Touch 'n Go eWallet Will Start Charging 1% Fee For Credit Card Reloads Beginning 23 Feb

TNG Digital said the move aims to reduce the significant costs related to credit card transactions that it has shouldered up to this point.

It might be a good idea to consider changing how you reload your Touch 'n Go eWallet.

Starting February 23rd, a 1% fee will be applied to all credit card reloads.

TNG Digital (TNGD) Sdn Bhd chief operating officer Alan Ni said that the decision was made to discourage excessive cash withdrawals using credit cards to bank accounts.

Additionally, the move aims to alleviate the considerable costs associated with credit card transactions borne by TNGD up to this point.

However, reloads via DuitNow and debit cards remain free

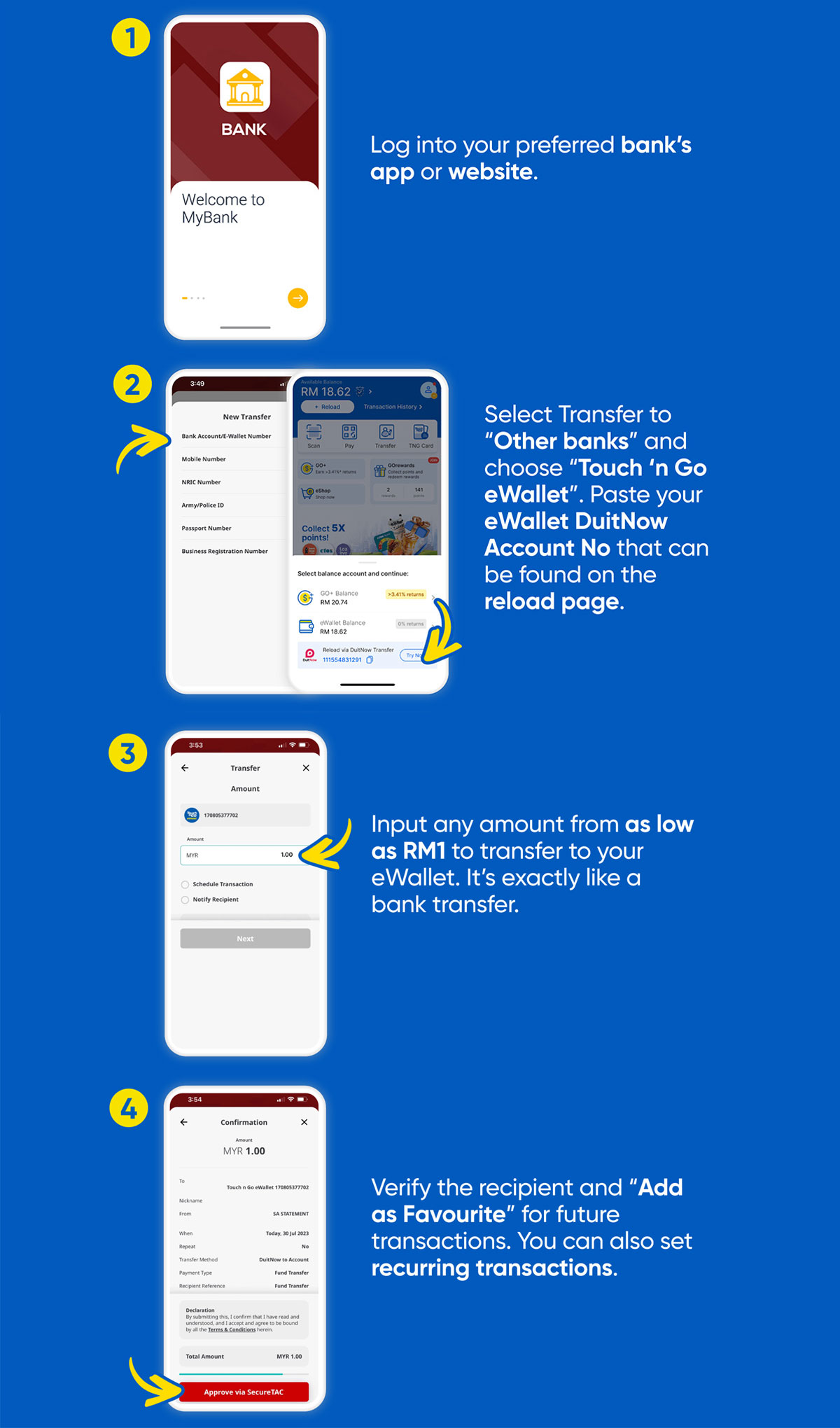

"Users are encouraged to use bank transfers via DuitNow, which has exactly the same process as [a] fund transfer among bank accounts.

"Bank transfers via DuitNow is subjected to enhanced anti-fraud measures such as biometric authentication and device binding to account, which makes it one of the safest reload methods," the New Straits Times quoted Ni as saying.

He added that TNGD, the largest financial institution serving over 20 million electronic know-your-customer verified users, has to strike a delicate balance between convenience, security, and the sustainable long-term costs imposed on the company.

The infographic below shows how you can reload your Touch 'n Go eWallet via DuitNow on your bank apps: