CoKeeps Becomes Malaysia's First Qualified Digital Asset Custodian

CoKeeps is the first and currently only company to receive full approval from Securities Commision Malaysia (SC) to offer custodial services for digital assets.

CoKeeps has become Malaysia's first Digital Asset Custodian (DAC) to be approved by Securities Commission Malaysia (SC)

They are the first, and currently the only, company to receive full approval from the SC to offer custodial services for digital assets.

The SC's approval means there is now a credible third party service that facilitates the safeguarding of digital assets. This is an indication of the SC's recognition of the widespread adoption of digital assets by individuals and institutions, as well as their awareness that compliant solutions are needed to protect the market.

"After three years of hard work building a robust DAC solution with the guidance of the SC, we are honored to be the first company approved to operate under the SC's Guidelines on Digital Assets.

"The SC is at the forefront of global regulators in developing a methodical approach to regulating digital assets, and its guidelines provide a clear roadmap for the safe and responsible development of this asset class," said Suhanna Husein, CEO of CoKeeps.

"We are committed to working closely with the SC to ensure that our DAC solution meets the highest regulatory standards, and we are excited to play a leading role in the development of the digital asset ecosystem in Malaysia," she added.

CoKeeps' aim is to bridge the gap between the crypto space and the regulated market

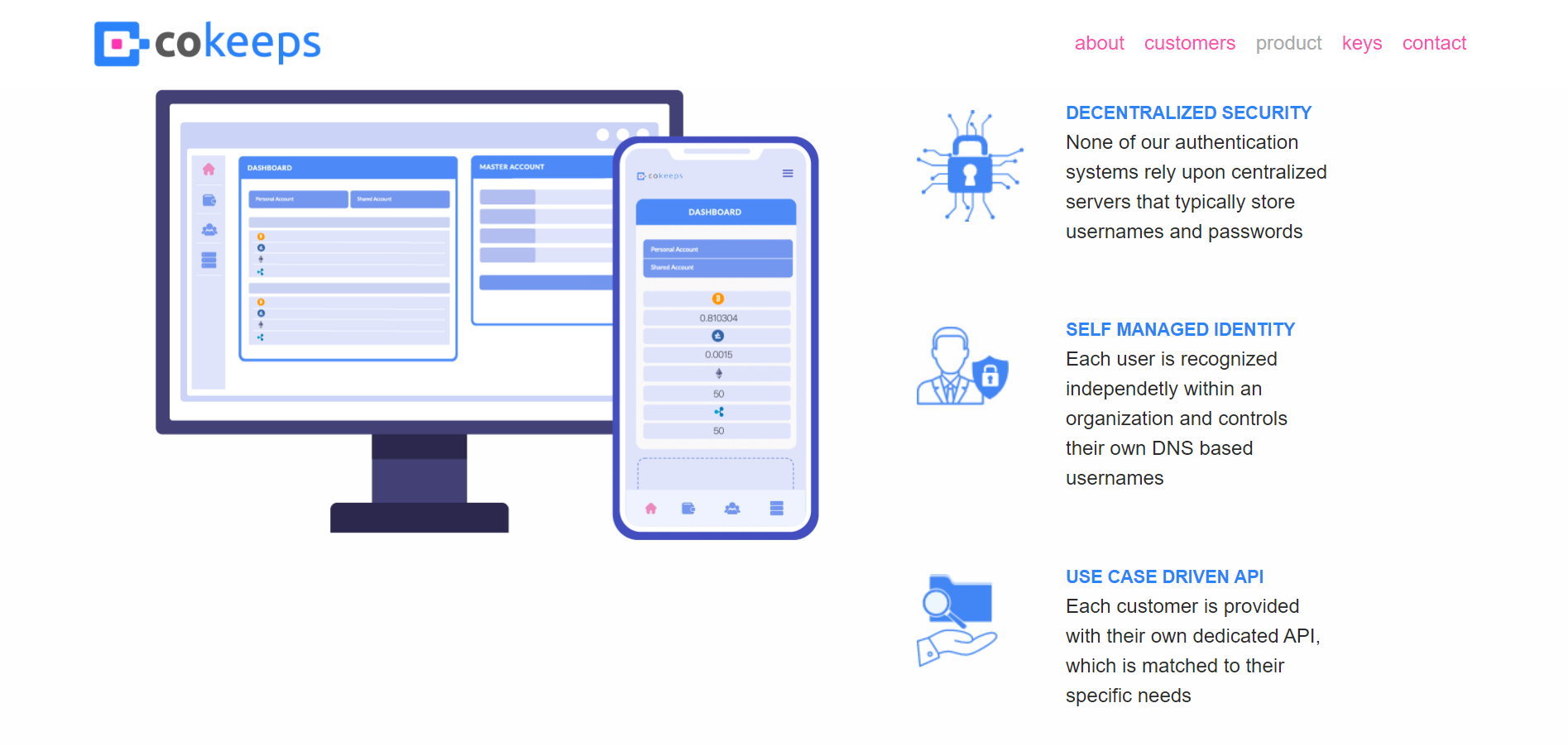

Their services are based on their own core proprietary — CoKeeps Wallet, an institutional-grade digital asset management tool based on decentralised security and and multi-party computation (MPC) methodology.

With features including cold wallets, hot wallets with API access, and smart contract solutions, it is able to remove single points of failure commonly found in storing crypto.

Additionally, what makes CoKeeps unique compared to other crypto wallets is that they do not require customers nor themselves to store private keys, which are generated on demand.

CoKeeps is currently engaging with other regulated entities in the capital market such as recognised market operators, including digital asset exchanges for digital currencies and initial exchange offerings for digital tokens.

"CoKeeps' security features are unique as the infrastructure is built against both external and internal threats.

"Furthermore, fund managers and various financial institutions are incorporating the digital asset class to broaden their offerings. This expansion necessitates ready-made solutions, such as ours, to ensure compliance," Suhanna shared.

Due to the inherent risks associated with this type of investment, a deep understanding and technical capabilities beyond the scope of traditional custodial services is required, in order to ensure that assets are fully secure and marketable

"Globally, there has not yet been a comprehensive solution that could address the risk of insider threats. Trust is either relied on a group of people managing funds, whereby accountability is lacking, or worse, trust on wallet providers that credentials are not compromised without users' knowledge.

"This is where CoKeeps aims to fill the gap, with our security solutions ensuring that every action must be authenticated at each layer, ensuring no single party can act of their own accord," Suhanna said.

Those interested in using CoKeeps can verify that it has been listed as a registered Digital Asset Custodian by checking on the SC's website

Follow SAYS Tech on Facebook, Instagram, and TikTok for the latest in tech in Malaysia and the world!