[SHARE] 12 Expert Opinions On The Pros And Cons Of Budget 2014

How will Budget 2014 affect our spending habits and Malaysia's financial growth? Analysts and economists share their thoughts on Budget 2014 here.

1. Global Movement of Moderates (GMM): Measures for prudent govt spending and cutting corruption is missing from Budget 2014

The Auditor General's Report 2013 reveals hundreds of billions of ringgit wasted and mismanaged by government bodies. Image from The Star.

Image via imgur.com2. The Edge: GST at 6% will cause a spike in inflation, but Budget 2014 is a brave and good budget

3. Deloitte Malaysia: More than 85% of Malaysians don't pay taxes, GST will distribute the burden of paying tax across all Malaysians

4. IDEAS: The govt should set a time frame for GST at 6% as to not arbitrarily increase the percentage

5. KPMG Tax Services: Lowering income tax to give people more disposable income balances the burden of GST

6. Economists: GST will boost the country's economy as it gives the govt a steady source of revenue

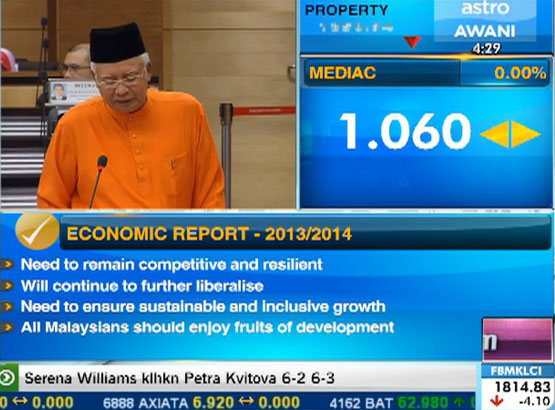

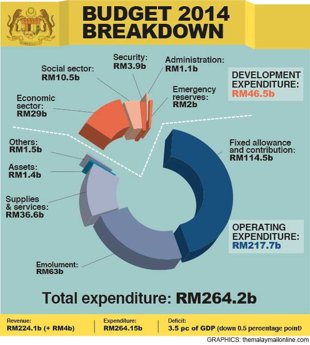

The Goods and Services (GST) that was announced by Prime Minister Najib Tun Razak last Friday is expected to be boost the economy as it would now allow the government to have a predictable source of revenue, economists contacted by The Malaysian Reserve said.

While the GST is expected to raise more revenue with its broader taxpayer base, corporate income tax, income tax for small, medium-size enterprises, cooperative income tax and individual income tax rates have all been reduced in some measures.

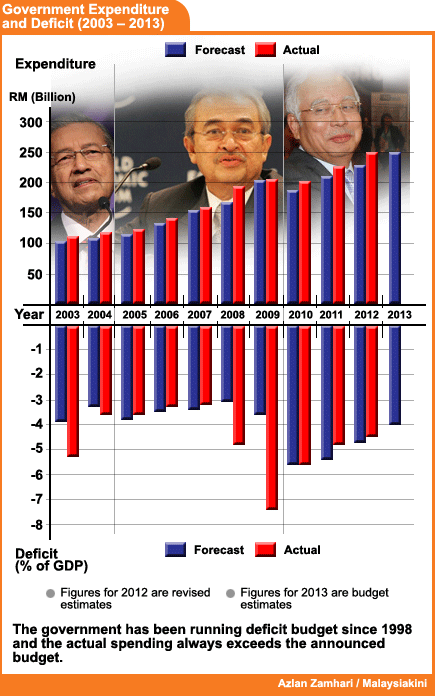

7. Economists: Budget 2014 shows the govt's commitment to reducing fiscal deficit

Johan Mahmood Merican, Talent Corp Malaysia Bhd CEO:

The Government has shown in this budget that besides committing to managing the finances and reducing the fiscal deficit, it has shown a commitment to investing in human capital development.

thestar.com.myTan Sri Teh Hong Piow, Public Bank Bhd chairman: We welcome the Government’s firm commitment to continue addressing the country’s fiscal challenge by further reducing the budget deficit from 4.0% of GDP in 2013 to 3.5% in 2014, through a combination of efforts in increasing revenue and controlling of expenditure of the Government.

thestar.com.myTan Sri Azman Mokhtar, Khazanah Nasional Bhd MD: This budget is, above all, for economic rebalancing. This states clearly that Malaysia’s future growth should not be driven by the expansion of debt, but rather by moving up the global value chain in an inclusive manner which leaves no citizen behind.

thestar.com.my8. Economists: Budget 2014 structural reforms are essential to drive higher market growth

TAN SRI AZMAN HASHIM, Malaysian Investment Banking Association: Budget 2014’s efforts at structural reforms are essential to generate higher growth. It relates to boosting competitiveness, improving productivity, embracing innovation culture, while focusing on boosting quality growth.

thestar.com.myGAN ENG PENG, Hwang Investment Management: From a market perspective, the budget is a step in the right direction while a return of global growth and the delay in quantitative easing tapering will provide impetus to drive the market higher by the year-end.

thestar.com.myDatuk Abdul Farid Alias, Malayan Banking Bhd president: The continuation of high-impact major infrastructure and investment projects is positive for the banking industry and the capital market in terms of continuing to supporting fund raising and market activities.

thestar.com.myEconomists: Budget 2014 structural reforms are essential to drive higher market growth

Image via theborneopost.com9. Fitch Ratings: Budget 2013 shows constructive steps to lower deficit but implementation is key

The latest budget contains three key announcements which are potentially constructive for Malaysia's sovereign credit profile. One is the restated commitment to the existing objective of a Federal Government deficit of 3.5% of GDP in 2014, and 3% by 2015, signaling a potential intensification of efforts to consolidate government finances.

Second is a budgeted reduction in subsidy expenditure. However, Fitch points out that the steps to achieving this outcome are not yet fully identified, and remain subject to external shocks.

Third is the proposed introduction of the long-mooted GST in April 2015, at an initial rate of 6%. Fitch feels this is a key reform which could strengthen the credit profile by broadening the revenue base and lessening the budget's dependence on petroleum-derived revenues.

The upshot of all this is that budget deficit reduction is heavily reliant on expenditure restraint, and a track record of sound budget management and implementation will be integral to our assessment

Fitch Ratings: Budget 2013 shows constructive steps to lower deficit but implementation is key

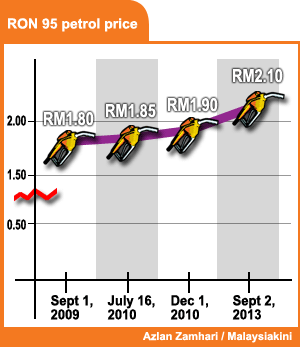

Image via themalaysianinsider.com10. BBC: Cut backs, such as the sugar subsidy, are needed as the govt spends about RM4000 a year per family to keep the cost of essential items artificially low

11. BBC: Businesses will only suffer from the price increase for a short while. Once the government can cut back on spending and boost revenues, it can then spend money to boost projects with high paying jobs

12. International Business Times: The increase of sugar price will have a serious effect on the price of other products

The increase in sugar prices will have a series of effects on other products, and those already struggling with the high cost of living may need to further tighten their belts.

"Shops are going to increase the price of drinks by at least 10 sen [0.1 ringgit] per glass. Other prices will go up as well and we will feel the pinch," Jason Tan, a 24-year-old insurance agent, said.