From Stocks To Property, Malaysians Share How They're Journeying Towards Financial Freedom

How far are you from your financial goals?

When it comes to having financial freedom, it's something that many of us dream of accomplishing

Nevertheless, one person's definition of financial freedom may differ from another's. For some, financial freedom could mean being debt-free; for others, it could mean being able to spend on whatever they wish.

According to Nasdaq, financial freedom means having complete control over your finances — you make choices based on your desires, rather than being limited by how much things cost.

When you're financially free, it means you have enough income or savings to live life on your own terms.

So, how do you achieve financial freedom? We spoke to a few Malaysians to gain some insights:

Note: Some names have been changed to protect the privacy of individuals.

1. "My investment strategy leans more towards passive-aggressive, where I focus on stocks with growth potential and a decent dividend yield"

"I was first exposed to financial instruments such as stock investment during my university years, as I was part of a business investment society. Since then, understanding the power of compounding and investing, I have taken steps towards constantly scouting for undervalued stocks with high dividend yields.

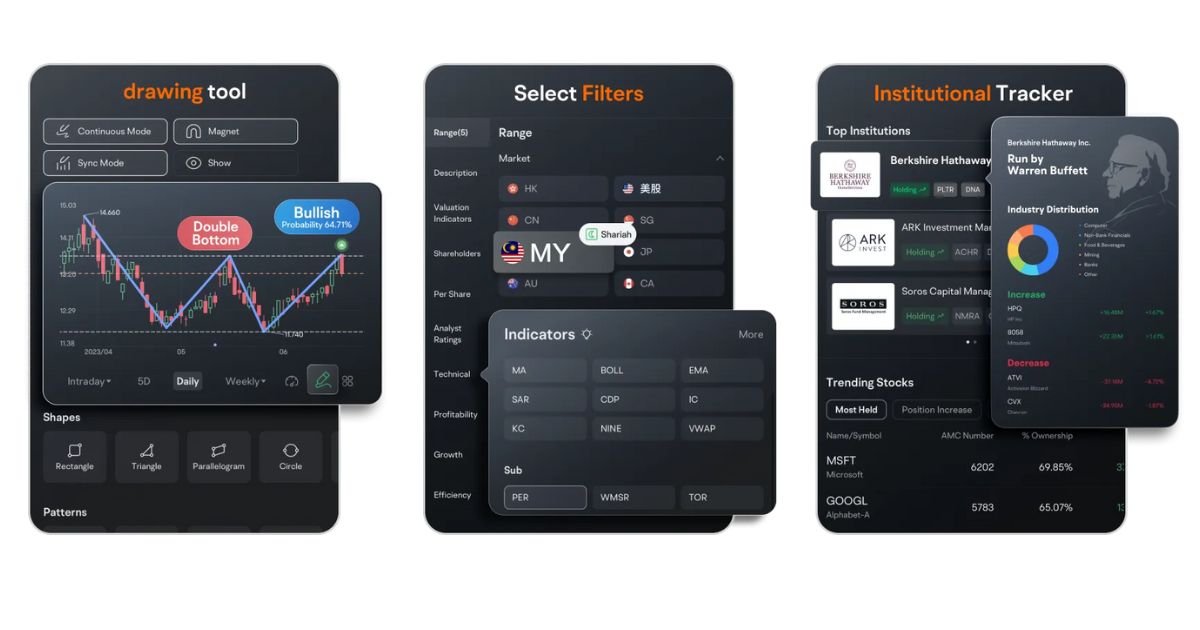

"I would also like to commend Moomoo Malaysia for introducing a wonderful high dividend yield screener function, which has saved me the hassle of individually screening stocks and allows me to focus on deep analysis after the initial screening process.

"One of the most rewarding experiences in my investment journey so far has been implementing my plan to invest in high-growth and high-dividend-yield stocks for long-term investment. I've been rewarded with high capital appreciation within a short span of time. In Malaysia's stock market, which mainly consists of cyclical sectors, we are able to identify undervalued gems with strong fundamentals during sector downturns.

"In addition to stocks, I also diversify my investment portfolio with less risky products such as unit trusts and robo-advisors, which tend to be safer investment options compared to stocks."

- Sim, 25 years old

2. "I reinvest profits back into my business. I also invest in different investments with varying risk levels based on 'buckets'."

"After over two decades of being an entrepreneur, I am glad to say that I've made significant strides towards financial freedom. For me, it's to achieve a level of independence where I can make personal and financial decisions without being constrained by immediate financial concerns.

"To reach my financial goals, I've consistently reinvested profits back into my business, fuelling its growth. This is the part of my investment which I can completely control and grow.

"Apart from that, I've also invested in different investments with different risk levels based on 'buckets'. 20% is in higher risk investments like crypto, 60% in blue chip stocks (Malaysia and US), and remaining 20% in newer financing products like peer-to-peer (P2P) lending. This balances my investments, giving pretty decent returns while balancing risk.

"One of the most rewarding experience is seeing the significant and sustained growth of my company. It's not just purely about financial gains, but also the realisation of the impact the business has on customers, employees, and the industry as a whole. I enjoy the journey so much that I'm starting a new one with my latest venture into metacommerce."

- Charles Tang, 47 years old

3. "Habitually saving and habitually investing"

"I habitually save and put money in an account that I cannot touch. I habitually invest in different assets with a reasonable return on investment (ROI), be it real estate, contract for differences (CFDs), or foreign exchange.

"I also talk to financial advisors and experts to get the right knowledge. I also like to be involved in more businesses to increase my income, because diversifying gives me more options to do what I want to do."

- Eli, 37 years old

4. "You need to seek for opportunities, then take the risk to invest"

"With our economy, I would say it's a challenging journey towards financial freedom, but the question is, 'Where do you wanna go?' and 'How rich is rich?'

"The first step towards financial freedom is setting your GPS, a.k.a. your destination. It depends whether you want to live a luxurious life, make the world a better place through societal impact, or just chill and enjoy the simple life with enough money in the bank to support your cost of living.

"For me, getting financial freedom requires a lot of market research, studying, and social networking to seek for opportunities. And of course, you need to take the risk to invest. For instance, I invested in crypto back in 2020 as a short-term investment. I've also seen my property grow by 40% in value, and my Rolex watches by 10% to 20%.

"When I invested, the future was uncertain, the lockdown duration was unknown, and business and investment opportunities were limited. But now, the economy is slowly picking up and everything is back to normal. In hindsight, it was a risk worth taking."

- Andy Look, 33 years old

5. "Anything I invest in should aim to outperform EPF's performance"

"I'm turning 45 this year and retirement savings just got real. I've done the math and will need RM2 million stashed up for a comfy ride till the end. No debts, no loans, just cash and liquid assets.

"To get there, I review my portfolio of investments from time to time. Our EPF performance is pretty solid, averaging around 5.5% over the past few years. Anything I invest in should aim to outperform that, especially with unit trusts. I'm also slowly swapping in lower risk and more liquid assets, so I'll be looking to pick up more blue chips and ETFs, and let go of China and small cap funds.

"Setting aside money every month is also key, as compounding interest makes a big difference in the long run. The goal is to be able to travel my way, my style, having the freedom to choose when and where to fly, from exotic destinations to island getaways."

- Colleen, 45 years old

6. "Invest wisely, save enough for a rainy six months, and live within your means"

"These are some golden nuggets of advice I learned from self-professed financial gurus on Instagram and TikTok.

"When it comes to investing, I'm the cautious type and tend to go for low-risk investments, like private retirement schemes (PRS) and robo-advisors.

"I still have a long way to go before I can travel the world and live my best life, but the good news is time is on my side, I think. Ultimately, it's important to enjoy the journey, so I make it a point to go for annual vacations and celebrate significant milestones.

- JH, 40 years old

7. "I use passive income returns to purchase guaranteed savings plans"

"Although I'm in the early stages (of my journey towards financial freedom), I am lucky enough to receive an inheritance from my parents in the form of an investment instrument that generates passive income.

"I work a nine-to-five so that I have a steady income flow, that way I don't touch the lump sum in the account and enjoy the full power of compounding. But I do use my passive income returns to purchase guaranteed savings plans towards retirement.

"Some other steps I've taken include making sure I'm financially protected with insurance and having six months worth of living expenses saved up for emergencies. I'm also working towards buying an investment property sometime in the near future, but I'm still scouting, so that's pretty exciting."

- Hilmi, 31 years old

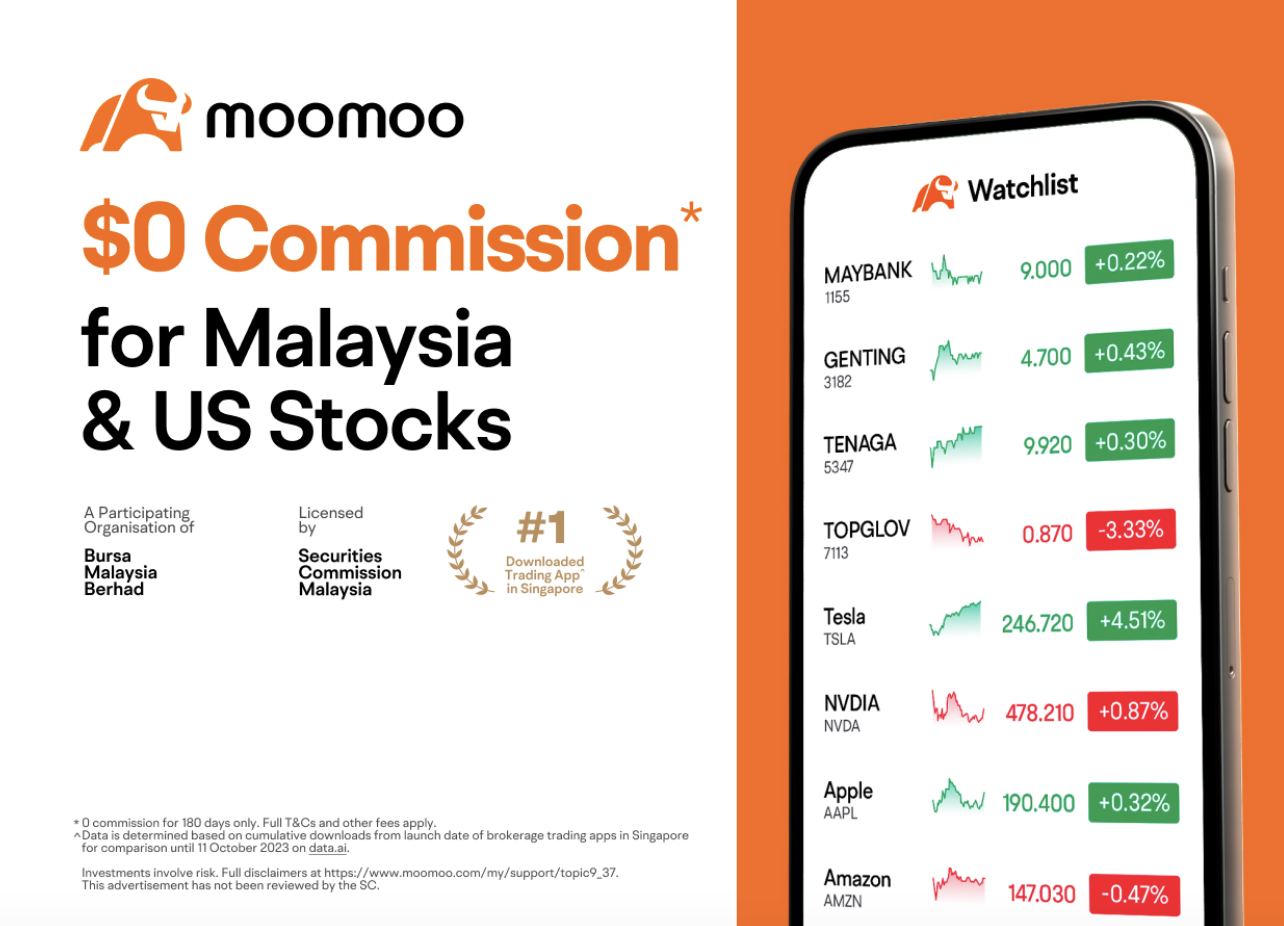

No matter where you're currently at, moomoo is the super app for your investment journey

In case you didn't know, Moomoo is the latest talk of town. With over 21 million users worldwide, the all-in-one investment super app now provides Malaysian investors with a professional, reliable, and innovative digitalised investment experience.

Whether you are a seasoned trader or you're new to investing, the moomoo app provides a comprehensive, yet easy-to-use interface that allows you to trade an extensive range of over 1,000 Malaysian stocks and 9,000 US stocks, as well as ETFs, warrants, and REITs.

The moomoo trading app is provided by a brokerage that is licensed by the Securities Commission Malaysia, so you can always trade with peace of mind

Furthermore, the app is equipped with real-time insights into the Malaysia and US stock markets. In fact, you can maximise your investment opportunities thanks to powerful tools built-in within the app, including a personalised stock screener, institutional holdings tracker, over 100 technical indicators, and more!

For a limited time, you can also enjoy amazing welcome rewards when you start trading on the moomoo app

First things first, you'll get to enjoy zero commission trading for Malaysian and US stocks, valid for 180 days from your account opening.

Besides that, Moomoo Malaysia is giving away RM100 in cash and stock cash coupons when you successfully open a Moomoo Malaysia universal account, deposit RM500, and hold assets for 30 days*. You could also earn a free Apple stock* by depositing RM8,000 before 31 March and holding the asset for 30 days!

Ready to start investing and trading your way to financial freedom? Learn more about the moomoo app on their website.

Or download the moomoo app on the App Store, and Google Play today.

*Terms and conditions apply. Other fees apply. All views expressed in the article above are the independent opinions of the interviewees, which are not necessarily shared by Futu Malaysia Sdn Bhd ("Moomoo Malaysia"). No content shall be considered financial advice or recommendation. Moomoo Malaysia links may be included in this article. Please contact Moomoo Malaysia for more information.