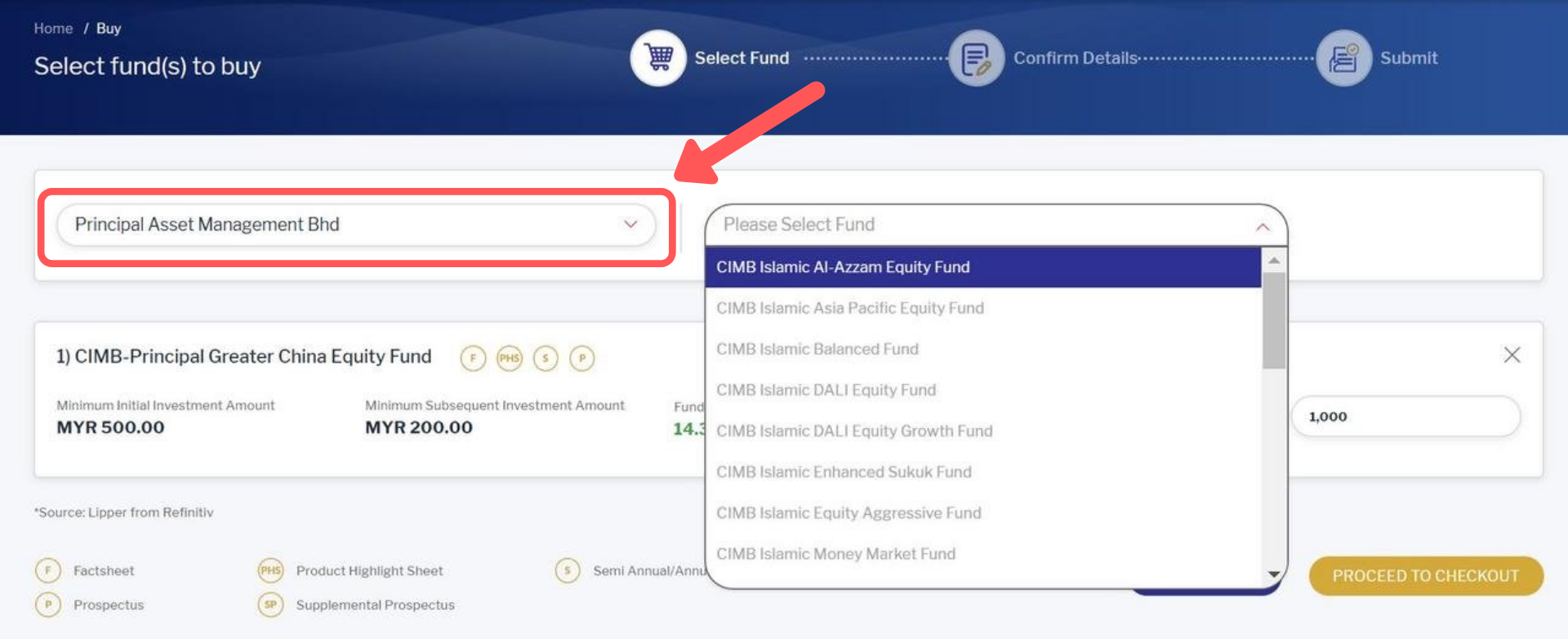

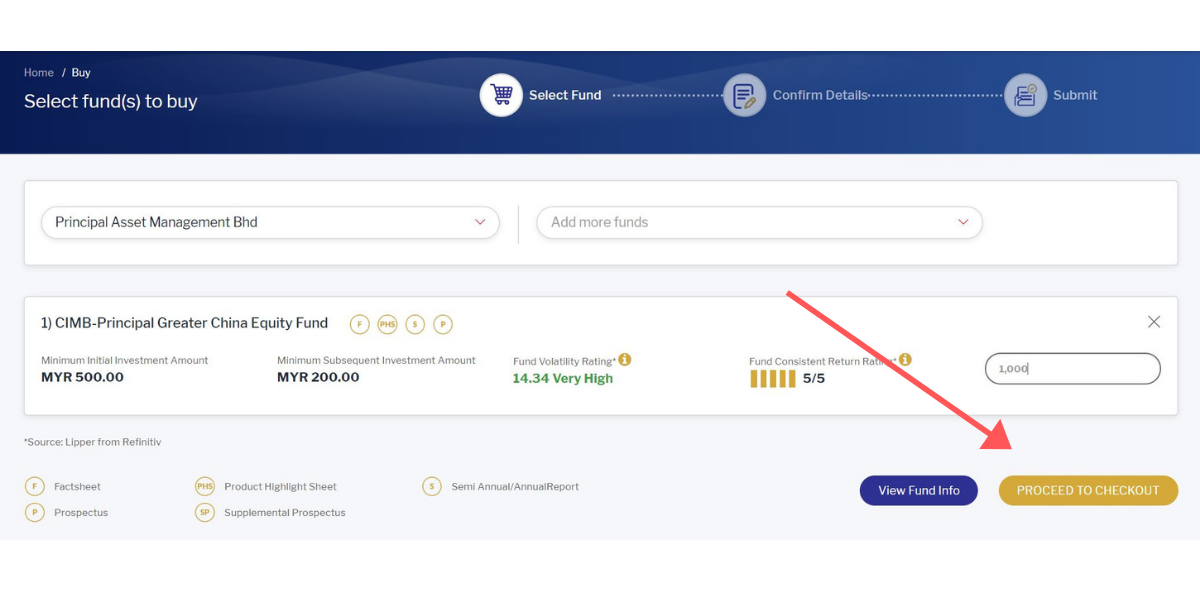

Select "Principal Asset Management Bhd" and the fund you want from the drop-down menu. Not sure what to invest in? Here are a few unit trust funds to get you started:

- Principal Islamic Asia Pacific Dynamic Equity Fund | 5-year annualised return: 7.91%

- CIMB-Principal Asian Equity Fund | 5-year annualised return: 9.26%

- CIMB-Principal Asia Pacific Dynamic Income Fund (Class MYR) | 5-year annualised return: 10.91%

- CIMB-Principal Global Titans Fund (Class MYR) | 5-year annualised return: 12.08%

- CIMB-Principal Greater China Equity Fund | 5-year annualised return: 14.30%

STEP 4:

Key in your investment amount (a minimum of RM500), click "Proceed To Checkout," and you're almost done.

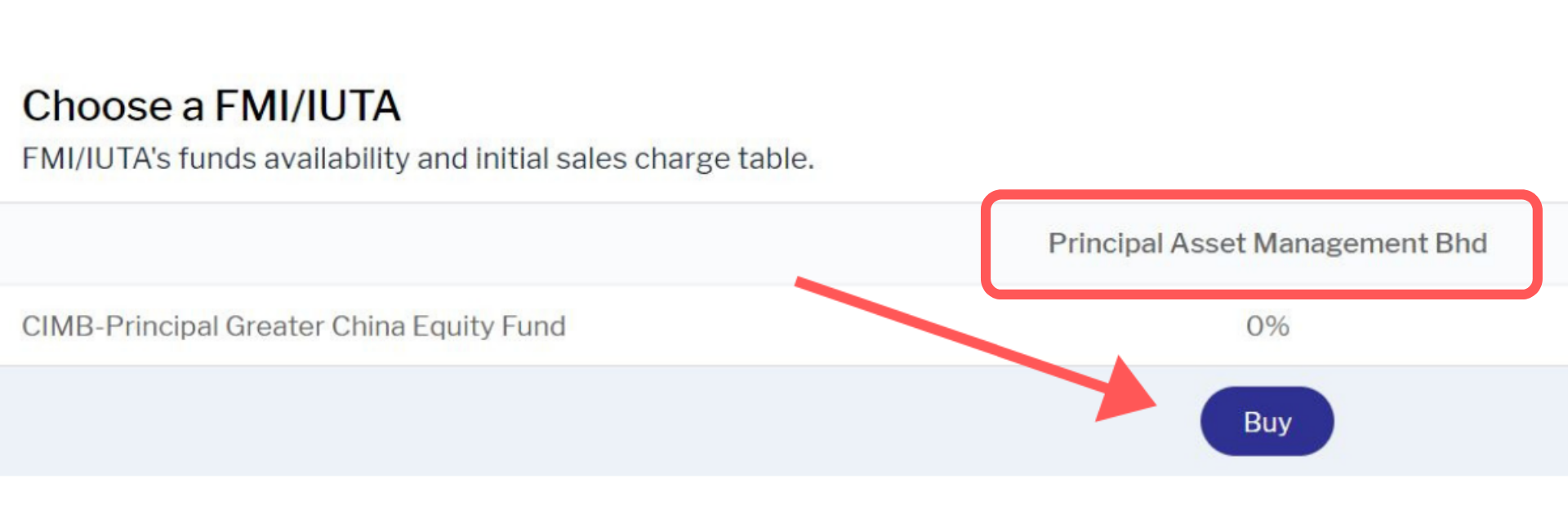

STEP 5:

Be sure to choose FMI/ IUTA.

One last thing you gotta do is click "Buy" from Principal Asset Management Bhd. This ensures you get to enjoy the 0% sales charge!