Maybank Launches Online Investment Tool For Beginners That's Easy, Convenient & Affordable

From as low as RM200 a month, you can start investing in funds and growing your wealth.

Have you always wanted to start investing but are overwhelmed or unsure of how to begin?

Maybank has just simplified the entire process with the launch of Maybank Goal-Based Investment. The beginner-friendly tool allows you to kickstart your financial wealth journey through verified investment funds in an easy and convenient way.

Available on the MAE app and Maybank2u website, the latest investment feature walks you through step-by-step, allowing you to customise your investment journey, as well as offering expert recommendations based on your preferences.

Maybank Goal-Based Investment has a comprehensive suite of offerings that are managed by professional fund managers, so you can feel secure and safe in your investments, especially if you're a newbie.

The best part is, the entire process can be done online; you don't even have to visit a physical Maybank branch!

From left: Joanne Lee, Strategic Programme Director, Maybank; Syed Ahmad Taufik Albar, Group CEO of Community Financial Services, Maybank; Datuk Hamirullah Boorhan, Head of Community Financial Services Malaysia, Maybank; Kalyani Nair, Group Chief Digital Officer, Maybank.

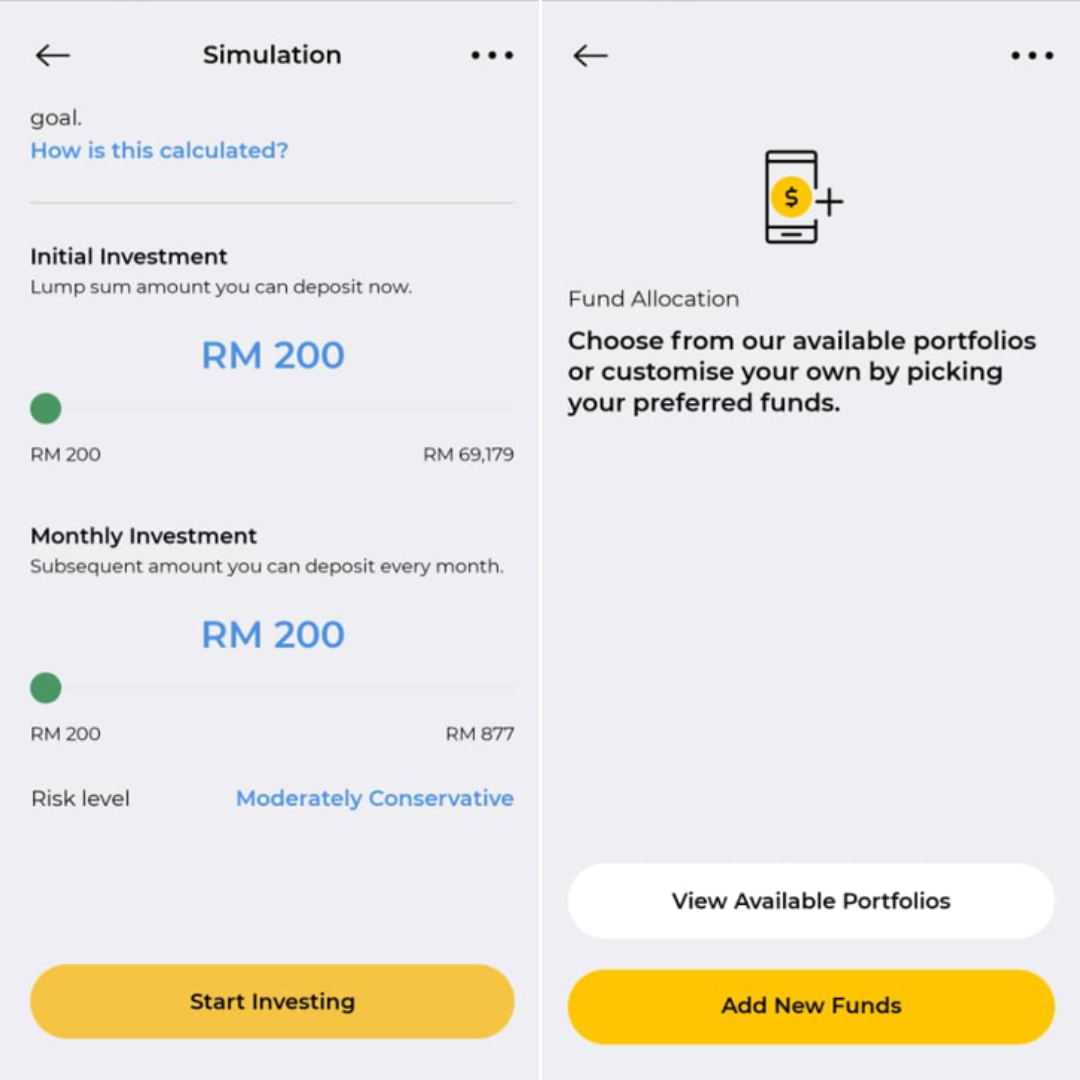

Image via Maybank (Provided to SAYS)With a minimum amount of RM200, you can start investing in funds with low sales charges and no lock-in period. This means you can withdraw your investments at any time.

Speaking to the press during the launch at Menara Maybank today, 22 April, Group CEO of Community Financial Services of Maybank, Syed Ahmad Taufik Albar, said common issues that many people face is not knowing where to start and concerns about high fund management or processing fees.

Maybank Goal-Based Investment removes these barriers by making investing accessible and affordable for everyone.

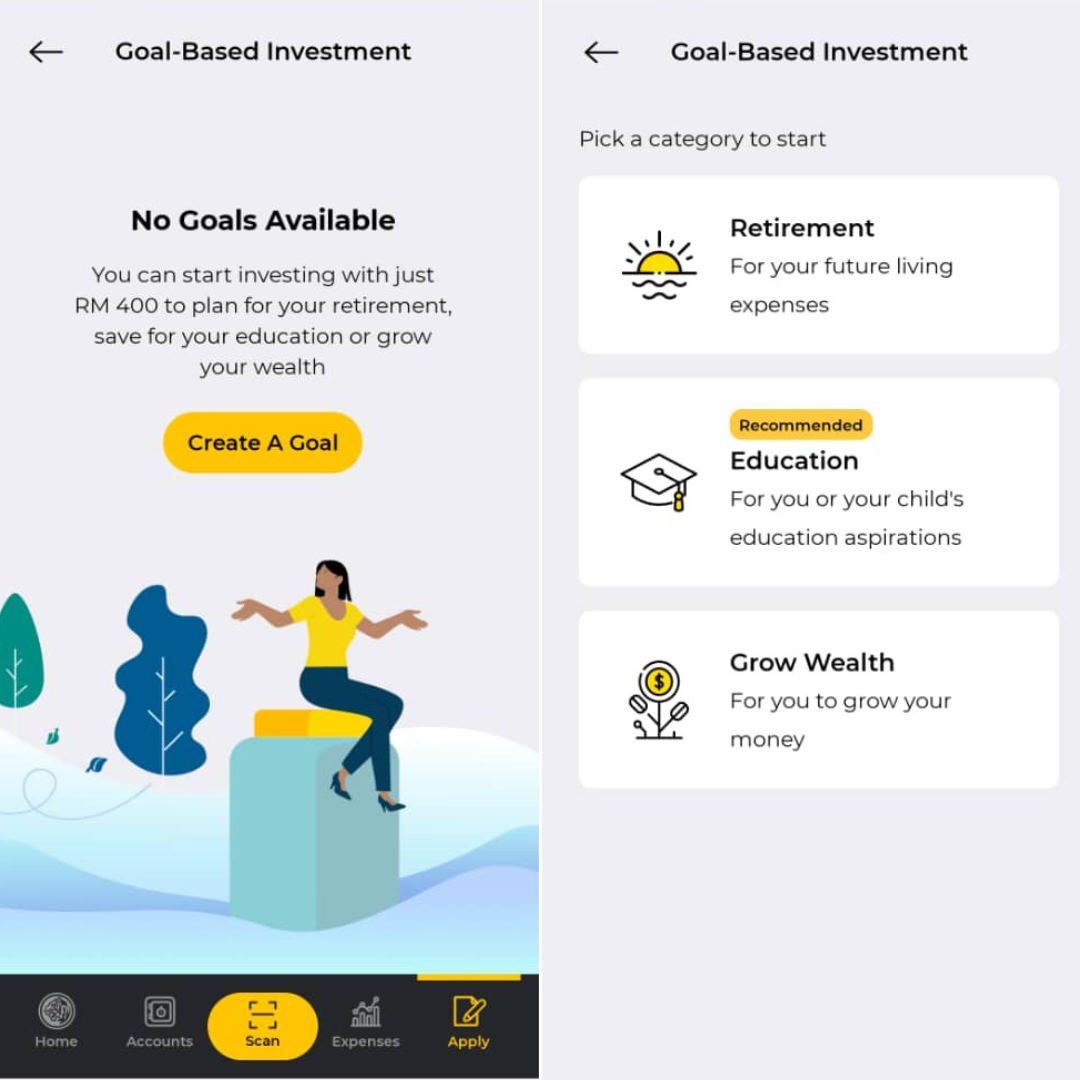

For convenience, you can select from goal options that are aligned with common life aspirations such as retirement, children's education planning, and growing wealth.

Registration is simple and convenient as everything can be done on either the MAE app or Maybank2u website, even if you aren't already a Maybank user

New customers can register for a Maybank savings or current account entirely online in just under 10 minutes, while customers with existing accounts can get started immediately.

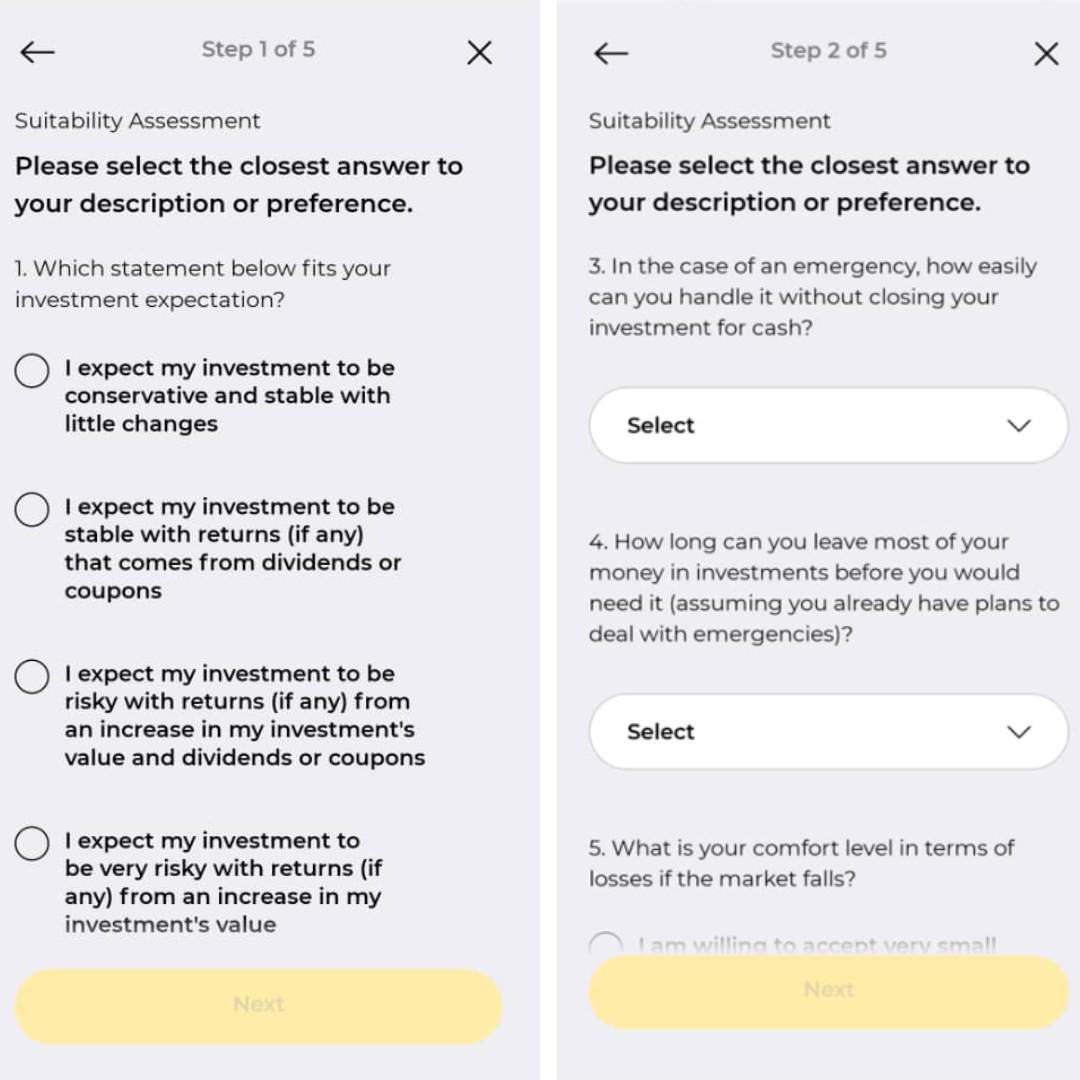

Maybank Goal-Based Investment will then enable you to easily create portfolios out of a range of unit trust funds that are catered towards your risk appetite, financial goal, and your goal's timeline.

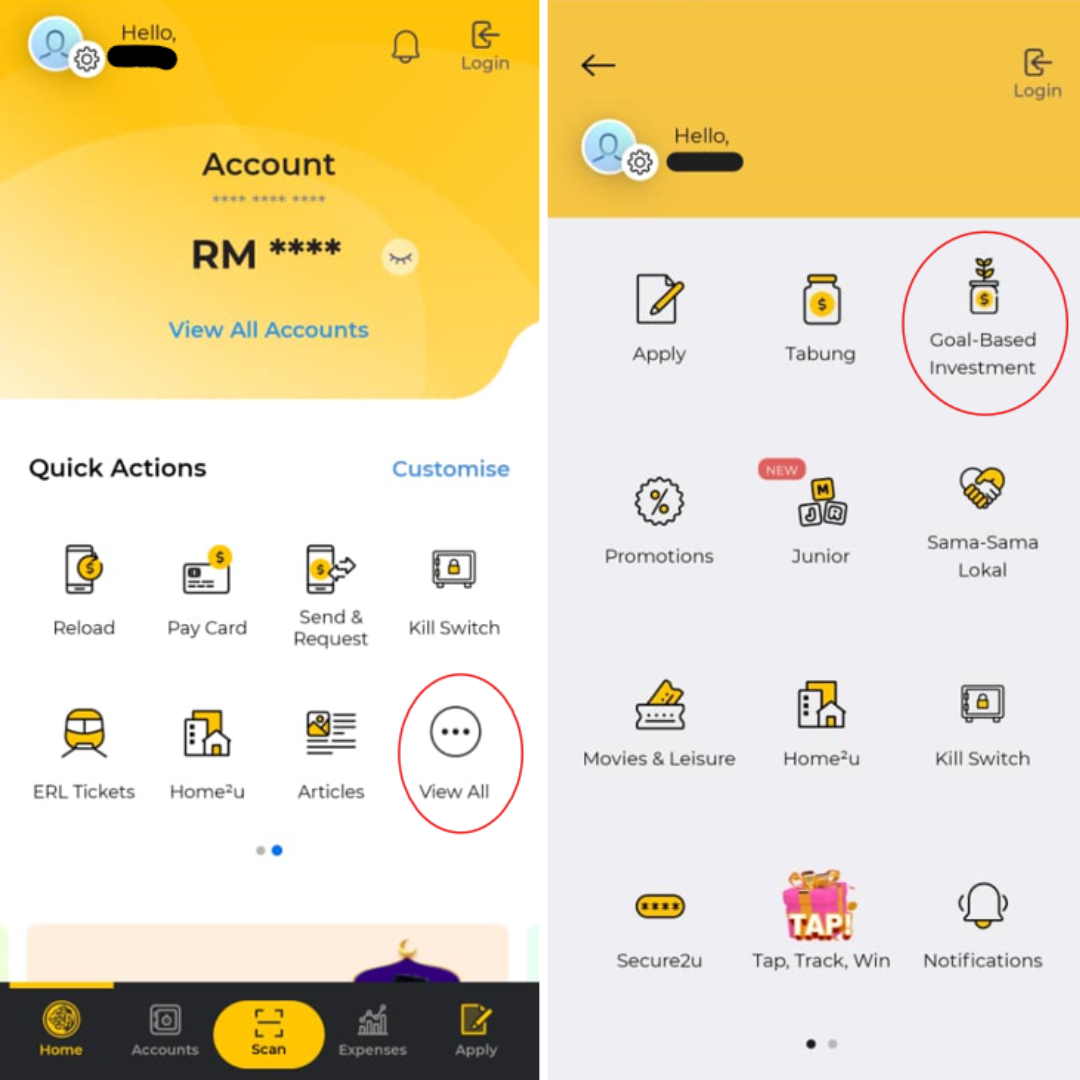

Here's a quick tutorial on how to get started:

2. Select 'Goal-Based Investment'

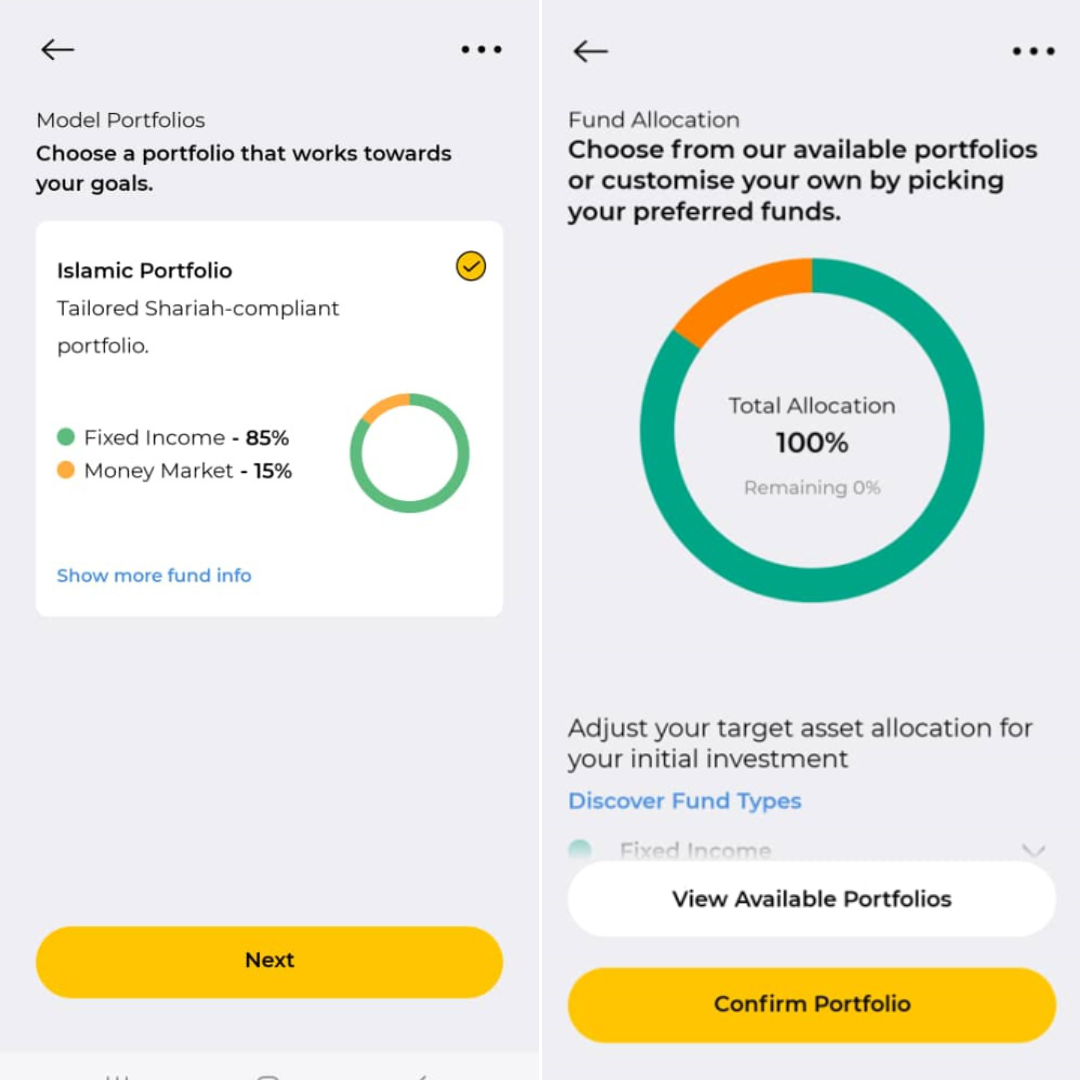

6. Choose between available portfolios, which are recommended by Maybank based on your suitability assessment, or select your own manually.

8. Make additional tweaks or confirm your portfolio. And you're all set!

Both conventional and Shariah-compliant funds are available, while the sales charge is set at a maximum of 1.5%. From now until 25 June 2024, customers can also enjoy a 0% sales charge on their initial investment.

Key Features of Maybank’s Goal-Based Investment:

- Easy and convenient registration

- Low initial investment from RM200

- Flexible contributions with no monthly commitment required and no redemption penalty/restrictions/lock-in period

- Personalised unit trust portfolios based on customers' unique needs

- Conventional and Shariah-compliant options are available to cater to the customer's specific financial values

- Competitive fees at 0% - 1.5% sales charge

"Maybank is driven by its mission of Humanising Financial Services, aligned with our M25+ strategy to prioritise customer-centricity through digitalisation and technology modernisation in our product offerings. This initiative also addresses our broader commitment to foster financial literacy and inclusivity across the communities we serve.

"As part of Maybank's quest to strengthen our business presence and position in the region, we have also made Maybank Goal-Based Investment available to Maybank Singapore customers via the Maybank2u SG (Lite) App and Maybank2u Web," said Taufik.

Find out more about Maybank Goal-Based Investment here.