Retirement Planning: 7 Things Malaysians Should Take Note Of

EPF chairman says Malaysians do not engage in a retirement plan due to the lack of financial literacy. Here are 7 things Malaysians should be take note of when it comes to retirement planning.

1. An active EPF member can save an average of RM158,302 by the age of 54, this amount will only last for 20-25 years

Surveys have found that most Malaysians do not give any thought to retirement even if they are retiring in five to 10 years. One reason they do not engage in a retirement plan is due to the lack of financial literacy, Employees Provident Fund (EPF) chairman Tan Sri Samsudin Osman said.

Image via quizzle.comSecond Finance Minister Datuk Seri Ahmad Husni Hanadzlah said that although the EPF gave an average dividend of 6.11% in the last 5 years, the average savings of an active EPF member at the age of 54 was just RM158,302.

thestar.com.my2. The Employees Provident Fund (EPF) will offer retirement and financial advice to its members at EPF branches in Klang Valley in 2014

"Members will be assisted to create a comprehensive financial plan that will help them achieve their goals and dreams," said second finance Minister Datuk Seri Ahmad Husni Mohamed Hanadziah.

“We will begin a pilot project in the Klang Valley with an eventual national roll-out at the end of the pilot phase in one or two years," said Chairman Tan Sri Samsudin Osman.

3. One rule of thumb is that you'll need 70% of your annual pre-retirement income to live comfortably

First, determine what you'll need to contribute to reach your retirement goal. You want a nest egg that can annually deliver between 70 to 90 percent of your pretax, pre-retirement salary.

cnn.comCreate a budget of your recurring expenses & include your savings contributions as a monthly expense; this will clearly show you where your money's going & should provide some insight into what debts should be dealt with first.

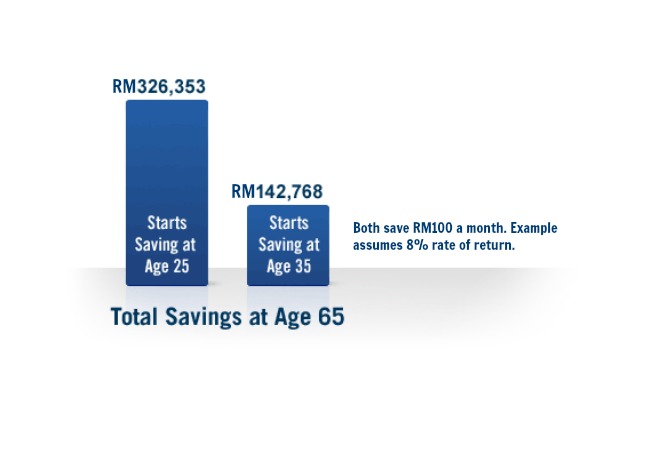

4. It's almost freakishly easy to design a retirement plan that gives you a strong chance of a 7-figure nest egg if you start in your 20s

The earlier you start saving, the more time you have to build wealth. Even small monthly contributions allow your money to yield better results over time than if you start saving at a later age (Projection from USAA).

Image via imgur.comIf you start in your 20s, it's almost freakishly easy to design a retirement plan that, if you consistently execute it, gives you a strong chance of getting you to retirement with a seven-figure nest egg.

5. Diversify your portfolio by spreading risk among your investments

The saying, "Don't put all of your eggs in one basket," couldn't apply more to saving for retirement. Financial advisors, investment bankers and economists will all tell you that the more diverse a portfolio, the safer it is.

Image via blogspot.comFocus on a well-diversified investment portfolio with reasonable exposure to other asset classes for example, bonds, cash and property and aim for steady returns. Understand the tax implications of your investments.

fin24.comA person heavily involved in just one type of investment is more vulnerable to financial problems if the markets associated with that investment tank.

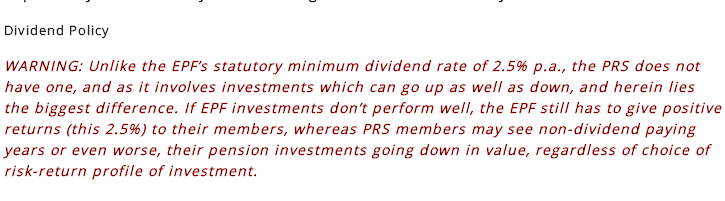

6. Tax relief of up to RM3,000 a year is given for contributions to Malaysia's voluntary Private Retirement Scheme (PRS)

PRS is a defined contribution pension scheme which allows people (or their employers) to voluntarily contribute into an investment vehicle for the purposes of building up their retirement income.

The 8 PRS Providers approved are AmInvestment Management Sdn Bhd, American International Assurance Bhd, CIMB-Principal Asset Management Bhd, Hwang Investment Management Berhad, ING Funds Bhd, Manulife Unit Trust Bhd, Public Mutual Bhd and RHB Investment Management Sdn Bhd.

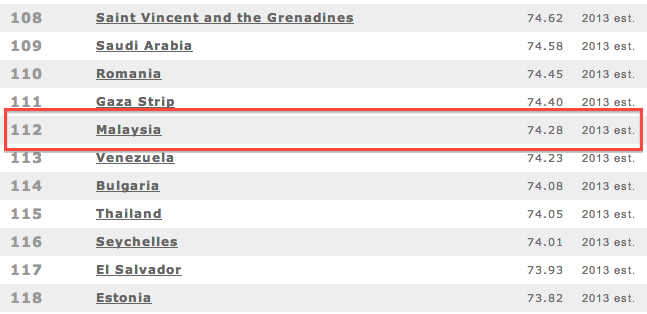

malaysiandigest.com7. Life expectancy and longevity can be powerful planning tools, Malaysia's life expectancy at birth is 74.28 (stats from CIA)

This entry contains the average number of years to be lived by a group of people born in the same year, if mortality at each age remains constant in the future. The entry includes total population as well as the male and female components. Life expectancy at birth is also a measure of overall quality of life in a country and summarizes the mortality at all ages. It can also be thought of as indicating the potential return on investment in human capital and is necessary for the calculation of various actuarial measures.

Image via imgur.comYou may live longer than you expect - Life expectancy & longevity can be powerful planning tools that can help provide a truer picture of what you have to do to make your retirement years both comfortable & secure.

"Each year of our working life, we will actually be saving each year of our retirement years. You cannot afford not to miss a year's of savings."

Crazy stuff happening around you? Facebook or Tweet us! We'll feature it on SAYS

SAYS is Malaysia's social news network. Find today's must-share stories, news and videos everyday, produced and brought to you by Malaysian social media users.

facebook.com

facebook.com

Yang terkini daripada Latest on SAYS (@SAYSdotMY). SAYS is Malaysia's social news network. Tweet us and let us know what's happening around you! We'll look into it.