'Ah Longs' Are Now Using Mobile Apps To Prey On Younger M'sians

These applications were developed to specifically target millennials and Gen-Zs.

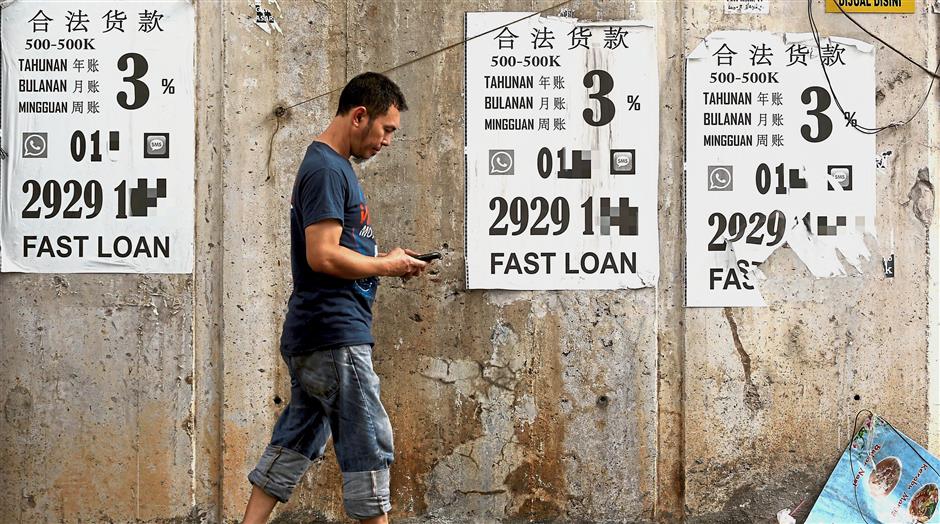

Remember those flyers we used to see on the walls of Kuala Lumpur buildings offering to help people in need of financial aid?

Well, as technology advances and humans discover new ways to consume content, 'Ah Longs' (loan sharks) have also discovered new ways to fish for younger Malaysians.

These loan sharks have abandoned traditional methods of advertising, such as passing or pasting flyers and posters, in favour of developing mobile applications aimed at attracting millennials and Gen-Zs, reported Kosmo.

Compared to the traditional method, this new technologically advanced method was created for these 'Ah Longs' to be more systematic in trapping their prey

These syndicates also use paid advertising on social media platforms like YouTube and Facebook to reach a wider audience and strengthen their ability to attract and retain customers who are interested in applying for loans.

Zharif Johor, the working secretary of the Islamic Consumers Association of Malaysia (PPIM), said that over the past two years, an estimated 49 illegal money loan applications had been developed.

According to Zharif, these Ah Longs are also using WhatsApp to spread scams in the hopes that gullible people will download them and end up borrowing money from shady lenders

"The loan offered is as low as RM300 and the borrower will get RM150 of that amount and will have to repay it within a week or two," he told Kosmo.

He went on to say that the first report of the syndicate was received in November of 2019, but the number of reports grew higher and higher when many people lost their jobs as a result of the Movement Control Order (MCO).

"Advertisements for apps on social media platforms like Facebook and YouTube are beginning to pique users' interest. These advertisements popped out of nowhere as if they could read the user's mind," he added.

However, only Android users are able to download these Ah Longs' applications as they are not available on the Apple Store

Zharif went on to say that initially, these loan sharks would charge interest at 30% of the loan amount, but after blackmailing the victim, the interest rate would skyrocket to as much as 800% for a single day of late payment.

To make matters worse, even as the victim's financial situation worsens due to the compounding interest, they will continue to receive offers via new messaging channels.

"Some victims have borrowed from more than 10 applications, with monthly debts reaching RM20,000, because of this method of operation," said Zharif.

"These loan sharks will also distribute photographs and contact information for close relatives and friends if their borrower is unable to make repayments."