Shopee Now Provides Personal Loans Of Up To RM100,000 To Sellers On Its Platform

The service is called SLoans.

Shopee SLoan is a digital financing solution that Shopee provides to their sellers in the form of a personal loan

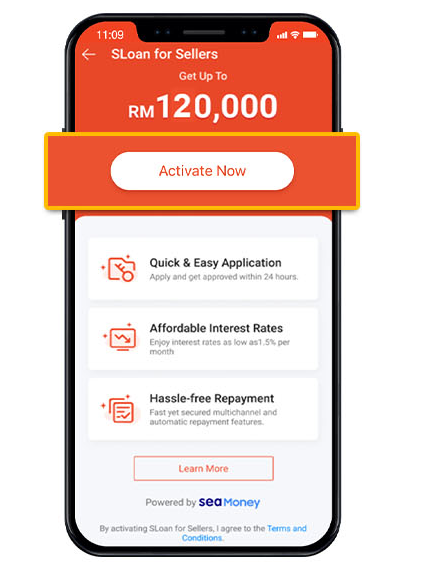

According to Shopee, selected sellers are eligible for a capital loan of up to RM100,000. They also claim that an application can be approved within 24 hours.

There are also numerous flexible loan tenures that Shopee is offering to their sellers so they can choose a personal loan that fits their needs.

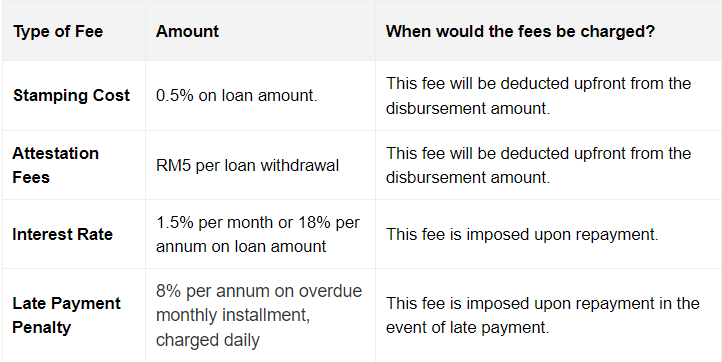

The personal loan service comes with certain fees:

Shopee also stated that the interest rate is fixed throughout the loan tenure, meaning it won't go above 1.5% per month or 18% per year.

Additionally, your first withdrawal from SLoan must be a minimum of RM1,000, and subsequent withdrawals are required to be in multiples of RM100.

Keep in mind that the interest rates only take effect upon withdrawal. Repayment periods can also be set at three, six, or 12 months.

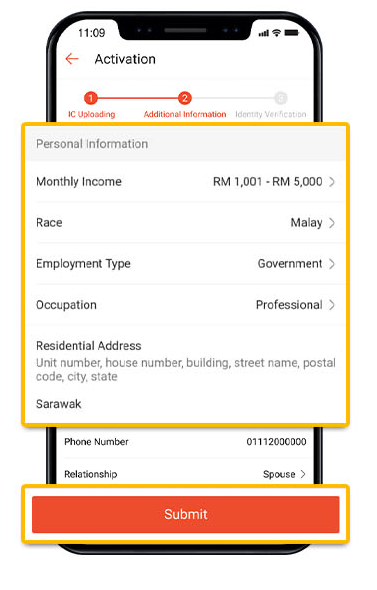

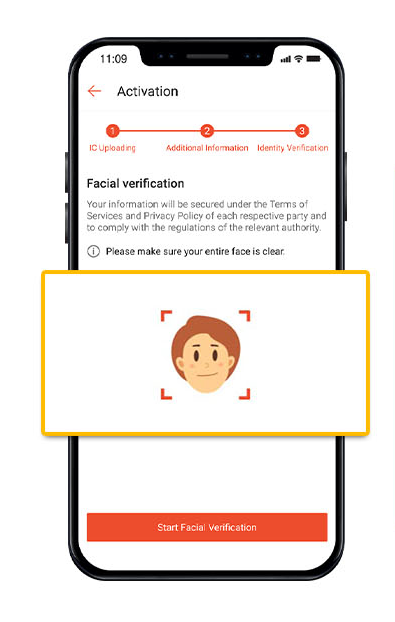

If you do have it on your Shopee and want to apply for financial backing, here's how you activate SLoan:

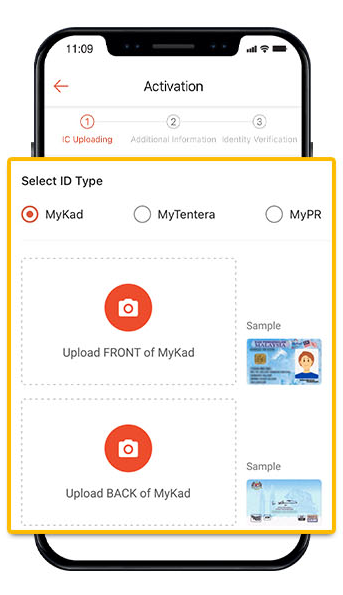

First of all, you need to prepare your MyKad, MyTentera, or MyPR IC, a smartphone with Shopee installed, and stable Internet connection.

1. Open 'SLoan' from the 'Me' section of the Shopee app and click 'Activate Now'

2. Upload pictures of both sides of your IC (MyCard/MyPR/MyTentera)

If you can't see the SLoan option on your Shopee app, don't worry — you're not the only one

The feature is now only available to selected users, but will be rolling out to more people over time.

Other terms and conditions for this service include:

- You must be a Citizen or Permanent Resident or Armed Forces of Malaysia (MyKad/ MyPR/MyTentera)

- You must be at least 18 years of age (as stipulated by Kementerian Pembangunan Kerajaan Tempatan)

- You must be a Shopee seller