Companies In These 4 Sectors Are Eligible To Gain Financing Guarantees From The Government

The financing limit is up to RM30 million per company for working capital or capital expenditure.

One of the major challenges faced by companies in Malaysia is access to capital or financing

Whether it's Small and Medium-sized Enterprises (SMEs) or Mid-Size Companies (MSCs), many business owners struggle to secure financing to support their operations or growth. Cash flow is also a major issue, especially for businesses with uneven revenue streams.

Furthermore, not every business is able to successfully apply for loans or financing facilities — often times, these businesses do not have the type of collateral that financial institutions (FIs) like banks require. This leads to a funding gap for many viable local businesses.

In an effort to help business owners obtain financing, the Ministry of Finance Incorporated established Syarikat Jaminan Pembiayaan Perniagaan (SJPP) in 2009. Through its Government Guarantee Schemes, it incentivises FIs to provide loans and financing to Malaysian businesses, while reducing the financing risks borne by them.

A recent scheme by SJPP is the Government Guarantee Scheme MADANI (GGSM), which focuses on guaranteeing financing for all economic sectors, particularly these four: high technology, agriculture, manufacturing, and tourism

If you own an SME or MSC in one of these sectors, you could be eligible for this financing guarantee.

Here's a closer look at what this financing guarantee entails:

Tenure of Guarantee

Up to 10 years or until 31 December 2035, whichever is earlier

Eligibility

Open to all entities (SMEs and MSCs) in all industries with annual revenue of not more than RM500 million based on their audited accounts (or relevant income tax returns where applicable) for any of the financial year ending 2019 or later:

- Sole proprietorships owned by a Malaysian Citizen;

- Partnerships, and Limited Liability Partnerships controlled and majority owned by Malaysian Citizens; or

- Companies with at least 51% shares held and controlled by Malaysian Citizens

Which are duly registered with:

- Companies Commission of Malaysia either under the Registration of Business Act (1956) or the Companies Act (1965/2016) or Limited Liability Partnership Act (2012); or

- Respective authorities or district offices in Sabah and Sarawak; or

- Respective statutory bodies for professional services providers

Excluding:

- Entities that are public-listed on the main board, government-linked companies (GLCs), Syarikat Menteri Kewangan Di Perbadankan (MKDs), and state-owned enterprises

- Subsidiaries with at least 51% shares of the entities, mentioned in No. i above

- Civil servants, who are currently in service, except with prior written approval from the employer – (Majikan/Ketua Jabatan)

Application Period

Applications are open until 31 December 2024

Purpose of Financing

- Working Capital*

- Capital Expenditure (CAPEX)*

*Both for New Financing. The facility cannot be used to refinance existing facility granted by the same or other FIs.

Type of Facility

Term Loan/Term Financing-i, Overdraft/Cash Line-i, Revolving Credit/Revolving Facility-i, and Trade/Trade-i Facility

While the scheme is open to businesses from economic sectors, the four focus sectors are eligible for a higher financing limit

SMEs and MSCs in high technology, agriculture, manufacturing, and tourism will be able to obtain financing of up to RM30 million per company**.

What GGSM covers is up to 90% guarantee of the financing obtained from participating FIs (including principal and interest/profit) for the four focus sectors. The financing limit eligible for the guarantee coverage of 90% will be capped at RM10 million per company, while 80% coverage for the balance RM20 million of the financing limit per company.

As for businesses from all other sectors, they will be able to obtain financing of up to RM20 million per company** with up to 80% guarantee coverage of the financing.

**This is subject to the aggregate Group Limit not exceeding RM50 million financing limit for all other schemes under SJPP including this scheme.

Additionally, SMEs and MSCs who obtain financing under GGSM will be subject to these guarantee fees:

- For Bank Negara Malaysia funding schemes: 0.5% per annum (payable upfront)

- Four focus sectors: 0.75% per annum (payable upfront)

- All other sectors: 1.0% per annum (payable upfront)

As for the interest or profit rates for the financing provided, it will not exceed the FI's Base Lending Rate (BLR) or Base Financing Rate (BFR) plus 2%.

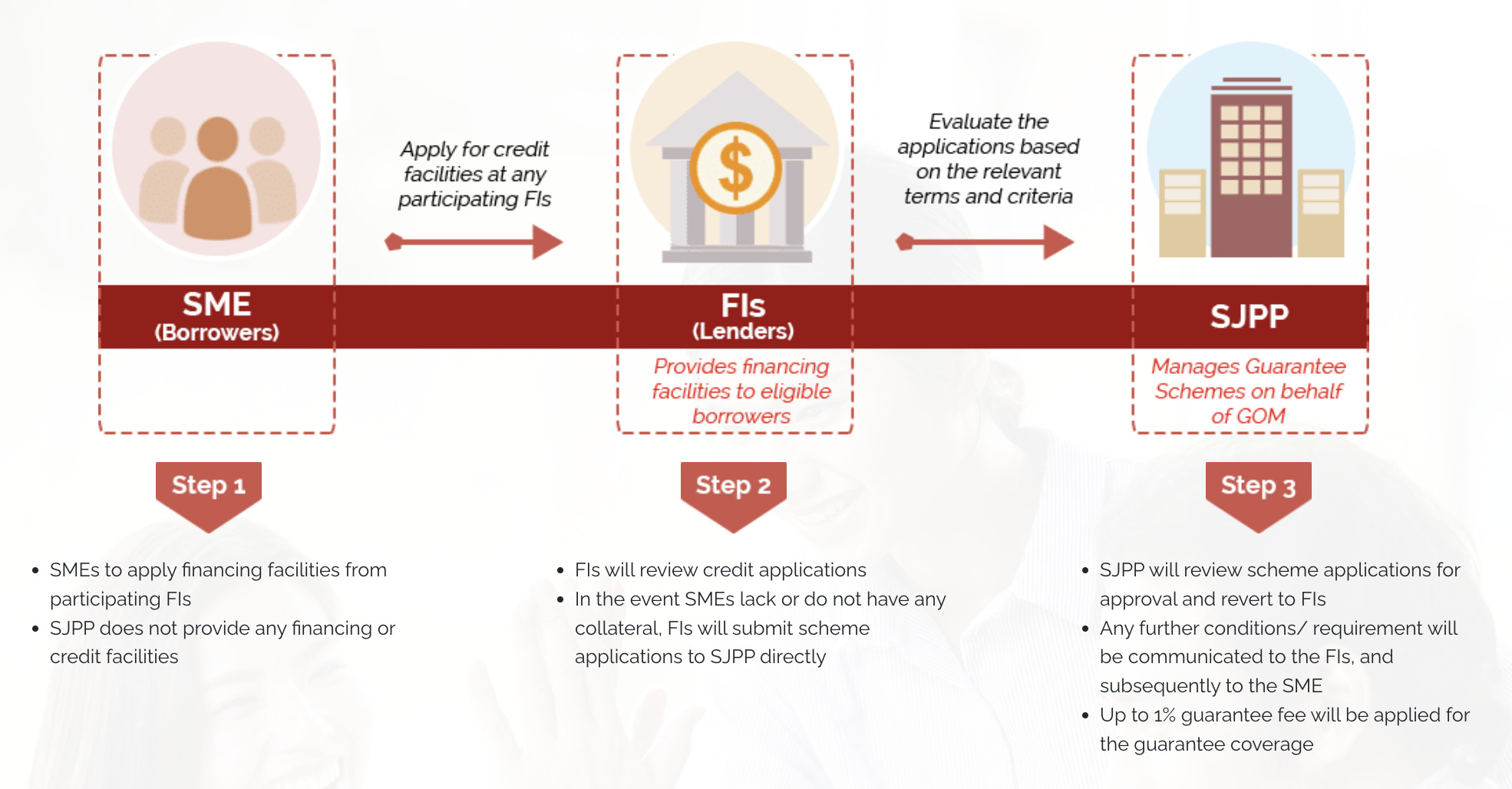

If you're still not too sure how SJPP's Government Guarantee Schemes work, here's a closer look at the application process:

Ready to bring your SME or MSC to the next level? Find out more about how you can obtain financing guarantees with SJPP today on their website!