Groupon Is Cutting 1,100 Jobs And Shutting Down In 7 Countries Including Taiwan

The deals site said the job cuts will result in pretax charges of up to USD35 million.

Deals website Groupon will cut 1,100 jobs by September 2016 as part of an effort to reorganise its business. In a blog post explaining the job cuts, Groupon's COO wrote that the decision was a tough one to make, "especially when we believe we're stronger than ever."

The company's chief operating officer Rich Williams made the announcement about the job cuts and international closures in a blog post on Tuesday. Jobs will be eliminated in customer service and international sales as Groupon attempts to engineer its "next chapter," Williams said.

According to COO Rich Williams:

"We’re doing all we can to make these transitions as easy as possible, but it’s not easy to lose some great members of the Groupon family.

Yet just as our business has evolved from a largely hand-managed daily deal site to a true e-commerce technology platform, our operational model has to evolve.

Evolution is hard, but it’s a necessary part of our journey. It’s also part of our DNA as a company and is one of the things that will help us realize our vision of creating the daily habit in local commerce."

As part of the restructure, the daily deals and e-commerce site is also shutting down operations in several markets internationally

Morocco, Panama, The Philippines, Puerto Rico, Taiwan, Thailand and Uruguay will all be closing. The closures come on top of recent exits in Turkey and Greece and a sell-off of a controlling stake in Groupon India to Sequoia (news we first broke in March of this year). Before the closures, Groupon was active in over 40 countries.

Groupon, like many tech companies with a big overseas presence, has been hammered by the strong dollar. Markets outside North America generated about 43% of Groupon's revenue in 2014.

"We've ... taken a close, honest look at where we do business. We saw that the investment required to bring our technology, tools and marketplace to every one of our 40+ countries isn’t commensurate with the return at this point," Williams wrote. "We believe that in order for our geographic footprint to be an even bigger advantage, we need to focus our energy and dollars on fewer countries."

As of last December, Groupon had about 12,000 employees

Groupon said it expects to take $35 million in pretax charges for severance and compensation benefits, including up to $24 million in its current quarter. Groupon said an “immaterial amount” is related to impairments and exit costs.

wsj.com

wsj.com

The short statement Groupon has filed with the SEC notes that between $22 million and $24 million of the charges will come in Q3 2015, and that the full restructure should be completed by September 2016.

“Substantially all of the pre-tax charges are expected to be paid in cash and will relate to employee severance and compensation benefits, with an immaterial amount of the charges relating to asset impairments and other exit costs,” the company notes. Cost savings from the cuts, Groupon says, will be reinvested in the business.

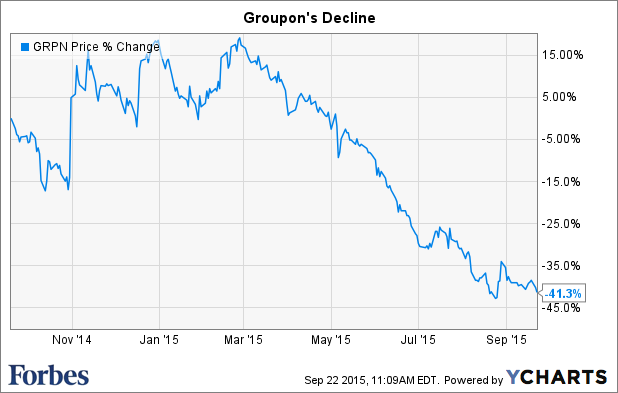

It's tough to believe that Groupon is indeed stronger than ever

The company’s star has fallen significantly in the past five years, as it sought to rebrand itself as an e-commerce platform amid the decline of the daily-deal email craze and growing competition.

Groupon has posted a loss almost every quarter since it went public in late 2011. Its shares closed at $4.17 yesterday; they closed at $26.11 in Groupon’s first day of trading after going public.

In April, the company reached a deal to sell a controlling stake in Ticket Monster—a large mobile commerce company based in South Korea—for $360 million. The sale netted a significant return on the business it had bought from rival LivingSocial Inc. last year.

wsj.com

wsj.com

Groupon launched in 2008 as a website for companies to attract customers through one-off offers. However, according to a BBC report, many businesses that used Groupon struggled to transform the discount buyers it supplied into long-term clients.

Groupon makes more than 35 percent of its sales outside of North America, and the dollar’s strength has crimped its efforts to expand internationally. In April, Groupon sold a controlling stake in South Korean e-commerce site Ticket Monster to investment firm KKR & Co. and Hong Kong-based Anchor Equity Partners, for $360 million. And last month, venture capital fund Sequoia India agreed to invest in Groupon India.

“They’ve tried to clean up their international operations for several years now,” said Blake Harper, an analyst at Topeka Capital Markets Inc., who recommends holding the stock. “They’ve also exited a lot of markets internationally. This is a natural extension of that.”