PTPTN Helps Teacher Settle RM515 Debt In Her Account That Grew From RM0.01

The teacher said she had already settled all her PTPTN loans in July 2015.

A school teacher was surprised to receive a warning email from the National Higher Education Fund Corporation (PTPTN) recently, stating that legal action will be taken against her for an overdue payment of RM515

Fateema Dzulkifli wrote on her Facebook account on 18 June that she was surprised because she had settled her PTPTN loan in a lump sum payment using her Employees Provident Fund (EPF) in July 2015.

PTPTN told her that she had a balance of RM0.01, which had accumulated into RM515 in six years.

In the post, Fateema shared how the RM0.01 was not supposed to exist, as EPF had dealt with PTPTN directly to settle the outstanding amount.

However, she did clarify that she did not receive a PTPTN release letter as she was told to wait for a month, but received nothing and forgot about it when she moved to Terengganu, thinking she had already done her part in settling the debt.

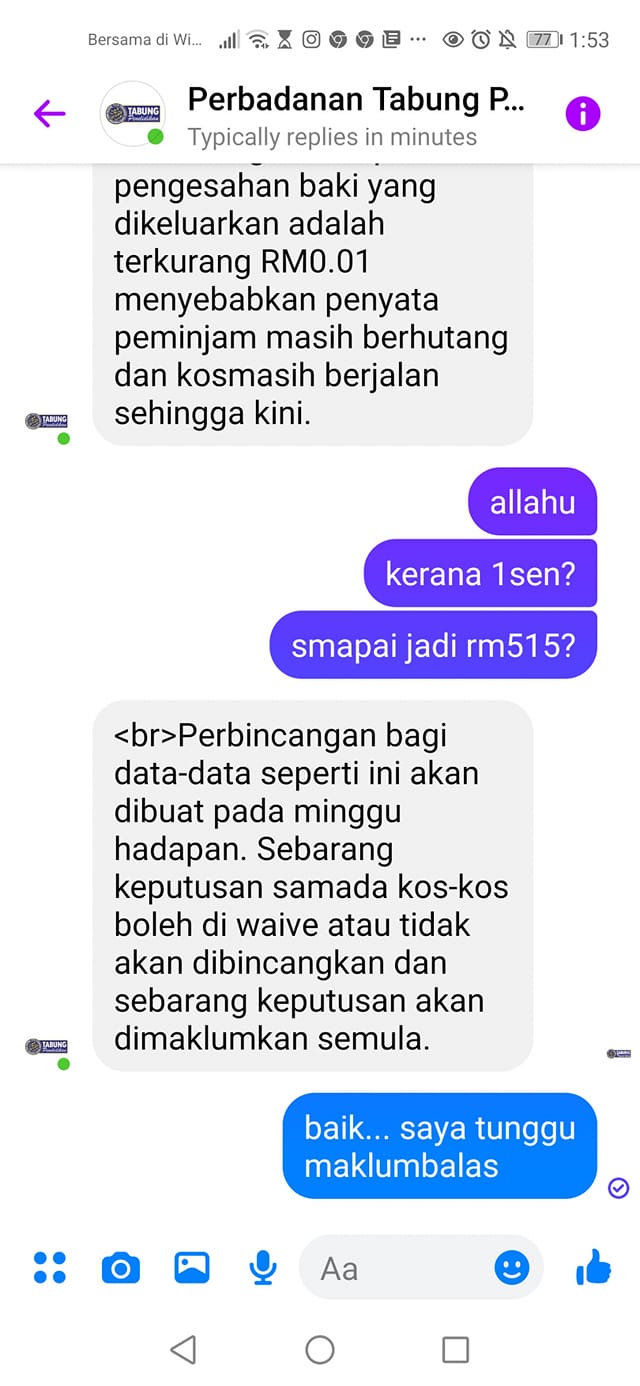

After receiving the email, Fateema contacted PTPTN and was given a reply on 19 June, with PTPTN clarifying that the initial balance accumulated over time was due to interest, overdue fees, and other costs

On top of that, she was told that the RM0.01 was mistakenly deposited into her account for Takaful services.

According to PTPTN, prior to April 2016, they used a manual system and an officer must have accidentally filed in one cent for Takaful services into her account, one month after she settled the loan.

The officer may have done this because the system was late to update the statement from their end.

With the explanation, Fateema sent her final statement as proof to PTPTN and filed an appeal with them

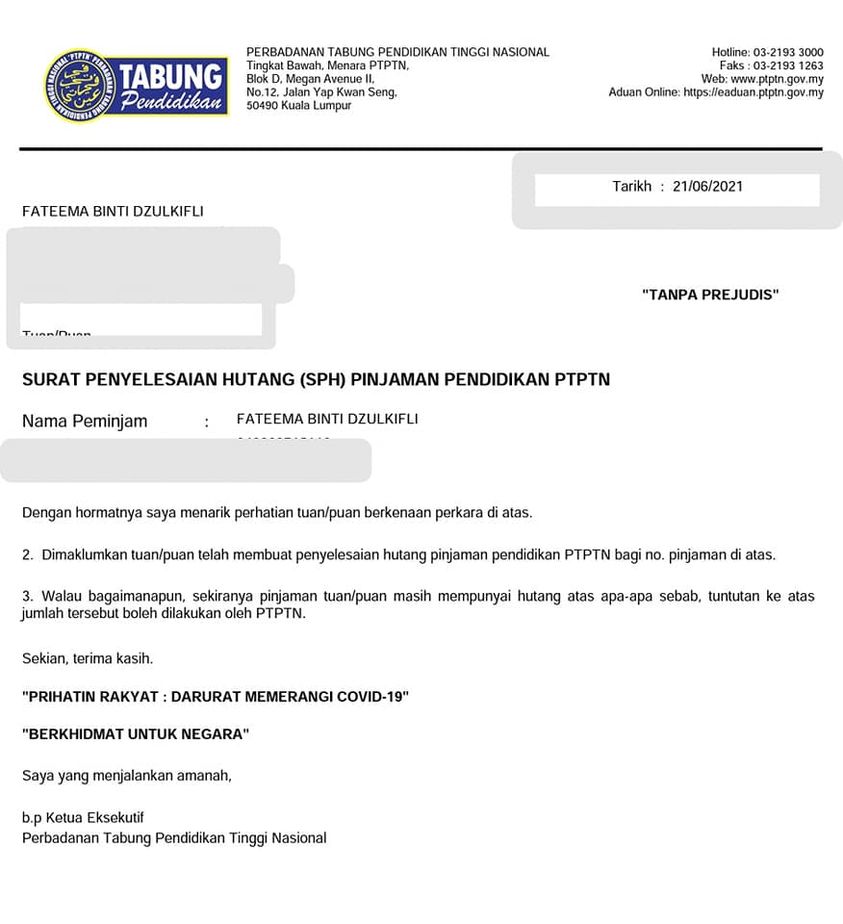

She later updated on Facebook that the possible lawsuit by PTPTN has been dropped and she finally received a debt completion letter on Monday, 21 June.

When contacted by SAYS, Fateema said that she hopes PTPTN would recheck their system and also share the penalties and fees that they charge as it remains a mystery to the general public.

She urged everyone with PTPTN loans to hold on to their important documents and to be aware of their balances. She added that such debts can affect your financial status in the Central Credit Reference Information System (CCRIS).

SAYS reached out to PTPTN for a statement and were directed to this Facebook post, which was uploaded on 28 June, and admitted to the technical mistake. They also advised borrowers to update their information on the website regularly and always obtain debt completion letters when they have been fully repaid.