Apple's New Titanium-Made Credit Card Is Your New Way To Flex

No card number, expiration date, signature, or CVV security code.

After desktops, laptops, and phones – Apple is now making credit cards

The Silicon Valley giant announced its plan to take on payment cards last night, 25 March, with its latest hardware – a sleek, minimalist credit card made out of titanium.

Financial Times reported that the Apple Card, launched in association with Goldman Sachs, will be rolled out on the Mastercard network in the next few months.

Hailed as the biggest card innovation in half a century, the Apple Card will have no information on it other than the user's name

There will be no card number, expiration date, CVV security number or signature on the Apple Card.

The user's name will also be etched onto the card by laser.

The idea of the card was to let Apple Pay users pay at stores that do not support the service

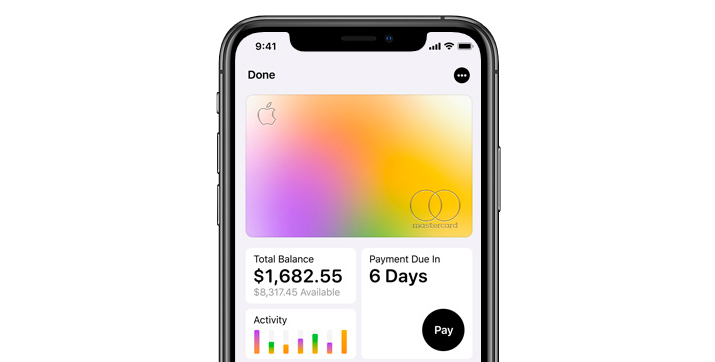

According to CNet, Apple Card is a digital card that resides on an iPhone, while being a traditional credit card backup whenever Apple Pay is unavailable.

Fortune reported that the card will also come with no annual fee, late fees, over-limit fees, or international fees.

However, while it will be built into the Apple Wallet app, one woud still have to "qualify" to be approved for an Apple Card. The company has not shared details on how a user would qualify for the new hardware.

With the Apple Card, you can track your expenses in the Wallet app

There will be visuals on the app showing how much you spent on what, how much you owe, and when the payments are due. Additionally, your expenses will also be categorised by weeks and months.

CNet added that the app will link your purchase with the location of where you spend the money, so it does not show up as cryptic messages on your transaction history.

Apple is also aiming to reward its users through a reward program called Daily Cash

For every dollar you spend, Apple will give you cash back through the program.

Here are the percentages of cash back you will get from your purchases:

- 1% when you use the physical Apple Card

- 2% when you use the digital Apple Card, and

- 3% when you use the digital Apple Card on purchases from the company itself.

However, you will be charged with additional interest if you are late to a payment. The rates reportedly range from 13.24% to 24.24% (as of March 2019) based on a user's creditworthiness.

The card will only be made available in the United States later this year. No information has been revealed for its release in other countries.