TNG eWallet Can Now Invest In Private Retirement Schemes (PRS) With Up To 8% P.A. Rewards

And your investments qualify for 2024 income tax relief, making it a smart move for your finances!

If you've been looking for a way to invest or save that's easy and rewarding, there's one available right now in the Touch 'n Go eWallet app — and it’s even eligible for tax relief this 2024!

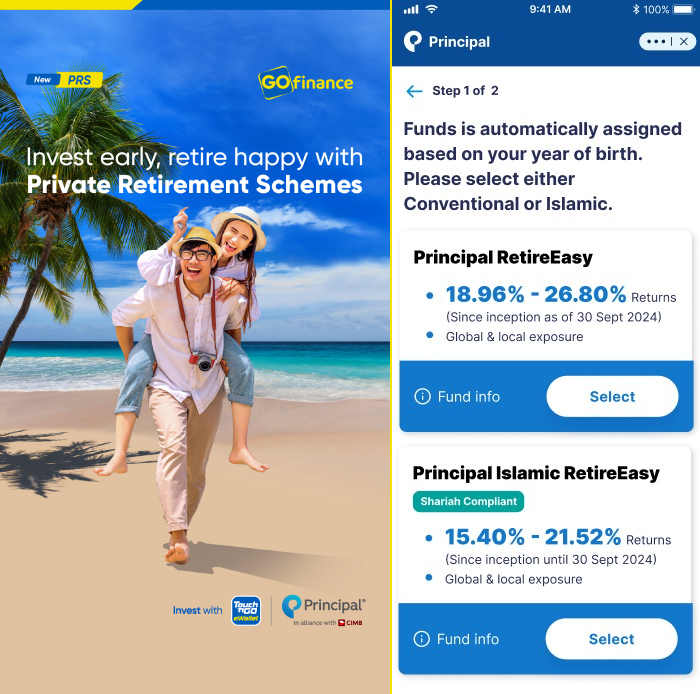

You probably already use the Touch 'n Go (TNG) eWallet on a regular basis, and you can now use it to invest or save in Principal's PRS funds for your retirement with GOfinance-Principal in theTNG eWallet app.

This feature is a collaboration between TNG eWallet and Principal, a globally renown asset management firm with over 140 years of experience and one of the top asset management providers in Malaysia.

It’s a hassle-free, first-of-its-kind retirement solution that empowers you to complement your EPF savings, close the gap in your retirement savings, and potentially earn higher returns. Additionally, you can enjoy tax reliefs on your PRS investments -- up to RM3,000 in annual tax relief until Year 2030.

To start investing in PRS through GOfinance-Principal, you only need to perform a one-time eKYC process for verification, then choose between Conventional or Shariah-compliant option and invest as little as RM100 in the Retire feature. The best part is, there is no need to download anything new — you can access this feature directly from your TNG eWallet app.

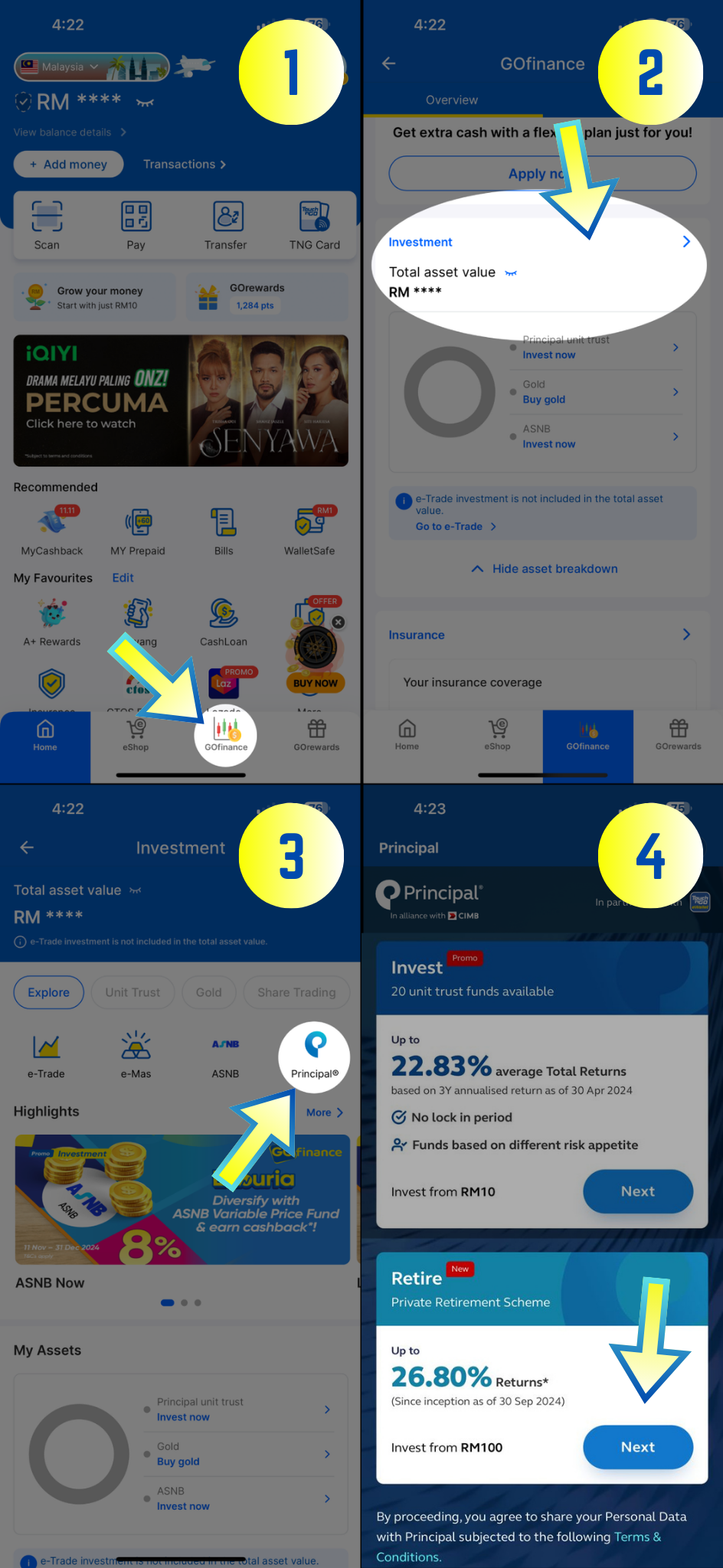

Here's how to access GOfinance-Principal in the TNG eWallet:

You can kickstart your first PRS investment journey with these simple steps:

1. Launch the TNG eWallet app

2. Click on GOfinance section

3. Select 'Investment', then select 'Principal'

4. Select the ‘Retire’ option

5. Start your eKYC verification process and perform a risk assessment

6. You're ready to invest!

Explore Principal’s target date funds, tailored specifically for your retirement plans

With GOfinance-Principal's new Retire feature, you can begin saving and investing for your golden years without having to scratch your head over which funds to pick from.

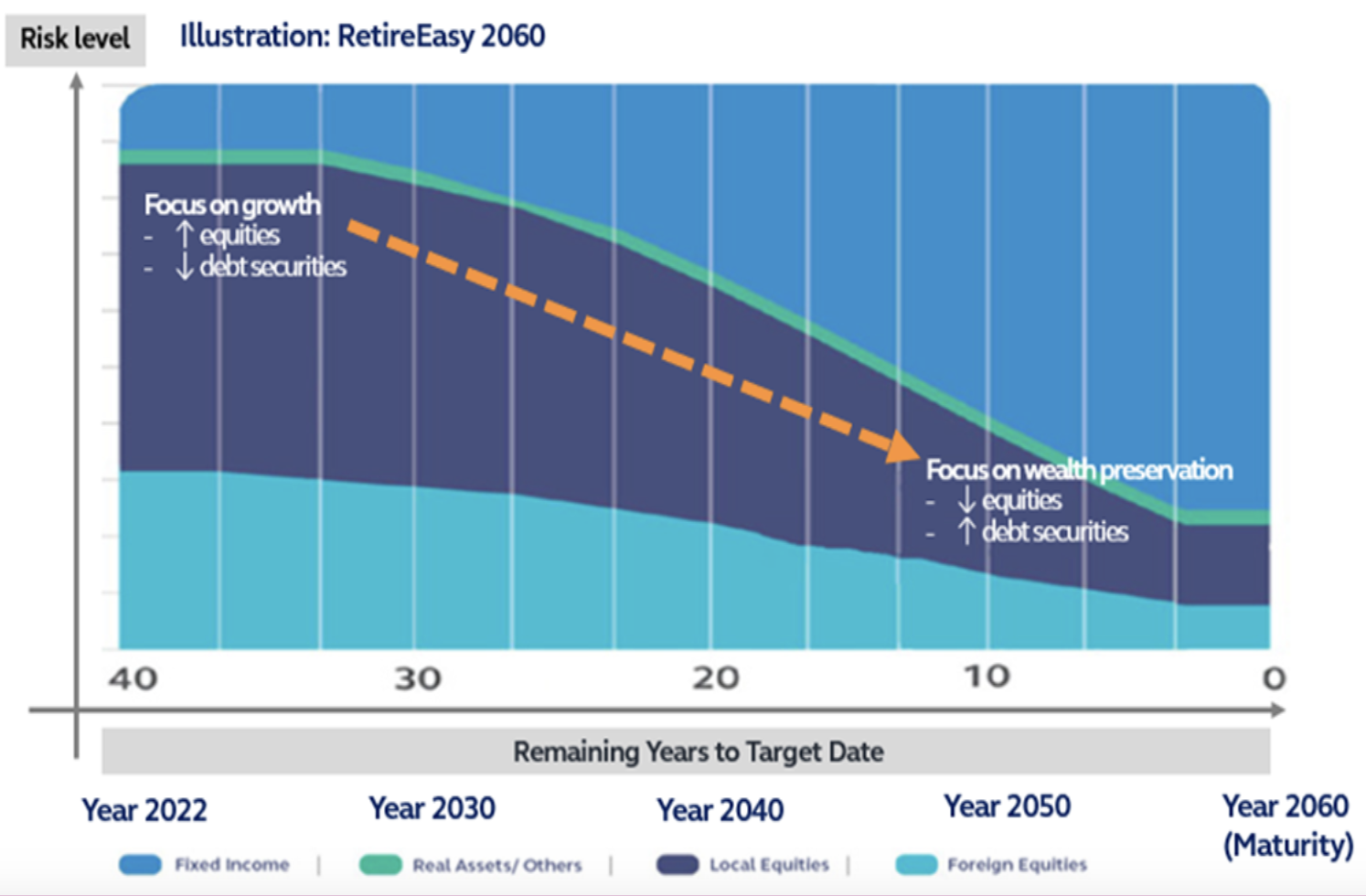

The Retire feature introduces you Target Date funds (TDF) - which is a hassle-free solution where the investment mix of the funds will be adjusted gradually over time, corresponding to your age.

This means that your investment mix will shift gradually (from aggressive towards more conservative) over the years and will be managed on your behalf to ensure you get the optimum amount once you reach your golden years.

For example, when you're younger, your portfolio will have a higher allocation in growth assets like equities. As you near retirement, the fund gradually shifts to more conservative investments like bonds to help protect your savings.

Whether you're new to investing or prefer a hands-off approach, TDF provides a solution that aligns with your long-term goals. This tailored approach to a secure retirement is only offered by Principal and you can access it through GOfinance-Principal feature, with as little as RM100!

Start investing and enjoy up to 8% p.a. in extra rewards alongside your retirement investments via the Laburia promotion

Through the Laburia promotion, there will be two rewards tiers for users who invest in Principal's funds via Invest or Retire feature:

TIER 1: Invest from RM100 – RM29,999 in any of Principal's Invest or Retire funds and you’ll receive 5% p.a. Cashback for 30 days on your investment amount in the form of TNG eWallet credits.

TIER 2: Invest RM30,000 and above and you’ll receive 8% p.a. for 30 days in the form of TNG e-Mas units (gold units).

*Terms and conditions apply.

Begin investing with Principal today to enjoy tax savings and earn extra rewards via the Laburia promotion — and set up for a more secure and comfortable future.

For more information about PRS via eWallet, visit this website. Or, click here to learn more about the Laburia promotion.

Disclaimer:

You are advised to read and understand the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) before Investing. Among others, you should consider the fees and charges involved. The registration of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) with the Securities Commission Malaysia (SC) does not amount to nor indicate that the SC recommends or endorses the funds. A copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) may be obtained at our offices, distributors or our website at www.principal.com.my. The issuance of any units to which the relevant Prospectus, Information Memorandum and/or Disclosure Document relates will only be made on receipt of an application referred to in and accompanying a copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document. Please be advised that investment in the relevant unit trust funds, wholesale funds and/ or private retirement scheme carry risk. An outline of the various risk involved are described in the relevant Prospectus, Information Memorandum and/or Disclosure Document. As an investor you should make your own risk assessment and seek professional advice, where necessary. Securities Commission Malaysia does not review advertisements produced by Principal.