This Bank Offers The First Shariah-Compliant E-Wallet In Malaysia. Here's A Look At It

As your everyday e-wallet, it has a transaction limit of up to RM200, and can only carry a maximum balance of RM1,000, allowing you to budget effortlessly.

If you're looking for a convenient and secure way to pay for your everyday expenses, check out MBSB Bank's e-wallet :D

MBSB Bank is an Islamic banking entity in Malaysia, and in 2019, they developed the first-ever Shariah-compliant e-wallet. This means that the e-wallet will only be accepted at Shariah-compliant merchants, and can only make Shariah-compliant transactions and purchases. Put simply, you can rest assured and go cashless each time you're out and about.

Plus, MBSB Bank's e-wallet is easy to set up and use. It also boasts various security features, so you can have peace of mind every time you spend.

As your everyday e-wallet, the MBSB Bank e-wallet has a daily transaction limit of up to RM200, and can only carry a maximum balance of RM1,000

In other words, you can make as many transactions as you want, but each transaction cannot exceed RM200. This allows you to budget and monitor your daily expenses accordingly, ensuring you don't impulse buy or overspend. Isn't it helpful?

Aside from seamless payments at merchants by scanning the QR code, the e-wallet also allows for airtime reload, bill payments, and secure top-ups through bank transfers

And you can rest assured that each transaction is secure and protected. Every payment will require you to key in your six-digit transaction PIN, while sensitive data such as passwords or transaction information will be transmitted on public networks through secured protocols like Secure Socket Layers (SSL), Transport Layer Security (TLS), and Hypertext Transfer Protocol Secure (HTTPS).

Besides that, the e-wallet's access to banking services is protected by a secured login procedure. It will always require a username and password.

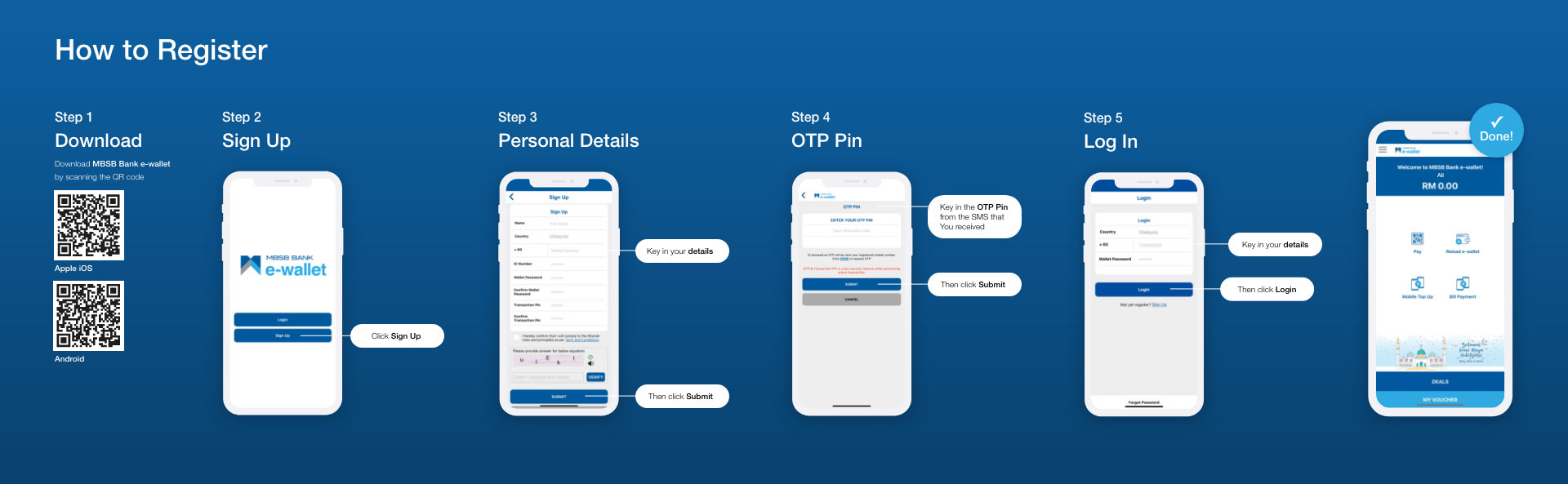

The best part? It's so easy to set up the e-wallet. Here's how:

STEP 1: Download the MBSB Bank e-wallet app via Google Play or Apple Store

STEP 2: Tap the 'Sign Up' button

STEP 3: Key in all of your details

STEP 4: Tap 'Submit'

STEP 5: Request and key in your six-digit OTP code

STEP 6: Click 'Submit' to complete your registration

Once all of that's done, you can start spending immediately, yay!

MBSB Bank's e-wallet is currently accepted at 32 merchants, with a total of 1,918 outlets nationwide you can spend at.

From bookstores like MPH to restaurants like Pelita, everyday stores such as Mr.DIY and Mydin, and more, there are so many outlets that you can enjoy using the e-wallet at. In fact, you can expect this list of supported merchants to continue to grow.

Head over to MBSB Bank's website to learn more about the e-wallet today