How To Start Investing With Just RM1,000 And Start Making Money

Do not underestimate the potential of RM1,000.

Think RM1,000 is a small sum that would amount to nothing? You would be surprised at how much RM1,000 could help you make if you invest it in the right places right now

You may scoff at the idea of getting into investments with just RM1,000. You might think, “What can I do with that meagre amount?” A lot, actually. You’ll be surprised at how much you can gain in years to come if you invest that money right now. You don’t need to invest hundreds of thousands up front to see a healthy return. With just RM1,000, you can kick-start your investment portfolio and see money rolling in.

imoney.my

imoney.my

Amanah Saham Bumiputera (ASB)

Risk: Low

Average return: 8% to 10% per annum

Example: If you invest RM1,000 over 10 years, your return will be RM1,367.36

ASB is a premier unit trust investment specifically for Malaysian Bumiputera. It is managed by Amanah Saham Nasional Berhad (ASNB), a wholly-owned subsidiary of Permodalan Nasional Berhad (PNB). It is meant as a long-term investment, with the longer you keep your money, the higher the possibility of higher return.

Some of the ASB features:

Capital guaranteed – low risk

No sales charges – higher return

No redemption charges – higher return

Maximum investment amount: 200,000 units

Real Estate Investment Trusts (REITs)

Risk: Medium

Average return: 6.82% per annum

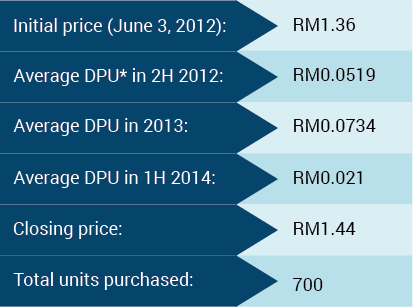

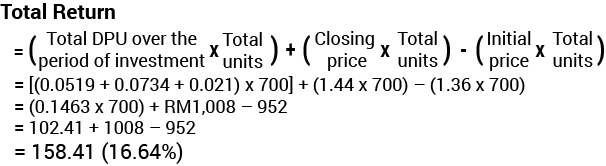

Example: If you purchased 700 shares from Sunway REITs in 2012, and sold them in the first quarter of 2014:

imoney.my

imoney.my

REITs are meant for investors who would like to invest in property, especially retail lots, but do not have the capital to buy them outright as investments. These trusts are formed by companies that purchase and manage real estate using funds pooled from shareholders. Dividend payouts can be generous depending on which REIT you are buying.

imoney.my

imoney.my

Like most long-term investments, the longer you leave your money in it, the higher the return will most likely be.

DPU stands for Distribution Per Unit, or also known as, dividend per share of the financial year. It is listed in sen. imoney.my

imoney.my

Unit trust funds

Risk: Low to medium

Return: Depends on portfolio and funds

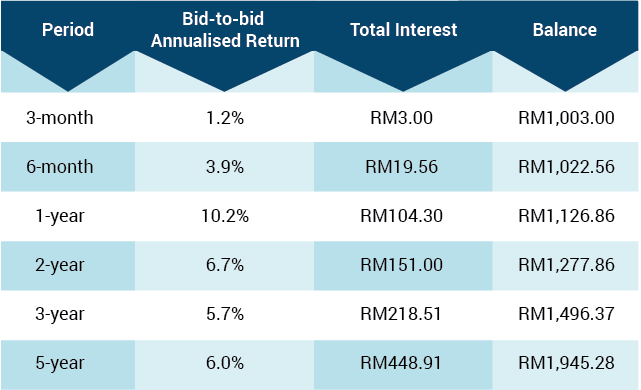

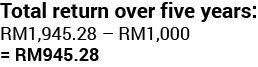

Example: If you invest RM1,000 in the AMB Lifestyle Trust Fund Today for five years on Fundsupermart.com.my, your return, based on the historical performance, may be:

Unit trust funds are a form of collective investment that allows investors with similar investment objectives to pool their funds to be invested in a portfolio of securities or other assets. A professional fund manager then invests the pooled funds in a portfolio which may include cash, bonds and deposits, shares, properties and/or commodities.

The return on investment of unit holders is usually in the form of income distribution and capital appreciation, derived from the pool of assets supporting the unit trust fund. Each unit earns an equal return, determined by the level of distribution and/or capital appreciation in any one period.

However, investing in unit trust will usually involve certain costs like sales charge, platform fee, annual management charge, trustee fee and other charges. By investing via Fundsupermart, investors can reduce these fees and charges as compared to investing through a fund manager.

With a unit trust fund, you can still maintain liquidity and security, but it is no longer a savings account – it is an investment. Unit trust is the most suitable investment for the common man who is interested in equities but lack the funds to diversify independently. Unit trusts offers an opportunity to invest in a diversified, professionally managed portfolio with lower starting capital.

Blue chip stocks in Stock Exhange

Risk: High

Return: Possibly high return, depending on market and company

Example: If you invested RM 1,000 in Axiata in 2009 (five years ago), it would amount to about RM2,340 now.

imoney.my

imoney.my

Investing in blue chip stocks are recommended not just because of the capital appreciation, but also the attractive dividends, depending on the company. In the example above, Axiata is a well-known and reputable blue chip company.

imoney.my

imoney.my

Blue chip companies refer to reputable and financially sound companies, selling high-quality, and widely accepted products and services. These companies are known to weather downturns and operate profitably in the face of adverse economic conditions, which helps to contribute to their long record of stable and reliable growth.

imoney.my

imoney.my

However, if you’re risk averse and not well informed, stocks should not be used as a short-term investment in order to make a big profit. This action is not investing, but pure gambling. There may be times in which stocks have put a record on short-term growth, but these occurrences are very rare.

imoney.my

imoney.my

Making short-term transactions with stocks can lead to high cost of investment due to the various brokerage and transaction fees. Depending on your investment amount, these fees can add up to a significant amount.

imoney.my

imoney.my