"I Wanna Buy Crypto, But I Dunno How" — Here Are Some Helpful Tips To Help You Get Started

It really isn't all that complicated! ;P

Did you know that cryptocurrency is one of three most popular types of investments among Malaysians?

According to a YouGov survey, 37% of Malaysians thought the use of cryptocurrencies for long-term investing was interesting, as reported by The Star. Besides that, 40% of respondents also found it enticing to utilise crypto as an alternate way to store value.

There is a clear and growing interest for the digital asset, and it's estimated that 15% of Malaysians own cryptocurrency, which is slightly higher than the global average, woah! :O

Nevertheless, for those new to cryptocurrency, you might be unsure where or how to start. With a wealth of information available online, it can also feel a little overwhelming and intimidating.

"How do I buy or invest in cryptocurrency?"

"Which coin should I get?"

"Is it even safe to invest in crypto?!"

To help you get started on your crypto journey, we've partnered with cryptocurrency investment app Luno to give you some helpful tips:

1. Start by investing only what you can afford

The rule of thumb is to only put in money you would consider as 'extra', that you can live without.

Since crypto is considered a high risk asset class, investing in it means there is no guaranteed return.

The problem is that many new crypto investors treat it as a get-rich-quick scheme. Worse still, some choose to spend on crypto while neglecting more important expenditures, like loan repayments.

If you are barely getting by or don't have emergency savings in place, work on that aspect before even thinking about crypto. Only invest whatever you have left after deducting your monthly commitments, loan repayments, and basic savings.

2. Use a trusted crypto exchange platform

One thing you don't want to happen is to lose all your crypto investments. There have been instances of crypto exchange platforms collapsing or getting hacked. People have also been victims of crypto scams.

A good way to secure your crypto investments is to use a trusted crypto exchange platform.

Before choosing one, do your research and ask yourself if it's legal, secure, and transparent.

Currently, there are only four digital asset exchanges registered with the Securities Commission Malaysia. In regards to security, go with platforms that prioritise the safety of its users — this includes requiring stronger passwords and two-factor authentication.

Furthermore, never go through a third-party or individual to create an account on crypto platforms. Also, don't click on links or download apps from unknown sources. Instead, make sure you sign up via the exchange's official app or website.

3. Learn about what you're investing in, and don't just follow the hype

Don't just get into crypto investing because of FOMO.

One thing you should know is that many cryptocurrencies are not backed by anything, which means investors just rely on someone paying more for a digital asset than they paid for it. In other words, if everyone decides the digital asset is worth nothing, it could end up having zero value.

Similar to investing in stocks, make sure you read up about the cryptocurrency you want to invest in, and keep tabs on how it performs. Just because a cryptocurrency is popular now or getting a lot of media attention, it doesn't mean that it will perform well in the long-run.

4. Don't put all your eggs in one basket

While Bitcoin is still the most popular cryptocurrency, a common investment strategy is to diversify your portfolio, a.k.a. not putting all your eggs in one basket. The reason for this is if you go all-in on Bitcoin or another digital asset, you'll risk being over-exposed if it plummets in value.

Since the market for cryptocurrencies is highly volatile, a smart strategy is to spread your investments out among different digital currencies.

Also, it's good practice to always put aside a portion of your investment money. This means that you will always have some spare money meant for investment, in case the rest of your investments aren't performing well or a good opportunity arises.

5. Stay invested long-term, but have a risk management plan

Those who do well in crypto investing understand the market and stay invested. In fact, investors with a long-term approach tend to hold on to their digital assets when the value drops — some even see it as a time to 'buy low' and add to their investments.

For beginners who may not be able to invest with such a long-term mindset yet, a good approach to investing in crypto is to start with a risk-managing plan.

To start out, you can begin with a short-term risk-management plan by setting strict rules of when to sell (e.g. when it's -10%) to help mitigate losses. As you build your knowledge, you can gradually adjust to having a longer-term approach.

6. Remember, don't buy or sell just based on emotion!

One of the most common mistakes among cryptocurrency investors is entering the market at its peak, only to get scared and back out when the prices drop, resulting in a loss along the way.

That is why it's important to only invest in a cryptocurrency once you have studied the trends. Another thing to take note of is that low prices may not always be a bargain, as there may be a bigger reason behind it. If user rates for a cryptocurrency is falling, that's a sign to be careful!

Lastly, volatility can shake traders, even experienced ones. When that happens, it's important to not rely on your feelings in the moment, but to take a step back and review your investments based on your long-term goals. Even if the market spikes or drops rapidly, where it goes next is not always certain.

Do not buy or sell just out of greed or regret!

If you're still unsure of how to take the first step, Luno is a cryptocurrency investment app that can help you on your journey

You can rest assured when you invest with Luno — it was the first cryptocurrency exchange to be fully approved by the Securities Commission Malaysia back in 2019, and is still the leading regulated digital assets exchange in the country.

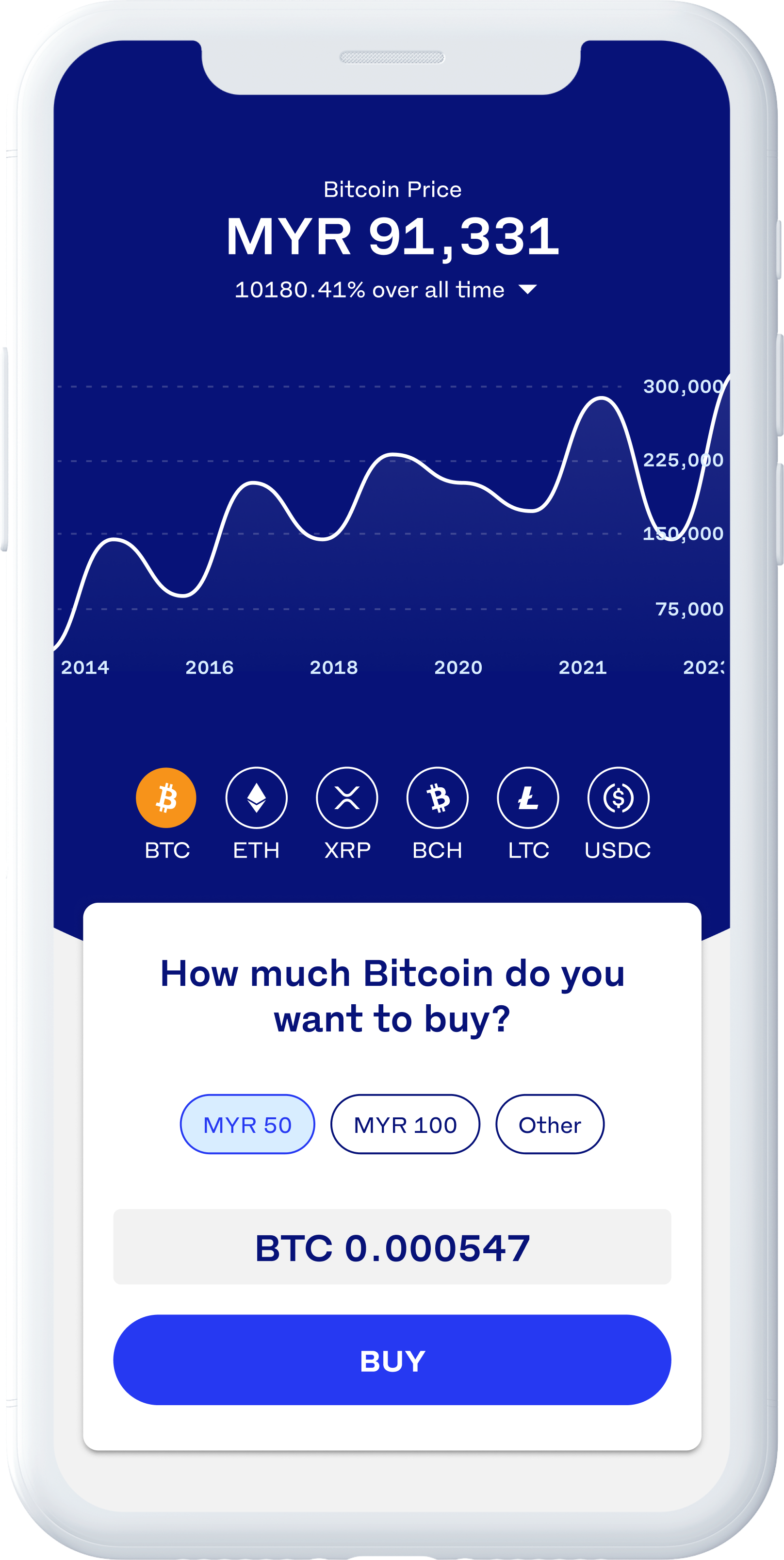

The great thing about Luno is that it's beginner-friendly, offering an easy-to-use interface while providing helpful knowledge at every step of your investment journey. The best part is that you can get started from as low as RM1, with nine approved cryptocurrencies to choose from.

The Luno app is pretty easy to navigate. Here's a closer look at how it works and all the features that may come in handy:

Firstly, you'll wanna sign up for a Luno account online or on the app itself. This part is fairly simple, but if you want to start investing in cryptocurrencies, you'll need to go through a verification process and make a deposit into your wallet.

Then, it's as easy as adding a new wallet and choosing the cryptocurrency you wanna buy, either as a Once-off purchase or Repeat Buy.

Once you're in the app, the homepage will display a comprehensive glance of your favourite cryptocurrencies and their performance. By default, it will show Bitcoin (BTC) and Ethereum (ETH), but you can customise it by adding your own favourites.

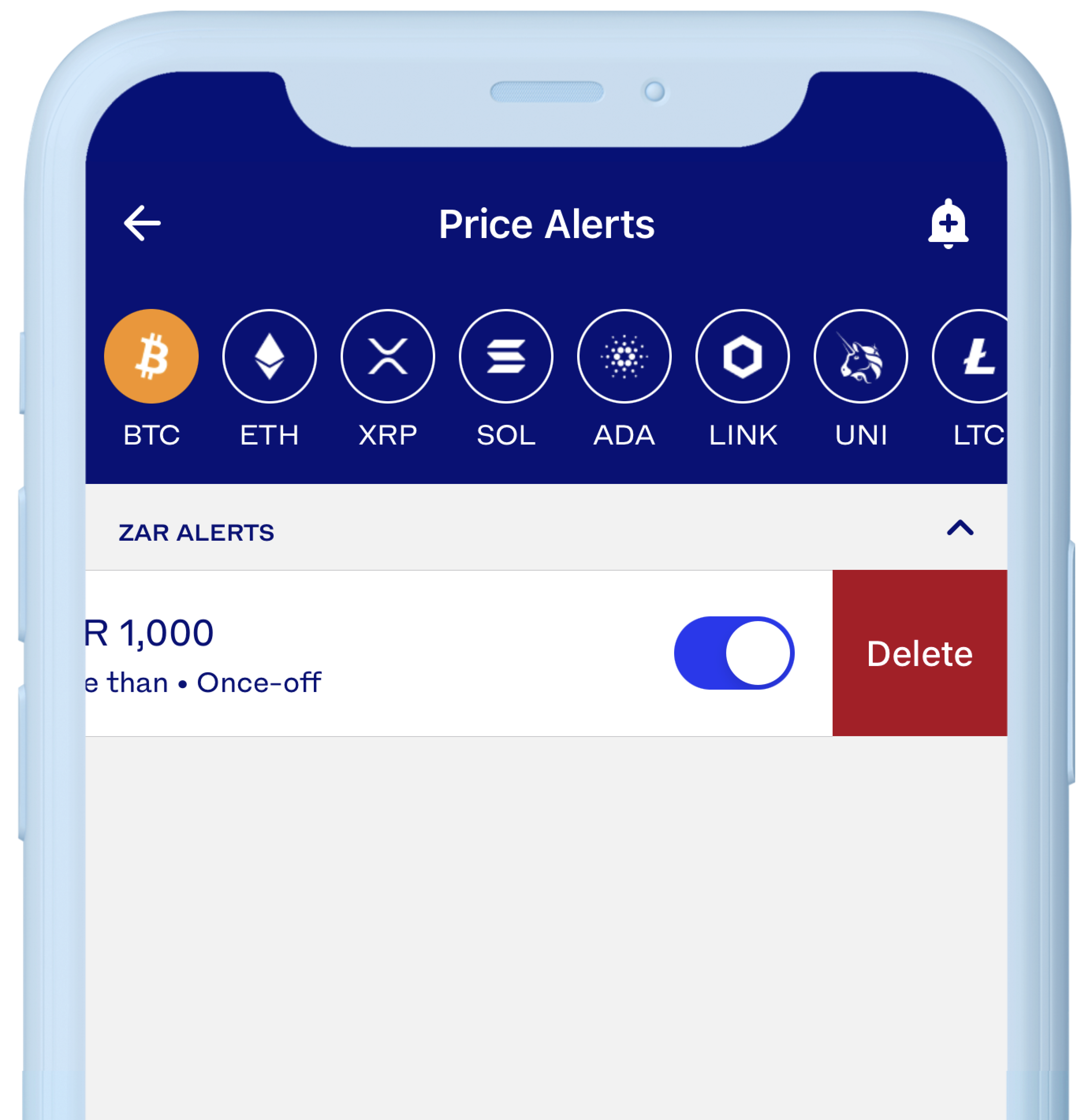

Next, you can create price alerts so you'll receive push notifications whenever the price of your selected cryptocurrency hits a certain amount. This helps you get notified on the best time to buy or sell your digital assets.

To keep up with the latest news and movements in the crypto space, head over to the Explore page and level up your knowledge.

That's not all, you can even earn Bitcoin rewards with Luno whenever you refer friends and family to use the app to buy cryptocurrency.

All in all, the Luno app makes it hassle-free for you to invest in cryptocurrency, and it's beginner-friendly, so anyone can do it! :)

Head over to Luno's website for more information, or follow them on Facebook, Instagram, or their community group.