PSA: M'sians With Tax Issues May Face Travel Restrictions. Here's How To Check Your Status

Over 200,000 Malaysians are currently barred from going overseas.

As we approach the year end, many Malaysians are gearing up for vacations. But imagine queuing in the immigration line, and finally being told you can't travel because you have tax arrears!

While this may sound like 'someone else's problem', the fact is that 203,123 individuals and companies have been given travel restrictions as of 30 November, according to the Inland Revenue Board (HASiL).

If you fit into one of these categories, you could be stopped at the immigration gate and restricted from travelling abroad — that means flight tickets and pre-booked holiday packages all burned! :O

That's why HASiL is encouraging all Malaysians to check their tax status, especially those who are planning to travel out of the country

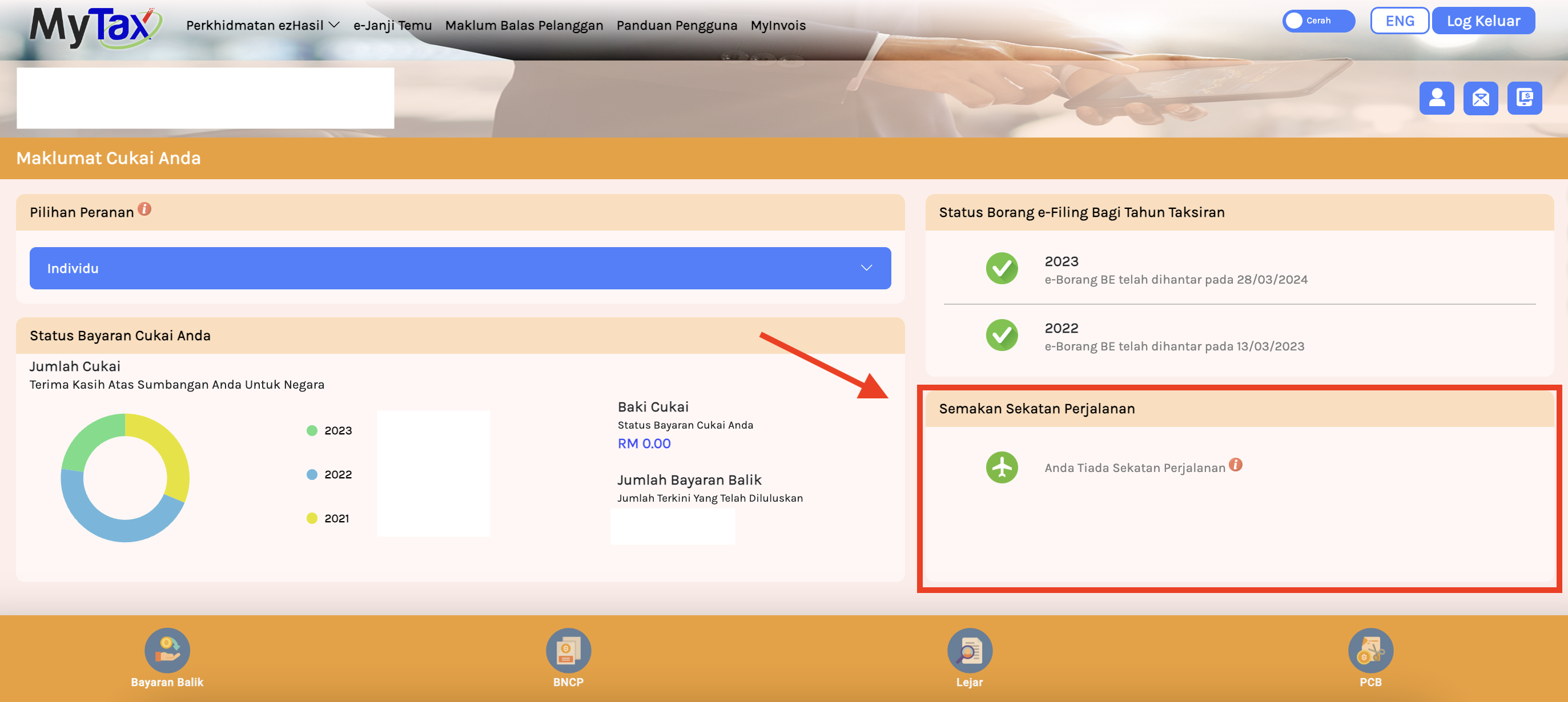

The good news is that checking your tax status is as easy as signing in to the MyTax portal, and navigating to the 'Semakan Sekatan Perjalanan' or 'Stoppage Order Review' on the bottom right of your dashboard.

As long as you have no unresolved tax issues and travel restrictions listed there, you're clear to travel, yay!

But if you have a Stoppage Order and unresolved tax issues, you are advised to make your tax payments via ByrHasil or apply for a temporary release a minimum of five days before your travelling date.

Visit this website for more details.

According to a statement by HASiL, the board is empowered "to prevent any individual from leaving Malaysia if they or their companies have unpaid tax arrears to the government."

The statement also emphasises that the travel restriction is the last action that can be imposed if the taxpayer still fails to pay the remaining outstanding tax (individuals and companies) after various reminders and notices have been issued.

Ultimately, HASiL also wants to remind Malaysians that your taxes contribute to the nation's growth

Tax compliance is key to nation-building, and the future of Malaysia is dependent on the commitment of all parties to fulfil their tax obligations. The revenue from tax collection not only funds development projects, but also provides better opportunities for future generations.

HASiL continually strives to make tax compliance more accessible and seamless for everyday Malaysians. This includes simplifying income declarations and tax payment processes through e-services like MyTax.

If you have further queries regarding your taxes, check out these helpful resources by HASiL.

Ready for that vacation abroad? Remember, always check your tax status before you travel by logging on to MyTax!