7 Things You Should Buy AFTER GST Is Implemented

Not everything will be more expensive after GST is implemented in April. Before you panic and buy everything in the shop, here is a list of GST-exempted products that would be cheaper after April.

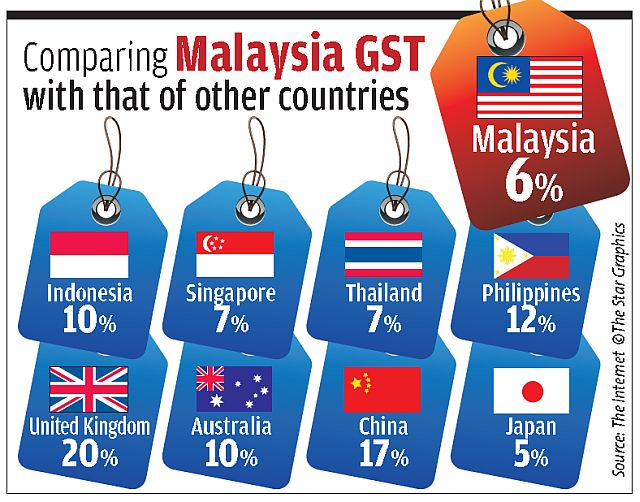

The 6% Goods and Services Tax (GST) will be officially implemented on 1 April 2015. However, it doesn't mean that everything will become 6% more expensive.

The GST is set to replace the 10% Sales and Services Tax (SST). That means items that are currently taxed with SST will see a reduction in price.

Conversely, that means items that have been tax-free all these while will become more expensive for consumers after being subjected to the 6% tax. This includes computers, laptops, iPads, mobile phones, men’s watches and cosmetics, including lipstick and nail polish.

1. Essential food items like rice, bread, meats, and oil

Customs Department director of GST Datuk Subromaniam Tholasy said there would be no GST for essential food items such chicken, beef, mutton, fish, duck, fish, eggs, ikan bilis, rice, bread, fresh vegetables and fruits, coconut oil, peanut cooking oil, palm oil and infant formula as well as for petrol RON95, diesel, toll and public transport.

But non-essentials such as tomato sauce, chilli sauce, oyster sauce, cup noodles, luncheon meat, tempe, cheese, margarine, quail egg, corn oil, olive oil, biscuit, donut and croissant chocolate will be subjected to the standard 6% GST.

For a full list of GST-exempted food products, see this list by the Customs Department.

3. Household appliances including TV, air-conditioner, electric fan, washing machine and hair dryer

7. In fact, cars are likely to be slightly cheaper too

The new tax rate was 6%, while the current sales tax on vehicles was 10%. The vehicle sales tax will be abolished on April 1.

Customs director-general Datuk Seri Khazali Ahmad said there had been doubt as to whether vehicle prices would go up or down. This arose from confusion among car dealers about how they would dispose of vehicles for which they had already paid 10% vehicle sales tax.

“The Customs will reimburse the dealers the 10% tax once they produce documented proof that they have paid the tax but had yet to sell the vehicle as of March 31,” he said.