Merchantrade Money Biz Officially Launch Their Malaysia's First Visa Business Prepaid Card

Set to streamline expense management for companies across various industries and sizes, from Corporates to SMEs.

Merchantrade Asia Sdn Bhd (Merchantrade), a leading innovator in digital financial services, unveiled their Corporate Card, Merchantrade Money Biz, which is now Malaysia's first Visa Business Prepaid Card

Another innovative product by the company, set to streamline expense management for companies across various industries and sizes, from Corporates to Small and Medium-sized Enterprises (SMEs).

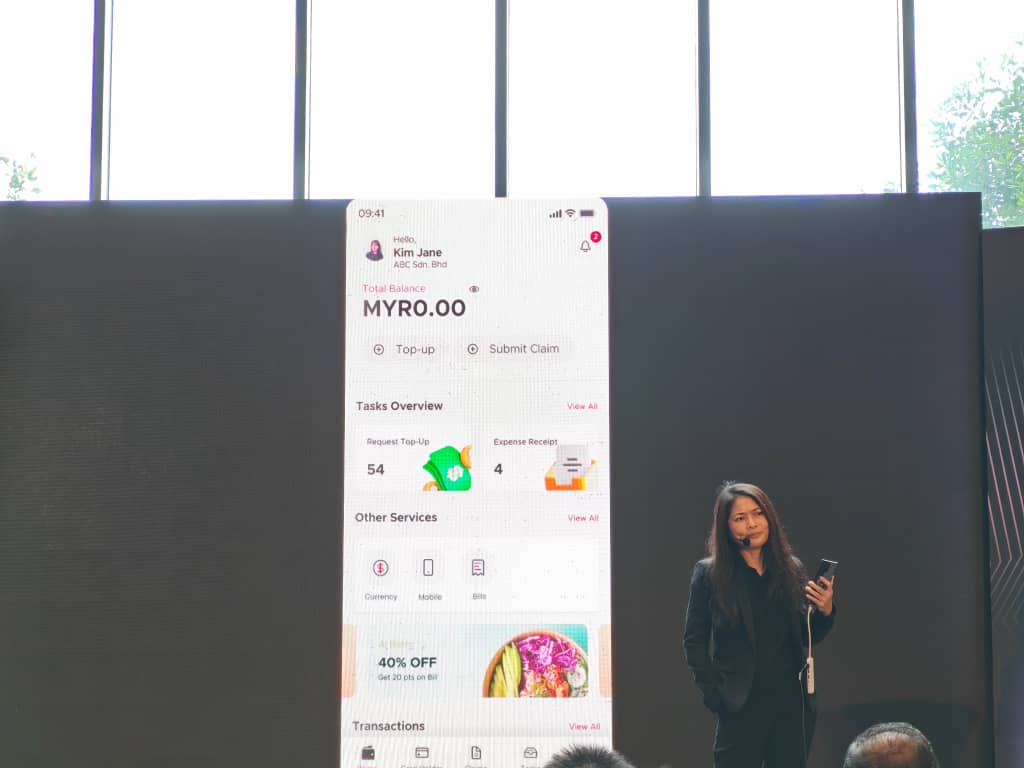

Merchantrade Money Biz seamlessly combines 3 innovative tools - a Visa Business Prepaid Card (with a RM50,000 limit and unlimited card issuance per company) linked to a multi-currency eWallet, and an expense management portal with functions designed for the modern business.

Founder and Managing Director, Merchantrade, Ramasamy K Veeran shares: “Merchantrade Money Biz is set to challenge traditional corporate credit cards issued by banks. Corporate credit cards are a privilege limited to top executives; now, with Merchantrade Money Biz, it empowers employees at all levels with corporate prepaid cards while providing employers with the right controls to manage expenses. We believe corporate prepaid cards will emerge as a disruptive innovation for companies seeking control over their expenses and will be a great alternative for those unable to obtain corporate credit cards as it offers no risk of overspending and is interest-free.”

Streamlining global payments, multi-currency eWallet, and advanced automation

Powered by Visa, the business prepaid can be used by employees to make payments worldwide, both online and retail for various company related expenses. It is also paired with a multi currency eWallet that allows users to convert up to 20 major foreign currencies with locked-in rates for international payments.

The expense management portal on the other hand, not only automates and digitizes business processes, it also provides 100% visibility on all transactions and includes robust controls, enabling finance teams to close books faster.

Head of Commercial and Money Movement Solutions for Regional Southeast Asia at Visa, Roy Choudhury Debarun said: "We are delighted to work with Merchantrade Asia to introduce the first prepaid card for Malaysian corporates and SMEs. This is a relevant and timely solution, as we have seen a double-digit growth in commercial card spending in Malaysia compared to the previous year.

"This shows the increasing demand for businesses in the country to adopt digital and innovative payment methods. At Visa, we are committed to empowering businesses with our global network and expertise in payments. Our collaboration with Merchantrade is a demonstration of our vision to enhance financial inclusion in the B2B payments space and support a sustainable economic growth for Malaysia," he said.

Over 80 companies have registered for the solution during the pilot phase, signaling strong demand and positive reception for the new product. This underscores Merchantrade's commitment to delivering inclusive digital financial solutions that effectively address the evolving needs of companies in Malaysia.

With new tools, functions, and partnerships in development, Merchantrade is confident the solution will transform the way companies operate. Merchantrade's vision also aligns with the government's push to encourage companies to digitalize operations and embrace automation in building a more cashless economy.

For more info, visit https://www.merchantrademoney.com/business/.