[VIDEO] Malaysians Try Going Cashless For A Day In Kuala Lumpur. Jadi Or Not?

Watch Daniel and Fanyi attempt at using only cashless payments as they run around the city.

It's safe to say that we have, more or less, moved towards a cashless society

Most stalls, shops, and restaurants in big cities now encourage cashless payments, be it via credit or debit card, e-wallet, QR pay, or Buy Now, Pay Later.

But is it actually possible to get through 24 hours without using any cash at all?

In collaboration with Alliance Bank, we challenged local TV host Daniel and SAYS talent Fanyi to see if they can spend a day out in KL using only cashless payments.

Watch the full video below to find out how it went:

Daniel and Fanyi make their first stop at a mamak for some roti canai, mmmm. And lucky for them, the mamak accepts QR payments! :D

Daniel: "Alright, okay, Fanyi, done. I've already topped up my e-wallet. Now, let's go! On to our next challenge. Let's pay first. Woo!"

The best way to explore KL is by taking the train, amirite? But alas, Fanyi needs to buy a ticket, oh nooo. Fortunately for her (again), the MRT kiosk accepts cashless payments, yay. :D

Daniel: "Okay, guys. So, we're going to get our tickets right now. And Fanyi is basically just purchasing in the background, while I'm going to use my virtual credit card to top up my Touch 'n Go NFC card. And then we'll be on our way."

Everything basically went smoothly for the duo until... Fanyi booked a slot to visit a pop-up museum, thinking it was at Pavilion KL when it's actually at Pavilion Bukit Jalil. Whoops. :P

Daniel: "Fanyi, it's in Pavilion Bukit Jalil, not Pavilion Bukit Bintang."

Fanyi: "No, it's n... Oh."

Daniel: "Girl! How can you make such a big mistake?"

Fanyi: "Oops."

Daniel: "Fanyi!"

Fanyi: "It's okay. It's okay. We can book a Grab!"

After a whole day of running around the city centre (and Bukit Jalil, hehe) using only cashless payments, it's clear that it is possible to get through the day without cash, woots!

Fanyi: "It's been such a long day. Thank you everyone for watching us run around KL the whole day."

Daniel: "And speaking of which, I can see them there. Oh my god, those producers, y'all made us run the whole KL!"

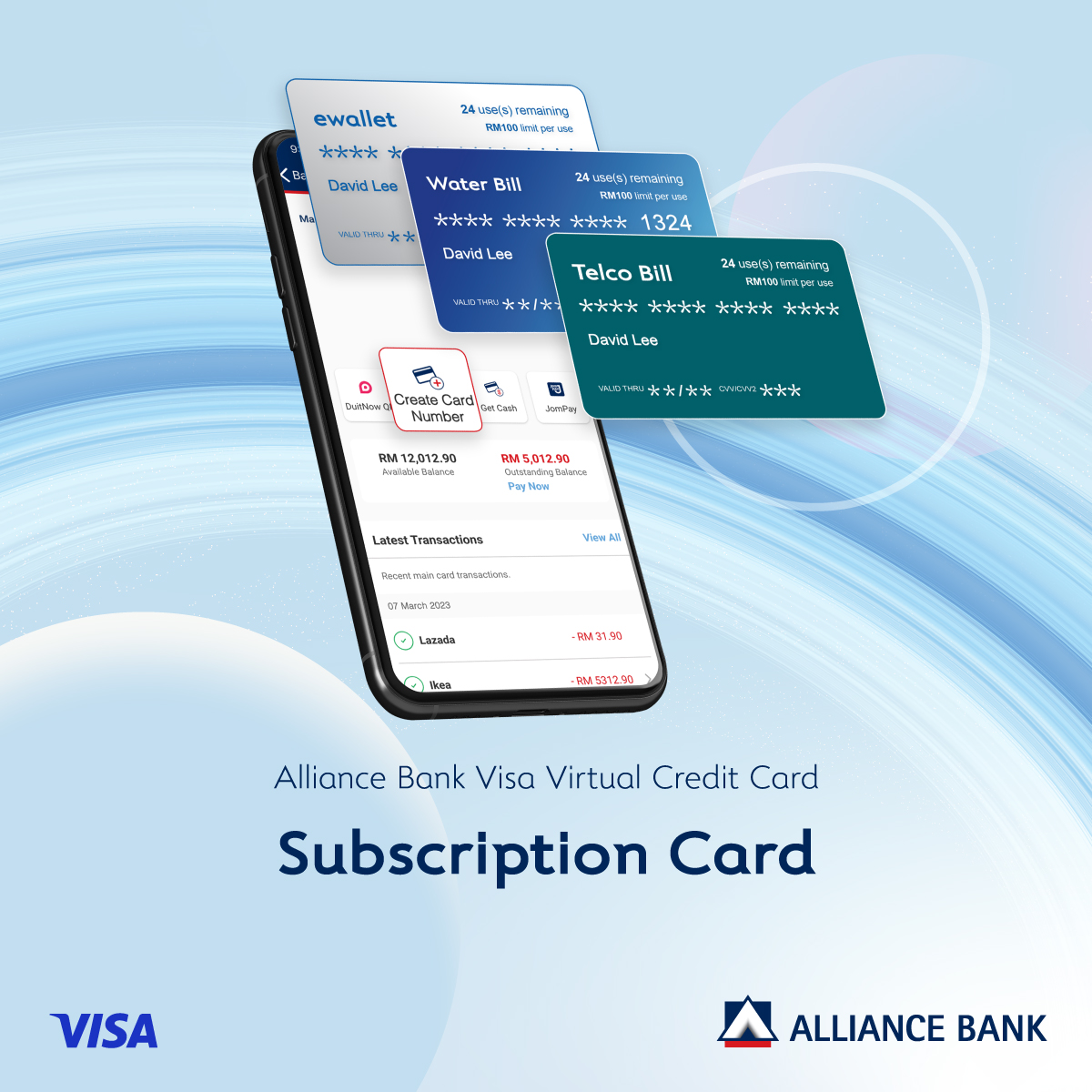

What made the challenge so much easier for Daniel and Fanyi was using Alliance Bank's Visa Virtual Credit Card (VCC)

A VCC helps to manage your payments efficiently and allows contactless payments at merchant checkouts, as well as online payments. VCC is similar to a physical credit card, but exists only in a virtual form. But of course, VCC can do so much more than your normal credit card.

Here's a look at the unique features of VCC:

1. One-Time Card Number

You can generate a 16-digit card number and it will automatically be cancelled after the usage of that number. Or, it will only stay on for a maximum of 30 minutes before it expires.

2. Subscription or Recurring Payments

You can also have complete control of your spending by customising the card's spending limit and expiry date.

3. Freeze/ Unfreeze Your Card

You can freeze the card immediately without the hassle of calling customer service if you notice any irregular transactions

4. Customise Your Card

You can choose the preferred brand, logo, or even colour for the card's design.

Another great thing about the VCC is that there are no additional SST charges when you create an additional Dynamic Card Number. RM25 Sales and Service Tax (SST) is only charged annually.

Interested to apply for an Alliance Bank VCC? Here are the steps:

STEP 1: Download the allianceonline mobile app

STEP 2: Tap on "Virtual Credit Card" and scan your MyKad

STEP 3: Upload your income documents

STEP 4: You will receive an in-app notification whether your application has been approved or rejected

To be eligible for the VCC, you need to be 21 years old and above, and have a minimum annual income of RM24,000.