Have You Found Out If Your Home And Car Are Properly Insured From Flood Damages?

Your property and vehicles might have insurance, but it might not be protected from one of the most frequently occuring natural disaster in Malaysia.

Dato' Seri Ahmad Shabery Cheek has proposed for the government to collaborate with insurance companies and create a flood insurance policy to better protect the welfare of the people

Communications and Multimedia Minister Ahmad Shabery Cheek has suggested that the government consider the need of having flood insurance policy for the people to protect their welfare in times of natural disasters.

malaysiakini.comHe said the government could discuss with insurance companies to create insurance policies which would benefit all parties, especially victims of disasters. The minister said the move should be seen at ensuring the effectiveness of national preparedness in facing floods, especially during the monsoon season.

malaysiakini.comAhmad Shabery said to meet the objective, the insurance scheme could be contributed through the 1Malaysia People's Aid (BR1M) next year for the 1Malaysia People's Group Takaful Insurance (i-BR1M) implemented this year. "Deductions of RM50 to RM100 could be deposited for the insurance and in my view would not burden everybody," he said.

malaysiakini.comIn the US, the National Flood Insurance Program allows property owners to purchase insurance protection from the government against losses from flooding

The US National Flood Insurance Program (NFIP) was created by the Congress of the United States in 1968. The programme allows property owners in participating communities to purchase insurance protection from the government against losses from flooding. Through nearly 90 private insurance companies, the NFIP was designed to provide an insurance alternative to meet the escalating costs of repairing damage to buildings and their contents caused by floods.

The NFIP protects two types of insurable property: the building and the contents of the building. Building policies start coverage at $20,000 and go up to $250,000 while content coverage starts at $8,000 and goes up to $100,000.

By April 2010, nearly 5.5 million homes in the United States were protected under the NFIP.

In Malaysia, MSIG reports that while most homeowners insure the building of their property, which covers damage from floods, a 2007 survey shows that only 5% have protection for the contents of their home

Most house owners in Malaysia have basic fire insurance protection for homes or the more comprehensive houseowner insurance protection for the building which covers floods; but stopped short of having protection for home contents which are only covered in householder insurance plans.

msig.com.my"Based on our own portfolio, less than five per cent of homes have householder insurance for protection against the loss or damage of their household products and personal belongings" said Mitsui Sumitomo Insurance (Malaysia) Bhd (MSIG) Chief Executive Officer, Mr Song Yam Lim.

msig.com.myFlood damage protection comes with most Houseowner and Householder Insurance. It is important to note that these are two separate policies that protect different parts of your home.

Most homeowner's insurance in Malaysia do have flood damage protection, however it is important to note that there are big differences between a Houseowner and Householder Policy as they protect different things.

Houseowner Policy provides coverage for the structure of the building and not the contents of your home. The damage can be caused by anything from floods to a vehicular accident.

Householder Policy protects only the contents of your home, such as your furniture or important documents. Most good householder policies include damages caused by flood.

According to the General Insurance Association of Malaysia (PIAM), flood coverage does not include loss or damage caused by subsidence or landslip

A Basic Fire Insurance is not sufficient as it provides basic coverage for the building and cover damage by fire, lightning and explosion only

It is important to check if your property is covered by the Houseowner or the Householder Insurance to know how well are your assets protected should disaster strike

It is important to note that the protection for the building structure and the contents of your home are two separate policies. Be sure to check which policy you have. The General Insurance Association of Malaysia recommends buying both the Houseowner and Householder Policies for comprehensive cover for your property and its contents. Some insurance companies provide a combined coverage of both Homeowner and Householder Policy, which is sometimes called the Home Insurance Policy. The premium of this combined policy would be higher.

If you own a vehicle, you definitely have motor insurance, but is it enough to protect your vehicle after being damaged by floodwater?

Basic car insurance policy does not cover flood as it is listed as 'Special Perils', an additional protection against unexpected natural disasters

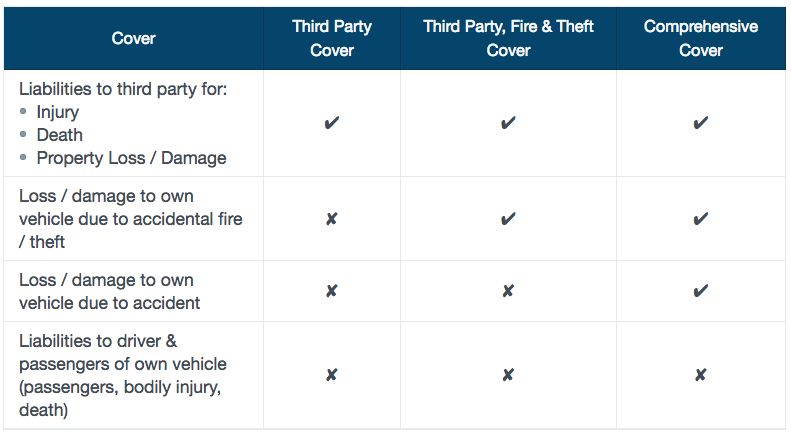

In Malaysia, motor insurance is compulsory before road tax can be purchased. There are three categories of insurance parties including Third Party, Third Party with Fire & Theft, and Comprehensive coverage. However, as the table from iMoney below depicts, car insurance policies only provide coverage for damage or loss to the vehicle due to accidental fire, theft or accident. Flooding is considered as a natural disaster and thus is not covered under the basic policy.

Disasters that are listed under Special Perils include landslides, earthquakes, tsunamis and storms. According to Insurance Info, damage or loss caused by floods include:

- damage to a vehicle submerged in flood

- loss of vehicle due to drift during floods

- fire and explosion due to flood water entering the vehicle

Flood protection is an optional coverage and can be purchased with an additional premium of 0.5% of the sum insured

This additional protection will cost vehicle owners an additional premium of 0.5% of the sum insured. For example, if the sum insured is RM50,000, vehicle owners will be charged an additional premium of RM250. For a private car with a RM100,000 sum covered, that works out to an additional premium of RM500.

insuranceinfo.com.myAccording to a 2012 figure released by General Insurance Association of Malaysia (PIAM), only 0.4% of motor insurance policyholders bought Special Peril cover benefit

“At present, many don’t take flood cover as they deem it too expensive."

The Malaysian Reserve debated on whether insurance and takaful operaters should provide flood damage cover as a standard coverage in motor policies

THEY SHOULD: Some industry executives have suggested that insurers and takaful operators provide automatic motor insurance coverage for flood damage for an across-the-board increase in premiums. With more and more flood incidents, some quarters argue that a push to get all vehicles owners to get automatic flood cover, with a marginal increase in premiums, may be the way to go. If we have a smaller across-the-board increase in premiums, insurers can provide flood damage cover as standard cover in their motor policies for all motor vehicle owners,” said one industry executive.

THEY SHOULD NOT: Bank Negara Malaysia (BNM), which supervises the insurance and takaful industries, is not in favour of such a move. In a written reply, BNM said mandating the purchase of flood cover would necessitate an increase in motor premiums for all motorists so as to reflect the additional risk undertaken by insurers. “However, not all vehicle owners in Malaysia may want to purchase the cover especially if they feel that they are not exposed to the risk of flood.”

On the other hand, RinggitPlus opines that flood coverage should no longer be considered in the same category as typhoons, earthquakes and volcanic eruptions as it happens so often in Malaysia. It is time for car insurers to catch up with home insurance policies, the writer said.

It seems like 'comprehensive' really isn't so comprehensive if we have to pay for so much additional coverage for common losses such as flood and windshield damage. Home insurance policies were tweaked to include floods considering how prone the country is to experiencing it, so why haven't car insurers caught up?

Flood was included as a peril alongside typhoons, earthquakes and volcanic eruptions. Whilst I understand why those three would be excluded (like seriously, where are we to even find a volcano in Malaysia to erupt over our cars?); flood coverage shouldn't be considered in the same category considering how often it happens even in the middle of a city carpark!

In lieu of flash floods occurring in non-flood prone areas, the PIAM strongly advises customers make informed decisions and look into buying flood cover to protect their property

PIAM believes that not all consumers are fully aware of the availability of insurance policies to cover their home investments from flood and certain perils. Where houseowners’ insurance on the building is concerned, the tendency in the majority of cases is to leave these insurance arrangements to the financial institutions which provide financing or loans to the owners. This seems to be a very common feature of home ownership and, unfortunately, does not involve the homeowner actually having to obtain a higher level of information about the insurance product itself.

PIAM would strongly advise consumers to make a very informed decision on buying flood cover to protect your property and contents therein, irrespective of whether one lives in a flood prone area or not. This is in view of the frequent flash floods that have occurred in areas we may not have envisaged it would have happened, and if it happens, it may be a bit too late as your property or the contents therein may have been damaged by the flash flood. The rate charged for flood cover is tariffed, that is, it is a standard rate charged irrespective of the area you live in and can be purchased at any time of the year.