What Is Service Charge? Do I Have To Pay It?

Service charge has long existed before GST, but many of you have been asking us questions about it of late. Allow us to clear your confusion.

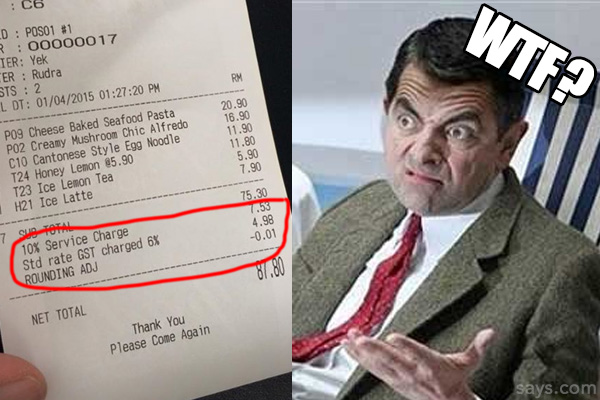

With the implementation of GST, restaurant bills have become a little bit more complicated

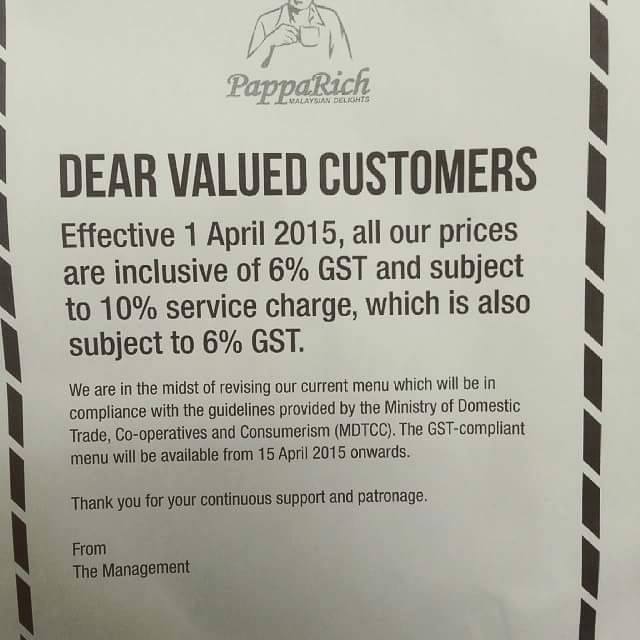

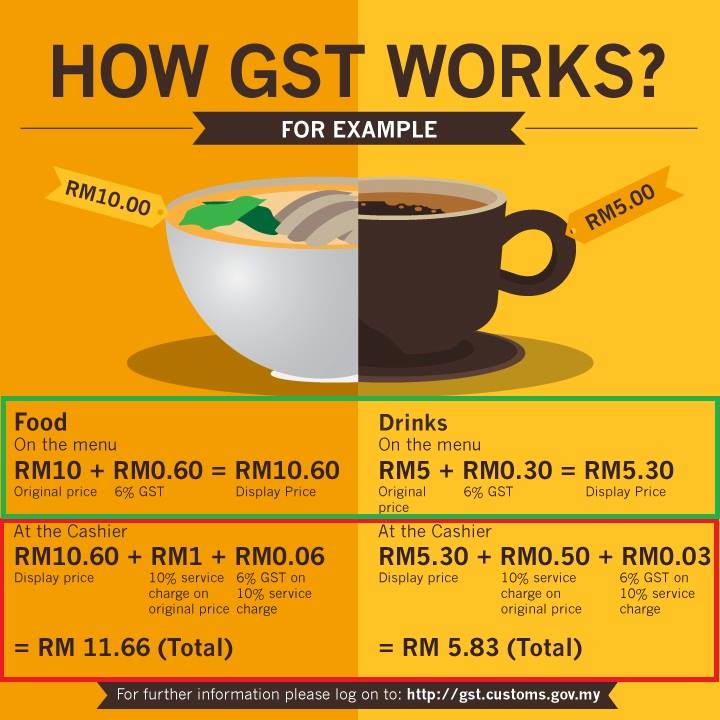

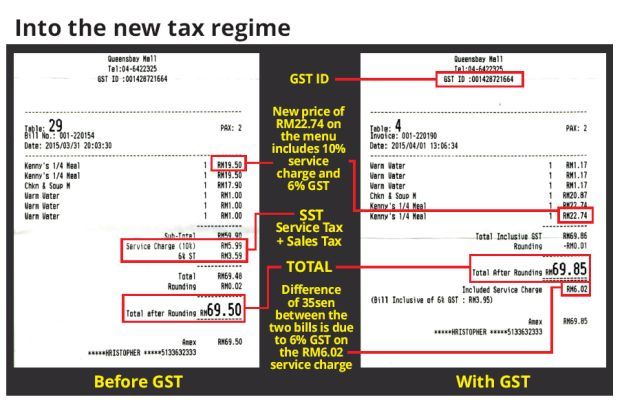

Several restaurants have announced that there will be a 6% GST tax on food, plus an additional 10% service charge. This 10% charge will also be taxed with GST.

In other words, the calculation of your restaurant bill is now:

110% (food, drinks and service charge) x 6% (GST).

What exactly is the service charge? Firstly, it is important to know that service tax and service charge are not the same thing.

Prior to April 1, 2014, service tax was collected by the service providers as stipulated in the Services Tax Act 1975. The purpose of collecting such service tax is because the business owners are bound by the statutory duty to pay such amount of tax to the Customs of Malaysia. It was illegal for a non-taxable person to collect such service tax.

The implementation of the Goods and Services Tax (GST) has now replaced the previous Sales and Services Tax (SST). SST was at 10% for sales tax and 6% for service tax respectively. With GST in place, that means companies should not be collecting service tax anymore.

The service charge you see in receipts is not a government tax. It is a surcharge independently added on by the establishment in exchange for the service provided.

Service charge is not new, it has long existed before GST but has picked up interest recently.

According to a restaurant owner who wish to remain anonymous, service charge or fees are decided by the restaurant owners. They can decide to charge customers a fee for the service provided. "It is not mandatory, some decide not to charge, some charge 5%, some charge 10%, some even include it into their menu price. GST is a separate thing altogether, and restaurants are merely collecting 6% on behalf of the government."

The amount collected from the service charge does not go to the government. In other words, the service charge is actually tips used to pay the wait staff.

Why is the service charge important?

In a non-tipping culture like Malaysia, hotels and restaurants implement the service charge as tips to supplement their staffs' meagre income.

According to Jobstreet, the F&B industry average for a waiter is RM1,100. The starting pay is at a paltry approximate of RM700.

In the hotel industry, the staff is paid by a point system. For example, a junior waiter's salary is RM500 per month, plus three service points. If one service point is RM350, the waiter's monthly salary would be calculated as such:

RM500 (Basic) + 3 Points (3 X RM350 (Service Charge) = RM1050) = RM1550

The service point is determined by the rank and position of the staff. However, the monetary value per point varies from month to month, depending on the service charge collected and revenue of the month.

This means that the staff's income is highly dependent on the service charge. Without service charge, they would only receive the basic pay.

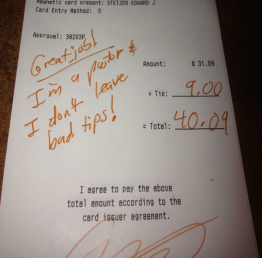

Compared to a tipping culture like America, wait staff are paid from as low as USD2.75 an hour. However, customers are obligated to pay a tip of 15% - 20% of their final bill. The amount of tip to leave is up to the customer's discretion, based on the satisfaction with the service received. This is part of the American society's social responsibility. To quote The Guardian, "tips are not optional, it's how waiters get paid in America".

On the flip side, smaller establishments and cafes have been known to abuse the service charge

"Restaurants and cafes generally don't distribute it to their staff," a Malaysian chef of eight years tells SAYS. "They distribute the tips from the cash people leave in the tip jar, but not the money collected from the service charge."

"I cannot speak for every establishment, but service charge is generally split amongst employees," says the restaurant owner.

The chef explains that establishments like that try to justify it as services provided by the restaurant, but not the staff.

Mr. Cheong, a pub manager says some restaurants use the service charge to give their staff a monthly or yearly bonus. He also agrees that some bosses do keep the service charge to themselves.

Do you have to pay the service charge?

Conflicting reports about the service charge have caused much confusion

Early March, Deputy Finance Minister Ahmad Maslan says consumers do not need to pay the 10% service charge, especially if they feel that the service received is not good

The 10% service charge imposed by hotels and restaurants need not be paid after the Goods and Services Tax (GST) is implemented, said Deputy Finance Minister Ahmad Maslan.

“The service tax imposed by hotels and restaurants does not go to the government. This charge is called tips and should be given to the employees but some companies abuse it by keeping it to themselves and not passing it on to the workers. So I want to inform that you don’t have to pay the 10% service charge if their service is not good,” he told reporters here yesterday.

On the other hand, customs senior assistant director II Maria Madel says customers should pay the 10% as they are receiving service from a restaurant

Customs senior assistant director II Maria Madel said customers “should” actually pay the service charge.

“Suppose the patrons receive the service from the restaurant, they should pay the service charge.

“Those services include serving you the meal and cleaning the table. It’s what the service charge is meant for,” she said, responding to questions by The Rakyat Post readers on the service charge.

The bottom line? You are not legally required to pay the service charge, but you should as part of your social and ethical responsibility.

It is a social responsibility, as the livelihood of an industry of wait staff are dependent on the service charge. Sadly, it is difficult to find out if a restaurant honours or violates the concept of the service charge.

The government and the service providers should be aware that the tips or so called "service charge" should only be charged on voluntary basis when a consumer feels that good services had been rendered to them.

Unfortunately, service providers are violating the usage of the words "service charge" so that they can collect more and more revenue/profit/income for their own company.

If a restaurant declares that there is a service charge, in the case of OldTown and PappaRich, and you still choose to patron them, you are then obligated to pay the 10%

Some restaurants will print a notice on the menu or the front door that a 10% service charge applies. Alternatively, you can ask a waiter.

In this case, the service charge has become a social contract between you and the restaurant as you are knowingly accepting it as informed before you even place an order.

If there is no declaration of service charge, we suggest leaving the decision of whether or not you should foot the 10% to your own judgement of the service received

Pay the service charge if the service you received was good; if you think the service is not up to par, you may politely talk to the manager and decline the surcharge. The manager should issue you a new receipt without the service charge on it.

Remember that it is your right as a consumer to decline paying for a product or service that is unacceptable.

There are advantages and disadvantages to this. On the bright side, this might motivate the service industry in Malaysia to improve their quality and standards. On the dark side, the livelihood of wait staffs in Malaysia could be jeopardised if everyone decides not to pay at all.