What Is Co-Payment For Medical Insurance & Takaful? We Answer 5 Commonly Asked Questions

All medical insurance and takaful plans in Malaysia now offer a co-payment option.

Bank Negara Malaysia recently announced the implementation of co-payment requirements for medical and health insurance/takaful (MHIT) products, starting September 2024

From 1 September onwards, all insurance and takaful operators (ITOs) are required to offer a co-payment option for all new and existing coverage plans. This will give policyholders the flexibility to choose between more alternatives.

But first, what is co-payment all about?

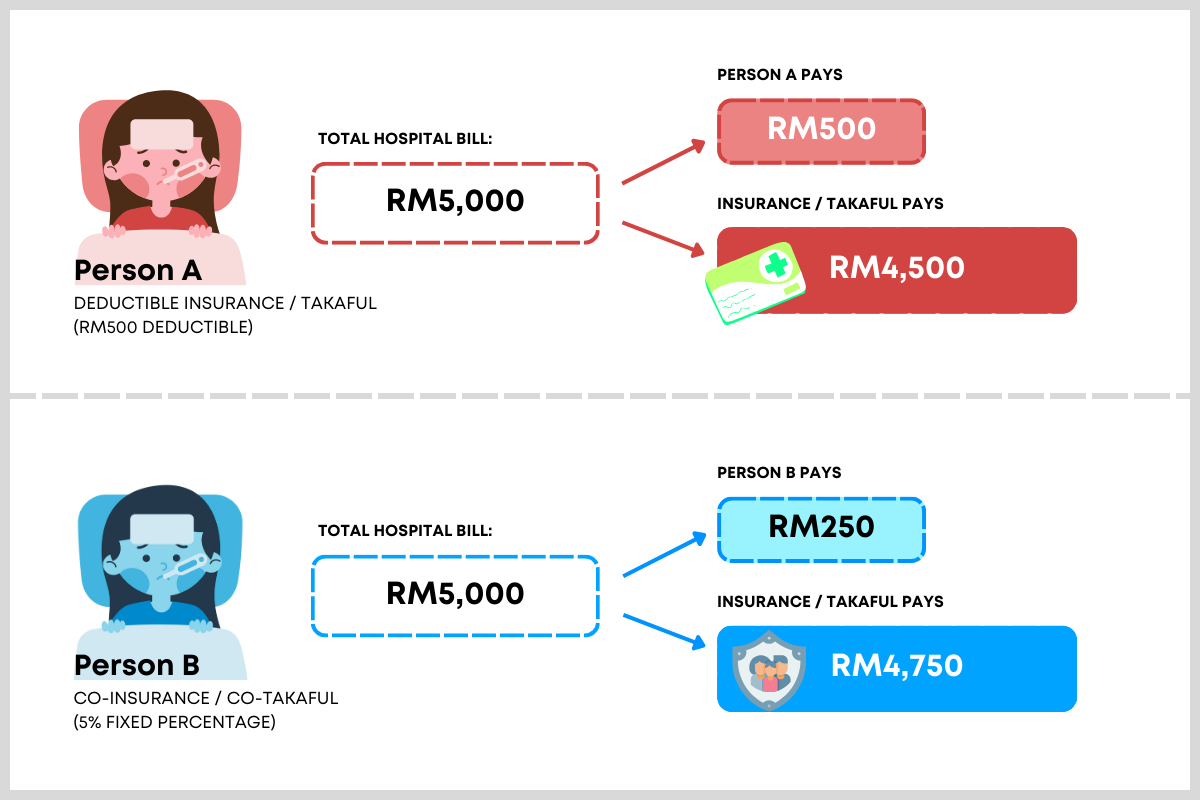

Co-payment is an amount that insured individuals must pay out-of-pocket for medical services, treatments, or medications, on top of monthly premiums. There are two kinds of co-payment MHIT products — deductibles and co-insurance/co-takaful.

Deductibles: You'll have to pay a fixed amount (depending on your coverage plan), before the rest of the medical bill is covered. For instance, if your deductible amount is RM500 and the total treatment cost is RM5,000, you'll pay RM500 while your ITO covers the rest.

Co-Insurance/Co-Takaful: You'll have to pay a fixed percentage of the medical treatment bill, which is agreed upon beforehand. For instance, if the fixed percentage is 5% and the bill is RM5,000, you'll need to pay RM250, while your ITO covers the rest.

One of the main benefits of MHIT products with a co-payment feature is that they tend to be more affordable upfront, with lower monthly premiums — this incentivises more Malaysians to get covered. Another key benefit is that Malaysians will now have a variety of coverage plans, which allows you to opt for an insurance or takaful that suits your financial and health needs.

1. Can I buy an MHIT product without co-payment feature?

Yes, you can. In fact, the choice is completely up to you!

ITOs are required to offer consumers an option to buy MHIT products either with or without the co-payment feature. This applies both at the point of sale and during policy renewal.

If you already have an MHIT product without a co-payment feature, you are not required to switch. Your existing product will remain unaffected by this policy change, and you may continue to enjoy the benefits of your current plan.

However, if you are looking at a lower premium option, you can always approach your insurance or takaful operators for a plan that suits your financial and health needs.

2. Will co-payment MHIT products be cheaper or more expensive?

Co-payment insurance and takaful products are generally more affordable, making it easier for consumers to access essential medical coverage. With different levels of co-payment available, these products are designed to suit a range of financial needs, while including safeguards to protect consumers' interests.

Furthermore, there are certain exemptions to the co-payment feature, ensuring consumers aren't overburdened in critical situations, such as:

- Emergency treatment, including accidents

- Outpatient treatment for follow-up care related to critical illnesses, such as cancer or kidney dialysis

- Treatment received at government healthcare facilities

ITOs will bear the cost of medical treatment in these scenarios, up to the amount agreed upon in the policy — there is no need for consumers to co-pay.

3. Why is the co-payment feature being introduced?

While the co-payment feature is not entirely new, the introduction of it for all MHIT products is aimed at addressing the challenge of rising medical costs.

Malaysia has consistently experienced a medical cost inflation rate higher than the global average. As medical expenses soar, this initiative offers a way to balance the affordability and sustainability of MHIT products.

It is part of a broader strategy to manage medical inflation, while also ensuring that insurance and takaful companies can continue providing adequate coverage for Malaysians.

4. What if I cannot afford to pay the deductible or fixed percentage?

ITOs are required to offer a range of co-payment levels to accommodate the varying financial needs of consumers. Co-payments are also capped at a maximum limit set by ITOs. This arrangement provides flexibility for ITOs to design and offer a wider range of MHIT products to cater to consumers with varying financial situations and needs.

More importantly, your ITO is required to inform you of the maximum cap when you purchase a policy. If it is beyond your budget, you can shop around for a product that best meets your health and financial needs. Or, talk to your ITO to discuss other options.

There are also certain exemptions where co-payment shall not apply — such as during emergency treatments, follow-ups for critical illnesses and treatment at government hospitals.

5. What is the minimum amount I'll have to co-pay?

The minimum co-payment amount is typically set at a fixed percentage at 5% of claimable expenses or a RM500 deductible, depending on the specific product you choose. However, this is subject to a co-payment cap determined by your ITO.

ITOs are required to inform you regarding these co-payment details at the time of purchase. And if the co-payment structure doesn't align with your financial capacity, you have the option to explore other products or discuss alternative solutions.