Here's Why It's Important For Young Malaysians To Get Critical Illness Insurance

Many people think they don't need protection especially when they are young and healthy.

Most Malaysians are familiar with medical insurance, but not as many people know about critical illness insurance and what it covers

Medical insurance covers the cost of treatment and medication if you get hospitalised. This could include expenses like ICU charges, pathology charges, and day care treatments.

On the other hand, critical illness insurance offers a lump sum payout when you are diagnosed with an illness like cancer, heart attack, and stroke, among many others. While both are important, many people think they don't need critical illness protection. However, the truth is that critical illness can affect any of us even when we least expect it.

For professional dancer and leukemia survivor, Emily Tan, her cancer diagnosis came as a shock because she had been fit and healthy for most of her life

"The financial aspect was definitely the forefront of my worries. But since getting insurance right before I got diagnosed, it was a blessing because I could channel all my focus into healing. I don't think I would be here, honestly, if not for insurance," shared Emily.

Despite its importance, a majority of young Malaysians tend to put off getting critical illness insurance

People usually think they don't need critical illness insurance when they are young and healthy. Also, the thought of having to fork out extra cash every month may keep young Malaysians away.

However, the truth is that critical illness can affect any of us at any time regardless of our gender, age, fitness and health. That's why it's better to get critical illness insurance sooner rather than later.

1. It helps to cover your living expenses and treatment costs

If you're diagnosed with critical illness, the recovery journey can be daunting. Critical illness insurance gives you a lump sum payout that can be utilised to pay for big expenses beyond what is covered by your medical policy.

This allows you to focus on getting well without having to worry about your finances. Some insurance providers even offer early-to-late stage coverage, which means you'll be covered at any stage.

2. It eases your burden and makes up for your loss of income

Critical illness may affect your ability to continue working like you used to. The lump sum payout could help to provide salary replacement temporarily, so you can continue paying for your prior commitments and providing for your family.

3. It prevents financial strain due to lifestyle changes

Your lifestyle may change if you're diagnosed with critical illness - you may have to modify your diet, your loved ones may need to relocate to take care of you, or you may have additional nursing and therapy costs. All this can add up quickly, so critical illness coverage helps to lessen the financial strain for both you and your loved ones.

Unfortunately, critical illness can affect even the healthiest of us, which is why having the right insurance can make all the difference

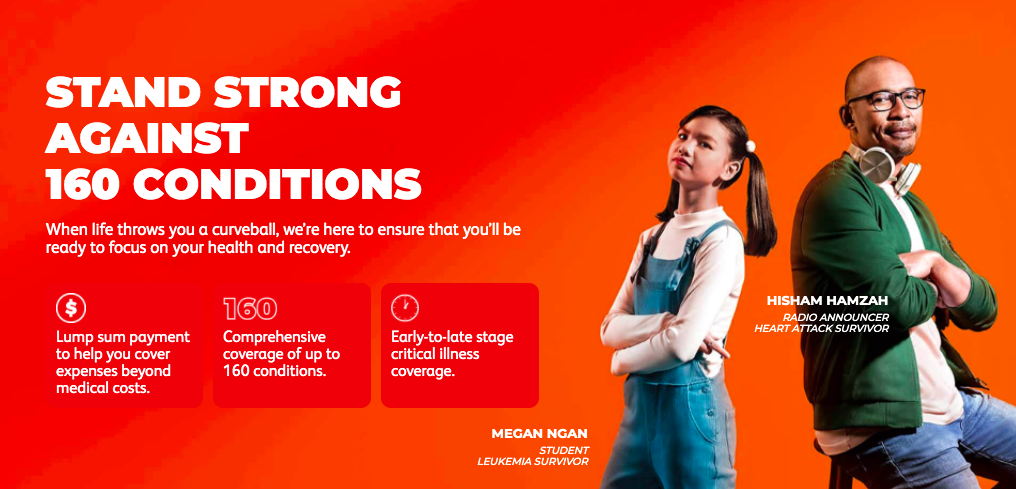

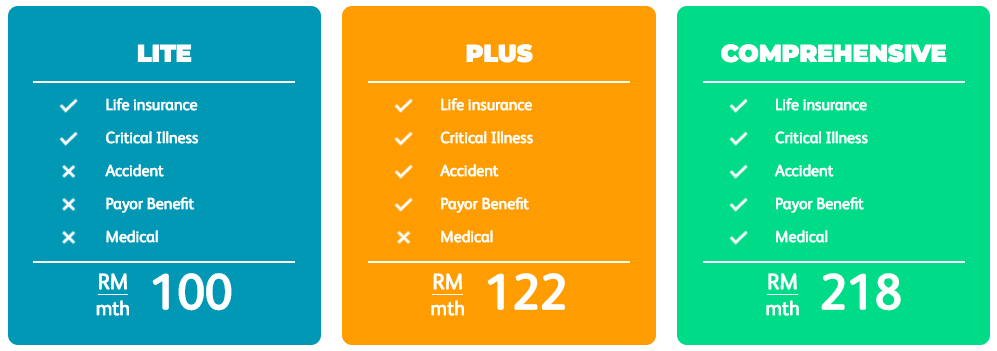

Prudential wants to help protect Malaysians with their PRUMy Critical Care solution from as low as RM100 per month. Here's what it covers:

Comprehensive financial protection against 160 conditions

If diagnosed with one of the 160 conditions, you'll receive lump sum payment to help you cover expenses beyond medical costs. It also provides early critical illness coverage on 101 conditions.

Coverage from the early to late stages of critical illness

Whether you are battling with early, intermediate, or late stages of critical illness, PRUMy Critical Care allows you to receive multiple claims for different stages of your illness, up to a total of four times the rider sum assured.

Re-diagnosis coverage for cancer, heart attack, and stroke

With the likelihood of relapse, this insurance solution offers coverage if you are re-diagnosed with the three most prevalent illnesses in Malaysia.

Special benefit for diabetic and joint related conditions

In addition to all the benefits above, you will receive an additional one-time payout of 20% of the rider sum assured if you are diagnosed with diabetic or joint-related conditions.

What's unique about PRUMy Critical Care is that it lets you customise your insurance solution based on your needs. For instance, you can opt for the basic critical illness coverage along with life insurance from just RM100, or you could get the full range of protection that even includes medical coverage.

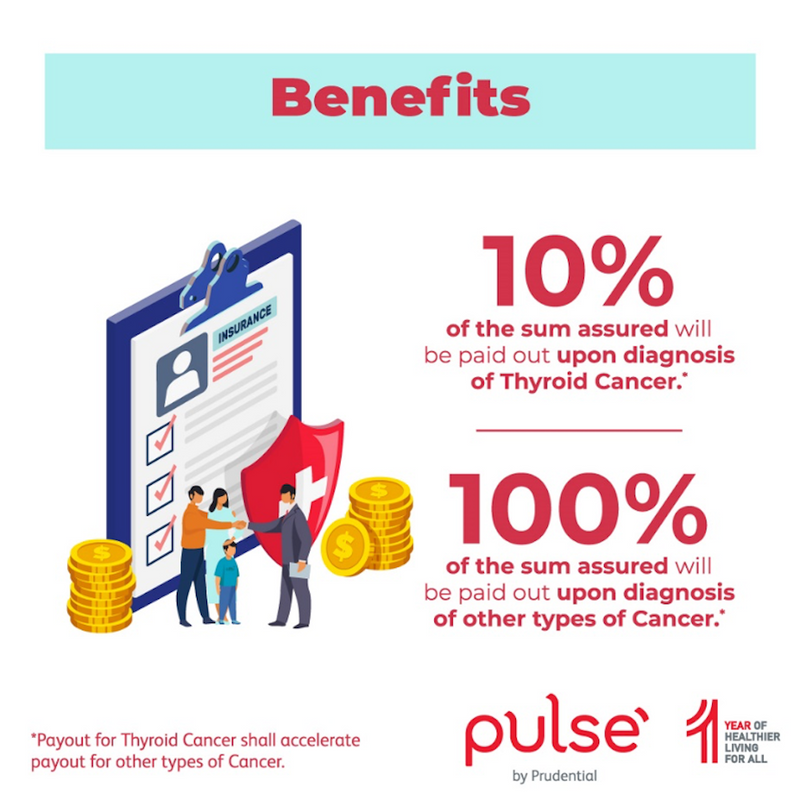

On top of that, Prudential has launched the #StepUpAgainstCancer Challenge on the Pulse app offering free cancer coverage of up to RM12,500*

If you don't have insurance coverage for cancer protection yet, this plan by Prudential is the perfect way to get started - plus, it's free!

With the #StepUpAgainstCancer Challenge, you can get yourself free cancer protection of up to RM12,500 for 12 months. Ultimately, Prudential wants you to enjoy a healthy lifestyle, while having peace of mind. This challenge is open to non-Prudential customers who are Malaysian citizens aged 19-50 on their next birthday.

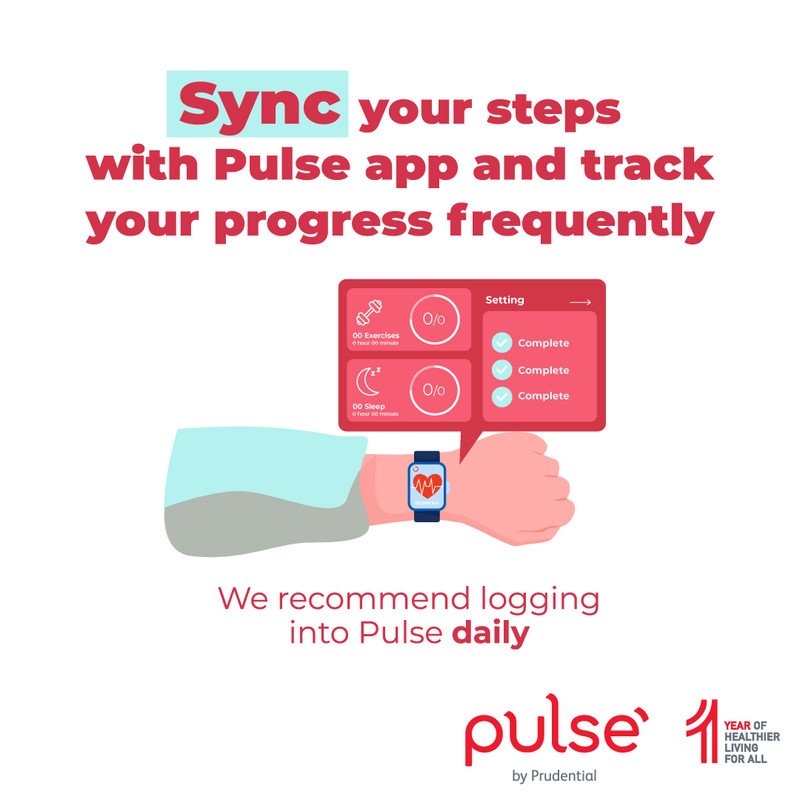

Once you’ve downloaded Pulse and signed up for the challenge under PRUShoppe, you'll start with RM500 cancer coverage. As long as you reach 5,000 steps or more per day for 100 consecutive days from the first day of challenge sign-up on the Pulse app, you’ll earn RM100 coverage amount daily for a total of up to RM10,000 coverage amount.

So, make sure your health tracker is connected to the Pulse app and synced daily. Plus, every new registered Pulse user who successfully signs up with your referral will give you additional coverage amount of RM200, up to additional RM2,000 coverage amount within 100 days starting from the first day of your sign up.

*Terms and conditions apply.

Download Pulse to participate in the challenge today! There’s a bonus as well. Users who sign up for the challenge are also automatically eligible for Prudential’s Special COVID-19 Coverage. The coverage provides a RM1,000 cash relief upon diagnosis and hospitalisation, as well as a RM10,000 death benefit due to COVID-19.

To find out more about the #StepUpAgainstCancer Challenge, head over to the website.

For information on how you can be financially prepared for critical illness, speak to a Prudential Wealth Planner or visit Prudential's website to find out more