KL-Native Shares 8 Hilarious & Insightful Tips On How To Enjoy Life In KL On A Budget

How far would you go to save some money?

A Kuala Lumpur native recently shared money-saving tips on how to live the best life in the city on RM2,000/month or less

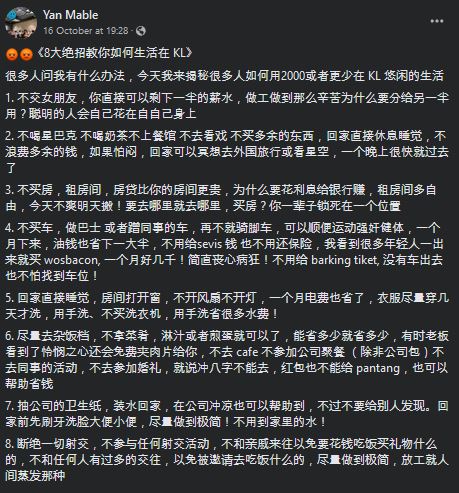

The Facebook user, who goes by the name Mable Yan, posted her tips in a Facebook group called KL Entertainment Station on Sunday, 16 October.

Yan's tips seem to have struck a chord with the group's members, as her post has garnered 685 shares and 1,900 likes at the time of writing.

While netizens laughed at this hermit lifestyle, some Malaysians also stood behind it as that's the only way to survive in KL with less than RM2,000 a month.

Well, whether you live in Kuala Lumpur or not, maybe Yan's tips can help you be the ultimate 'material gworl' on a budget.

1. Smart people only spend money on themselves

According to Yan, if you don't have a partner that you need to spend money on, you ultimately have more money to spend on yourself!

"Why would you give half of your hard-earned salary to someone else?" asked the KL-native.

Yan spends money on herself. Yan is smart. Be like Yan.

2. Don't. Do. Anything!

Don't spend money on Starbucks, don't drink milk tea, don't go to restaurants, don't go to the movies, don't buy extra stuff for yourself, and don't eat and breathe (okay, we're kidding about the last one).

But you get the gist. Yan's advice is to basically not do anything extra that would drain your pockets. "Just go home and sleep immediately," she said.

If you're bored, she suggests that you dream and meditate about going on a trip overseas or just watch the stars from your house.

Really taking the 'need versus want' philosophy seriously here.

3. Owning a house is where the debt is

Thinking about buying a house for yourself? Dreaming of calling yourself the owner of the house? Well, your wallet certainly isn't!

According to Yan, buying a house is a waste of money and you're better off renting a room. She reasoned that being tied to a mortgage is more expensive than the rental fee for the room.

She also adds that by renting a room, you can move as you please compared to being a home owner, where you have to be tied down in one place and deal with the ups and downs of the location.

4. Cars are money-wasting hunks of metal

"Use a bus or hitch a ride in your colleague's car," Yan said. If both aren't an option, just use a bicycle. That way, you get from point A to point B and you will manage to fit your daily workout in.

Plus, setting aside money for your car insurance and servicing fees is not the vibe. Not with the economic inflation that's plaguing us right now.

The car goes 'vroom vroom' and so does your money.

5. God said, "Let there be light!", but Yan said, "Not in this economy"

Why not save on your utility bills by simply not turning on your lights, fans, or air conditioning units? That way, you're probably saving a ton on your electricity bill every month.

Want to take it a step further? Get rid of your washing machine and just hand wash your clothes. But don't worry if that gets too tiring. Yan suggests that we all just wear our clothes for a few days before washing them.

6. Give puppy dog eyes to the 'chap fan' boss the next time you go eat mixed rice

Money-saving guru Yan advised us to not take any dishes from the mixed rice stall. Just load on sauces or curries onto your rice and maybe get a fried egg. That's it!

Then maybe... just maybe, the 'chap fan' boss will take pity on you and give you some meat dishes for free. So put on your best, "I'm broke" face to score some extra dishes for no cost at all.

7. Your company uses you, so you should use your company's resources

"Use their toilet paper, fill your water bottle to the brim, and take a shower at work," Yan encouraged. In fact, Yan goes as far as advising us to brush our teeth, wash our face, and do our business all at work before going home.

That way, you can ultimately save on your water bill but at the expense of your company. Just don't let them catch on to what you're doing.

8. Love your family and friends? Too bad! They are costing you money so you should cut them off.

Cut off all communication with your friends, family, and even colleagues. They are all just going to invite you to events and parties. Then, you'll have to buy gifts and spend money to hang out with them. No ma'am.

Yan also emphasised and advised us to not step foot into weddings, as you will have to cough out wedding gifts or money packets for the bride and groom. Remember tip #1?

If you follow this tip, you'll be alone. But you'll be alone and bougie at least.