Did You Know Road Tax Paid To JPJ Doesn't Go Towards Road Maintenance?

So what are we paying for?

Most of us take it for granted that road tax, by virtue of its name, goes directly into the maintenance of non-tolled roads, but that's actually not true

Instead, road tax is just yet another channel of government revenue, and it's not used exclusively for road maintenance. Which begs the obvious question, what are we paying for then?

Before we go further and for the benefit of those who missed our last article, here's some background.

The former director-general of Malaysian Institute of Road Safety Research (MIROS) and current deputy vice-chancellor of Universiti Sains Malaysia Professor Dr Ahmad Farhan said in a recent interview that road tax collected by the Road Transport Department (JPJ) doesn't go towards road maintenance but to a 'general use' fund.

"The road tax collected by the JPJ goes to the government's Consolidated Fund and there is no Consolidated Fund specifically for transport," Ahmad said.

"The road taxes that the JPJ collects funds many purposes including public transport projects like Prasarana's MRT, LRT, and Rapid Buses, and not specifically on road maintenance.

"So what are we paying road taxes for: bad road conditions," Ahmad asked rhetorically.

Actually, the term 'road tax' is a misnomer

Under Malaysia's Road Transport Act, there is no such thing as road tax. There are, however, provisions for Motor Vehicle Licence, which we colloquially refer to as 'road tax'.

This so-called 'road tax' is inherited from our British colonial masters, along with the practice of affixing a road tax disc on a motor vehicle's windscreen (now replaced by a road tax sticker).

But even before Malaysia gained its independence from the British, Westminster had long figured out that it is not practical to ring-fence road tax revenue and have it used exclusively only for road maintenance.

This is because road maintenance is often the responsibility of local councils, which draw their funds from the government.

Since 2015, the UK has abolished road tax, replaced by Vehicle Excise Duty (VED), which is equivalent to our vehicle excise duty but out of habit and convenience, the British still refer to VED as 'road tax'.

The difference between the UK's VED and our road tax is that VED is paid yearly, based on a car's CO2 emission. For us Malaysians, our vehicle excise duty is paid upfront, upon purchase of the vehicle, based on the car's engine capacity but locally-assembled models get discounts based on the value of their local content. On top of that, we pay an annual road tax based on engine capacity (or power output for electric vehicles).

Of course, we don't need to go further on how much excise tax are Malaysians paying for our cars.

Unlike the Brits, Malaysians are paying both (exorbitant) excise tax as well as road tax.

While Britain's VED has long been considered as just another form of tax (as opposed to a tax to fund road maintenance), the issue of poor road conditions and a high number of accident-causing potholes became a contentious issue in British Parliament in the early part of the last decade.

When it was revealed that just 24% of VED and fuel tax (also paid by motorists, grouped together with VED as motoring tax) was spent on road maintenance, there was strong pushback from the public.

In 2014, Professor Stephen Glaister, RAC Foundation director, said: "Over the past five years the gap between the Chancellor's income from motoring tax and what he spends on roads has widened sharply.

"At the same time, the pothole backlog has been growing and local authorities are warning that spending commitments on social care and environmental services mean there will be even less money available to maintain our highways in the future."

In 2018, the UK government reversed an almost 80-year-old decision to not ring-fence road tax/VED exclusively for road maintenance use. Now VED's collection goes strictly into road maintenance.

But that's the UK, so what about Malaysia? Over here, car owners bear the brunt of our country's fiscal commitments, but we still don't see minimum standards in road maintenance.

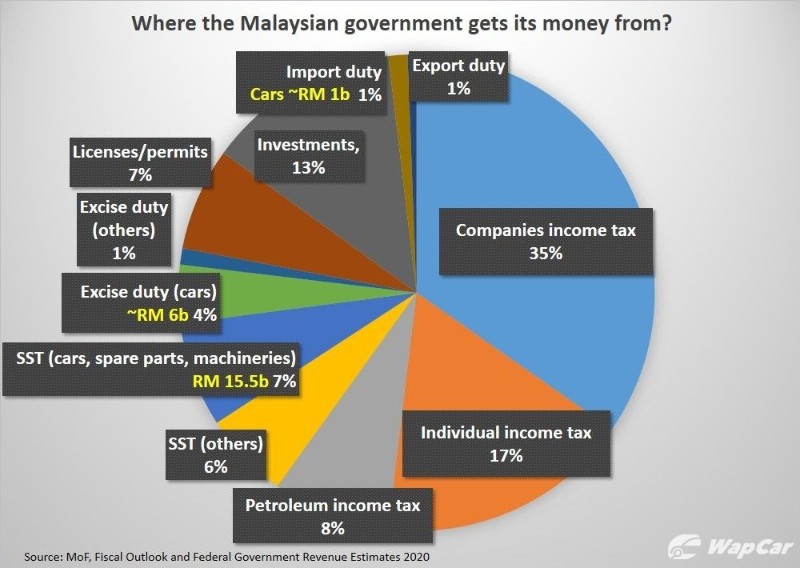

Malaysian car buyers shoulder nearly 10% of the Malaysian Treasury's collection — over RM10 billion in car taxes every year

5% from motor vehicle import and excise tax, 7% from SST on cars and car parts (also includes industrial machineries). The figure doesn't include road tax.

The last publically available information regarding road tax revenue collected by JPJ was for 2018, when then Transport Minister Anthony Loke said JPJ collected RM4.32 billion in 2018, of which 69% were contributed by road tax (about RM2.98 billion).

So who/what category of tax pays for road maintenance then?

There is no one single fund that is used exclusively for road maintenance but between your personal income tax, your company's corporate income tax, excise tax, import tax, SST, and all other taxes, it is your properties' quit-rent (cukai tanah dan cukai petak) and assessment rate (cukai taksiran) that have the closest relation to road maintenance as these are collected by the local council/local government, exclusively for use of infrastructural maintenance.

Fun fact: Malaysia is one of the few countries where drivers pay the excise tax, sales tax, road tax, as well as highway toll for travelling within urban areas. In most countries, it's only one or the other, and typically drivers only pay for tolled highways when they travel to places far away from urban centres.

Not only that, our sales tax is calculated after import and excise tax are loaded, so it's a tax upon another tax.

But it's not all that bad

Remember that Malaysians pay the one of the cheapest fuel prices, parking charges (with almost non-existent enforcement), and motor insurance rate. Malaysians can drive anyhow they want at any speeds thanks to lax enforcement.

Short of killing someone, there's no way you can realistically lose your driving licence here. Elsewhere, a simple speeding offence (especially when it's way above the posted limit) is enough to lose your licence.

None of it are anything to be proud of, as it only highlights the state of the rule of law in our country but hey, you can't pick and choose what you want in life. Good governance comes together with strict enforcement of regulations, not all of it agreeable to you.

Potholes that claims lives of motorcyclists are merely symptoms of a bigger problem.

The vigilante Lando Zawawi Brotherhood Malaysia group takes it upon themselves to complete road repairs.

Image via WapCarSo, now that we have established that road tax doesn't contribute to better roads, will there be a politician who wants to campaign on the platform of abolishing road tax?

Between abolishing vehicle excise tax (where is PKR's Rafizi Ramli's RM24.8k Perodua Myvi?), buying back highways (no updates from DAP's Tony Pua?), and road tax, the latter sounds more manageable.

The shortfall in revenue can be compensated by doing more than just opening number plates for auction. Why not go all the way and make vanity plates legal, but impose an annual renewal fee on it?

In Australia, some states limit vanity plates' validity period to between 12 and 36 months, subject to renewal fees.

Of course, supporting such a move would require JPJ to enforce standardised plates and hold the monopoly for the printing of number plates (which since they can make money from too), but why is that so difficult, when even Thailand, Indonesia, and Vietnam can easily do it?

Road transport authorities in many countries use vanity plates as a source of income, but standardized fonts are used.

Image via WapCar