Do Malaysians Spend Too Much Or Are We Not Earning Enough?

It is fair to say that most Malaysians are struggling.

Among the top worries of Malaysians is the high cost of living. This was made evident especially leading up to the recently tabled Budget 2018.

Prime Minister Datuk Seri Najib Razak had asked Malaysians for their suggestion in preparation of the Budget 2018. It then came as no surprise when the issue of cost of living topped the list by Malaysians to be addressed during the Budget tabling.

However, in April 2017, the prime minister said that the cost of living in Malaysia is the lowest among ASEAN country members. This was then followed by a statement by The Council of Former Elected Representatives (Mubarak) ahead of the Budget 2018 tabling. Mubarak deputy president, Tan Sri Abdul Rahman Sulaiman said that when assessing the real cost of living, it is possible that there may be a tendency for some Malaysians to mix both costs of living and cost of lifestyle.

So, is the cost of living really the top concerns of Malaysians, or are we indeed including the cost of lifestyle into the calculation?

The difference between cost of living and cost of lifestyle

In order to compare both, let’s first understand what cost of living and cost of lifestyle are.

Cost of living includes cost incurred for basic necessities to survive such as shelter (home), food, and medicine among others. As major cities grow and expand around Malaysia, the cost of living will vary significantly.

While the definition of cost of lifestyle is the expense of keeping up a certain way of life. Cost of lifestyle can be better understood as essentially lifestyle requirements, and the cost incurred are then referred to as the cost of lifestyle as it is not a requirement. For example, items such as the latest mobile phone models, tablets, entertainment and more.

Now that we’ve differentiated between the two, do Malaysians spend too much? Or are we not earning enough?

Are Malaysians spending too much or are we not earning enough?

Earlier in January this year, the Prime Minister had said that Malaysians need to think of increasing their income instead of depending on the government.

While the logic behind that does makes sense, it should also be noted that the increment salary of most Malaysians does not match the rise in the cost of living. Aside from that, the inflation rate also needs to be taken into account as it also has a correlation to the rise in the cost of living.

Try doing this exercise to see if your salary increment over the years has been equivalent to the inflation rate:

Calculate your salary increment and then the inflation rate over the previous 5 years. Then compare the increase between the two, you will then get to see your real wage growth. If your wage growth is on the positive, even if the number is minuscule, consider yourself lucky. Apparently, most Malaysian’s wage growth is actually in the negative.

“After adjusting for inflation, their wage growth is actually negative” – Dr Muhammed Abdul Khalid, Khazanah Research Institute’s Director of Research.

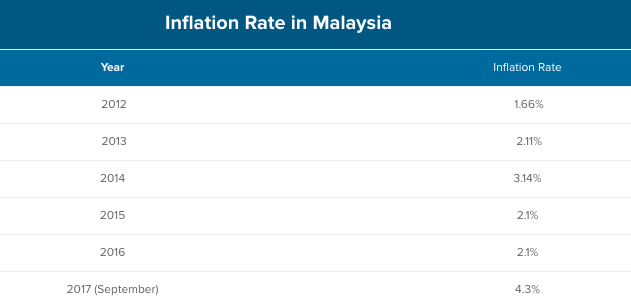

Let’s use Sarah as an example. Sarah’s salary has increased 60% from RM2,500 when she was a fresh graduate to RM4,000 over the course of 5 years (2012 – 2017). At the same time, the inflation rate in Malaysia from 2012 to 2017 is as below:

So how does Sarah’s salary wage growth compare to the inflation rate? Below is a calculation to show the percentage of salary growth versus inflation rate over the years:

RM4,000 – RM2,500 = RM1,500 increase, percentage of salary growth:

RM1,500 ÷ RM2,500 x 100 = 60%

Percentage of inflation rate between 2012 and September 2017:

4.3% (2017) – 1.66% (2012) = 0.44 increase

0.44 ÷ 1.66 x 100 = 159%

Comparison between salary growth and inflation rate:

Sarah’s salary increase of 60% over the years may seem like a lot at first. However, when compared to the 159% inflation rate increase for the same duration, it’s a different story.

Clearly, Sarah’s salary increase did not match the inflation rate during the same duration compared.

What about you? Has your salary growth matched the inflation rate?

If you are working and residing in the city, you will most likely feel the pinch even more so. The median wage in 2016 was RM2,200, which is the same in 2014.

This meant that there was no change in the median wage for 2 years. But at the same time, the inflation rate was constantly increasing, meaning Malaysians were getting less for the same amount of salary.

Therefore, when it comes to cost of living, it is fair to say that most Malaysians are indeed struggling. As mentioned above, the salary growth of most Malaysians is negative. Even if it is not, the growth may not even match the inflation rate. Therefore, Malaysians worry about the rising cost of living is justified.

As for the cost of lifestyle, living standards were simpler and the cost of living was also much more affordable in the past. But at that time, say about 30 years back, the major desires of many Malaysians were housing, food, clothing and medical care.

However, with technological advances, we then must consider additions to the accepted standard of living which now includes mobile telephones, Internet, entertainment and vacations among others. All of these requirements add up and then contribute to the increase in the cost of living.

While more Malaysians get used to a higher standard of living compared to the generations before, the lines get blurred between the cost of living and cost of lifestyle. Maintaining the current higher living standard will then naturally cost more.

Purchasing power of Malaysians

When it comes to disposable income of Malaysians, this amount has also declined. This is according to data from the Department of Statistics which showed that the value of Malaysian’s pay has been declining. Disposable income means the money left to spend after the amount that needs to go to paying off loans and other fixed financial commitments have been minus.

Evidently, for some Malaysians it is not about their spending pattern, rather their income is barely catching up with the inflation rate. As a result of that, this leaves them with not much choice but to still depend on the government to relieve some of the burdens.

This is very glaring especially when it comes to purchasing a home. PR1MA which is a government initiative housing development programme to provide affordable homes for Malaysians have seen poor take-up rate. Only 11,944 units have been sold off from the existing 141,661 units in various stages of building. This means only 8.43% of PR1MA homes have been sold.

This could be a telling sign that many Malaysians still can’t afford even to purchase an affordable home. Especially since PR1MA has also acknowledged that many Malaysians had to cancel their dream of purchasing a home during the financing stage.

What can Malaysians do to manage the rising cost of living?

The fact is that Malaysians have enjoyed many subsidies for a while now. When the subsidies are slowly reduced or removed, Malaysians will then start to feel the price increase.

However, it will not be sustainable for the government to continue dishing out subsidies. Malaysians have gotten used to the low prices because of government’s subsidies which covered petrol, cooking oil and electricity among others.

This may have skewed expectation of the real living cost after the subsidies were removed. It is an adjustment period for us now to come to terms with paying for the real prices of goods and services without subsidies. Managing our finances better is important now more than ever.

Here are 4 tips to help Malaysians manage the rising cost of living:

2. Malaysians need to learn to differentiate between needs and want, what is a necessity and what is a luxury. This will then help define what would fall under cost of living and cost of lifestyle so we don’t combine both of the costs. Of course, the price of iPhones will keep on increasing with every new model introduced, but then again, remember that it’s not a necessity.

3. Make use of the expanding public transportation to reduce daily cost, especially with the recently completed MRT lines.

4. Ensure you get the most out of your daily spending and necessities such as when grocery shopping and pumping petrol. One way to do so is by using a good cashback credit card when doing so.

What the government can do for Malaysians

Policies should be put in place to ensure a better balance when it comes to Malaysians salary, and to make sure that income does not just rise, but that the rise keeps up with the rising costs.

As far as disposable income is concerned, the government needs to not only acknowledge the problem but also step up and put some quantifiable measures in place, especially since Malaysia aspires to be a high-income nation by 2020, which is less than 3 years away.

Aside from that, the government should also look into introducing financial education early on in schools. This can then encourage Malaysians to have more financial responsibility, and the rising living cost can be better managed when Malaysians are better equipped to be smart with their money.

Conclusion: we may not have control over the price of items, but we can control how we spend

While we have no control over the movement of the price of items, which is ultimately incremental as a result of inflation, we certainly do have a LOT of control over how we spend, what we consume and what we purchase.

As for what Malaysians can do on their part, it also comes down to a matter of prioritising needs over wants, and practising delayed gratification when it comes to items of luxury for all of us to get through.

The first step towards that is by arming yourself with financial knowledge. The main take-away lesson here is:

- Learning to differentiate and separate cost of living and cost of lifestyle.

- Increase financial literacy by understanding financial concepts such as compound interest and inflation.

- Avoid making financial mistakes.