Can Merchants Charge You Extra For Swiping Your Card Instead Of Paying With Cash?

It's a rampant practice.

Have you ever been told by the cashier at the store that there will be a surcharge to your total bill if you use a credit or debit card to pay?

You may have experienced this for yourself, having told that you would need to pay extra (usually between 1% to 3%) for the goods or services if you choose to pay with card. If you choose to pay with cash, the extra charges will be "waived".

Most likely you would have thought twice about paying with card to avoid paying the extra charges and resorted to paying using cash.

While Malaysia and the world are moving towards becoming a cashless society, such a situation definitely deters consumers from using card payments.

Why do merchants even impose these extra charges on consumers anyway?

In the Payment Card Reform Framework issued by Bank Negara Malaysia (BNM), it has been stated that merchants have to pay a fee known as merchant discount rate (MDR).

This MDR, comprises of the interchange fee, the processing, and other fees imposed by an operator of a payment card network, and the other costs incurred by the acquirer (the bank or financial institution that processes credit or debit card payments on behalf of a merchant) and the acquirer's margin for facilitating a payment card transaction.

To put it in simple terms, this means that merchants face additional costs for accepting a credit card payment, and the fees are imposed every time a card transaction occurs.

Therefore, some merchants who do not want to bear these costs would usually resort to passing off the fees on consumers.

However, merchants in Malaysia are not allowed to pass on these fees to customers, at least in contractual terms

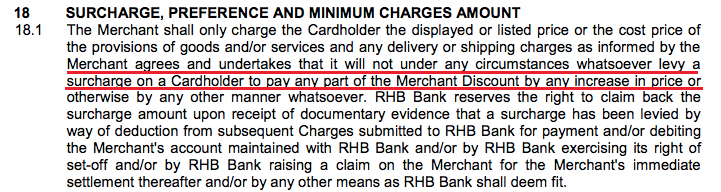

A screenshot of an excerpt from RHB Bank's Merchant Agreement: General Terms And Conditions document.

Image via RHB BankFor instance, RHB Bank's Merchant Agreement: General Terms And Conditions, states that the merchant "will not under any circumstances whatsoever levy a surcharge on a Cardholder (the customer or consumer) to pay any part of the Merchant Discount by any increase in price or otherwise by any other manner whatsoever. "

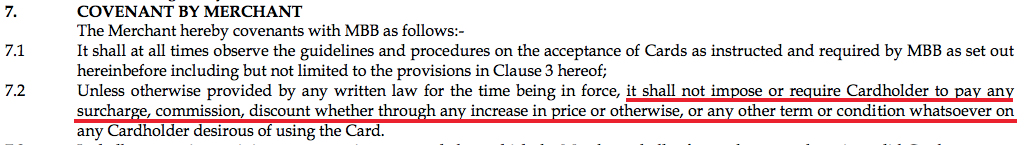

A screenshot of an excerpt from Maybank's Merchant Card Service Terms And Conditions document.

Image via MaybankThe same can be observed in Maybank's Merchant Card Service Terms And Conditions document, whereby it is stated that merchants are not allowed to to pass on the merchant fees to customers.

It may look like merchants are on the losing end, but the Association of Banks in Malaysia (ABM) has pointed out that its member banks have taken measures to reduce the cost for merchants to accept card payments.

Responding to an open letter on charging of fees for payments using debit card, ABM said, "The banks have, among other things, lowered the cost for merchants to accept payments via debit cards through the introduction of differentiated and declining merchant discount rates (MDR) to further encourage the use of debit cards in Malaysia".

So, what can you do as a consumer if a merchant imposes extra charges for a card payment?

Consumers can report the merchant to the financial institution that processes the card payment on behalf of the merchant. Just take notice of the merchant's bank or financial institution's logo which can be spotted at the card terminal or the receipt.

You may also report errant merchants to Bank Negara Malaysia by calling 1300-88-5465 or sending an email to [email protected].

Alternatively, you can also raise up the matter to ABM by calling the ABMConnect hotline at 1-300-88-9980, or submit your queries online via eABMConnect.