Remember The M'sian Student Who Spent RM15Mil That Wasn't Hers? She Won't Be Charged!

"She's obviously very relieved that all this trauma is over for her."

A Malaysian student in Australia who allegedly spent AUD4.6 million (approx RM15 million) on a shopping spree after a banking error gave her an unlimited overdraft, won't be facing any charges

According to a report in BBC, Australian prosecutors have dropped all charges against the 21-year-old Malaysian student.

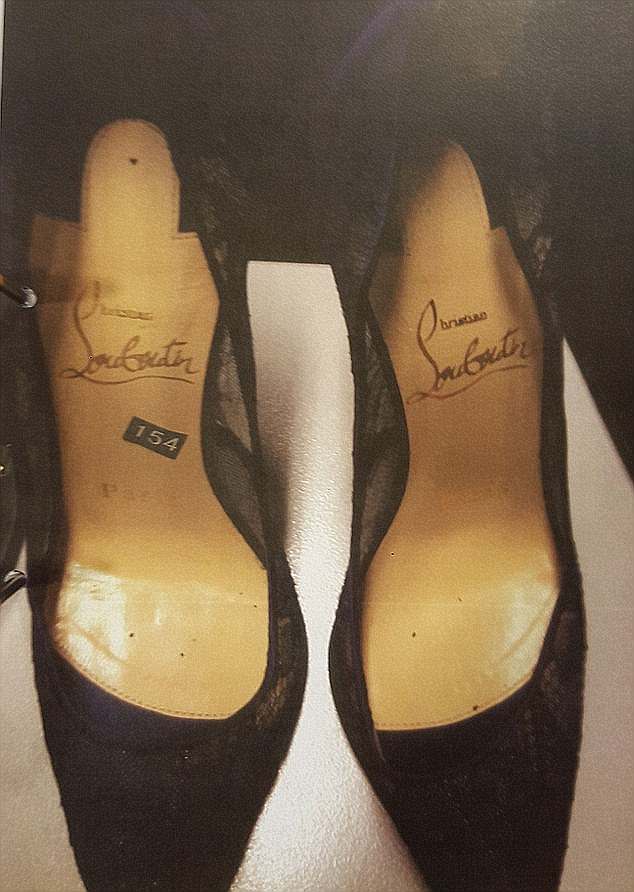

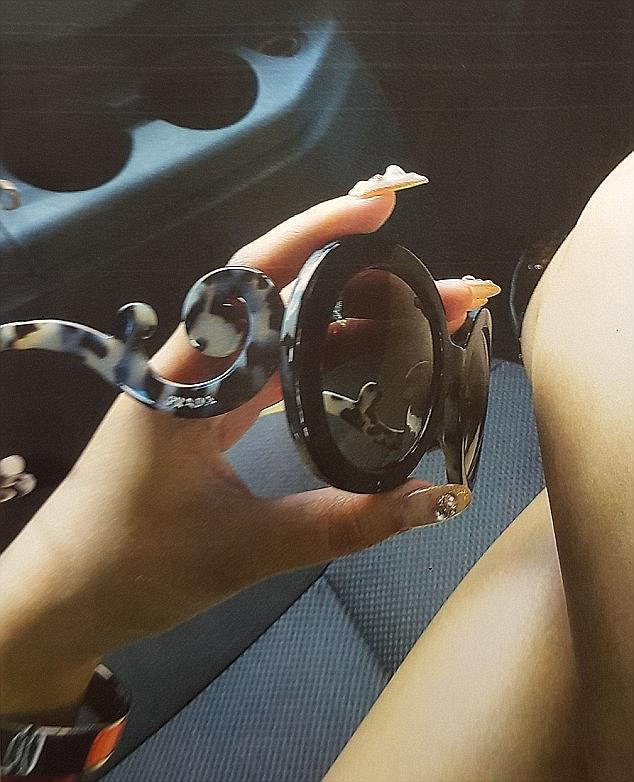

Christine Jiaxin Lee was alleged to have spent much of the sum on luxury items, such as jewellery, designer handbags, shoes and mobile phones over 11 months.

The Malaysian student had gone on a multimillion-dollar spending spree for 11 months after realising that she had an unlimited overdraft in July 2014 which was mistakenly made available to her by Westpac bank.

Police had claimed the withdrawals in 2014 and 2015 constituted fraud.

While the prosecutors did not give a reason for withdrawing the charges against Christine Jiaxin Lee, it was reported that this was because of a similar case involving a man charged with fraud for withdrawing AUD2.1 million which was thrown out of court

Some of the luxury items that she bought using the money that wasn't hers.

After the error was picked up by the Westpac bank in April 2015, she was given a chance to explain where the missing millions went

While she claimed that she believed the money had been transferred into her account by her parents, Christine after finding out that police was trying to contact her about the money, reportedly arranged for herself to be granted an emergency Malaysian passport and tried to flee Australia.

However, she was arrested at Sydney's Kingsford Smith Airport on 4 May 2016, as she was trying to board a flight to Malaysia.

Her lawyer says Christine, who has returned to Malaysia with her family and is happy to be getting back to her normal life, was "very relieved" to hear about the charges against her being dropped

According to her lawyer, although Christine had been dishonest, she had not committed any deception because the error had come from the bank.

"She is happy it is behind her, and to move on with her life. There was no deception. It's a very interesting case and an interesting outcome. It is obviously clear the bank should adopt better policies," he was quoted saying by news.com.au.