PSA: Even Cleaning Services & Durian Promos Can Be Scams. Here's What To Look Out For

Always be one step ahead of scammers!

With scam cases on the rise these days, Malaysians ought to be extra careful

In recent years, there have been a lot of different scam cases circulating, especially after the pandemic. Almost every week, we notice posts, statuses, or reposts on social media from friends and family sharing encounters of getting scammed. In fact, some of us have been victims of scams too.

With many of us being active online, especially on social media, it's so much easier for scammers to access the things we share and use this information to create a macam yes story and con us. How scary! :O

Besides that, scammers are also getting harder to detect as they pretend to be online businesses, the authorities, charity organisations, recruiters, and more.

That's why it's very important for all of us to be aware of common scam tactics and take the right precautions before it's too late.

1. If you come across any APK files, DO NOT download!

One of the most highly reported types of scams is scam apps. Scammers may pretend to be genuine businesses, including cleaning services, durian sellers, travel agencies, or other reward schemes.

They will then advertise their services online with attractive promos. However, in order to enjoy these promos, victims are asked to download the APK file, install, and make booking via the app.

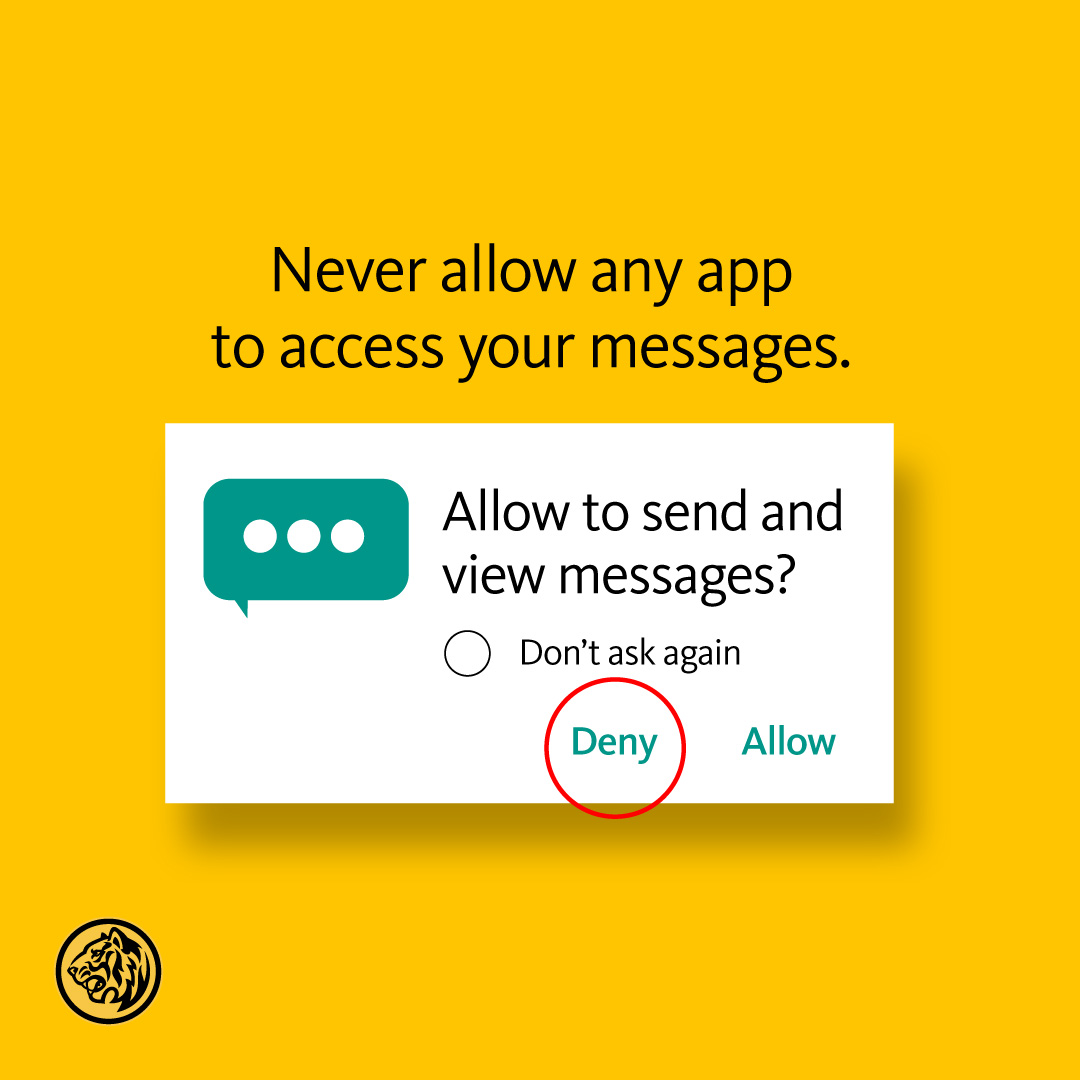

These are unverified apps that cannot be found in official app stores (Google Play Store, HUAWEI App Gallery, or Apple App Store) and the links will download right into your device once clicked and will request access to send or view messages. The scary part is that scammers can steal SMS TAC by gaining this access.

More advanced scammers will use this tactic to access your browser data such as usernames, passwords, Internet cookies, auto-fill settings, and history.

All in all, to avoid scam apps, train yourself to never click or install anything suspicious, be it an APK file link on email, chat message, QR code, or links on your social media.

2. If the payment site seems unusual, CLOSE IT immediately!

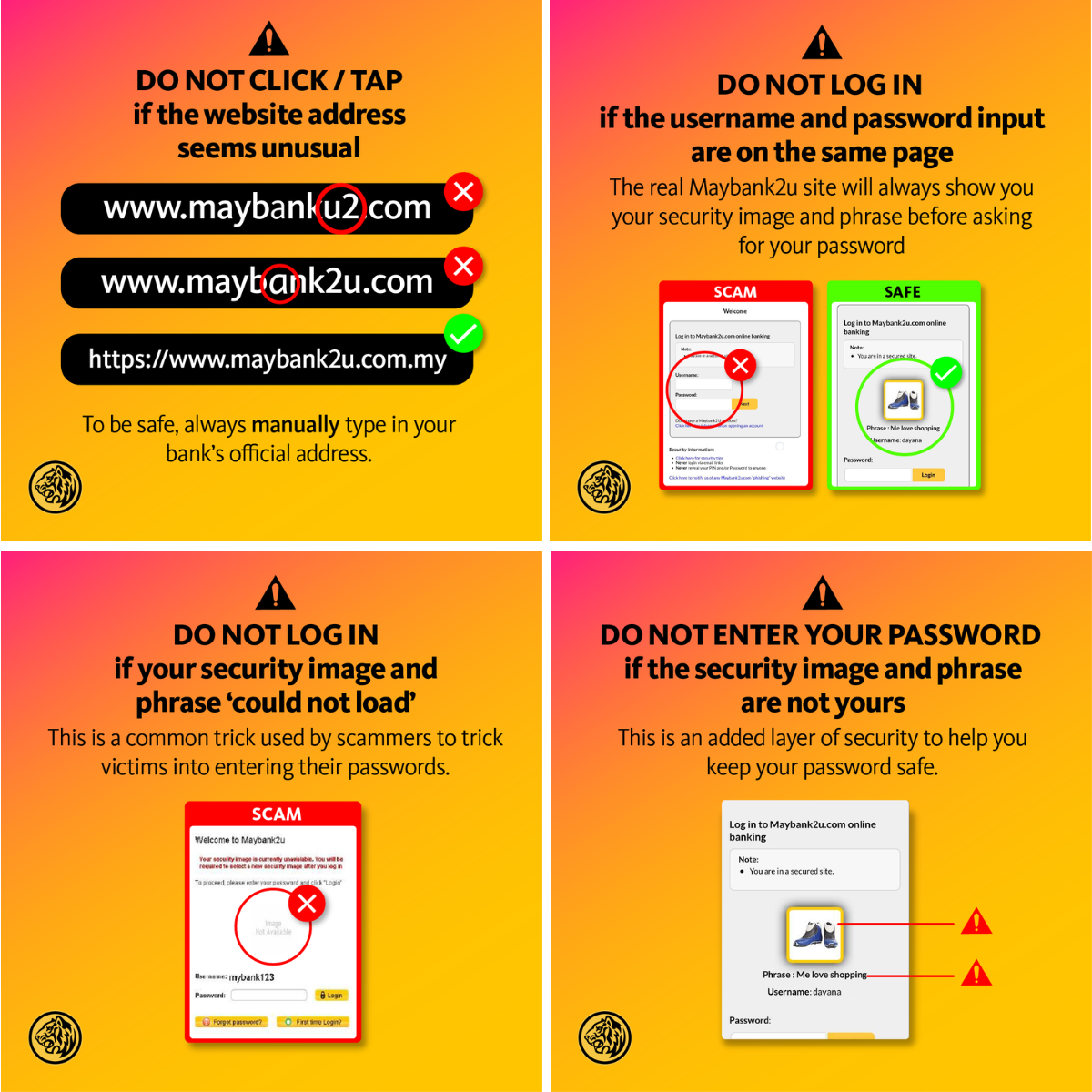

Scammers have also upped their game to create fake banking websites and payment portals that look just like the ones we normally log on to. The differences might be just a letter or number in the URL, or having a lot of typos and bad grammar within the site itself, which makes it hard to detect if we don't look closely.

When you don't realise and log in using your usual banking site username and password, your information will be directly sent to the scammers, which they can then use to transfer your money out.

To avoid this from happening, you have to always stay alert:

- Close the browser if the whole website looks unusual

- Don't log in if the username and password input are on the same page

- Don't enter your password if the security image and/or phrase is not yours

- Don't log in if the security image and/or phrase would not load

3. No matter what macam yes story you are told, DON'T EVER give out your six-digit TAC number to anyone!

Many of us use TAC (a.k.a. OTP) sent to our registered mobile number to approve online transactions.

However, in some instances, scammers will send you an SMS, direct message on social media, or call you requesting for a TAC, saying they mistakenly registered your number to receive their TAC. Macam yes? Don't fall for it!

They might even say that their registration on websites like Mudah or Lazada couldn't be completed because they accidentally typed in your number instead, and will need the TAC to successfully register.

TAC won't be wrongly sent and you should never forward this code to anyone. If anyone contacts you to get their TAC number, report it to the authorities (see the later part of this article to learn how).

4. If you ever get a call from the police or other authorities, HANG UP first and call their official number to verify!

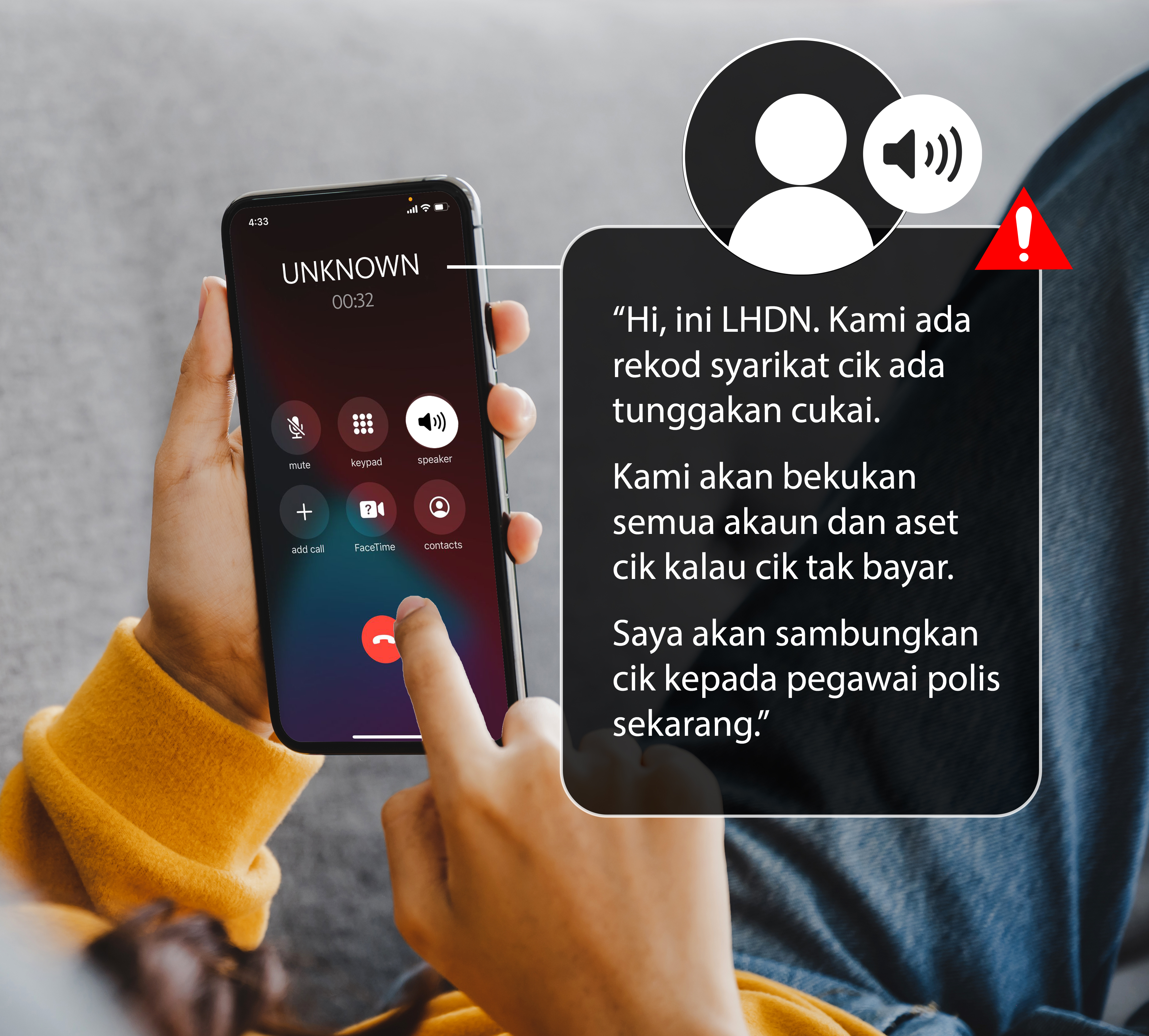

Posing as government officials, police, bank officers, service providers, business retailers, or LHDN personnel, phone scammers may sound credible, as they may have your full name or other personal details on hand.

These are some of the common macam yes stories phone scammers might use:

- that you have defaulted payments or taxes

- that your account or subscribed phone line is linked to money laundering activities

- that the conversation should be kept a secret as it's P&C information for investigation

- that your identity has been stolen to sign up for a new credit card and/or has racked up high spending

All these macam yes scam calls often start with an automated operator voice. Once you choose to speak with a kononnya real officer, they will transfer you to different officers during the call to create urgency. Next, they will proceed to convince you that your money needs to be temporarily transferred to another account for safekeeping while the investigation is ongoing.

They will usually give some kind of excuse as to why this is necessary, such as your current account is frozen. They might even ask you to give them your TAC or to approve transaction via push notifications sent from your banking apps.

Their scare tactics often cause you to mistakenly assume the matter is real and urgent. But, don't panic! If you receive a WhatsApp call from a number that has authorities as the profile picture, or any call using a mobile number, quickly hang up. If uncertain, you can always call the respective authorities back on their official numbers, so that you can be sure you're speaking to the right people.

With Maybank's fraud hotline (03 5891 4744) on standby 24/7, you can seek help immediately if you suspect that your account has been compromised!

Through their latest campaign #macamyesmaybenot, Maybank is determined to raise awareness on scams happening around us. By educating Malaysians on current scam trends and tactics, they hope the public will be more alert with the signs or red flags, to avoid becoming a victim to scammers.

If your banking details have been compromised or you realise any unusual activity in your banking account, you can contact Maybank's fraud hotline at 03 5891 4744. By disclosing the full truth to the officers, they can do their best to help you.

Here are some channels to report scams so others don't fall for it:

1. Commercial Crime Investigation Department (CCID)

Operating from 8am to 8pm daily, you can give CCID a call at 03 2610 1599, 03 2610 1559, or send a WhatsApp message to 013 2111 222, if you have made any transactions to suspicious bank accounts or encountered any money related forgery and scam calls.

2. Malaysian Communications and Multimedia Commission (MCMC)

You can lodge a report or complaint of any unusual telecommunication or online activities through their website or any of their provided channels, which will undergo thorough investigation and help you solve the issue.

3. Bank Negara Malaysia (BNM) Telelink

For any financial related scams, you can contact BNM's telelink at 1-300-88-5465, which operates from 9am to 5pm on weekdays or email them at [email protected].

4. Social Media

If you come across any accounts or posts on Facebook, Instagram, Twitter, Telegram, or WhatsApp, you can directly tap 'report ad as scam' through the respective platforms.

Keep up-to-date on Maybank's Facebook, Instagram, and Twitter for the latest #macamyesmaybenot alerts and tips to avoid scams. Stay vigilant, take precautions, and remind your loved ones to do the same!