5 Best Apps To Track Your Spending This Year

Let technology help you save some moolah.

Saving money is difficult in this day and age.

Goods and services are expensive, instalment plans and subscription services are a dime a dozen, and online shopping only makes it convenient for us to splurge on payday.

Maybe that explains why young Malaysians are struggling to pay off debts accumulated from credit card usage and bank loans. Some even had problems raising RM1,000 in an emergency.

Quoting a study by the Asian Institute of Finance in 2015, The Malaysian Insight reports that majority of millennials in the country have been living on high borrowings. 38% relied on personal loans while 47% engaged in expensive credit card borrowings.

But this generation is not all lost in financial planning. Help is around the corner (no, it's not your parents). Look no further than the device you spend most of your waking hours on – your smartphone!

If you’re just learning to get your finances in order, or you’re ready to start giving them some more thought, you have a wealth of app options:

1. Goodbudget Budget Planner

As its name suggests, Goodbudget Budget Planner is basically like an envelope budget for the digital age.

You can segmentise your spending into different categories for easy monitoring. It allows you to divide spendable income into the "envelope system".

There are also simple ways to see exactly how the percentage of your spending in certain categories affects your total budget, and how much you have left to spend in a category before you need to stop. A great choice for controlling specific areas of your spending life.

Price: Free with in-app purchases

Download: iTunes | Google Playstore

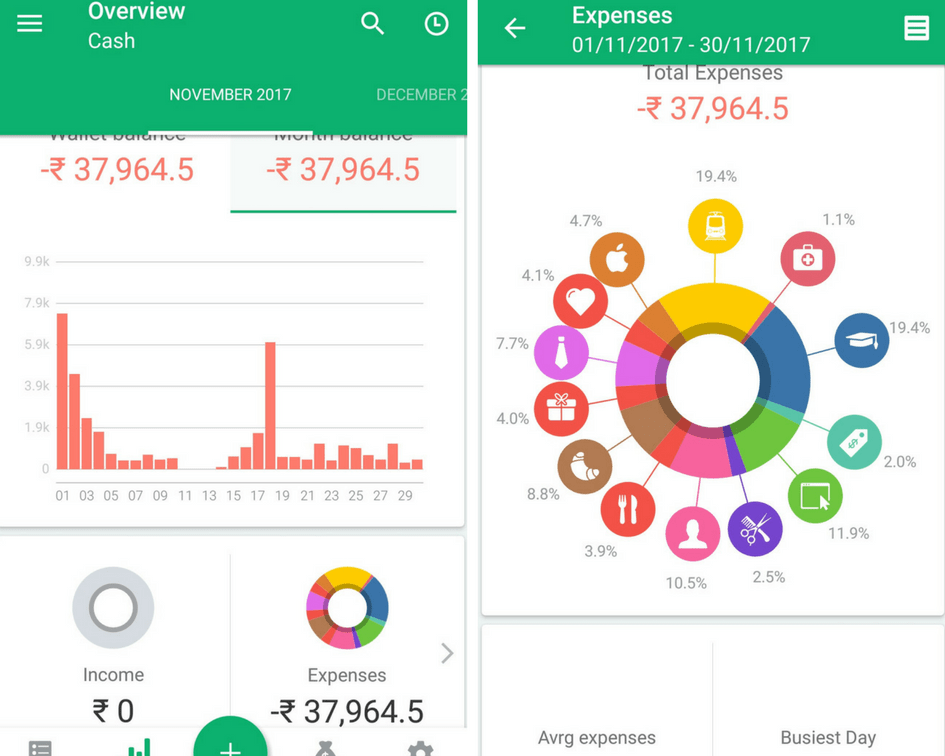

2. Spendee

Spendee is a bright and easy-to-use budgeting app, which is always important. It's already bad enough we have to spend time making sure we have enough money to pay the bills and enjoy ourselves, the least we should hope for is ease of use.

The addition of bright colours, graphs to show spending habits, and customisable categories with matching icons is definitely a plus.

Price: Free with in-app purchase

Download: iTunes | Google Playstore

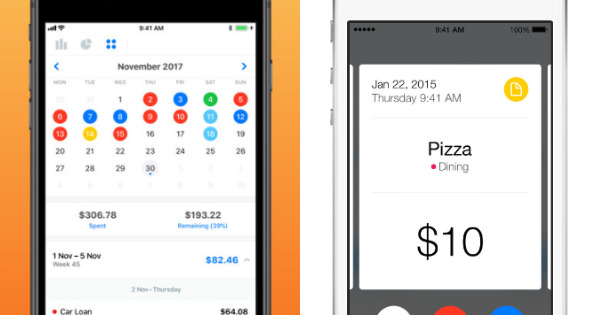

3. Saved 3

Saved 3 is a step-up from Saved, a budgeting app by local programming firm Snappymob.

It is a no-nonsense app featuring charts and graphics that depict your spending habits. You'll get an overview of your spending habits right when you crank up the app.

"We designed an all-new gorgeous dashboard that is now the primary screen of Saved. It loads snappily and provides immediate access to the most important numbers immediately so our users don’t have to go further unless they want to," the description on the website reads.

You can also colour-code your spendings on the app's calendar.

Price: RM19.90

Download: iTunes

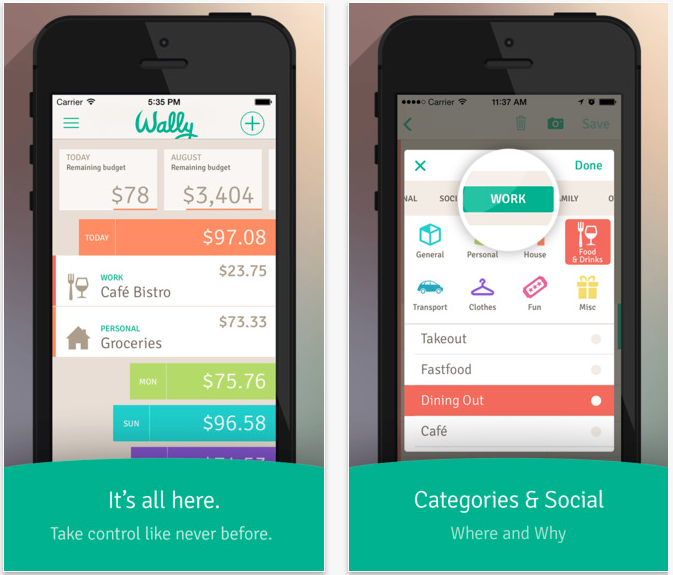

4. Wally

This is another app with rave reviews. Its developers claim the free app offers a

"360-degree view" of your money, tracking what comes in, what goes out, what you have saved, and what you have budgeted.

Wally also works with smartphone location services to track where you’re spending your money. Another feature is the ability to photograph your receipts to update your spending and expenses.

Notifications will remind you of upcoming payments and when you have reached a savings goal.

Price: Free

Download: iTunes | Google Playstore

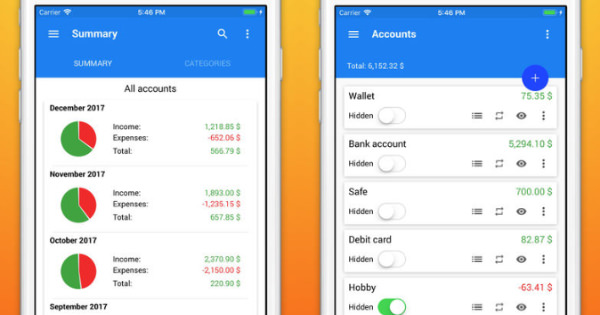

5. Fast Budget

Keep track of your credit and debit card expenses with Fast Budget. The app allows you to input credit limits, interest rates, and due dates.

Besides that, Fast Budget is also a competent financial tracker, letting you view your incomes and expenses with a quick summary based on the day, week, month or year. You can also use the app to generate pie and bar charts for a graphic overview of your expenses.

Price: Free with in-app purchases

Download: iTunes | Google Playstore

All the best in fulfilling your financial goals this year, everyone! Don't forget to spend wisely, shop sparingly, and eat at home more often.