Tycoon Jho Low Says He's Not Linked To 1MDB In Rare Press Statement

A whistle blower website has provided what it claims is fresh new evidence of tycoon Jho Low's link with 1Malaysia Development Berhad (1MDB).

Whistle Blower Website The Sarawak Report Has Presented Fresh Claims Linking Tycoon Jho Low To The Government's 1Malaysia Development Berhad (1MDB)

Whistleblower portal Sarawak Report has presented what it claims is fresh evidence linking the government's 1Malaysia Development Berhad (1MDB) to tycoon Low Taek Jho, who is seen to be close to Prime Minister Najib Abdul Razak's family.

malaysiakini.comThe Website Presented An August 2012 UK High Court Judgment Detailing Low's Involvement In A Dispute In The Purchase Of A Controlling Stake In The Coroin Hotel Group

Judgement proves the active link between 1MDB and Jho Low’s company The Wynton Group.

Image via sarawakreport.orgThe judgment detailed how in 2011 rival bidders were attempting to buy up approximately 39 percent of shares in the Coroin group from the distressed businessman Derek Quinlan, said the report.

malaysiakini.comThe Sarawak Report demonstrate that in January 2011 1MDB submitted a letter on behalf of Low and his private equity company The Wynton Group pledging to back a share purchase of the prestige Coroin hotel group (which includes the leading London hotels Claridges, The Connaught and The Berkeley) against rival bids from the UK’s Barclay brothers. That pledge backed Wynton to the tune of a final offer of £1.028 billion (RM5.7billion)!

sarawakreport.orgThe details of the Coroin bid and the involvement by 1MDB in Jho Low’s privately owned company Wynton Group’s attempted buy out are clearly detailed in a 158 page judgement produced on 10th August 2012 by Justice David Richards of the Chancery Division of Britain’s Royal Courts of Justice.

sarawakreport.orgAs it turned out, the shareholders turned down the Malaysian bid, in favour of what they viewed as a more reliable lower offer for the shares.

sarawakreport.orgThe Judgment Noted That Low's RM5.7 billion Offer For The Coroin Hotel Group That Was Done Through The Wynton Group, Was Backed By 1MDB

The report claimed the judgment had noted that Low's £1.028 billion (RM5.7billion) bid for the hotel group through the privately-owned Wynton Group, was backed by 1MDB against UK's Barclay brothers.

malaysiakini.com"The Malaysian based investor was Jho Low, a businessman with some backing from a Malaysian sovereign wealth fund. Through an entity called The Wynton Group, offers were made to the company and its shareholders in January and February 2011″

sarawakreport.orgThe judge made it clear on a number of occasions that Low was representing himself and his company as an entity backed by a Malaysian government ‘sovereign wealth fund.

sarawakreport.orgWhen The Bid Was Unsuccessful, Jho Low Provided Several Written Third Party Assurances Including A Letter From 1MDB

The report added when the British seller was unconvinced by Low's bid, he produced a number of written third party assurances including a letter from 1MDB confirming its support for the strengthened offer.

malaysiakini.comThe report quoted the judgment which read: "The provision on 15 January 2011 of a letter from 1 Malaysian Berhad (sic), an investment vehicle wholly owned by the Malaysian government, confirming its support for the offer, did not allay the concerns of the majority of the shareholders. "A further letter from Wynton dated 24 January 2011 stated that the financing for the offer had 'in principle' been fully underwritten by Malaysian government-backed investment funds."

malaysiakini.comUltimately though, the bid was not accepted even though Quinlan's representative noted that Low's offer was "better" on paper.

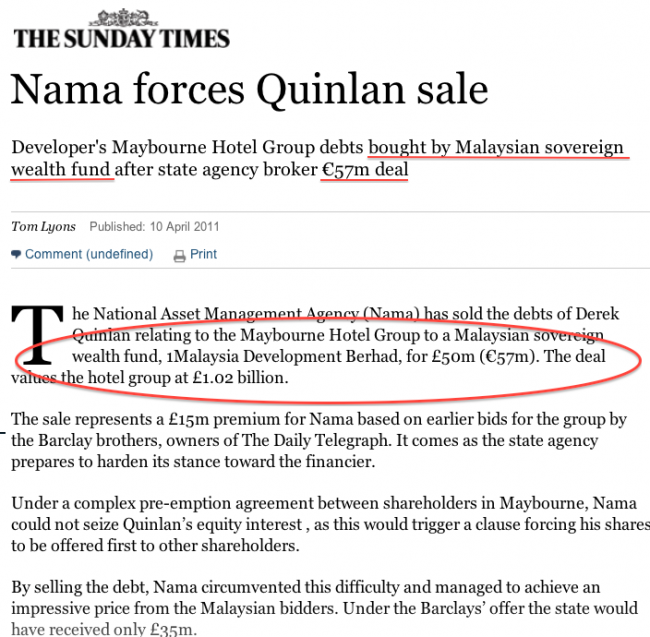

malaysiakini.comIn A Separate Deal, The Irish Press Had Also Reported That Low Had Purchased Debt In The Hands Of Ireland’s National Asset Management Agency (Nama) Using 1MDB

In a separate piece, Sarawak Report said the same judgment had zoomed in on a related deal in which Low purchased debt in the hands of Ireland’s National Asset Management Agency (Nama), which had been taken over from Quinlan. Curiously though, Sarawak Report pointed out that despite the judgment naming Low in the purchase, the Irish press had reported the purchase was by 1MDB.

malaysiakini.comJustice David Richards detailed in his judgement on a related case how as part of his bid Low purchased debt in the hands of Ireland’s National Asset Management Agency (“NAMA”), which had been taken over from a distressed property tycoon Derek Quinlan. It is well-documented that Jho Low was the individual who fronted these negotiations. Till now it was not known in Malaysia that he was being bankrolled by 1MDB.

The Sarawak Report Also Noted That Jho Low's CV Acknowledges Links To Unspecified Sovereign Wealth Funds

The Sarawak Report Also Noted That Jho Low's CV Acknowledges Links To Unspecified Sovereign Wealth Funds

Image via sarawakreport.orgDespite this, in company CV’s Low does acknowledge links to unspecified sovereign wealth funds.

sarawakreport.orgIn Response To These Allegations, Jho Low Has Denied Any Links To 1MDB. He Says He Was Merely A Coordinator In The Hotel Takeover Bid That 1MDB Was Involved In.

Jho Low had been known to be good friends with celebrities like Paris Hilton.

Image via blogspot.comNormally taciturn businessman Low Taek Jho has issued a rare press statement, challenging a series of reports in websites linking him and Malaysia's 1MDB to a failed attempt to buy three London hotels in 2011.

Tycoon Low Taek Jho, better known as Jho Low, merely played the role of a coordinator in a hotel takeover bid in which 1Malaysia Development Berhad (1MDB) was part of. Low's office added that he was coordinating the deal together with Aabar Investments PJS, an Abu Dhabi government-controlled sovereign wealth fund."

malaysiakini.com“Mr Low has never held any position in 1MDB or in the government of Malaysia. Mr Low was appointed as one of the many advisors invited by the stakeholders of Terengganu Investment Authority (TIA) to provide advice from Jan 2009 to mid-May 2009 given his market-based knowledge. “Mr Low has not been involved in TIA since mid-May 2009,” read the press statement carried by several news portals.

"Mr. Low was a co-investor and led the coordination efforts for the proposed bid for Maybourne Hotel Group (Claridge's, the Connaught and the Berkeley in London) along with Aabar Investments PJS (an Abu Dhabi Government controlled sovereign wealth fund entity). "1Malaysia Development Berhad (1MDB) was one of the several investors invited by Aabar Investments PJS to evaluate this early-stage investment opportunity in 2010/2011.

"To facilitate the bid, some initial interested investors provided preliminary letters of intent in support of the bid," the spokesman said in reply to The Malaysian Insider this morning.