This Housing Scheme Lets You Rent A Property Until You Have Enough Money To Buy It Later

Applicants can own a house without having to fork out a big down payment.

Owning a home is quite difficult and can be costly these days

It is said that it's increasingly difficult for average citizens to be able to be homeowners and some of the reasons include having not enough income and houses being too expensive.

One of the biggest challenges for many purchasers, especially first-time buyers, is coming up with sufficient down payments for their new houses.

In light of this, Maybank Group has introduced a rent-to-own (RTO) scheme known as 'HouzKEY'

Maybank Group's Islamic banking subsidiary, Maybank Islamic Berhad is offering an alternative financing scheme for homebuyers who struggle to fork out the large sum of money needed for upfront payments.

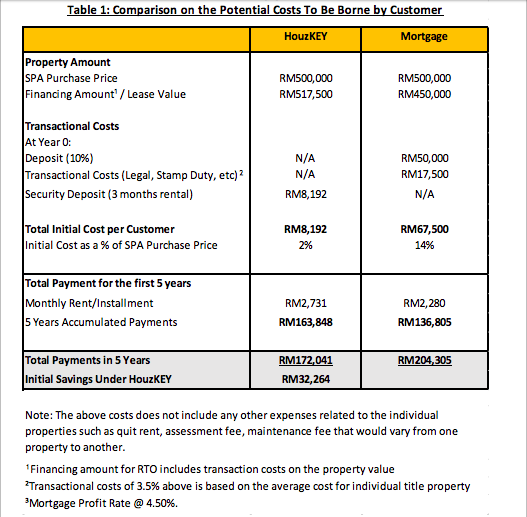

According to Maybank managing director of real estate ventures Sally Lye Saw Im, who explained in an interview with Malay Mail, HouzKEY gives 100% financing which would free buyers from having to pay for a down payment. This differs from when buyers opt for the conventional housing loan where they would usually be required to make an upfront 10% down payment as financial institutions would only allow buyers to borrow up to 90% of a property purchase price.

Launched in November 2017, HouzKEY, is based on Islamic concept of Ijarah (Lease) in which customers are provided with the option to purchase the property.

Under this scheme, applicants can choose to rent and own from a host of properties in Kuala Lumpur and Selangor by established developers such as S P Setia Bhd (SP Setia), Eco World Development Group Bhd (EcoWorld), Mah Sing Group Bhd, Gamuda Land, and Sime Darby Property.

How does it work?

To put it simply, applicants can rent a home from Maybank under the HouzKEY scheme and lock-in the unit at a pre-agreed purchase price.

Applicants will then have the option to purchase the house at a later stage, after servicing at least 12 months rental.

The rental price will be fixed for the first five years, while there will be a 2% step-up on the sixth year onwards until the tenure ends.

Homebuyers under this scheme will also be eligible to a 100% stamp duty exemption on the sale and purchase agreements (SPA), offered by the government.

Who is eligible to apply for this scheme?

The following information was obtained from the maybank2own website:

• You must be a Malaysian citizen or a permanent resident of Malaysia.

• You must be between 18 years or below 65 years at the time of application.

• Your household income must be RM5,000 and above.

• You MUST NOT have more than one (1) home financing/housing loan at the time of application.

• You are not under blacklist/bankruptcy status.

Those who do not have a household income that is higher than RM5,000 may bring up to three guarantors to support their application.

Do note that the monthly rental under the HouzKEY scheme would be higher than a housing loan instalment

In the Product Sheet Disclosure, it was stated that HouzKEY scheme offers more cost savings for the first five years than a mortgage loan but the overall payment would be higher if applicants choose to continue renting until rental tenure maturity, where the property shall be sold to the applicant at the nominal fee of RM1.

Since there are incremental hikes in rental from the sixth year onwards, it is said that the scheme is best suited for prospective homebuyers who intends to purchase a house in the near future without worrying about the high initial costs. Some people may not have enough money to purchase a house currently. However, they don't want to wait until they are able to save up money because property prices would have gone up by then since it's likely that the value of properties will continue to rise over time.

Through this scheme, they can know the upfront costs included and work towards their financial goals to purchase their home at the locked-in property price.

There's also the option to cash out - an opportunity for earning capital appreciation. What this means is that a HouzKEY participant may choose to sell the property to a third party buyer. After successful sales, the participant may keep the profit from the sales price based on current market value, which would be higher than the pre-determined sales price that was fixed at the time the leasing agreement was signed.

How to apply:

Those who are interested may submit their applications online via Maybank's digital platform, maybank2own.com.

Applicants can expect to receive a status on their approval within 24 hours (based on one working day, subject to completion of full document submission).

There are various tools that interested applicants may use on the website such as the ‘live chat’ feature to get instant responses for queries that they might have or the eligibility calculator to find a suitable home.

More information can be found on the FAQ section and also the Product Sheet Disclosure.

Do you think HouzKEY is an effective scheme to allow people to own a home without worrying about footing high initial costs? Let us know your thoughts in the comments section below.