Here's A Step-By-Step Guide On How To Pay Your Outstanding PTPTN Loan Online

If you don't feel like visiting one of their counters, or downloading the app.

For 25 years, PTPTN has provided an opportunity for all Malaysians to pursue tertiary education without having to worry about financial restraints

Making up a branch of the government's effort to forward the minds of young people (and mature people alike), the past few years have seen a radical shift in the mechanisms being made available to the public in relation to accessing PTPTN.

Among them include the various ways in which borrowers can now make repayments steadily and securely. Though some prefer to make all their payments in person, others opt for the handy myPTPTN app via their phones. Meeting the technological advancement half-way, you can also log on to your computers and get the process done just as swiftly through their online portal.

1. Telephone a PTPTN office and inform them of your intention to repay your outstanding amount

Now now, let's not rush our way into making the payment. How do we start?

Firstly, you'll have to telephone one of the PTPTN branch offices to notify them of your intention to make a quick repayment. For those with easy access to a mobile phone, you can search the list of their branches all throughout the nation, and call the outlet closest to your location. Click here for a complete list of all the offices in the nation.

Thankfully, however, PTPTN has also introduced numerous methods of contacting them since the pandemic began. These other options include their careline, a live chat agent, an e-aduan officer, and even through a social media officer. Click here to check out all the alternative methods of getting in touch with them.

During your call, you should receive a password for your respective account. That way, you'll be able to access your balance after logging into their portal.

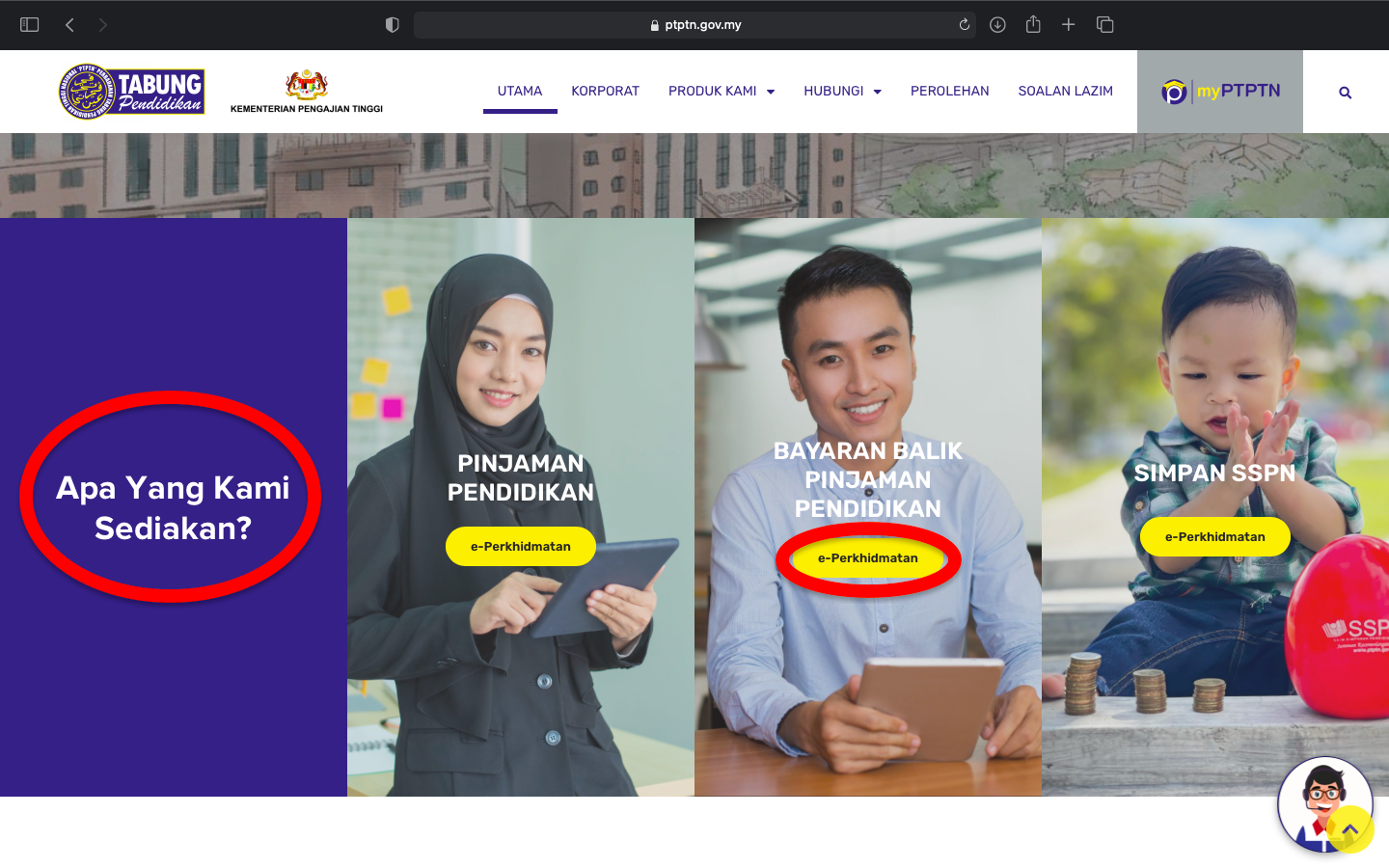

2. Visit the PTPTN portal

Upon reaching the portal, you should come to their main page. Proceed by scrolling down and viewing the 'Apa Yang Kami Sediakan?' column. Continue by clicking the 'e-perkhidmatan' button under the 'Bayaran Balik Pinjaman Pendidikan' section of the column, which should be in the middle of three selections.

You'll then be redirected to the 'Bayaran Balik e-Perkhidmatan' page. After that, find the 'Penyata Pinjaman' section, which should be the third box from the left on the first row. After finding it, click the button beneath it that reads 'Selanjutnya'.

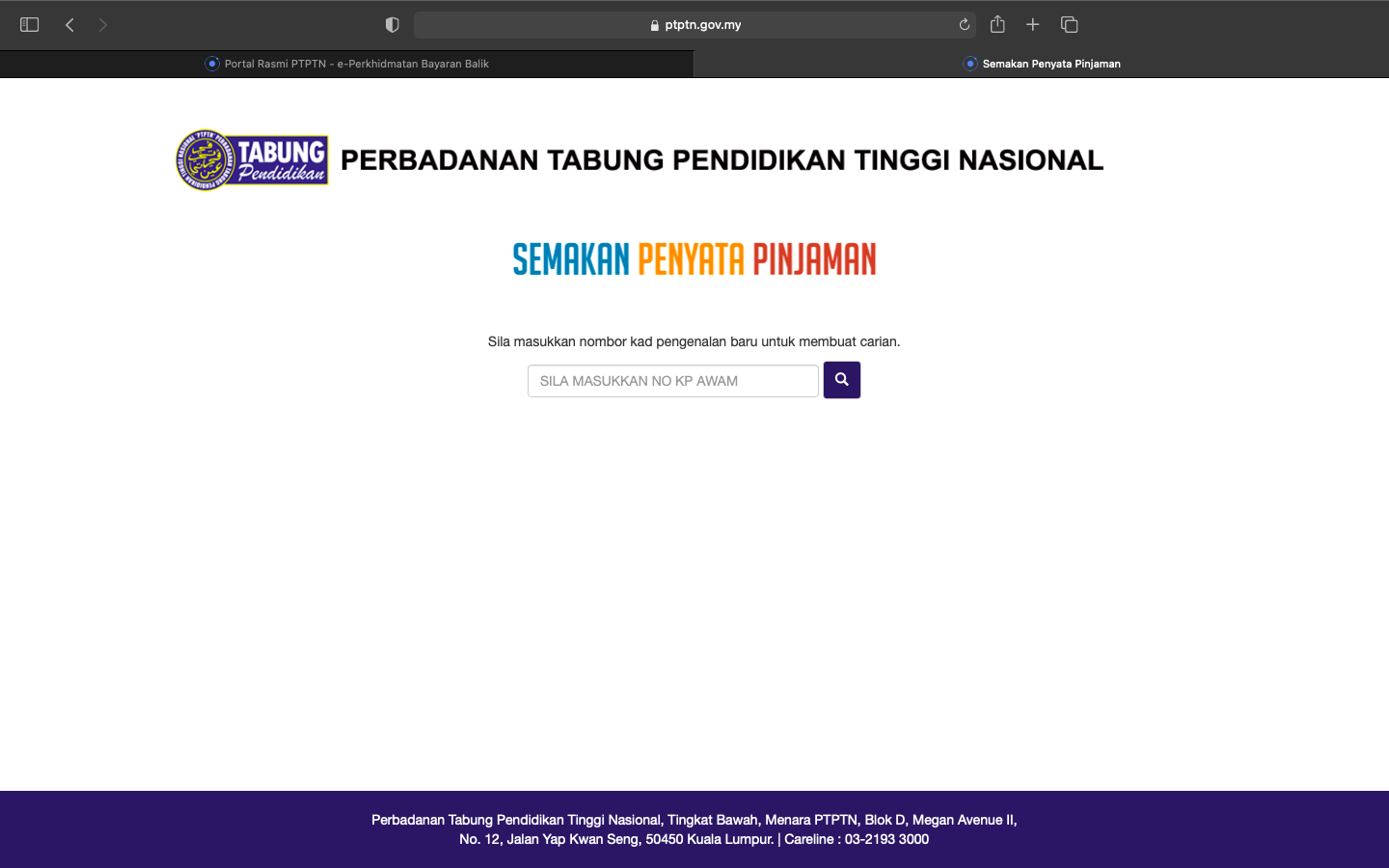

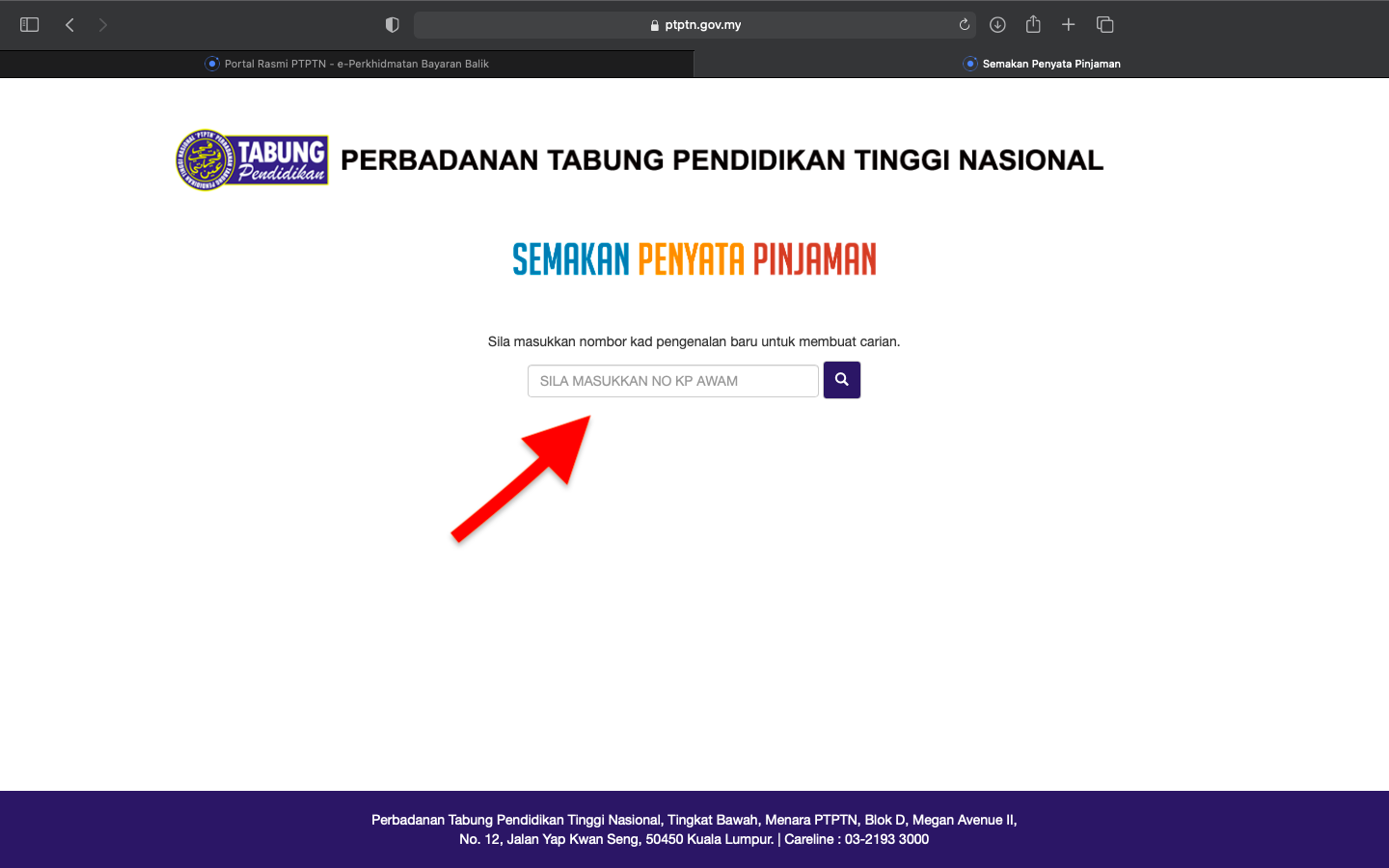

3. The portal will proceed to redirect you to a page titled 'Semakan Penyata Pinjaman'

Once you've approached this page, key in your identification card number (IC) within the box that reads 'SILA MASUKKAN NO KP AWAM'.

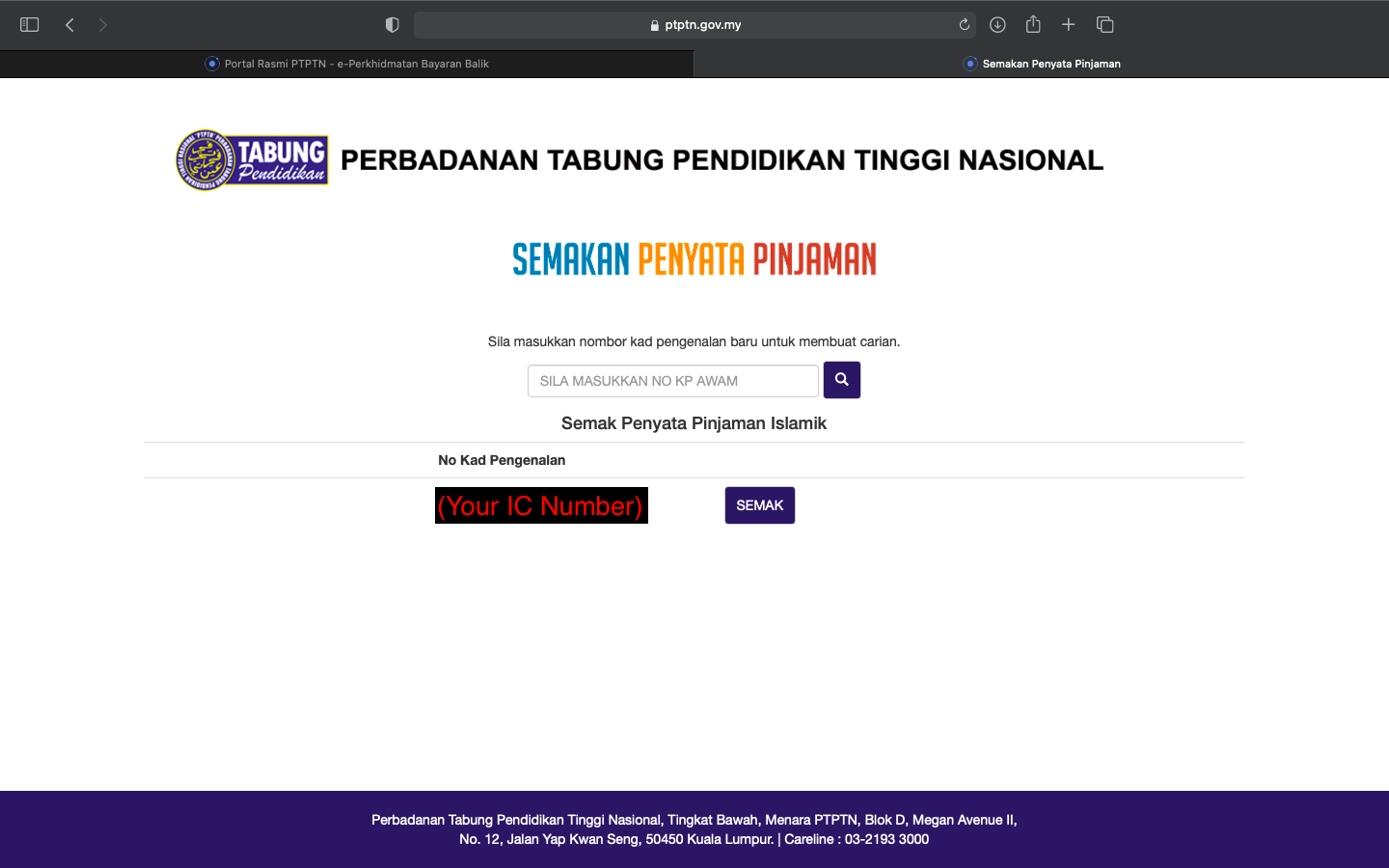

Your IC number will then appear beneath the box, under a header titled 'Semak Penyata Pinjaman Islamik'. Proceed by clicking 'SEMAK'.

4. You'll then be brought to i-Online, where you can check your PTPTN statement and borrowed balance

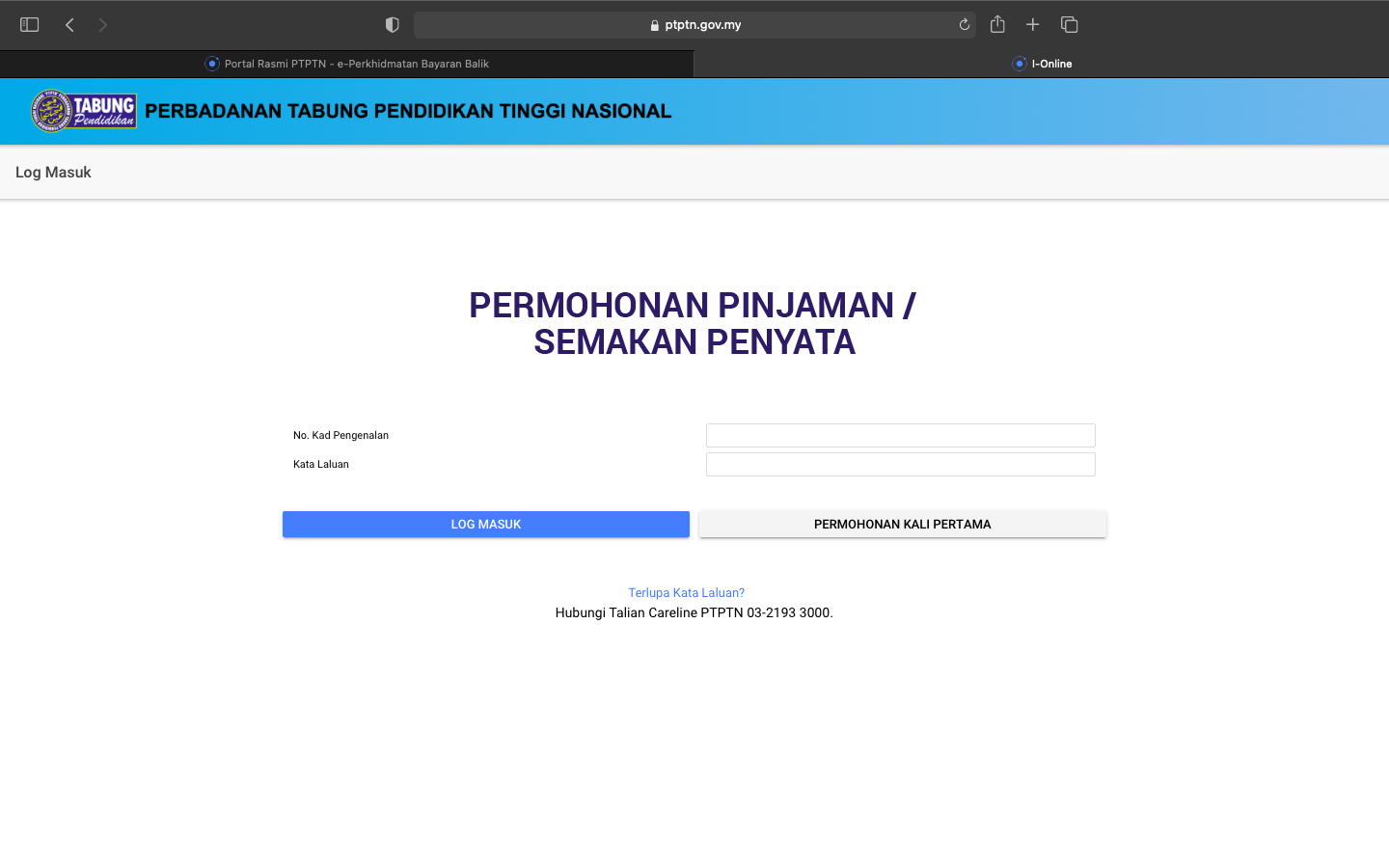

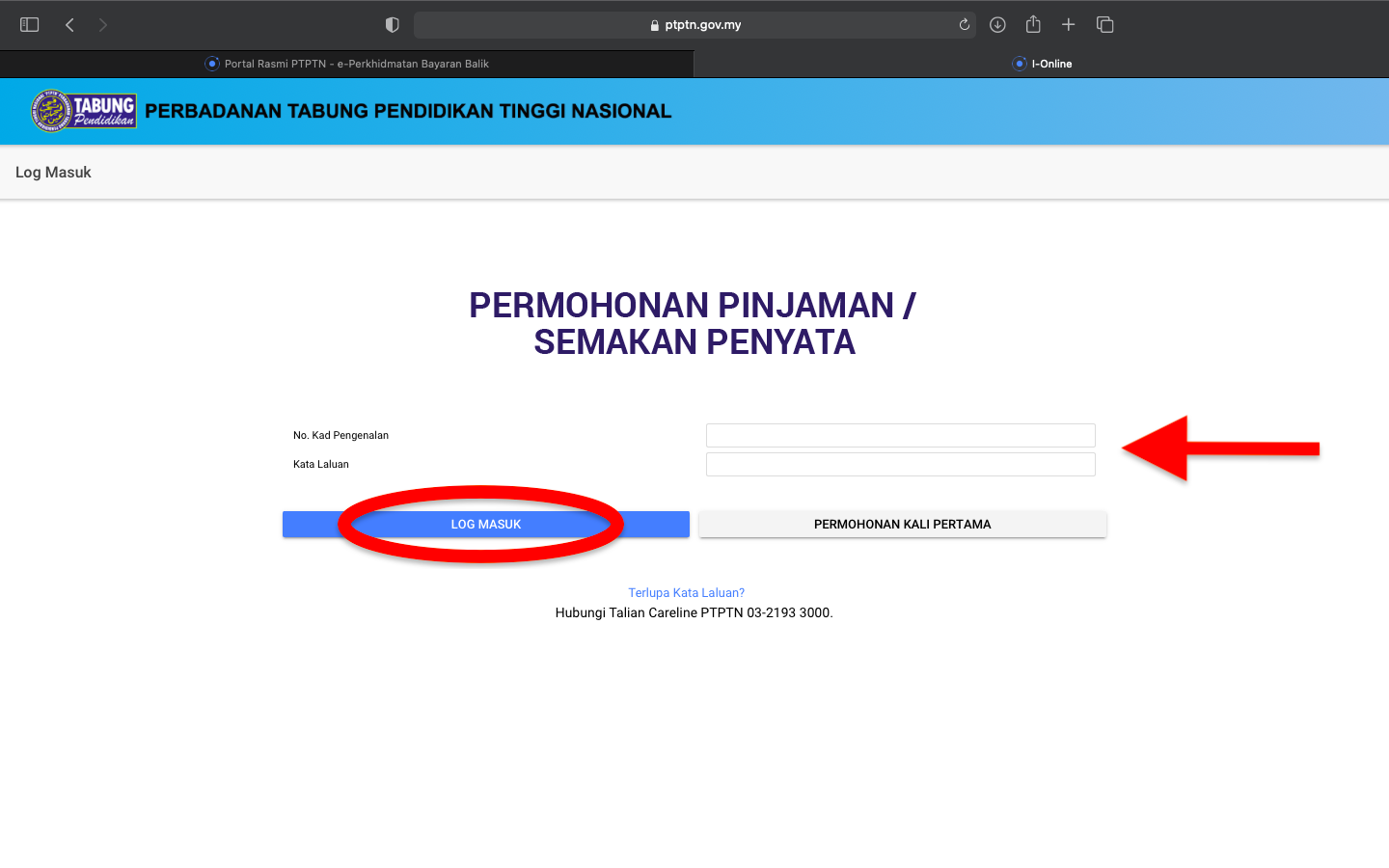

The page should look something like this, with the header reading 'PERMOHONAN PINJAMAN/SEMAKAN PENYATA'.

Fill in the relevant boxes with your information, which includes your IC number under the 'No. Kad Pengenalan' section. As for the password, or 'Kata Laluan', key in the password that you were provided by the PTPTN officer during your call earlier.

Once that is settled, click the login button ('LOG MASUK').

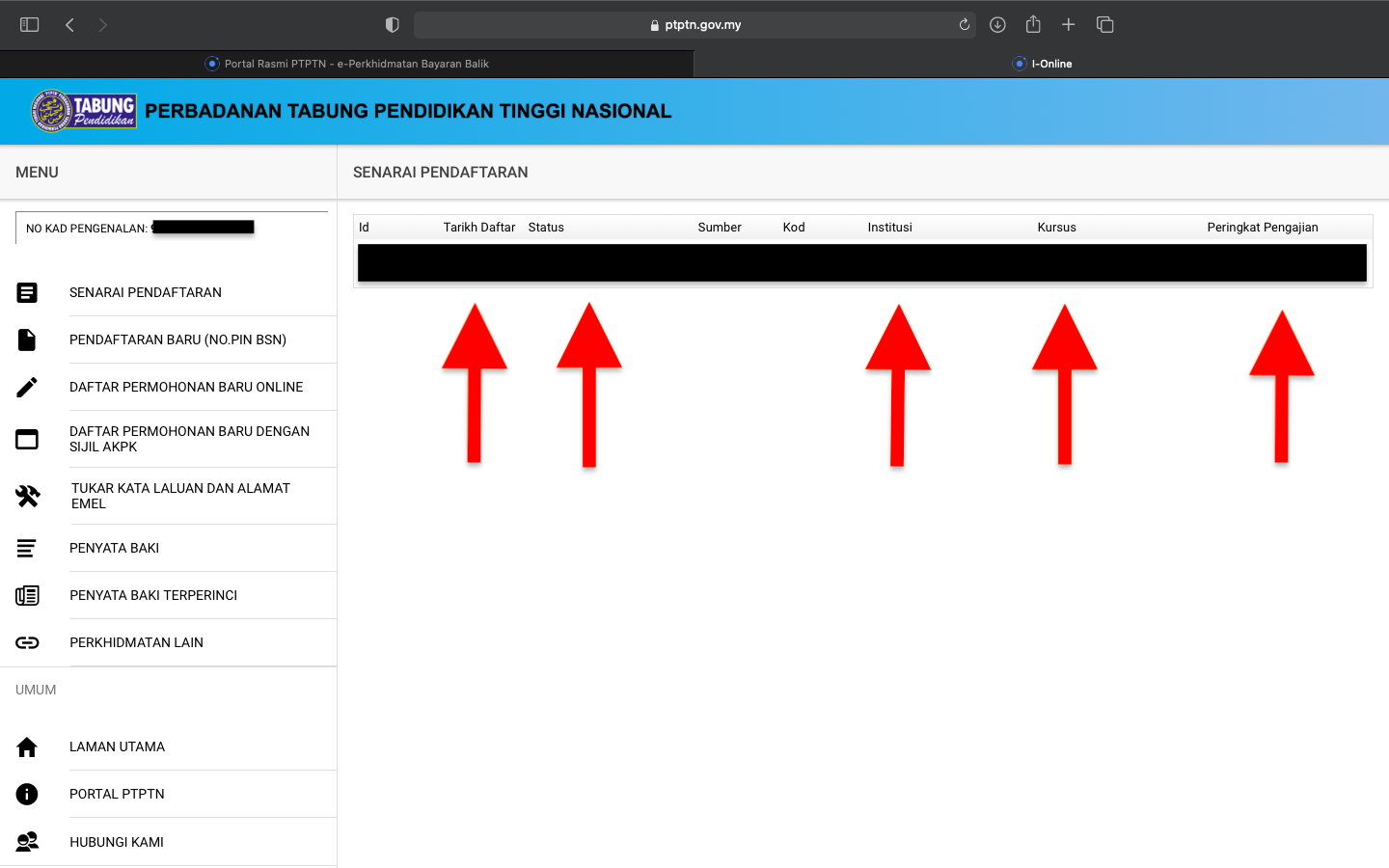

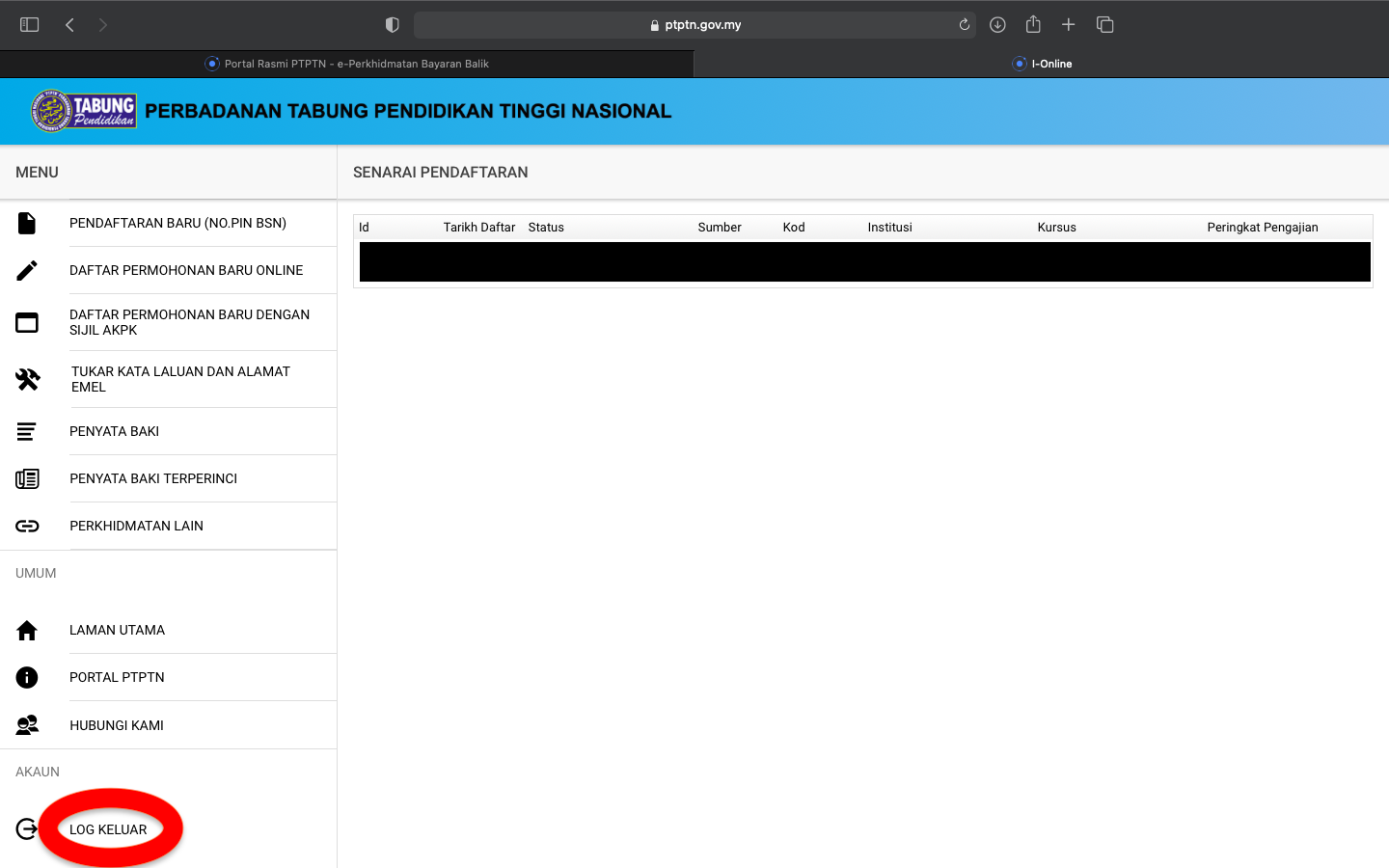

5. The main menu of your personal account will appear, which will include all of your personal details

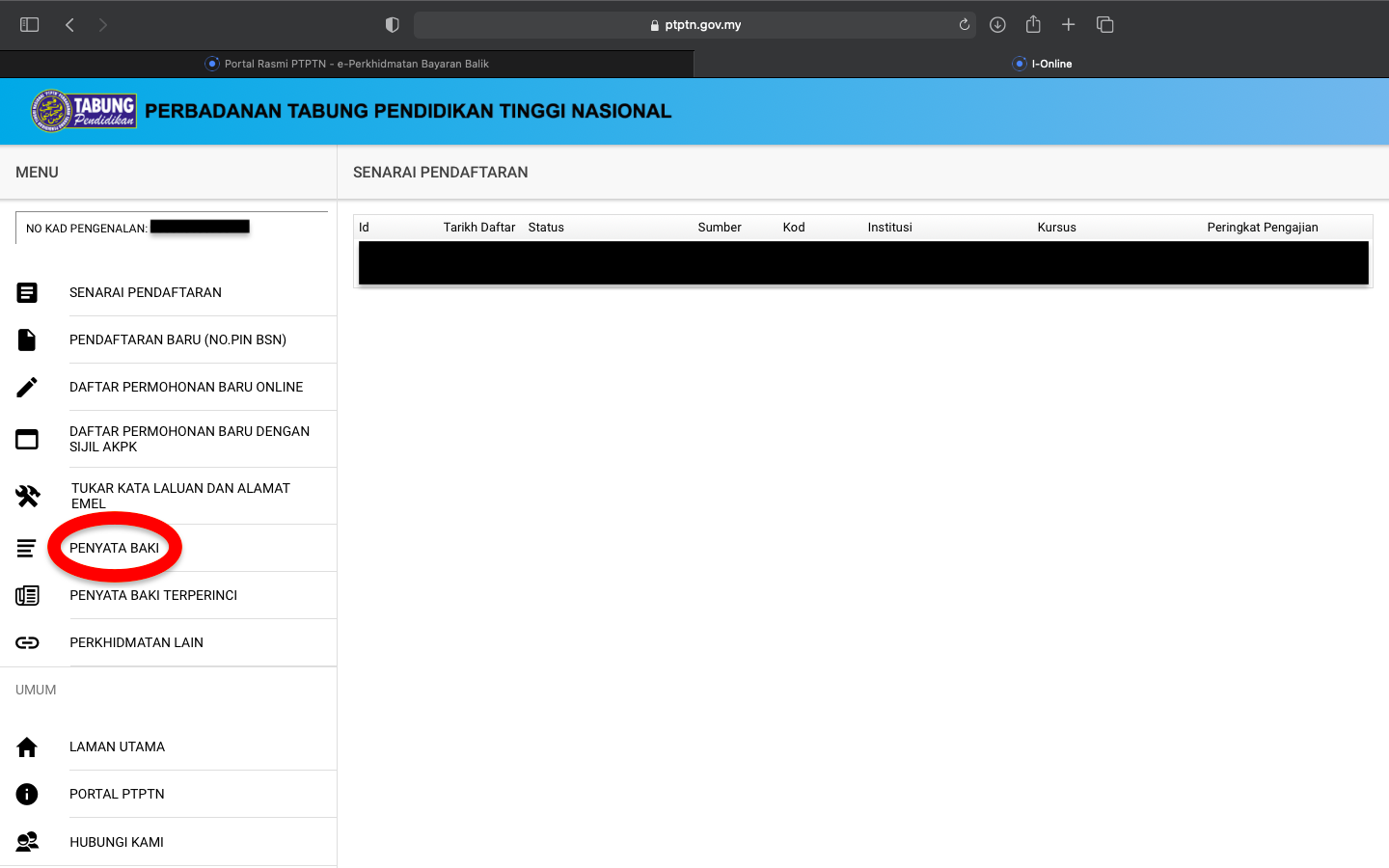

To further confirm your details, check the columns that include the date of registration of your loan ('Tarikh Daftar'), the institute you studied at ('Institusi'), your course ('Kursus'), and the level of education for your respective selection ('Peringkat Pengajian').

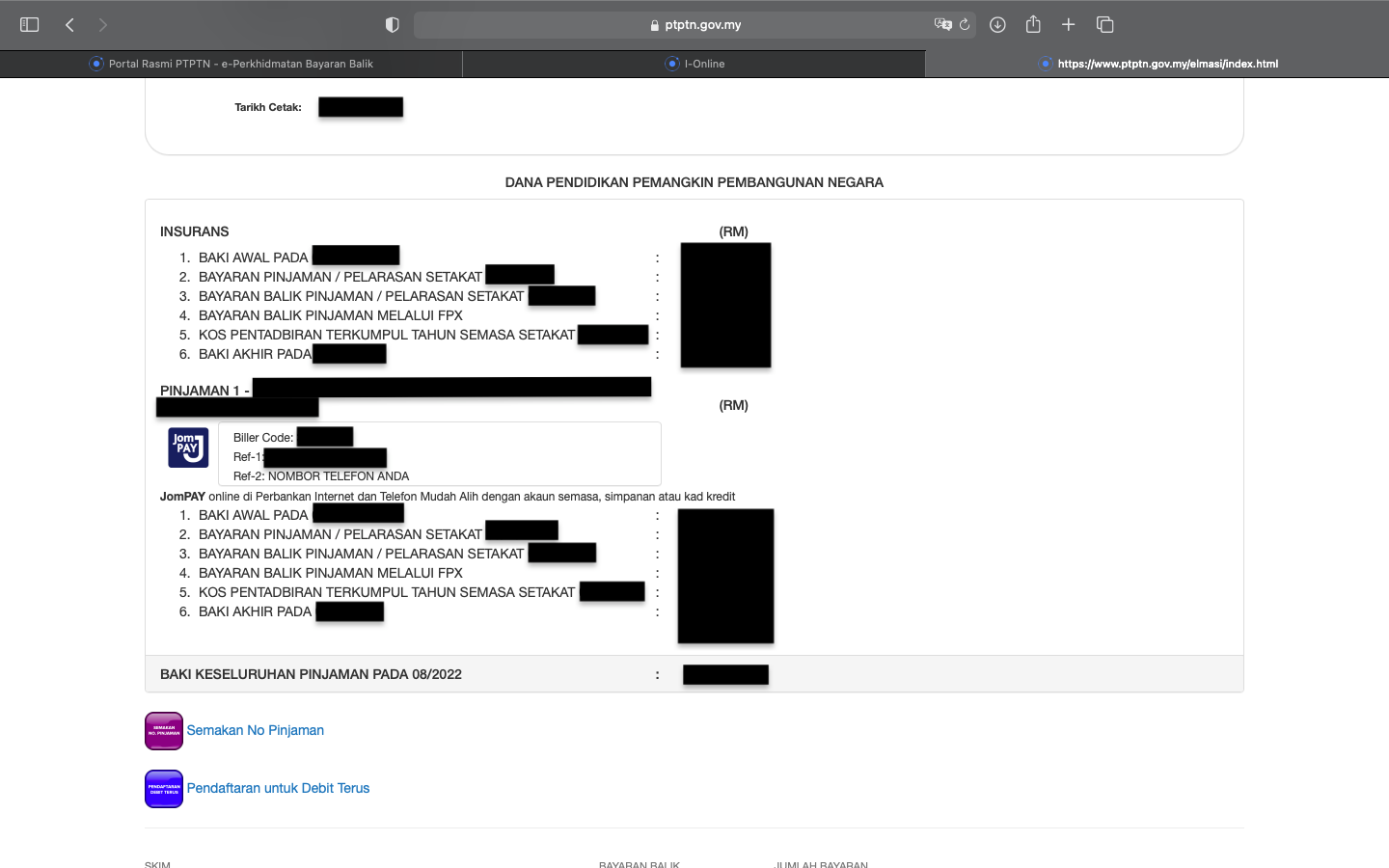

On the left, you'll see a list of options for your account. Click 'Penyata Baki' (balance statement) to open your outstanding PTPTN loan amount.

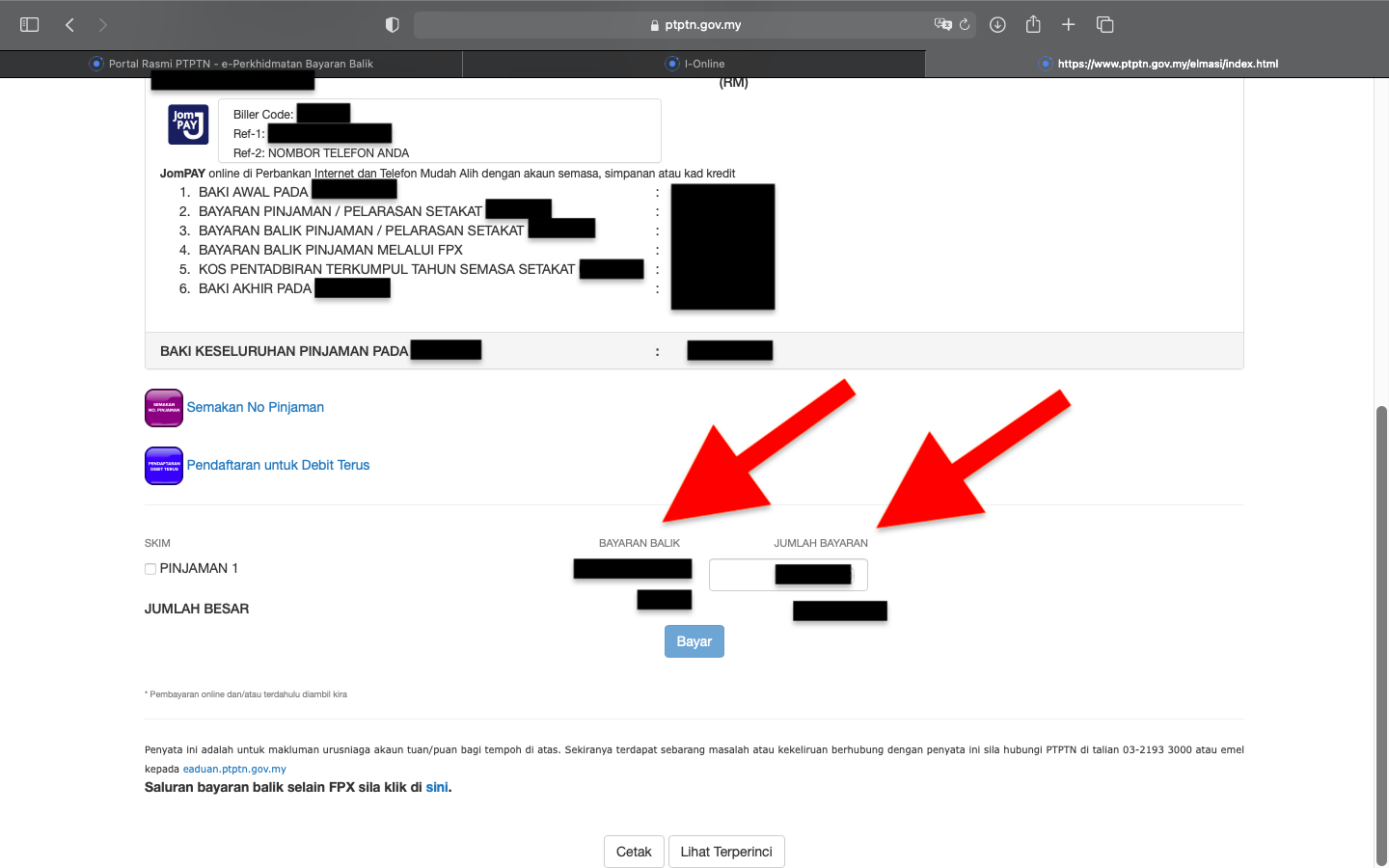

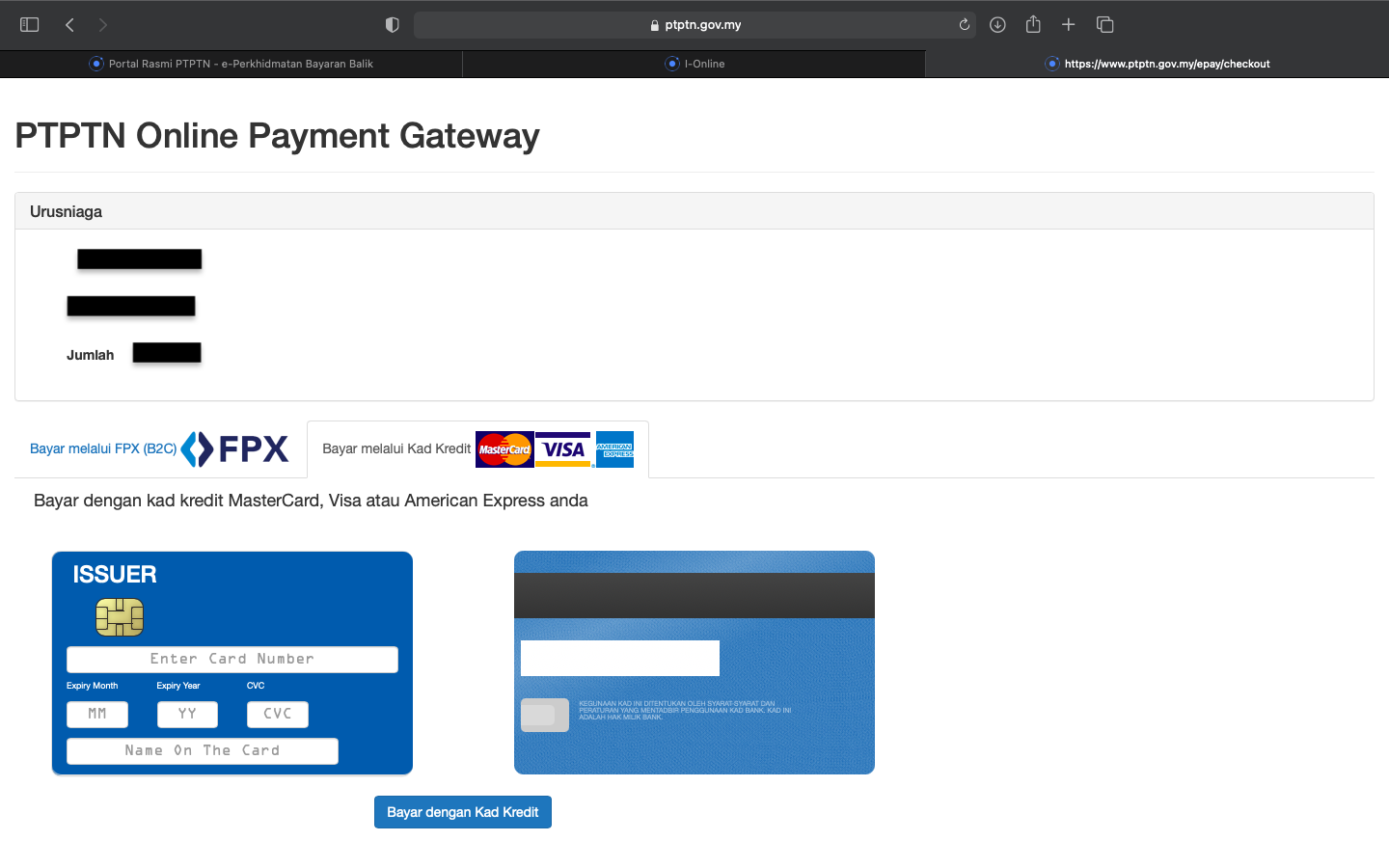

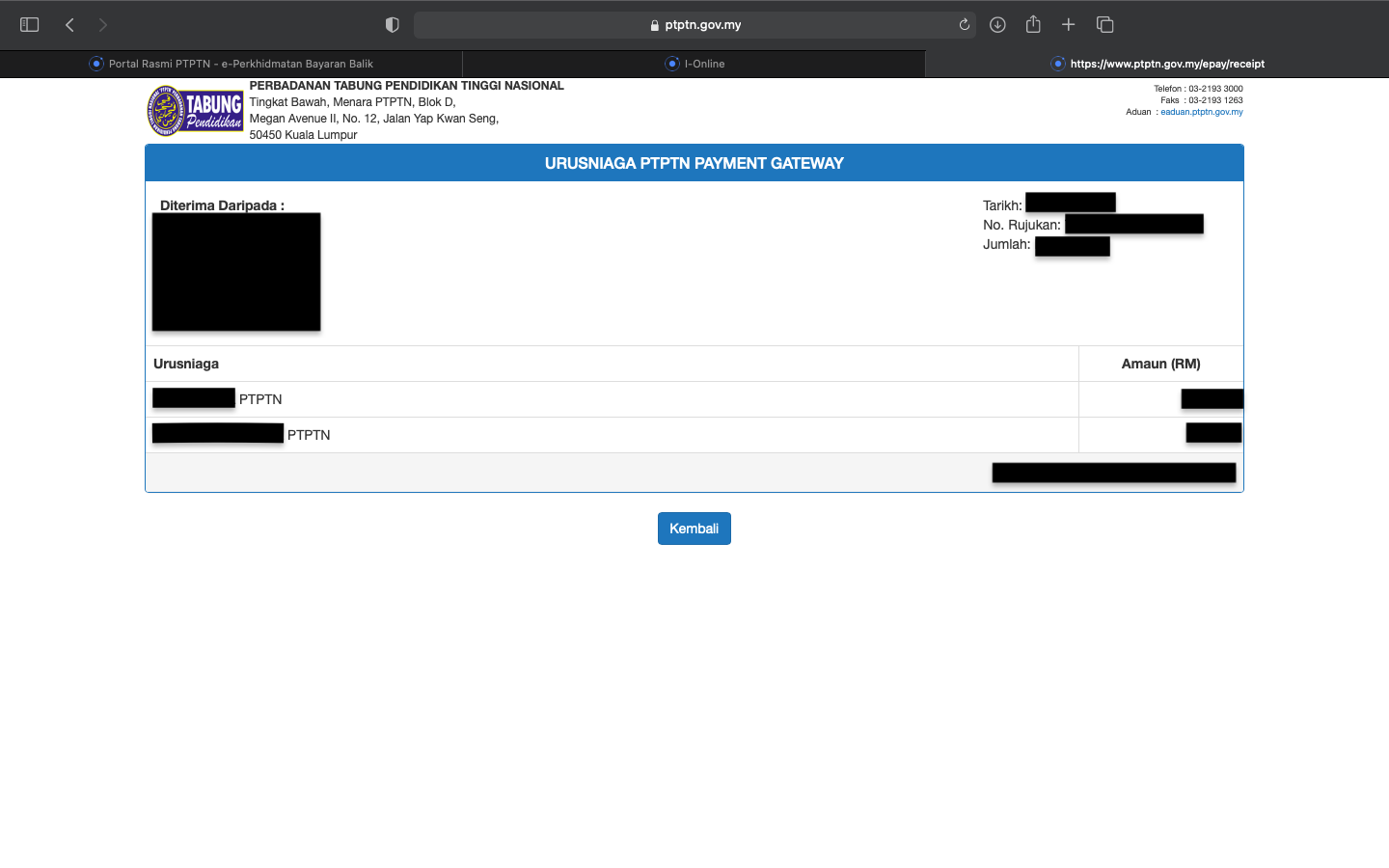

7. Scroll down to the 'SKIM' section and key in the total amount you'd like to pay back

Upon registering for your PTPTN loan, a fixed monthly amount would have been provided to you for your month-to-month repayment.

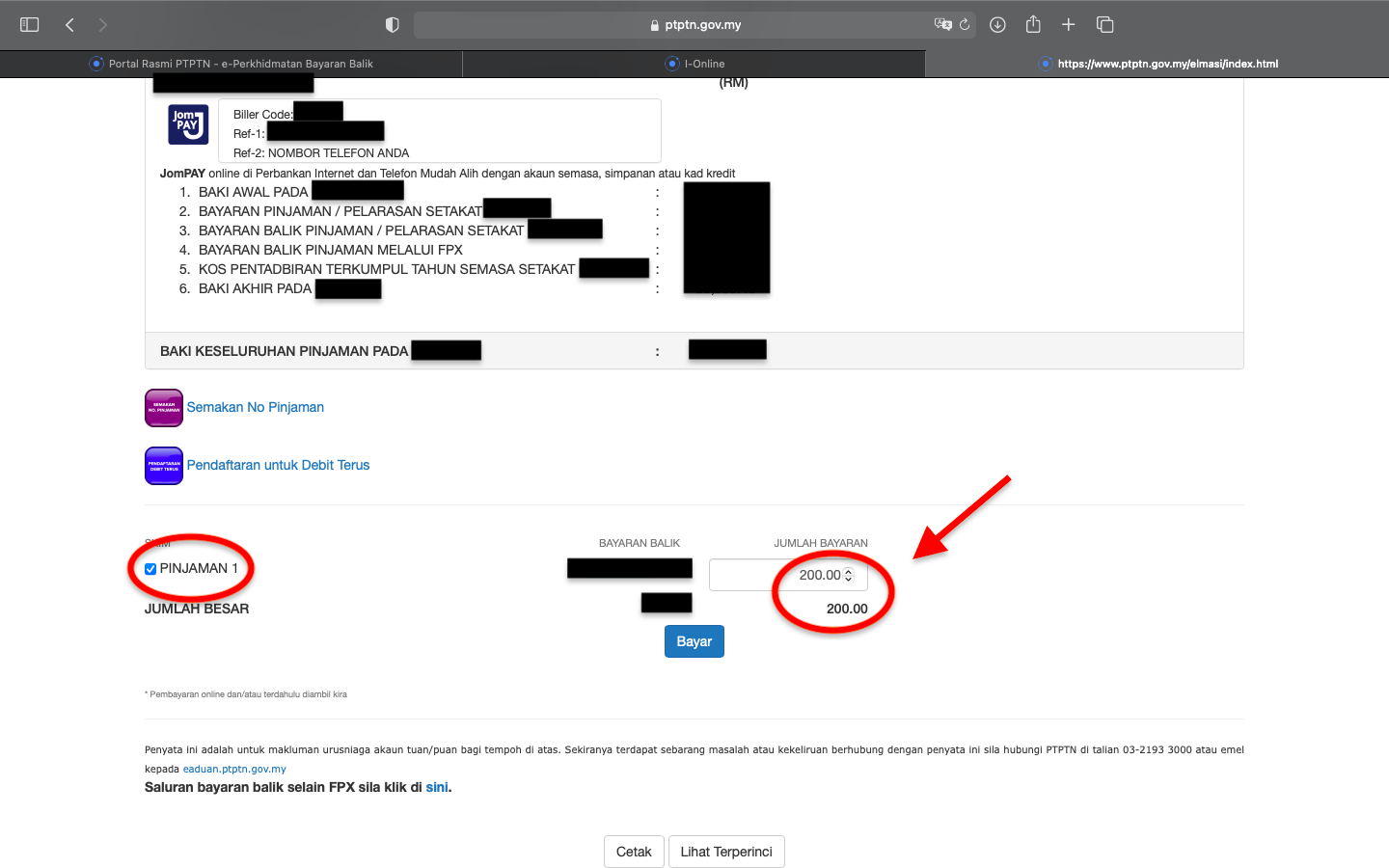

Select which loan you'd like to make payment for by checking the box.

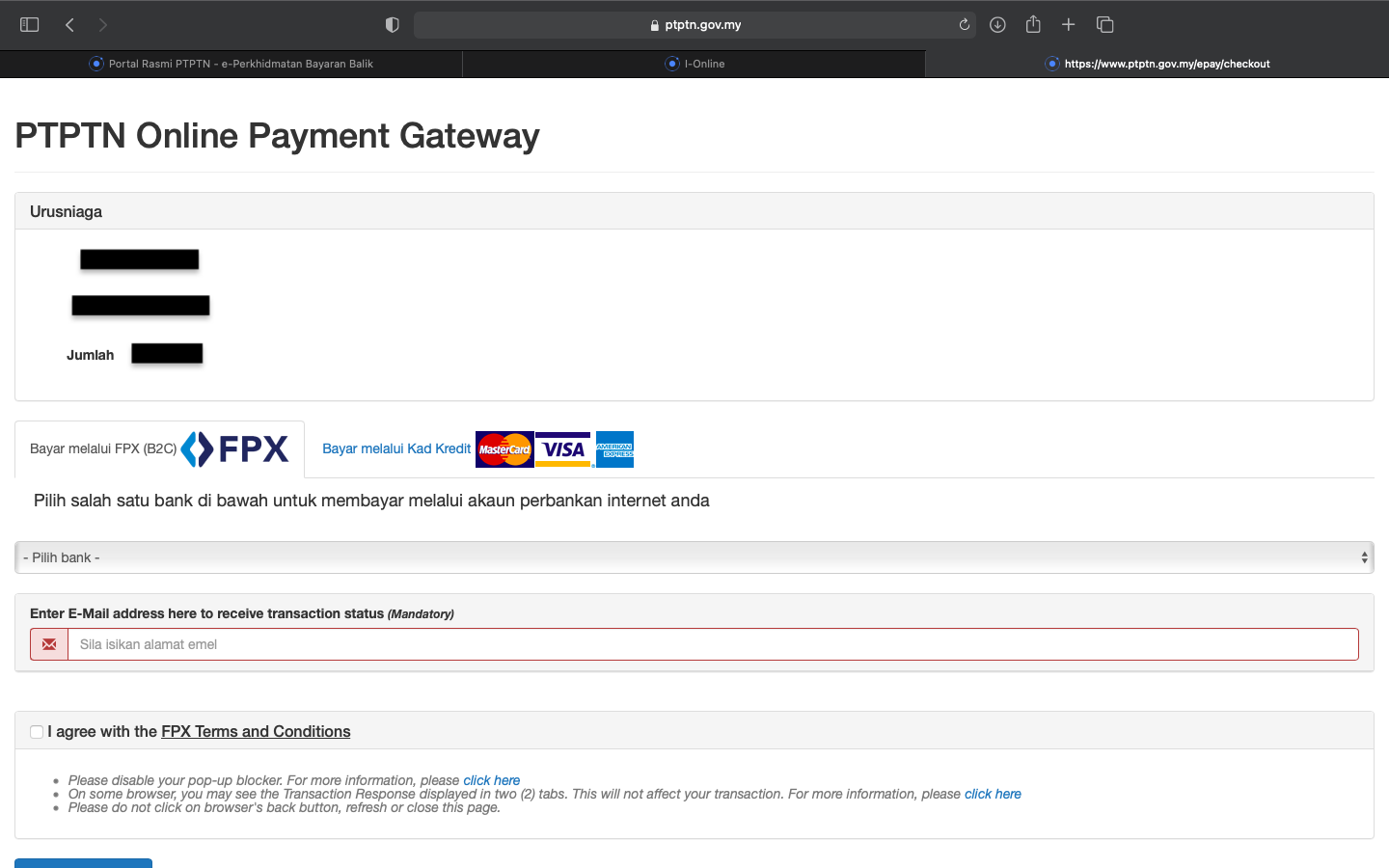

Under the 'Jumlah Bayaran' section, you may key in any figure (not below RM100) that will stand as your repayment. This amount can vary depending on your monthly preference. Once you've decided the amount, click 'Bayar'.