This Bank Account Lets You Convert To 12 Currencies & Get Better Foreign Exchange Rates

It can also let you earn up to 3.95% p.a. interest! :O

Introducing Hong Leong Bank's Pay&Save Account/-i, a flagship savings account that comes with higher interest rates and instant conversion to 12 foreign currencies, woah! :O

Firstly, this bank account offers up to 3.95% p.a. interest when you deposit, make online payments, and spend with your debit card. That's even higher than some fixed deposit rates.

Here's the breakdown:

- Earn 2.05% p.a. interest by depositing at least RM2,000 in one sum monthly

- Earn 0.5% p.a. interest by paying at least RM500 online for bills/loans/credit card monthly

- Earn 0.5% p.a. interest by spending a cumulative of RM500 with your debit card monthly

You can easily qualify for this by using the Pay&Save Account/-i for your salary, online payments for monthly commitments, and the debit card for daily purchases.

And if you invest in stocks with HLeBroking, you could earn up to an additional 0.9% p.a. interest!

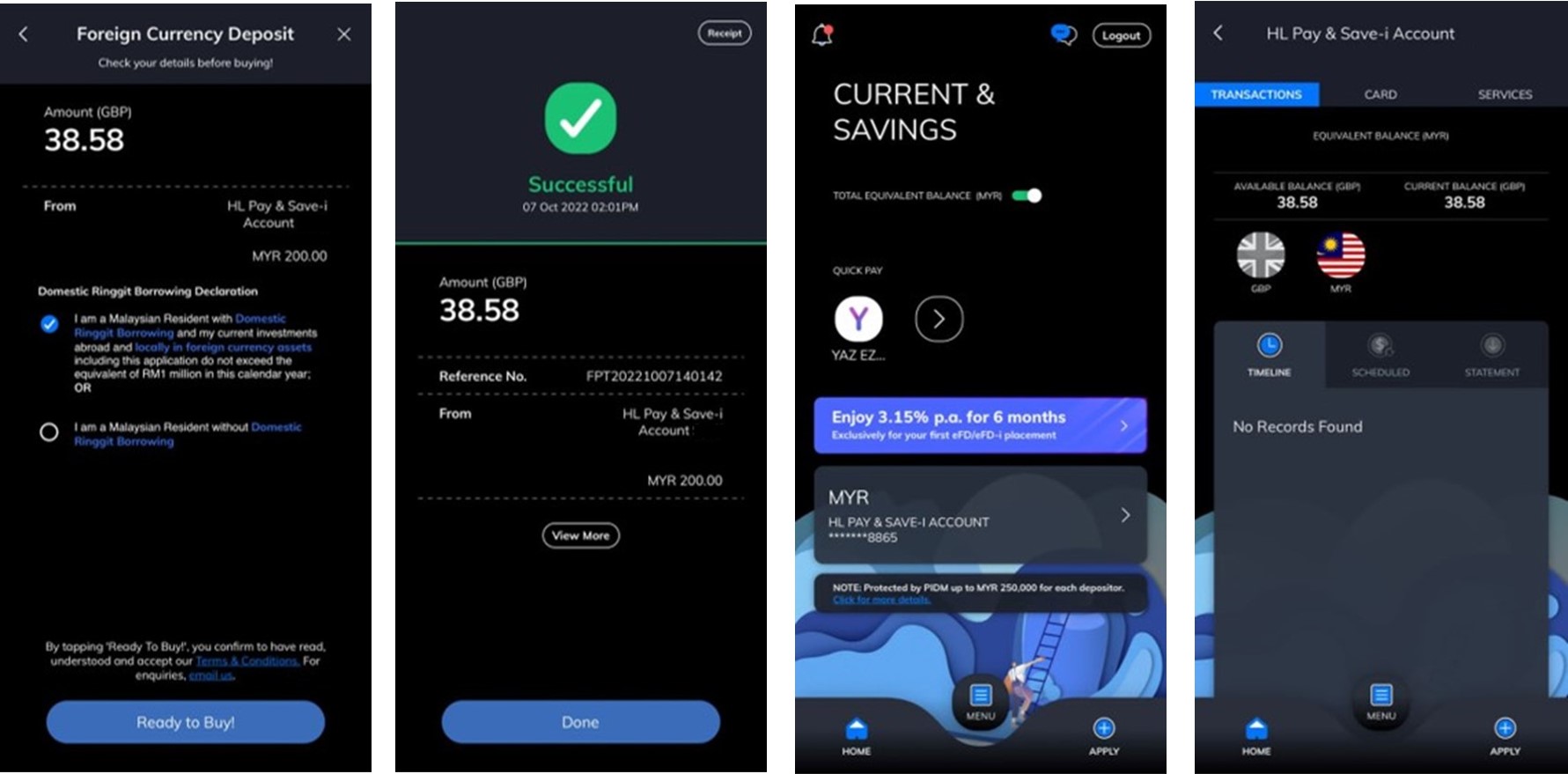

Next, one of the key highlights is the multi-currency feature

Hong Leong Bank's Pay&Save Account/-i is the only Malaysian Ringgit savings account with options to convert to 12 foreign currencies, including:

- Singapore Dollar (SGD)

- Chinese Renminbi (RMB)

- New Zealand Dollar (NZD)

- Thai Baht (THB)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- US Dollar (USD)

- Euro (EUR)

- Australian Dollar (AUD)

- Pound Sterling (GBP)

- Saudi Arabian Riyal (SAR)

- Canadian Dollar (CAD)

You can conveniently convert and keep these currencies within one account via HLB Connect Online banking or HLB Connect App mobile banking. Plus, you'll get to enjoy competitive foreign exchange rates and direct cross conversion from ringgit to your currency of choice, which means you can skip the usual long queues at the money changer, while enjoying potentially better foreign exchange rates.

Just use your debit card when travelling for all your overseas spending, you won't have to worry about carrying too much cash, hidden fee, or high exchange rate fees.

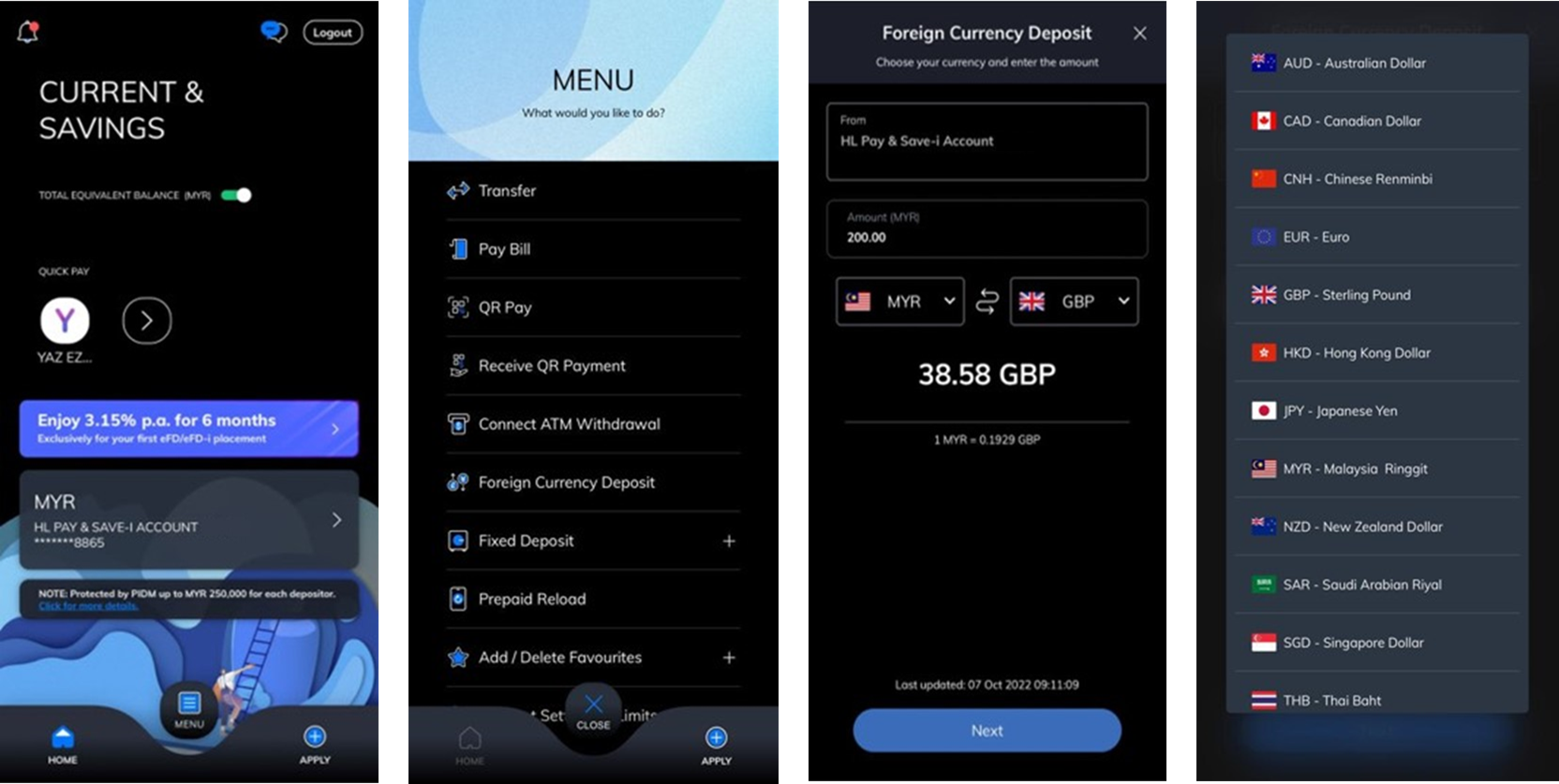

The multi-currency feature works seamlessly via HLB Connect App. Take a look at the step-by-step guide below:

STEP 1: Open your app and click on 'Menu'

STEP 2: Select 'Foreign Currency Deposit'

STEP 3: Select the currency you wish to convert, complete declaration, and confirm rates.

STEP 4: Click 'Ready to Buy!', and you're done!

Once you've bought any currency, you can easily navigate to your Pay&Save Account/-i to have an overall view of all your currencies at a glance. So easy, right?

If you're still not sure whether the Pay&Save Account/-i is for you, here's a practical look at how it could benefit you on a day-to-day basis

For people who love travelling:

The Pay&Save Account/-i allows you to start saving for your upcoming getaways. Not only do you get instant conversion and competitive rates, you can say goodbye to long queues at the money changer. If you're going on a trip with multiple international layovers or stops, you also won't have to worry about carrying around different currencies.

For people with kids or family overseas:

Whether you have kids studying or family staying abroad, you can easily send foreign currency without worrying about the fluctuating currency rates. The Pay&Save Account/-i helps you plan ahead and stay on top of your expenses, especially if you need to make big purchases or recurring payments like school fees.

For people who shop for international brands online:

If you're a serial shopper and you love buying from overseas brands you can't get in Malaysia, the Pay&Save Account/-i is great for you. When checking out your cart online, use your debit card to pay for competitive conversion rates (and earn extra interest for your savings account while you're at it).

For people who invest in foreign currency:

Now, you can easily convert ringgit to 12 foreign currencies when you see your desired rates. All it takes is a few clicks via HLB Connect Online Banking. Also, since you can hold all those currencies within one savings account, it's easier to view your portfolio at a glance.

Last but not least, opening a Pay&Save Account/-i with Hong Leong Bank is super easy, since you can do it online in just minutes

Alternatively, Hong Leong Bank can also come to you to open an account at your doorstep! Just make an appointment on their webpage and their HLB officer will reach out to make an appointment.

Once that's done, all it takes is a couple of minutes, and your debit card will be delivered to your address within 14 working days after your account is opened. It's that simple!

Find out more about the Pay&Save Account/-i today by visiting Hong Leong Bank's website

Terms and conditions apply.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.