Survey Finds That 29% Of Malaysians Have Less Than RM500 In Savings

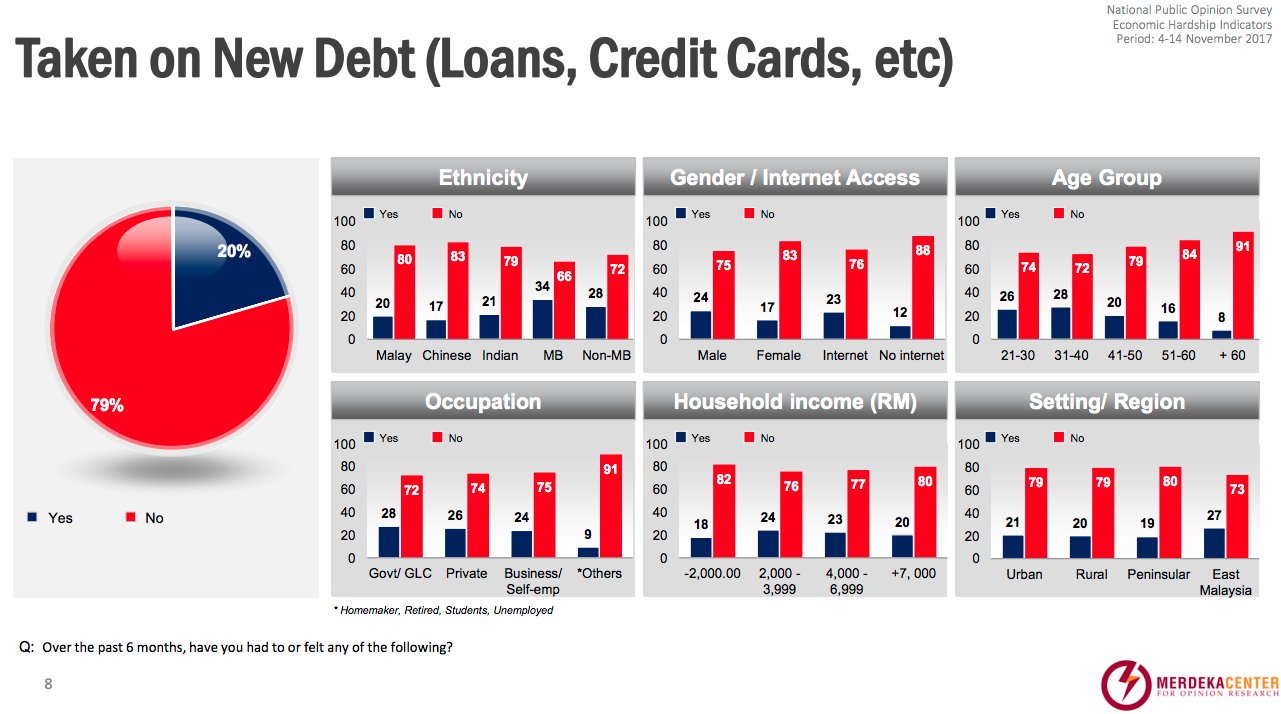

More Malaysians are also applying for loans and credit cards.

A sizeable number of Malaysians feel that the standard of living has not improved despite the government indicating stronger macro-level growth in 2017, a survey has found

The survey was conducted between 4 to 14 November by research firm Merdeka Center, involving 1,203 participants.

"In our opinion, the survey conveys a picture of a Malaysian electorate that was largely affected by rising costs and feeling some levels of distress in spite of the strong macroeconomic growth numbers," Merdeka Center said on its website.

The latest survey was a follow-up to a similar survey held in January. Merdeka Center noted that the results between the two were not too far-off.

In the January survey, 33% of respondents said they did not possess a minimum of RM500 of savings to address any emergency. The figures have slightly improved to 29% in November, but the differences are marginal.

The number of respondents saying they felt stressed thinking about the future dropped to 64% as compared to the results in January.

Meanwhile, the percentage of respondents who are reported to have delayed or are unable to pay their utility bills on time at 40% since January.

The survey, which cuts across all ethnicities, also revealed that 15% of respondents skipped meals to make ends meet

The result has remained unchanged since January, at 15%.

On debt, 22% said they have taken on new liabilities in the form of personal loans or charging of credit cards, a 2% increase from January

The Merdeka Center survey to gauge respondents’ perceptions of current developments involved 1,203 registered voters comprising of 52% Malay, 29% Chinese, 7% Indian, 6% Muslim Bumiputera, and 6% non-Muslim Bumiputera (from Sabah and Sarawak)

The survey was conducted via fixed line and mobile telephones. Respondents were selected on the basis of random stratified sampling along age group, ethnicity, gender, and state constituency.

You can view the full report here.