Spending Too Much On Coffee? Here's How To Make Sure You Still Set Aside Enough Regularly

And no, we're not telling you to cut out coffee completely! ;P

If you're a coffee, tea, or matcha person, chances are, you can't help yourself every time you pass by your favourite café

But as we all know, lifestyle expenses can add up real quick, and you may be alarmed at the amount you actually spend on things like coffee every month.

ASNB understands how hard it is for Malaysians to secure our financial future, while balancing everyday wants and needs

Addressing this issue, ASNB has released a new short film that resonates with the uphill struggle faced by a majority of Malaysians when it comes to putting aside funds for the future.

Titled Bina Simpanan, Bina Kegembiraan, the video illustrates the efforts of a young man who — like many of us — tries to spread his income as best as possible across monthly bills, daily necessities, small lifestyle luxuries, family dues, and savings for the future.

After putting his money into various commitments, he finds that he has little left for his savings, and is tempted by dubious loan offers and schemes before his future self reminds him of another possible option — investing through ASNB.

While it's fine to spend on your daily needs and occasional splurges, it's also important to keep your long-term finances secure

Rather than cutting out your daily coffee completely, why not walk a little further to get that slightly cheaper option? Perhaps you could alternate your usual order with a kopi O. Or maybe, convince your boss to get a coffee machine for the pantry, hehe.

After all, why shouldn't you have your coffee if it helps perk you up for the day? Just make sure you're still able to set aside some money for the future.

At the same time, the video also draws parallels between saving for the future and investing in trendy sneakers

In the video, the young man is drawn to the latest sneakers and even commits quite a bit of money to buy the pair that he likes.

Just like taking the time to research and understand the up-and-down demand curve and prices of popular sneakers, ASNB hopes that Malaysians can also take the time to learn about their investment options and make calculated decisions about how to best allocate their funds for better living.

If you're a sneakerhead who's interested in investing, ASNB will even be present at the upcoming SneakerLAH event, which you can check out from 2 to 3 November at MITEC.

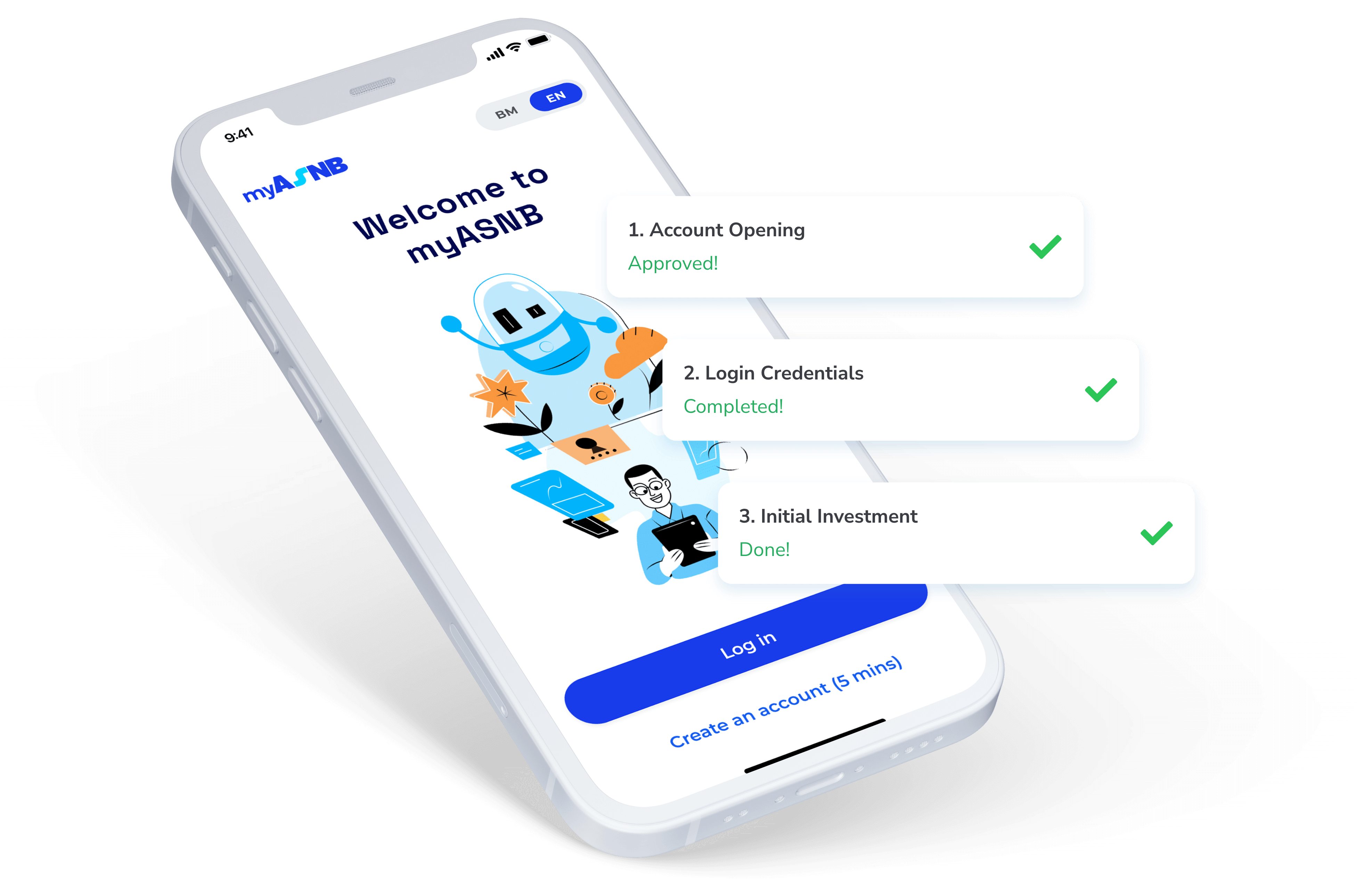

For those who want an easy way to build their future investments and savings, the myASNB app has gotchu covered!

ASNB, which is short for Amanah Saham Nasional Berhad, offers unit trusts that allow Malaysians to invest in various asset classes at affordable prices and grow their savings.

Right now, all Malaysians can invest in the various funds under ASNB, with the easiest route being through the myASNB app.

In the app, you can opt to park your money in funds such as Amanah Saham Malaysia (ASM), Amanah Saham Nasional (ASN), and Amanah Saham Bumiputera (ASB), depending on your background, risk tolerance, and investment goals.

Currently, myASNB has two methods that make it easier to invest and save for the future:

1. Auto Labur

This method allows you to conveniently set up a recurring monthly investment into several available ASNB funds.

From now until 31 December, ASNB is giving away free units for users (new and existing) who activate or top up funds using the Auto Labur feature on the myASNB app.

Users who maintain their automatic investments for two consecutive months will be eligible to receive up to RM50 worth of free units, depending on your investment amount.

Also, the first 500 new Auto Labur registrations every month will be given RM10 worth of free units.

2. Ria (Robo Investment Advisor)

Ria is a digital investment platform designed for younger, tech-savvy users who prefer personalised investment options based on the input offered by a robo-advisor.

Based on your risk tolerance and investment goals, Ria will recommend a suitable portfolio for you. All you need is a minimum of RM100 to start investing and continue to top it up regularly. Then, you can let the robo-advisor handle your investments while you kick back and reap the rewards.

From now until 31 December, ASNB is offering RM10 to current users for every new friend they refer to the platform. All they need to do is share their referral code to a friend and receive RM10 once that friend starts investing. That friend will then also receive RM10 as a welcome bonus!To take advantage of these methods and current offers, you can download the myASNB app for iOS or Android.

For more information on available investment options on myASNB, you can visit the official website.