When Did You Last Check Your CTOS Score? Here Are 5 Reasons Why You Should Do It Regularly

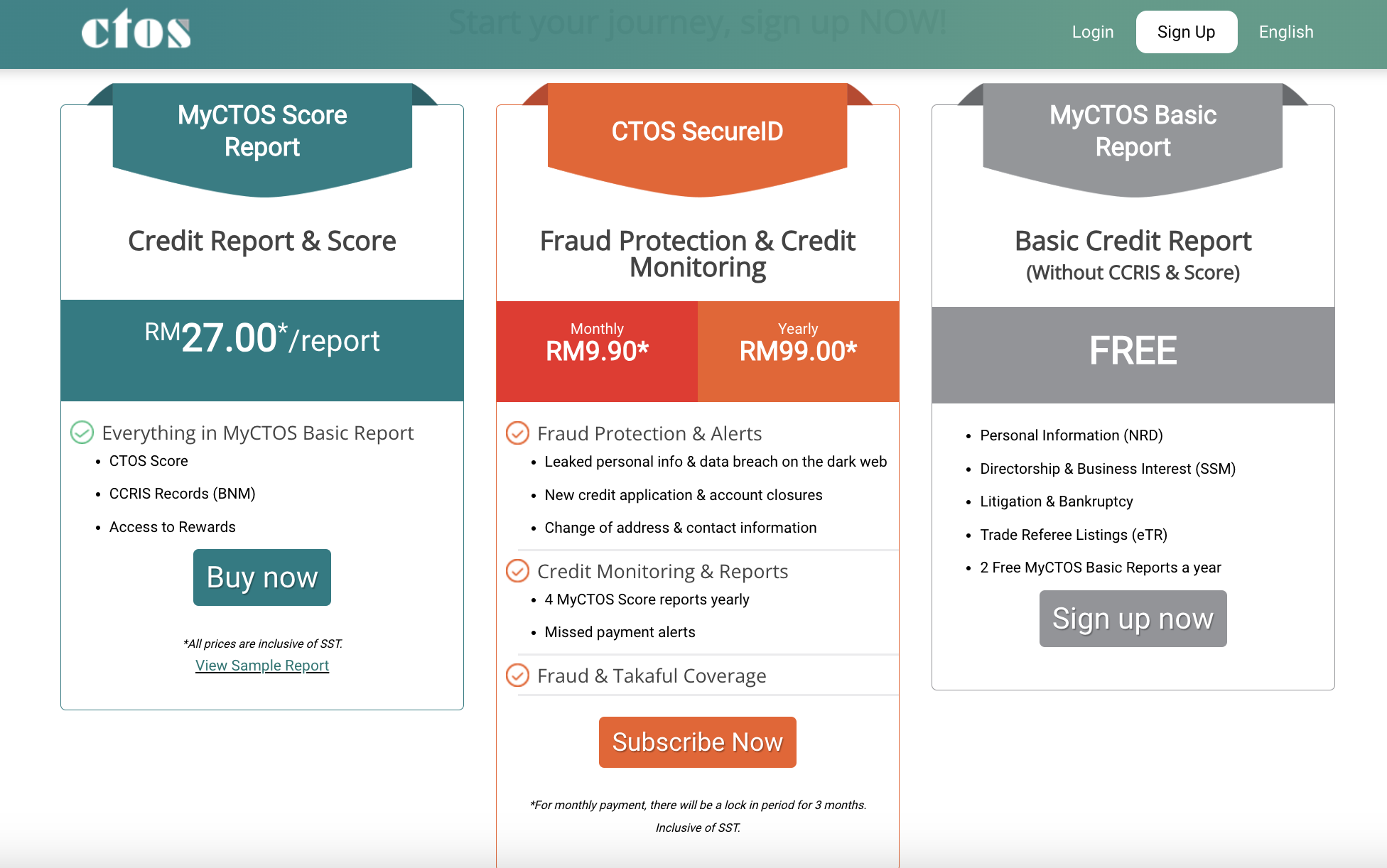

You can get a MyCTOS Score Report for just RM27!

Chances are, you may have heard that having a good credit score is important. But first, what is a credit score?

In essence, it is a score that reflects how likely you are to repay your debts on time. Lenders, such as banks or financial institutions, use this score to assess the risk of extending credit to you.

In Malaysia, CTOS — a leading credit reporting agency — scores range from 300 (poor) to 850 (excellent). The higher your score, the greater your chances of securing credit approvals.

The benefits of having a good credit score include:

- Having a higher chance of loan approval

- Having lower interest rates

- Getting better credit card deals

- Gaining access to higher credit limits

If you're wondering how often you should check your credit score, a good rule of thumb is once every three to six months

Your credit report is never stagnant — while your CCRIS info is generally updated monthly, other information like bankruptcy, trade references, and directorships will be updated as and when there are changes.

Here's why it's important to check your credit score regularly:

1. It helps you increase your chances of loan approval

A good CTOS score is your golden ticket to easier loan approvals. Lenders look at your creditworthiness before approving applications for home loans, car financing, or credit cards. Knowing your score allows you to address issues beforehand, increasing your chances of success.

2. Spot warning signs of identity theft and fraud

Identity theft is more common than you think. Regularly checking your CTOS report helps you detect unauthorised activities, such as loans or credit accounts opened in your name, and allows you to act quickly to minimise damage.

3. Check if there are litigation or bankruptcy cases under your name

Did you know that your CTOS report also reveals any legal cases or bankruptcy records under your name? Unresolved cases can negatively impact your financial standing, so it's crucial to stay informed and address these issues promptly.

4. Find out if you unknowingly owe businesses money

Your CTOS report includes trade references, which show if you owe any outstanding payments to businesses. This transparency helps you resolve debts before they escalate into bigger problems.

5. Fix inaccuracies and clean up your credit report

Sometimes, your credit report may require a review to ensure all information is accurate and up-to-date. To maintain an error-free credit report, ensure that your debts have been settled and that all your relevant particulars have been correctly updated.

6. Monitor loan balances for better financial planning

Your CTOS report gives you an overview of all your outstanding loans. Tracking these balances helps you plan your finances better, prioritise repayments, and avoid overextending your credit.

Checking your credit score is pretty simple — all you have to do is get a MyCTOS Score Report

The MyCTOS Score Report is open for all Malaysians, and you can purchase your personalised report via the CTOS app or website for just RM27. You can also get your MyCTOS Score Report directly via the Touch ‘n Go eWallet app too!

As part of the report, you'll gain access to your CTOS Score, a variety of rewards, and your CCRIS record — this includes credit information maintained by the Central Credit Reference Information System (CCRIS), which is managed by Bank Negara Malaysia (BNM).

Take control of your credit record with MyCTOS Score Report today! Find out more on their website.

Remember, 'jangan lupa, jangan kantoi!' (don't forget, don't get into trouble) hehe!