LGE Reveals Finance Ministry Has Been Bailing Out 1MDB By Paying Off Its Debt Obligations

In addition, 1MDB is due to pay RM143.75 million worth of interest by 30 May.

Lim Guan Eng has revealed that the Ministry of Finance (MOF) has been bailing out 1MDB's debt obligations since April 2017

In a statement released today, 22 May, the newly instated Finance Minister said that the current situation "confirms public suspicion that 1MDB has essentially deceived Malaysians by claiming that they have been paid via a 'successful rationalisation exercise'."

"All these while, it has been the MOF who has bailed out 1MDB," he added.

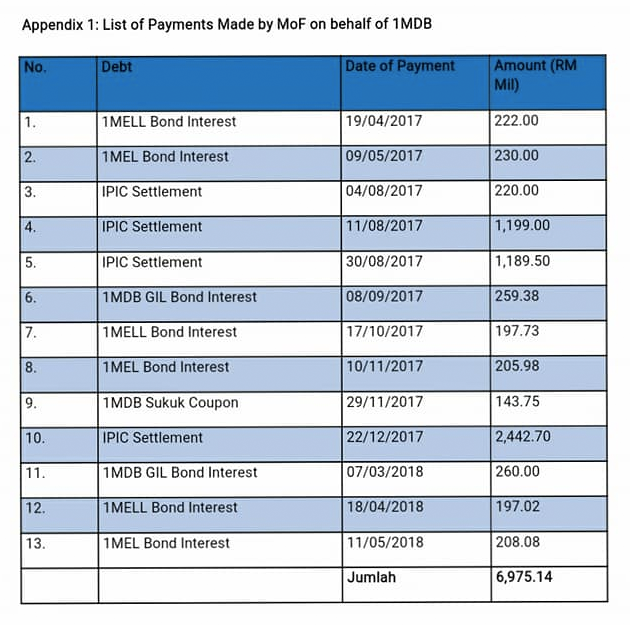

To date, MOF has made RM6.98 billion worth of payments on behalf of the scandal-ridden state fund

According to a List of Payments attached to the statement (below), the sum includes payments made to the International Petroleum Investment Company (IPIC) amounting to RM5.05 billion.

Lim's statement notes that the payments only involve interest, coupon payments, and the advance from IPIC.

"They have yet to take into account the billions of ringgit of debt which will be due from the year 2022," Lim added.

In addition, 1MDB is due for another round of payment amounting to RM143.75 million worth of loan interest by 30 May

That's not all - another RM810.21 million worth of interest is also due between the months of September to November.

Calling it one of the most "urgent items to be resolved" in his first few days in office, Lim said that he has called up 1MDB president and CEO Arul Kanda as well as its directors to explain the situation

"I have also been informed that Arul Kanda remains as the president and CEO of 1MDB until 30 June 2018. Arul Kanda has to date insisted that 1MDB is fully able to service its debt obligations. Therefore, I have given instructions for Arul Kanda to brief and clarify if 1MDB is able to pay the above sum due next week," the statement read.

"I have also requested to see the Directors of 1MDB, Dato’ Kamal Mohd Ali and Dato’ Norman Ayob to brief the Ministry on the state of affairs of 1MDB."