Malaysian Loses RM30,000 Within 5 Minutes After Scammers Pull Off Complex Bank Fraud

The impostors knew about his car loans as well as a police report he lodged five years ago when he was robbed.

In a viral post, a Facebook user named Jacqueson Cheok recently detailed his entire ordeal of dealing with bank fraud

In the Facebook post, Cheok allegedly received a call from scammers masquerading as AmBank agents asking if he had made a payment on Lazada. He denied, saying that he had not registered a card with them.

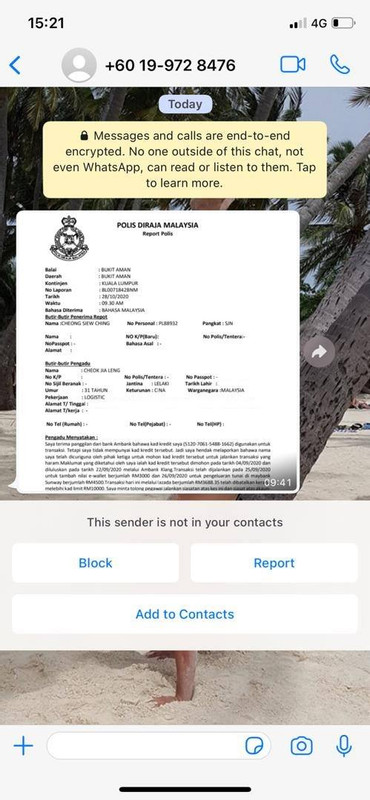

After confirming Cheok's personal information, the scammers told him that his 'card' was cancelled and sent him a fake police report through WhatsApp.

The line was then transferred to 'representatives' of Bank Negara Malaysia who confirmed Cheok's personal details again

He was told that there was an identity fraud and the 'case' will be filed to a high court.

The line was transferred again to another person posing as an Inspector who took his case.

Much to Cheok's surprise, the impostors knew about his car loans as well as a police report he lodged five years ago when he was robbed.

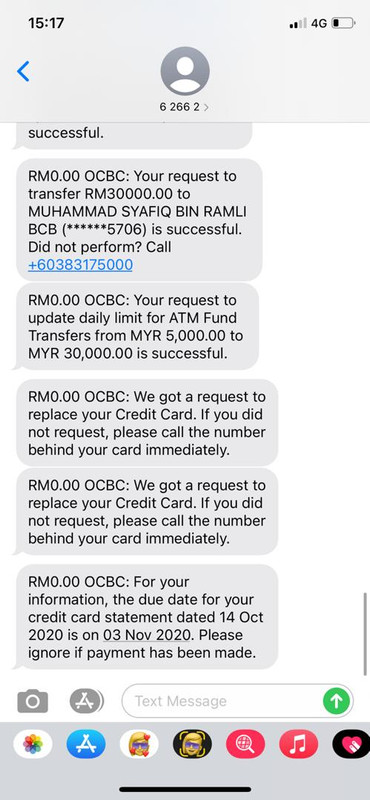

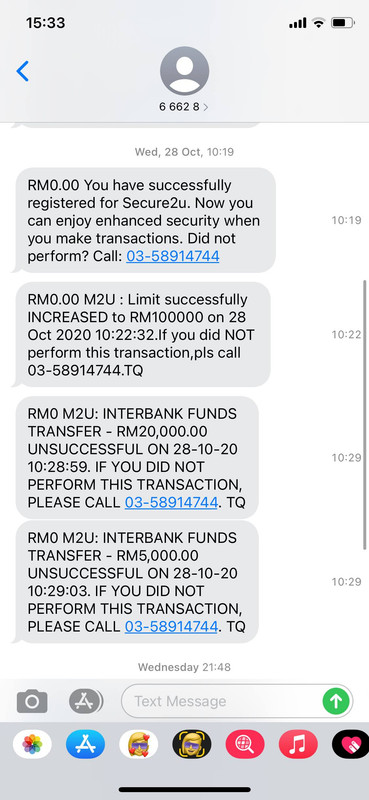

During the call, Cheok suddenly received text messages that his e-banking credentials were changed. Money was transferred from his Maybank and OCBC bank accounts.

"I was shivering from head to toe, literally going through a panic attack and hyperventilating. All my life savings were flowing out of my account without my control."

"This was all done between 10.23am, 10.24am, and 10.25am. [The bank] received my distress call at 10.27am. All within a five-minute window."

He reported the incident to the police as well as Bank Negara Malaysia

Maybank managed to freeze the accounts the money was transferred from and returned all his funds as they considered it an unsuccessful transfer.

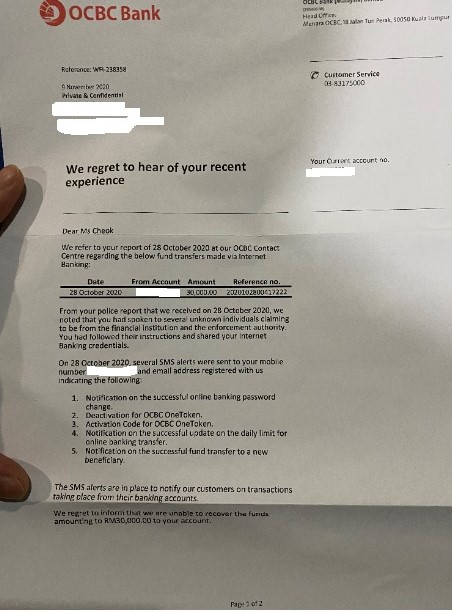

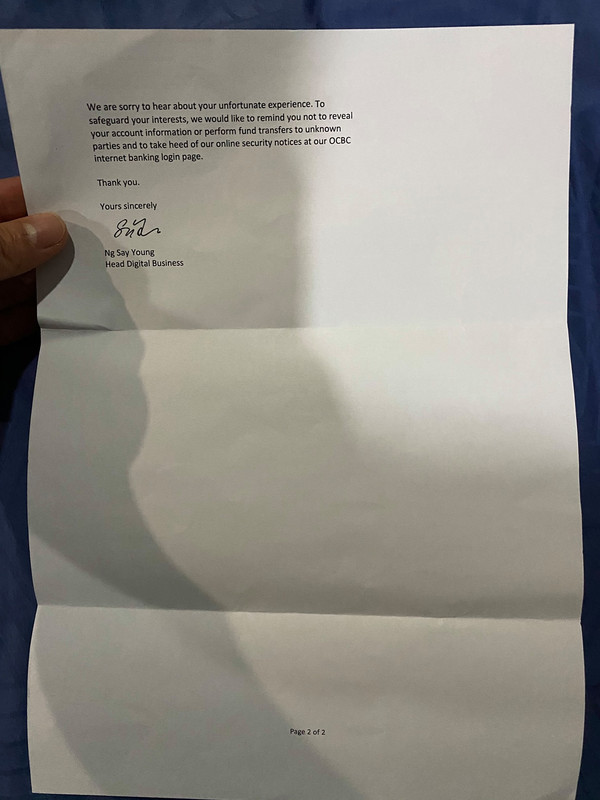

However, OCBC sent him a letter saying that they were unable to recover RM30,000 lost from his account as he "had followed instructions and shared [his] Internet banking credentials".

When speaking to SAYS, Cheok said the intent of his Facebook post was to create awareness so netizens will not fall for this scam tactic

"I do not have any proof that OCBC bank is liable for anything. Just my experience with them and Maybank," he said.

"One thing I am sure is that everyone's personal information is no longer safe as we expect them to be and we do not need to provide any verbal information for scammers/hackers to penetrate into our financial system. That’s the scariest part."

Cheok also urged all depositors to be careful when choosing banks to store their money.