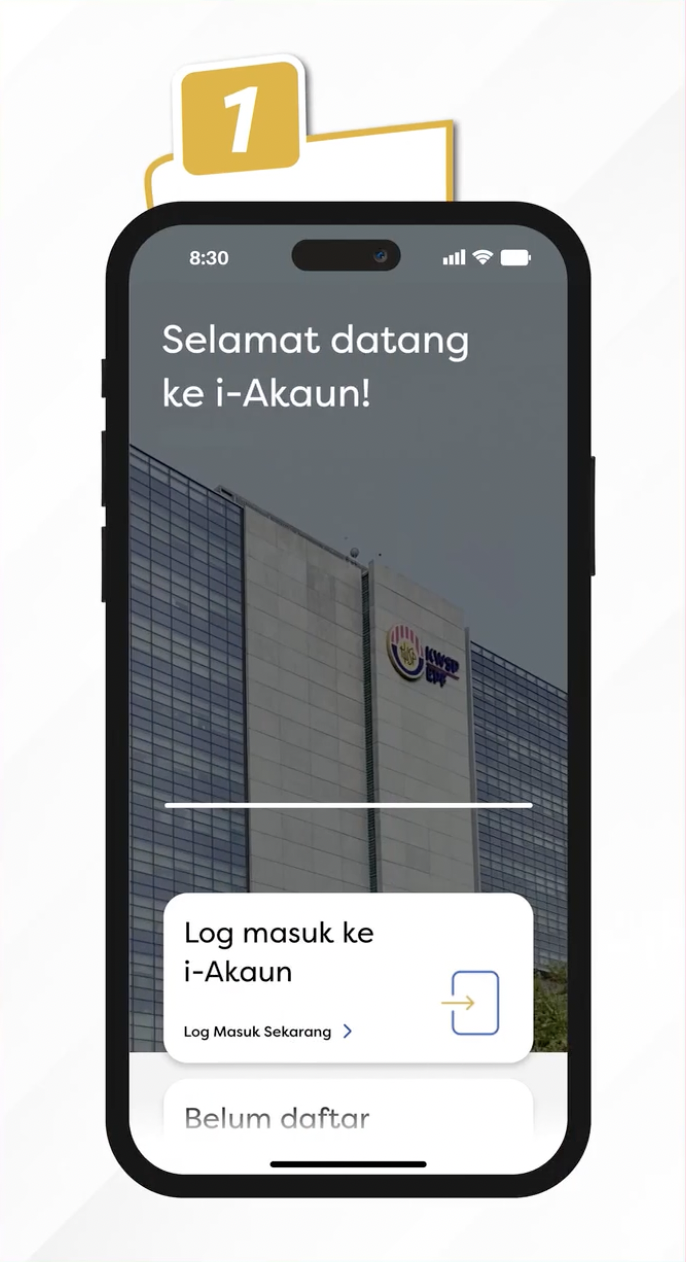

Follow This Simple Guide To Transfer Your EPF Savings From Account 2 To Account 3

Easy peasy lemon squeezy.

The Employees Provident Fund's (EPF) Account 3 is now live, and anyone below the age of 55 will see their funds restructured

Before you ask, no, you cannot opt out!

According to the official announcement, the restructuring applies to all EPF members, including non-Malaysians under 55 as of 11 May 2024, when the initiative kicked off.

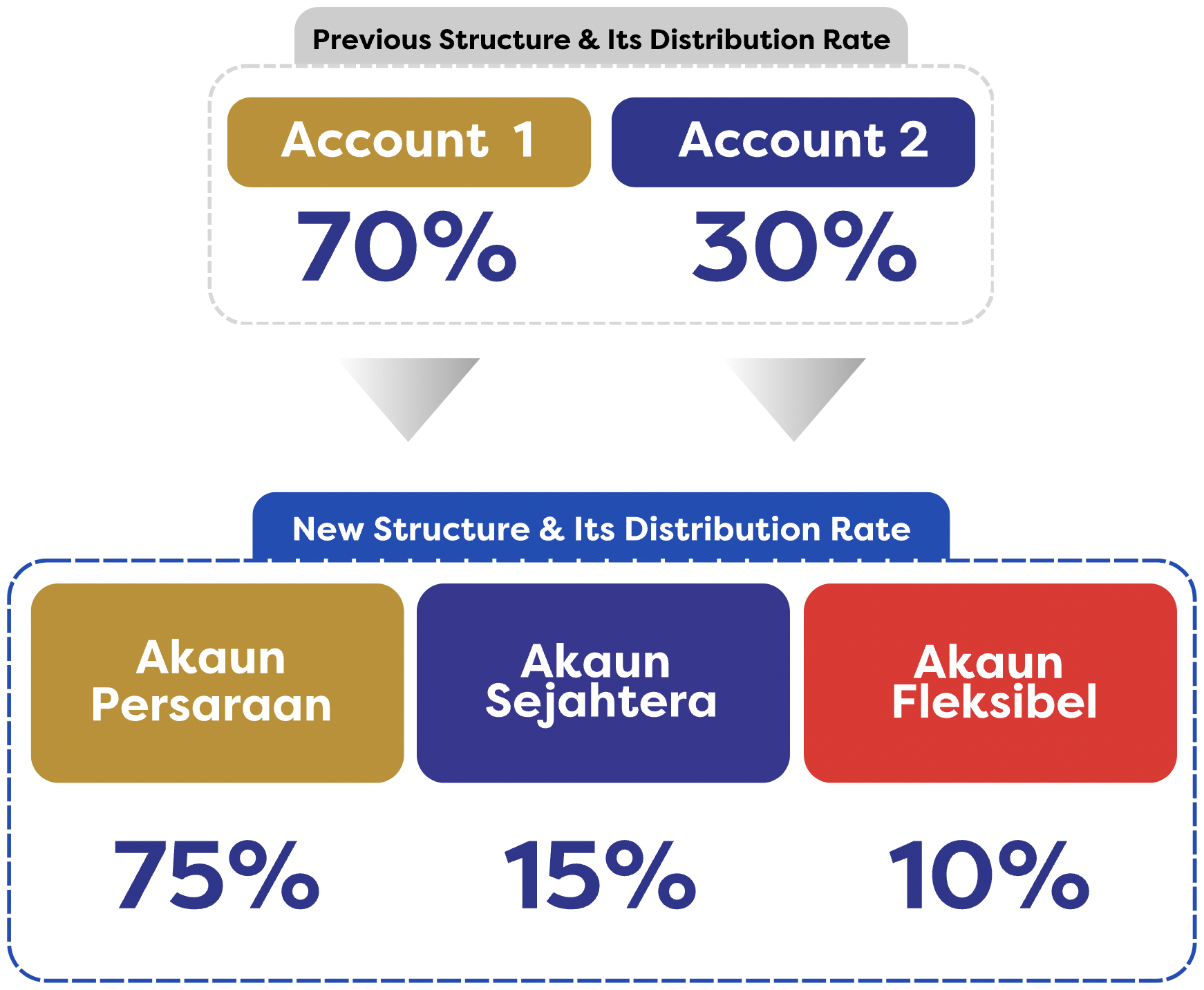

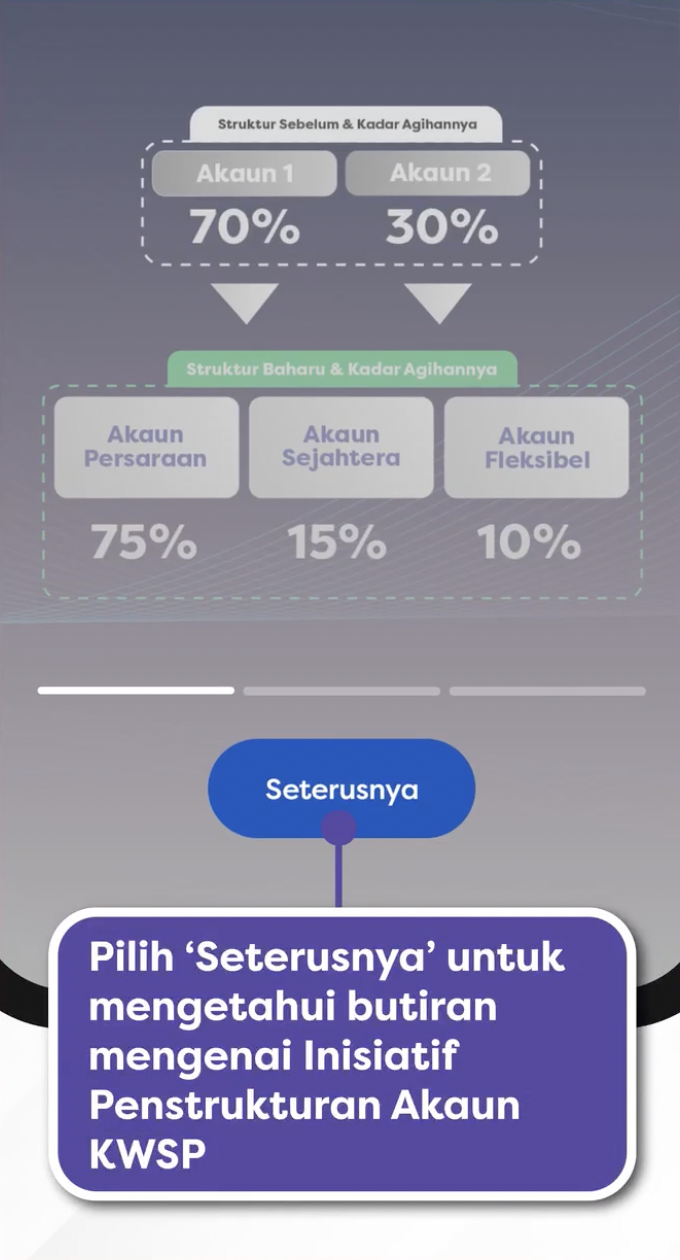

To recap, EPF's account restructuring initiative has divided its members' existing two accounts into three accounts. As announced by EPF, these three accounts are:

- Akaun Persaraan: Replaces Account 1, designated for retirement savings

- Akaun Sejahtera: Replaces Account 2, tailored for life cycle needs

- Akaun Fleksibel: Allows withdrawals for short-term needs

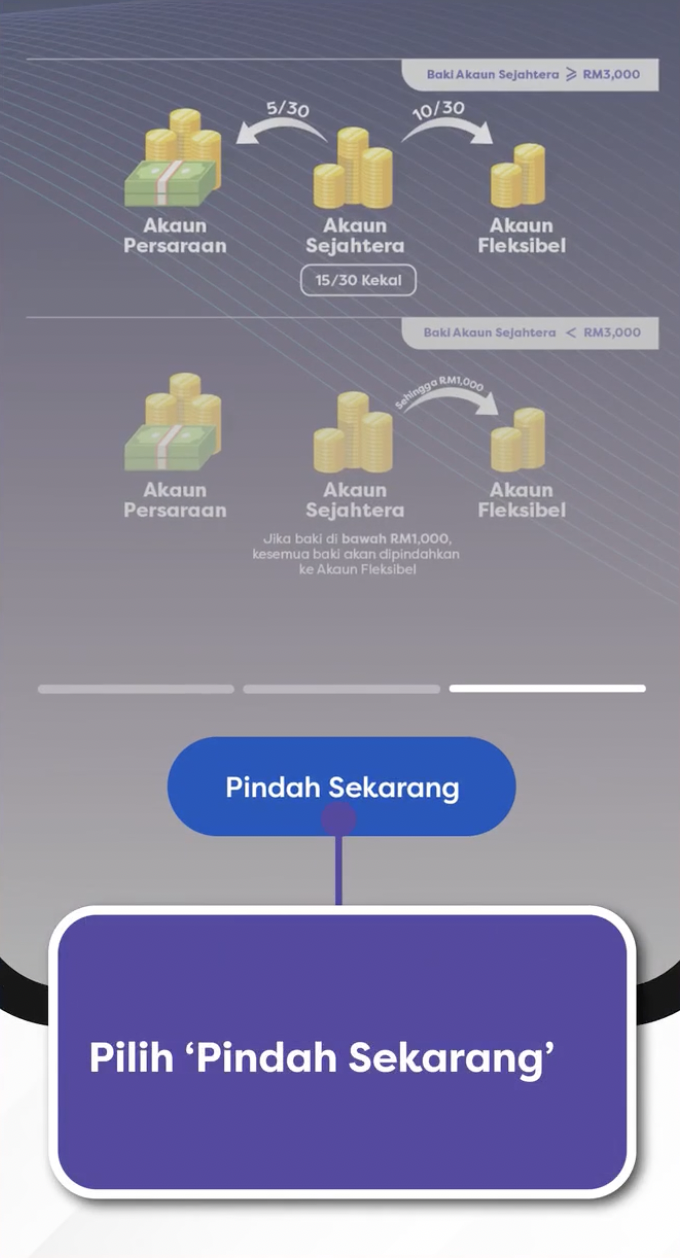

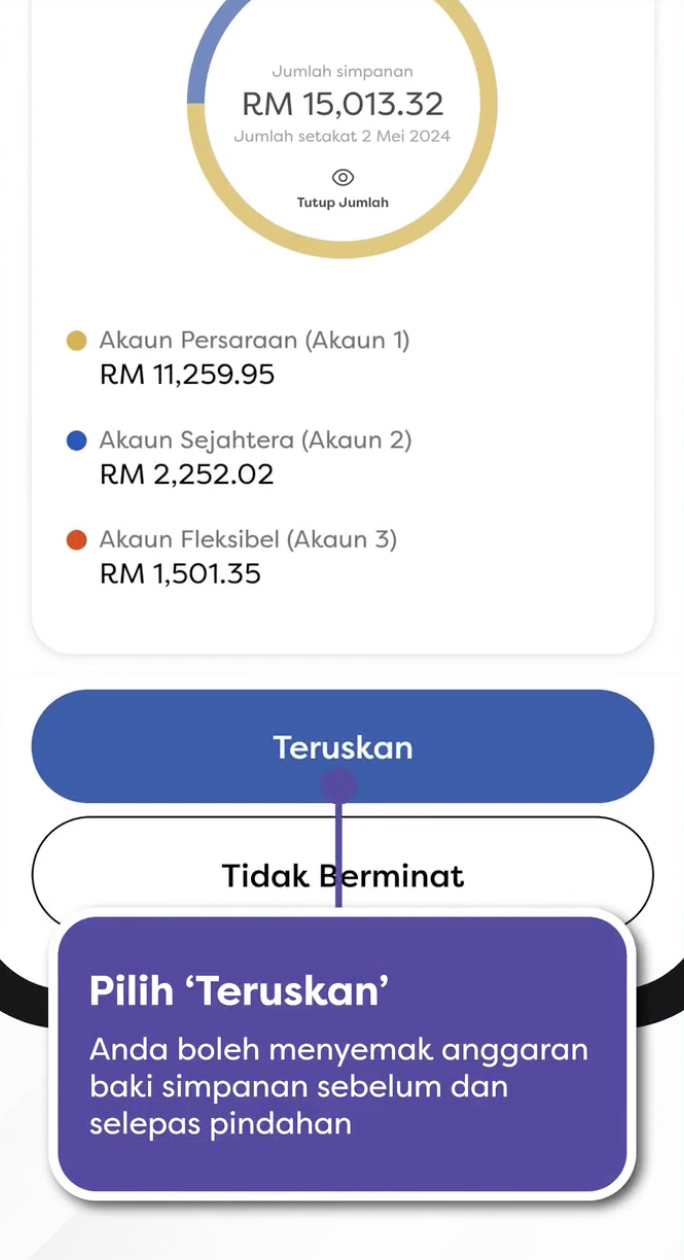

While existing balances will remain in Akaun Persaraan and Sejahtera, new contributions will be divided, with 75% going to Persaraan, 15% to Sejahtera, and 10% to Account 3 (Fleksibel).

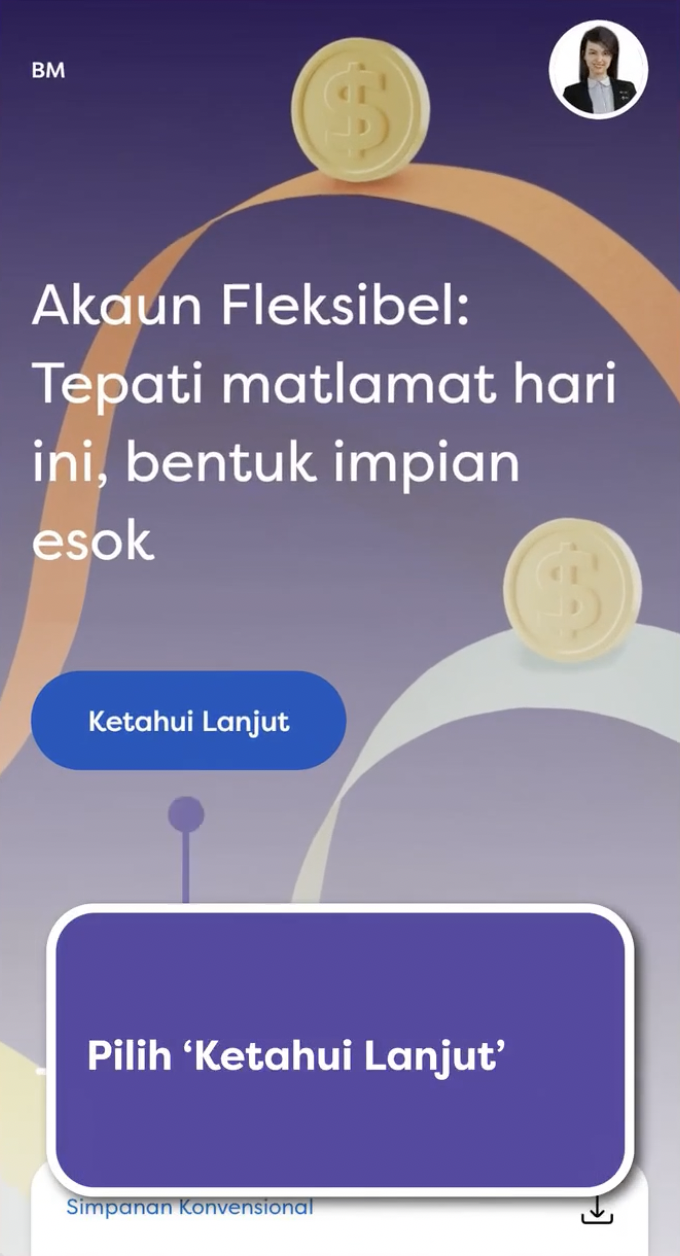

EPF members have the option to transfer a portion of their Akaun Sejahtera balance to the new Account 3 (Fleksibel) from 12 May to 31 August. It's a one-time option; if not utilised, the funds will remain in Sejahtera.

How can you opt for the one-time option when transferring an initial amount?

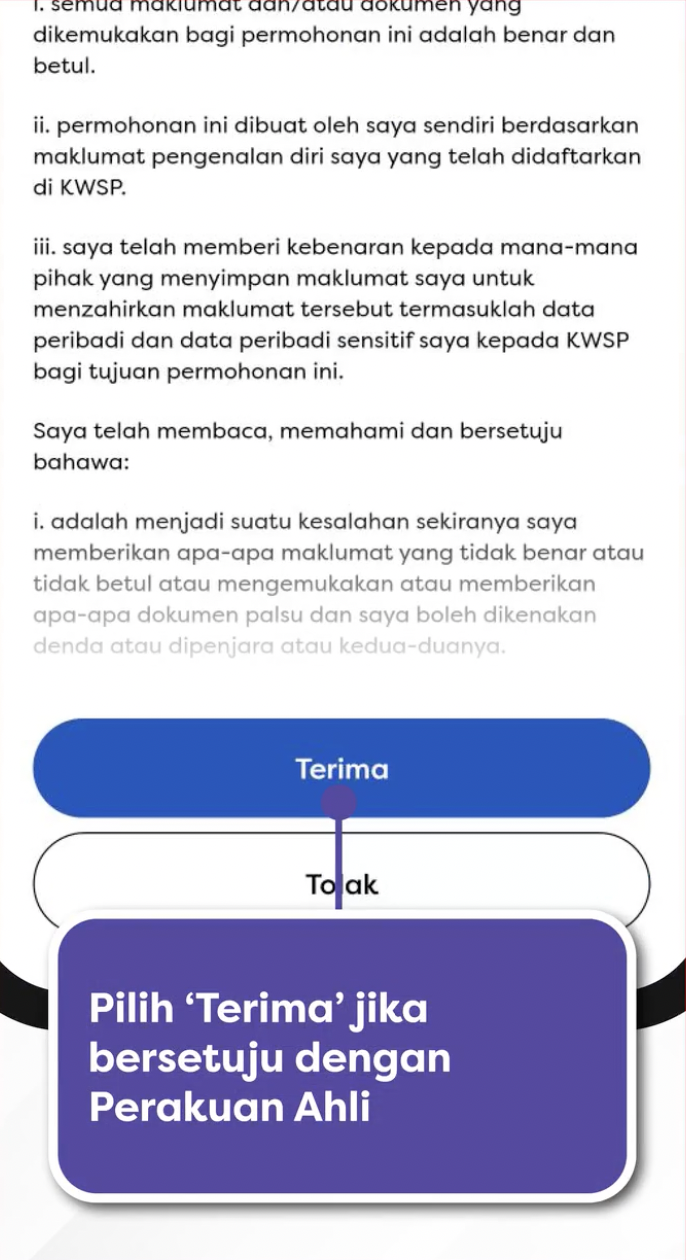

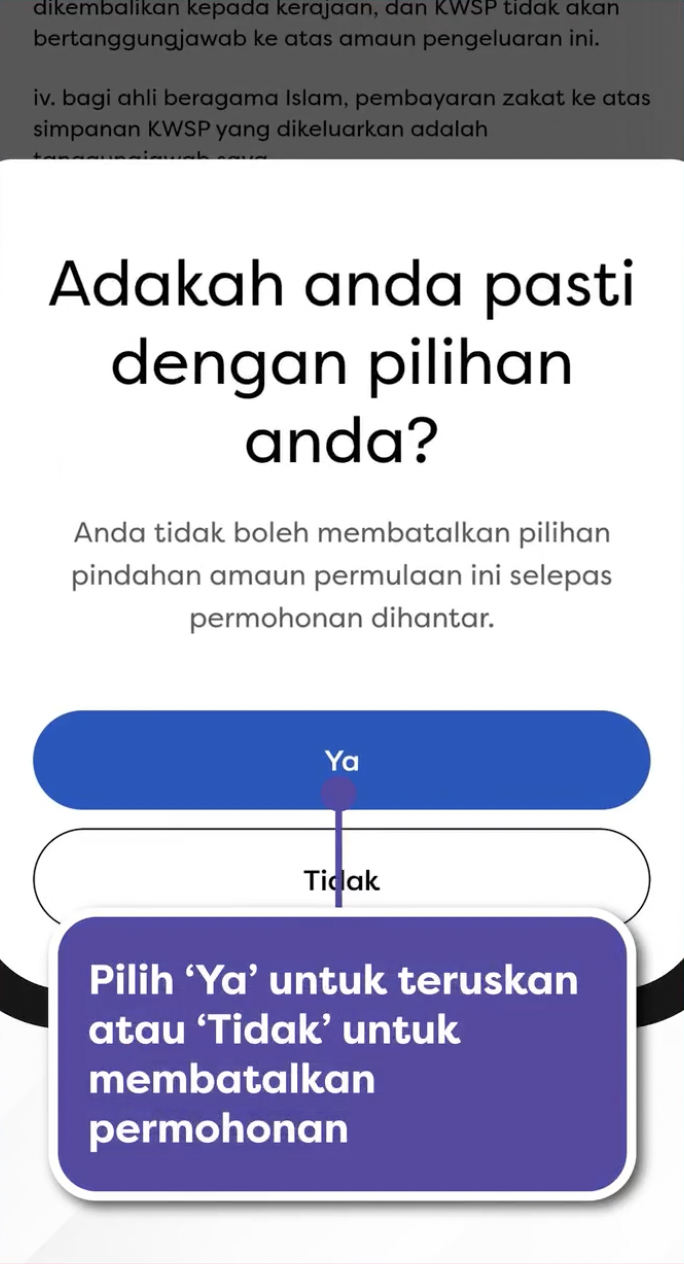

Just a reminder before proceeding; this initial transfer can only be made once and it cannot be cancelled. However, there's no rush to do it right now, as you have until 31 August 2024 to make the transfer.

Below are the steps to guide you through making the initial transfer:

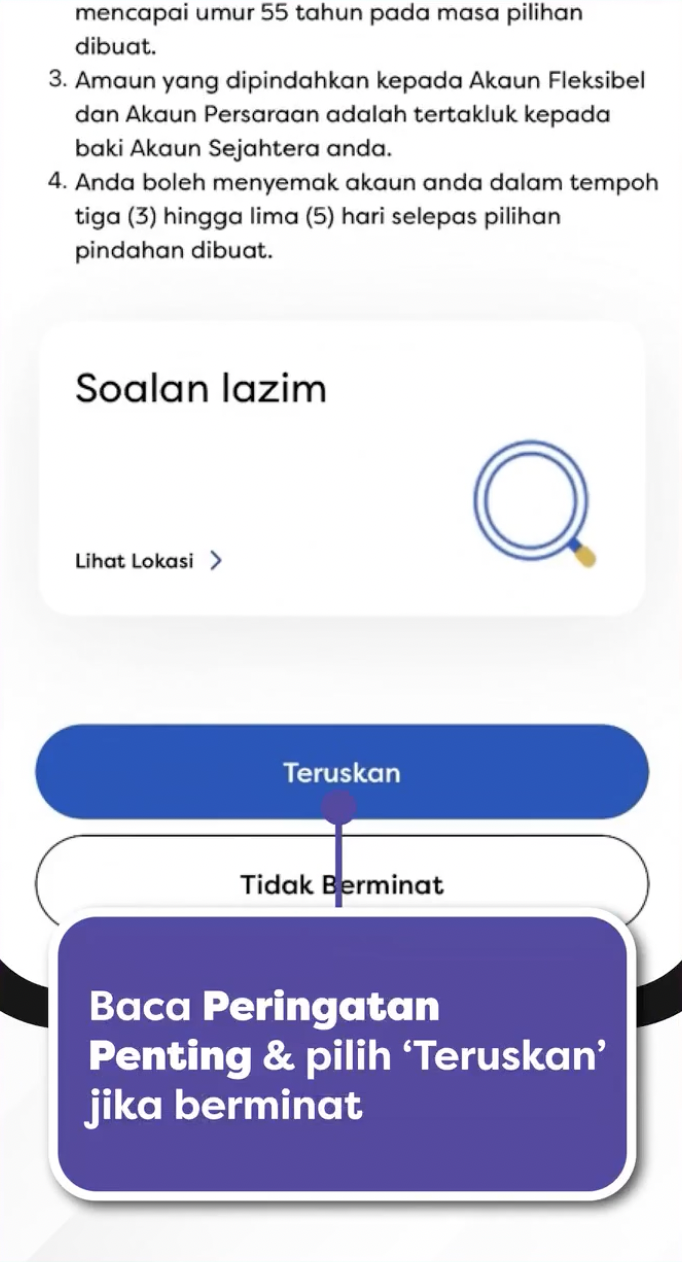

Step 5

Read the 'Important Reminder' (Peringatan Penting), then select 'Proceed' (Teruskan) if you are interested.

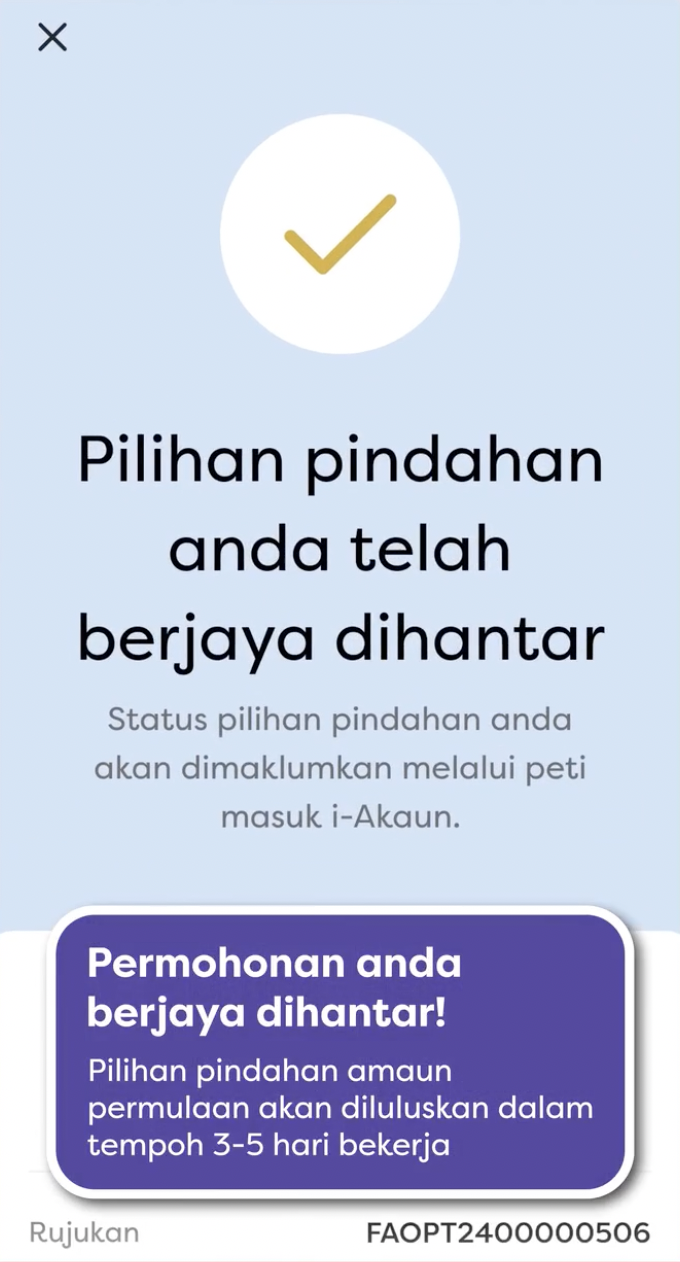

Your initial amount transfer request will take three to five working days to be approved before it shows up on your Account 3 (Fleksibel)

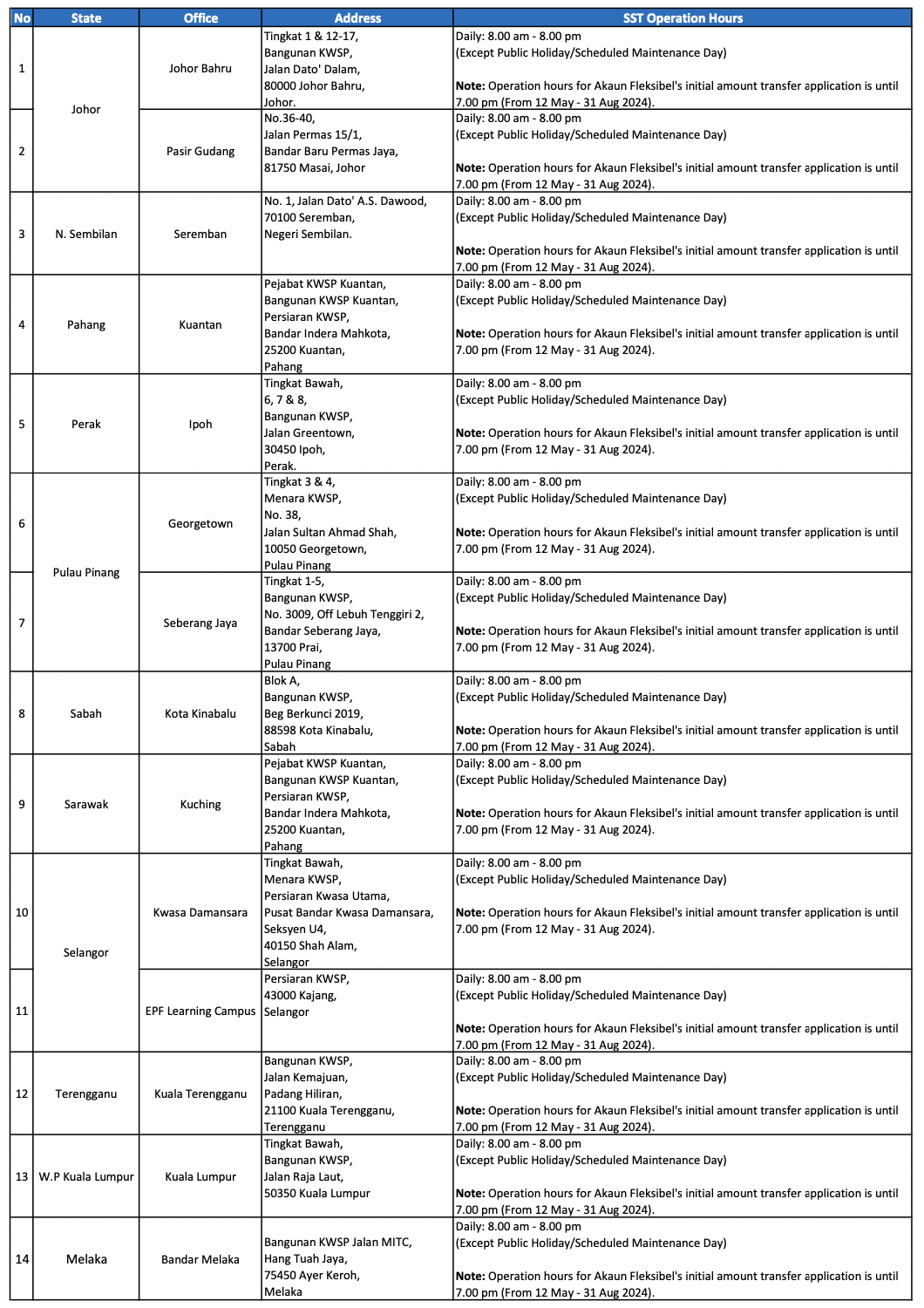

You can also use the self-service terminal at any EPF office

Below is detailed information regarding the self-service terminals operating outside of office hours.

Note: This is for initial amount transfer purposes only.