Versa Is Offering An Extra 1% P.A. In Returns When You Automate Your Investments

You can qualify for this when you auto debit a minimum of RM200 a month.

Versa, a homegrown digital wealth management app, wants to encourage Malaysians to build better financial habits — one easy way to do so is by automating your savings and investments

Saving or putting money aside for investment every month can be a hassle (and painful to your wallet). Nevertheless, it's an important habit to cultivate if you want to shore up wealth for the long term.

Understanding the struggle Malaysians face, Versa has launched their Money Booster Campaign, designed to reward users for building better financial habits by automating their savings and investments.

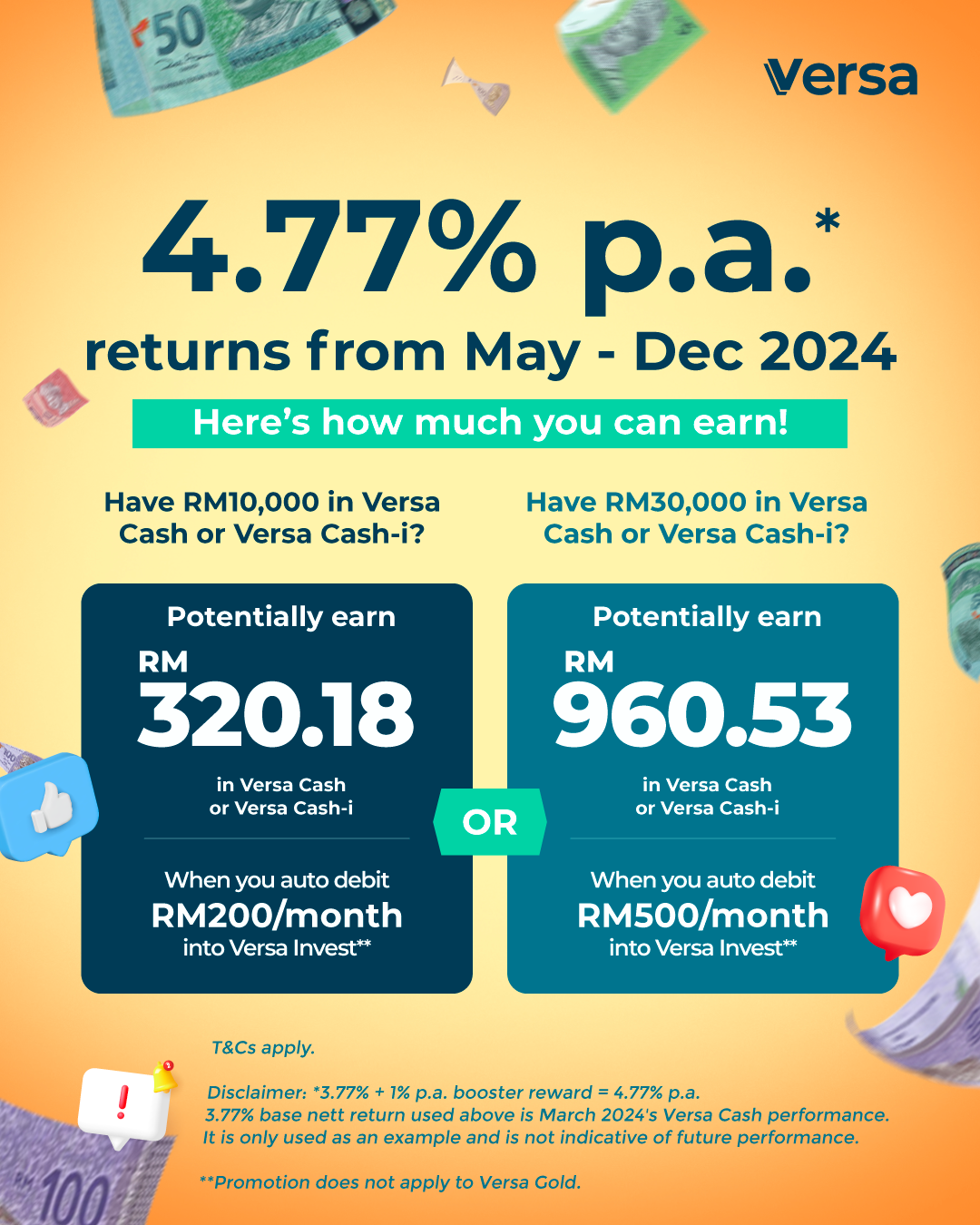

Starting from 1 May to 31 December, you can enjoy an additional 1% p.a. nett return in Versa Cash or Versa Cash-i, on top of your monthly base nett return rate

All you have to do to qualify for the Money Booster Campaign is by setting up an auto debit plan for any Versa Invest funds (except Versa Gold) with a minimum investment amount.

Here's how it works:

STEP 1:

Create a Versa account and make a cash in of RM1,000 into Versa Cash or Versa Cash-i.

STEP 2:

Option 1: Set up an auto debit plan of a minimum of RM200 per month into any Versa Invest fund (except for Versa Gold) to enjoy +1% for the first RM10,000 available balance in Versa Cash or Versa Cash-i

Option 2: Set up an auto debit plan of a minimum of RM500 per month into any Versa Invest fund (except for Versa Gold) to enjoy +1% for the first RM30,000 available balance in Versa Cash or Versa Cash-i

And that's all! You won't have to do anything else, as Versa will automatically apply these rate adjustments to your investments.

These are the eligible Versa Invest funds that are eligible for the +1% p.a. nett booster rate with an auto debit plan:

- Versa Global-i- Versa SGD

- Versa Growth

- Versa Growth-i

- Versa Moderate

- Versa Moderate-i

- Versa REITs

Versa has even helped you to do the math, so you can estimate how much your investments could potentially grow by the end of the year!

With the bonus 1% p.a. nett return, you could enjoy an estimated 4.77% p.a.* in returns in your Versa Cash .

What this means is you could potentially earn RM320.18* in returns (by investing RM200 per month) or RM960.53* in returns (by investing RM500 per month) from May to December 2024.

Both Versa Cash and Versa Cash-i are low-risk savings funds that are strategically allocated to provide you with competitive returns on par with fixed deposits, with the freedom to cash out anytime. They are under the expert management of AHAM Asset Management Berhad, one of Malaysia's top three fund houses.

Disclaimer: 3.77% + 1% p.a. booster reward = 4.77 p.a. The 3.77% base nett return used above is March 2024's Versa Cash performance. It is only used as an example and is not indicative of future performance.

What's cool about Versa is that you'll be able to track your funds and savings performance all within the app, and you won't have to worry about hidden charges

Versa strives to simplify saving and investing by offering intuitive features like a minimalist app interface, goal tracker, and educational resources. There are also over 16 diverse funds in three verticals that you can choose from based on your risk level.

Plus, with auto debit, you'll be able to automate your monthly savings and investments, freeing up your time and mind space for other things. The best part is that you'll still be able to enjoy zero sales fees and the flexibility to switch between funds whenever you want to.

"We recognise that many Malaysians face the emotional weight of financial challenges, and Versa aims to alleviate some of that anxiety and burden.

"The beauty of our auto debit is that it automates our users' monthly savings and investments, [fostering] financial peace of mind and confidence in Malaysians to manage their finances effortlessly and stress-free," said Teoh Wei-Xiang, CEO and co-founder of Versa.

P.S. Versa is offering a special sign-up promo for SAYS readers! Use the code VSAYS to receive a RM10 bonus when you create an account and cash in a minimum of RM100 into any funds in Versa.

Ready to automate your savings and investments, and get rewarded while you're at it? Download the Versa app on Google Play, the App Store, or HUAWEI AppGallery today.