You Can Now Withdraw From Your EPF Account 1. Check Here To See If You're Eligible

Check out how much you are eligible to 'withdraw' from your retirement funds under the new i-Sinar scheme.

The Employees Provident Fund (EPF) announced in a press release yesterday, 16 November, that certain members can start accessing their savings in Account 1

Calling the scheme i-Sinar, the initiative aims to relieve the financial burdens of EPF members whose livelihoods have been affected by the COVID-19 pandemic.

The proposal to allow EPF members to withdraw savings from Account 1 was brought up in late October and it sparked serious discussions among financial experts, employers, government officials, and the opposition.

After taking the views from all parties, the government announced during the tabling of Budget 2021 that they will allow EPF members to withdraw up to RM6,000 - or RM500 a month for 12 months - from their retirement savings.

While the move was generally welcomed, some lawmakers objected to the RM6,000 limit, while many more lawmakers said more studies needed to conducted before a decision can be made.

The i-Sinar scheme was born following debates in Parliament and it aims to supersede Budget 2021. EPF has since finalised its fundamental mechanics.

1. Not every EPF member is eligible for the i-Sinar scheme

Previously, the initiative would have benefited 600,000 EPF members affected by the pandemic and a total of RM4 billion would be channelled back to the people.

In a press release on Monday, EPF said they have widened the number of eligible members to two million and it is estimated that about RM14 billion will be made available.

The only eligible applicants for the scheme are people who have:

- Lost their jobs,

- Are on no-pay leave, or

- Have no other source of income.

2. EPF members can start applying for the scheme beginning December 2020

Eligible applicants can expect funds to be credited into their bank accounts by the end of the year.

"First crediting will take place in January 2021. Advances will be made over a period of six months from the first date of crediting," EPF said.

3. The savings taken from Account 1 must be replenished in the future

EPF chief executive officer Tunku Alizakri Alias emphasised that EPF members are not "withdrawing" from their Account 1, but rather asking for an "advance", reported The Edge Markets.

Meaning, those who opt for the scheme must one day re-contribute the money taken from Account 1 back.

"All future contributions will be 100% credited to Account 1 until such time the amount advanced is replenished. Thereafter, contributions will revert to 70% to Account 1 and 30% to Account 2," EPF said.

Tunku Alizakri said there is no deadline for EPF members to replenish the advanced amount, but they will have to start re-contributing to their retirement savings once they have been re-employed or their businesses start picking up again.

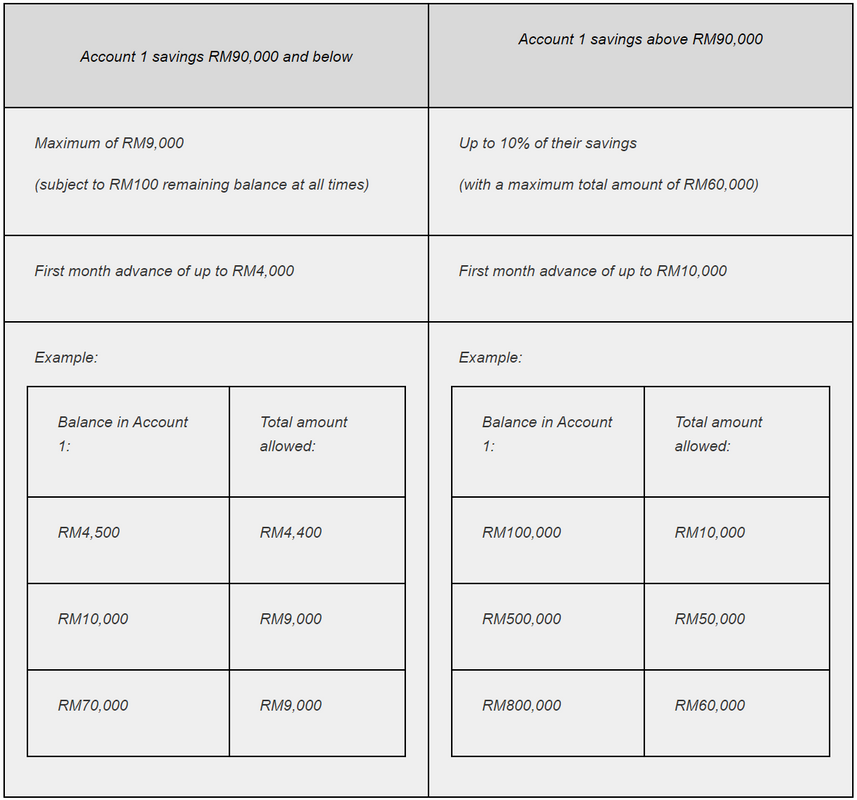

4. The withdrawal limit is capped at RM9,000 for those who have less than RM90,000 in their Account 1

Whether you have RM10,000, RM70,000, or RM89,999 in your Account 1, you can only withdraw RM9,000 from your savings.

In the first month, the advance for this category of applicants is capped at RM4,000, while the balance will be divided equally over the next five months.

As for those who have less than RM9,000 in their Account 1, they can advance all of the money as long as RM100 is left in the account.

5. Those who have more than RM90,000 in their Account 1 can only advance up to RM60,000

This category of applicants can only access up to 10% of their Account 1 or RM60,000, whichever is lower.

To illustrate, if an EPF member has RM100,000 in their Account 1, they are eligible to advance RM10,000; if an EPF member has RM1,000,000 in their Account 1, they can only advance up to RM60,000.

In the first month, the advance will be capped at RM10,000, while the balance will be divided equally over the next five months.

6. Although not all EPF members are eligible for the scheme, it will affect all members in the long-term

The CEO of the provident fund said those who plan to take advantage of the scheme will have to bear the consequences of forgoing their compounded returns given in their Account 1, citing there is "no free lunch" in the world.

As for EPF members who are not eligible for the scheme, their returns for the coming months will also be affected as the scheme will be allocating RM11 billion to RM15 billion to the members.

The pool of money EPF has for investments will be diminished and it is expected future dividend payouts will be affected, reported The Edge Markets.

You can read EPF's full press release here.