Grab Just Launched A New Credit Card. Here Are 5 Tips To Help You Make The Most Out Of It

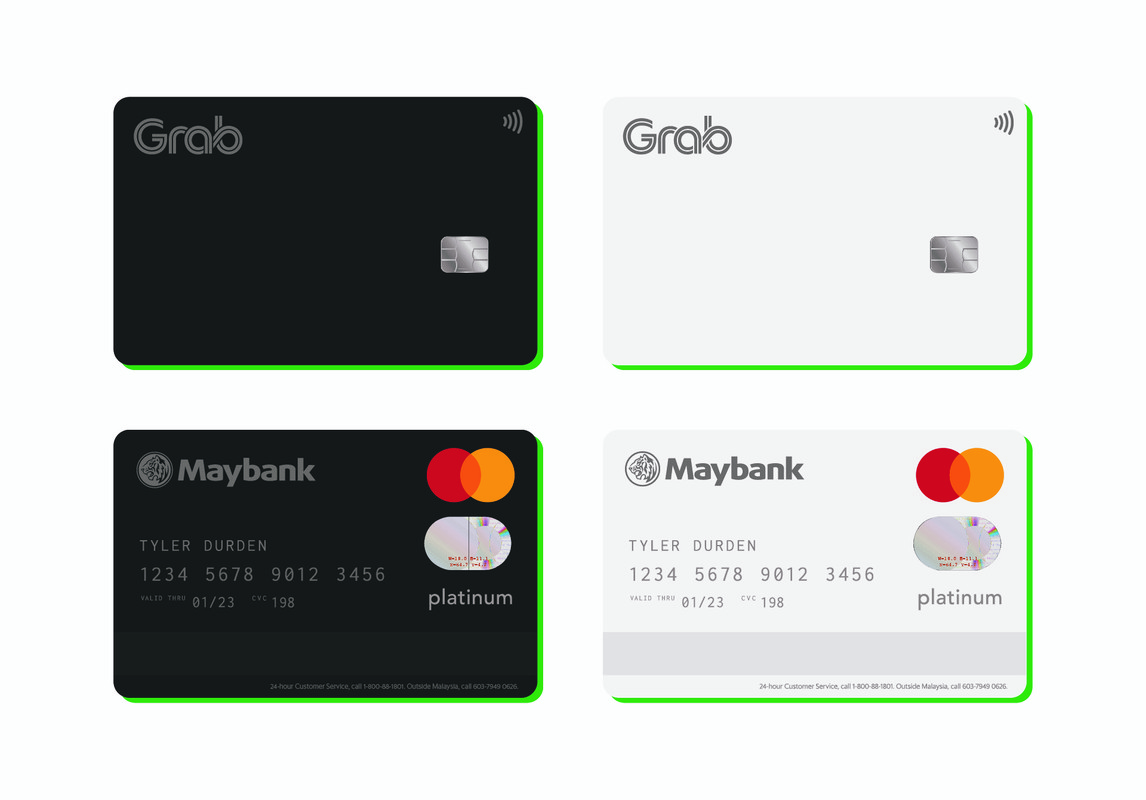

This first ever Grab credit card is in partnership with Maybank and Mastercard.

Thinking of applying for your first credit card? Grab together with Maybank and Mastercard recently launched their all-new Maybank Grab Mastercard Platinum Credit Card that will help you save more and enjoy amazing rewards.

Grab has partnered with Maybank and Mastercard to come up with the first Grab credit card in Malaysia. You can use it to pay via chip or contactless payment at millions of merchants worldwide and for online shopping. This sleek credit card looks minimalist, and comes in your choice of black or white.

What's cool about this lifestyle card is that you'll be rewarded with GrabRewards points every time you spend, while enjoying all kinds of discounts and benefits. Plus, with lifetime annual fees waived, you won't have to worry about forking out extra money each year, making it the perfect card for first-time cardholders.

Here are more amazing features of the Grab credit card:

1. Earn up to 5x GrabRewards points for every RM1 spend on Grab

This means you can earn 5x points whenever you use Grab for your rides, food, mart, or express deliveries. In fact, you get 5x points even when you use your card to top up your GrabPay e-wallet!

2. Get 2x GrabRewards points for every RM1 you spend overseas or online

Whether you're shopping on your favourite online stores or using your card across the Malaysian border, you'll get to earn 2x points.

3. Get 1x GrabRewards point for every RM3 spent in Malaysia

Use your GrabPay credit card when you're doing groceries, pumping petrol, paying for bills, or more to gain more rewards with Grab.

4. Enjoy amazing sign up offers

- 1,000 welcome GrabRewards points

- Platinum tier on GrabRewards (valid for first 6 months)

- Lifetime annual fee waiver

- RM50 worth of GrabFood and GrabCar vouchers (with a min. spend of RM300 within 45 days of card approval)

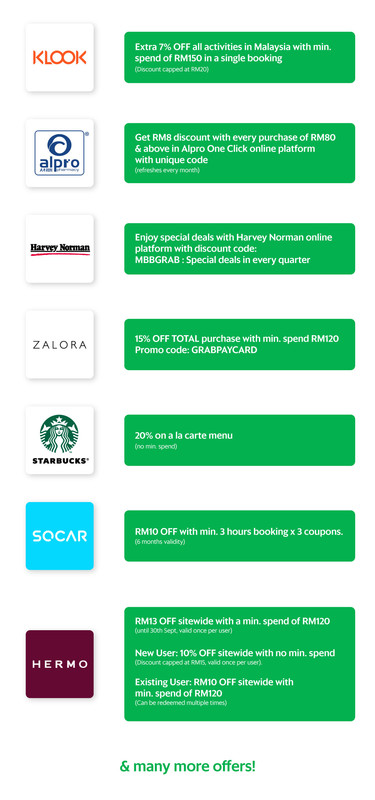

5. Gain access to exclusive offers with these merchant partners:

KLOOK: Extra 7% off all activities in Malaysia with minimum spend of RM150 in a single booking (discount capped at RM20) Use promo code: GRABMASTERCARD7

Alpro Pharmacy: Get RM8 discount with every purchase of RM80 & above in Alpro One Click online platform with unique code (refreshes every month)

Harvey Norman: Enjoy special deals with Harvey Norman online platform using discount code MBBGRAB (special deals every quarter)

Zalora: 15% off total purchase with minimum spend of RM120

Starbucks: 20% off for a la carte menu (no minimum spend)

SoCar: RM10 off with minimum three hours booking (x3 coupons, 6 months validity)

Hermo:

- RM13 off sitewide with minimum spend of RM120 (until 30 Sep valid once per user)

- New user: 10% off sitewide with no minimum spend (discount capped at RM15, valid once per user)

- Existing user: RM10 off sitewide with minimum spend of RM120 (can be redeemed multiple times)

If this is your first time owning a credit card, here are a few tips to help you make the most out of it:

1. Only spend money that you have

Some people have the misconception that a credit card is an advance payment tool to help them get that pair of sneakers or bag that they've been eyeing. However, to avoid overspending, you should limit your spending to the money you actually have in hand.

Although you are only required to pay the minimum monthly balance every month, doing so could cause your debt to pile up over time. That's why you should try to make it a habit of only spending money you have and paying your bill in full every month.

2. Always, always pay on time

One of the important things you'll want to keep in mind is the late fees, which is what you're charged when you pay late by even a day or if you don't pay the minimum amount due. It is usually a set amount or a percentage of your outstanding balance.

To avoid getting charged late fees, try to always settle your credit card bill on time every month. If you want to be extra careful, you can pay your bill twice a month or every time after you use your credit card. When you pay on time, not only will it prevent you from overspending, your Maybank Grab Mastercard Platinum Credit Card will also help you build a healthy credit score.

3. Keep track of your spending

Once you have a credit card, swiping or tapping your card can become really easy and convenient. Before you know it, you could lose track of your spending. For some people, setting a spending limit helps them to spend within their means - for instance, if you set your limit to RM1,000 a month, you'll stop using your credit card for the rest of the month once you hit that amount.

For others, what's helpful is having a visual money tracker. Certain apps require you to key in your expenses, and will show you a chart of your spending at the end of the month. Some credit cards will also have apps to help you track your spending and manage your card. What's good about the Maybank Grab Mastercard Platinum Credit Card is that you can keep track of your spending on the Maybank2u website.

4. Learn about all the fees involved

Apart from late fees, there are a few other fees and rates that you should take note of before applying for a credit card.

- Annual fee: A once-a-year charge for having a credit card. Cards with annual fees usually have a lower interest rate.

- Interest rate: The interest you'll have to pay on balances you carry from month to month.

- Credit limit: The maximum amount of credit you can borrow.

- Foreign transaction fees: Fees charged when making purchases with your credit cards outside of Malaysia.

Most of the cards with fancy perks and benefits come with high annual fees and encourage big spending, but may not be suitable if you're just starting out. For those of you getting your first credit card, you'll probably want to opt for a card without annual fees, like the all-new Maybank Grab Mastercard Platinum Credit Card. This will help you get used to using credit cards, while helping you avoid overspending.

5. Look for a card that will give you the most benefits according to your lifestyle

There are various kinds of credit cards to meet your needs, so you should do your research before applying for one that will bring you the most benefits. For instance, if you use your card mostly for grocery shopping, it'll be better to get a rewards or cashback card instead of a frequent flyer card.

Besides that, with e-wallets now becoming a trend, credit cards like the Maybank Grab Mastercard Platinum Credit Card let you double dip on rewards when you top up your e-wallet. When you know what you're gonna use your credit card for, you can apply for the one that best suits your needs.

If you're looking to apply for your first credit card, the all-new Maybank Grab Mastercard Platinum Credit Card is a hassle-free way to get started

Who can apply for this card?

- Malaysians with a minimum annual income of RM36,000

- Principal cardholders: those between 21 to 65 years old

- Supplementary cardholders: 18 years old to 65 years old

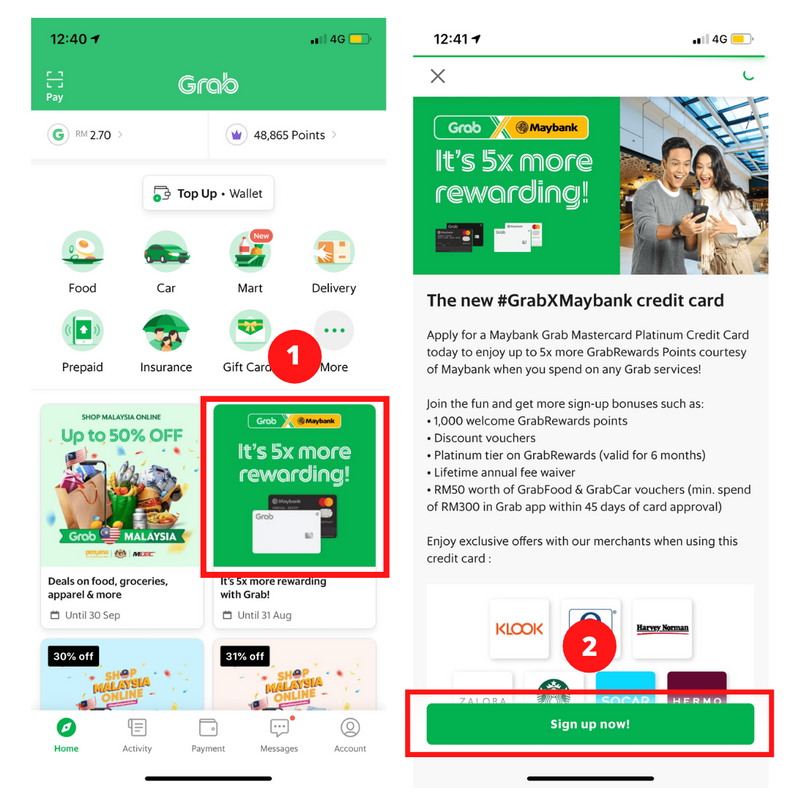

Here's a step-by-step guide on how to sign up for the card directly on the Grab mobile app:

STEP 1: Click on the card banner on your Grab app feed

STEP 2: Click on ‘Sign Up Now’ and you will be redirected to a Maybank site

STEP 3: Select your preferred card colour

STEP 4: Provide your personal details, including NRIC, salary slips, and bank statements

STEP 5: Submit. Upon completion, you’ll receive an SMS or email acknowledging that your application has been received

STEP 6: Once approved, you’ll receive a digital card first (existing Maybank2u users) and the physical card will be delivered to you within 10 working days

Read more about the FAQ and terms and conditions.

Ready to apply for your Maybank Grab Mastercard Platinum Credit Card? Find out how on their website today!